*** Update April 9, 2021 -- This article was written ahead of the U.S. court date last week, April 9, 2021. The hearing was deferred by 10 days, so the potential effects of DAPL on Canadian diffs remain. Look for updates here and at https://aegis-hedging.com/insights/ after April 19, 2021 ***

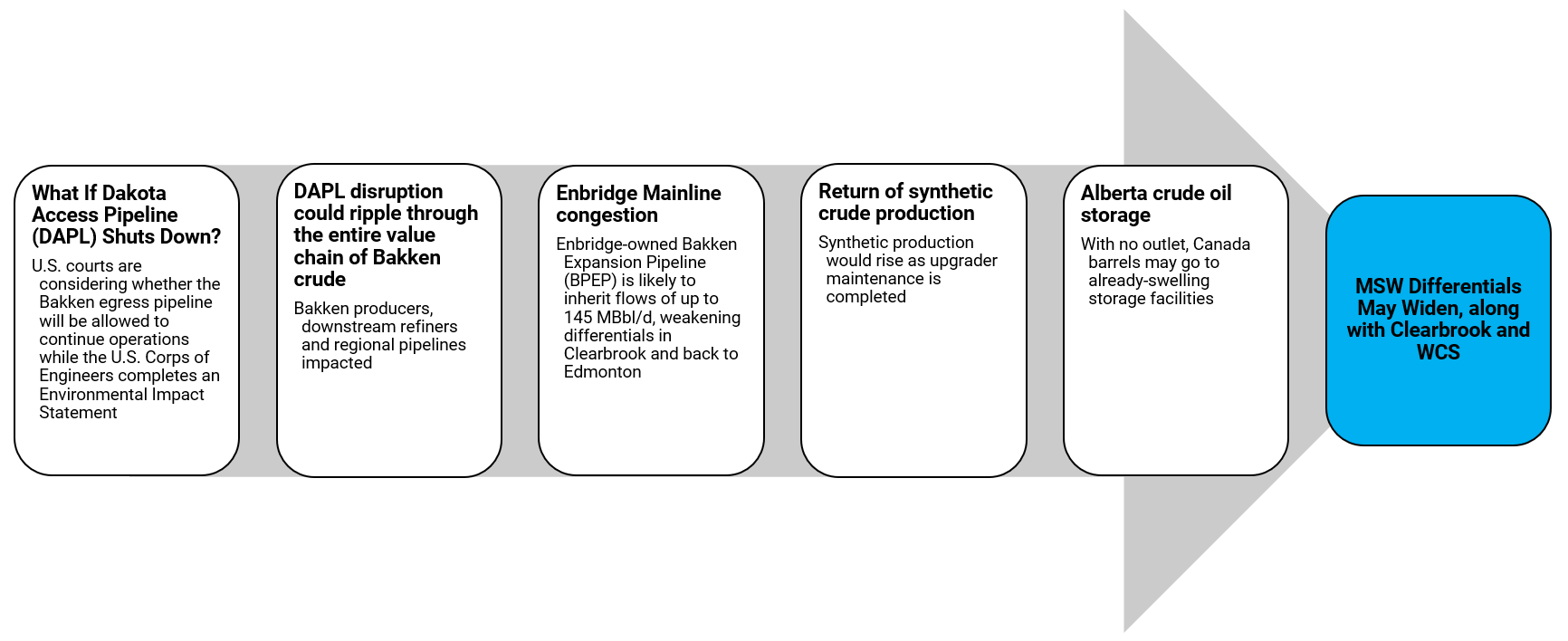

Once again, we're talking about regulatory hurdles facing egress issues for Canadian barrels. The DAPL status conference that was delayed in February 2021 is due to finally occur at the end of this week. The DAPL pipeline, which moves Bakken light sweet oil out of North Dakota and into Patoka, (where it can either be put into storage or continue to Nederland on ETCOP) plays an important role in the keeping the Canadian market as uncongested. While the DAPL pipeline is a US problem, it inherently affects Canadian barrels as removing this pipeline capacity from the market will push barrels onto the Enbridge owned Bakken Expansion Pipeline and ultimately onto the Enbridge Mainline system.

