|