The pipeline suffered a setback in August 2020 when the US Court of Appeals upheld a lower court ruling (from July 2020) that vacated the Corps of Engineers Lake Oahe easement. A January US Court of Appeals affirmed this ruling and directed the US Corps of Engineers to complete its Environmental Impact Statement (EIS) but reversed the parts of the ruling requiring the pipeline to be shut down during the process. A second motion filed by the Standing Rock Tribe for an injunction to shut down DAPL during the EIS is the topic of the status conference to occur on April 9. The Standing Rock Tribe is arguing that the pipeline should be shut down and not restarted during the EIS process, given that the easement for DAPL's crossing under Lake Oahe has been vacated.

A shutdown of the pipeline will force producers and shippers to find alternative means of egress for the DAPL barrels. The pipeline has been running at a little over 80% capacity meaning that the barrels looking for alternative means of egress is in the neighborhood of 490-500 kbpd, according to Genscape/Wood Mackenzie. Crude production in the Bakken has yet to fully recover from the COVID-19 downturn and faced additional headwinds in January and February's arctic blast.

Assuming production levels remain around 1.2 Mbpd, we estimate the total call on rail will be approximately 380 kbpd. Crude by rail out of North Dakota has been averaging around 200 kpbd — even in times when pipeline capacity isn't scarce, producers and shippers regularly use crude by rail as a steady takeaway option to refineries in PADD 5 and (to a lesser extent) PADD 1. Some fancy math leads to the assumption that, at current production, about 180 kbpd of additional rail will be required to clear the barrels.

Congestion would transfer to the Enbridge systemThe concern for Canadian producers is the volume of crude that finds its way onto the Enbridge Mainline at Cromer through the Bakken Expansion Pipeline (BPEP), owned by Enbridge. Recent economics have failed to incentivize moving any barrels on the BPEP line, but there are contracts still in place. Enbridge is also part owner of DAPL (a minority interest) and will be looking to recoup what it loses on DAPL through moving barrels on BPEP. Even if it doesn't completely fill the line, it won't take much to move the needle in terms of creating congestion on the mainline, and anything that doesn't go north to Cromer will add to what has to be moved by rail. |

|

|

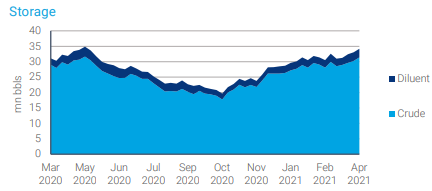

Source: Genscape. The chart shows Alberta crude oil storage has been filling. |

Not to throw more shade on the looming congestion in Alberta, but we have to pay attention to storage levels which are currently at an 11-month high. Inventories can provide a cushion for lost supply due to the upgrader maintenance, but PADD 2 refineries will also undergo seasonal maintenance decreasing demand for Canadian barrels.

Watch the DAPL results carefully in the U.S. If the threat of shutdown remains, there would be regional upsets, starting with Bakken oil discounts, and ending with more congestion in Canada and the pipelines that carry Canadian oil to market.

Commodity Interest Trading involves risk and, therefore, is not appropriate for all persons; failure to manage commercial risk by engaging in some form of hedging also involves risk. Past performance is not necessarily indicative of future results. There is no guarantee that hedge program objectives will be achieved. Certain information contained in this research may constitute forward-looking terminology, such as "edge," "advantage," 'opportunity," "believe," or other variations thereon or comparable terminology. Such statements and opinions are not guarantees of future performance or activities. Neither this trading advisor nor any of its trading principals offer a trading program to clients, nor do they propose guiding or directing a commodity interest account for any client based on any such trading program.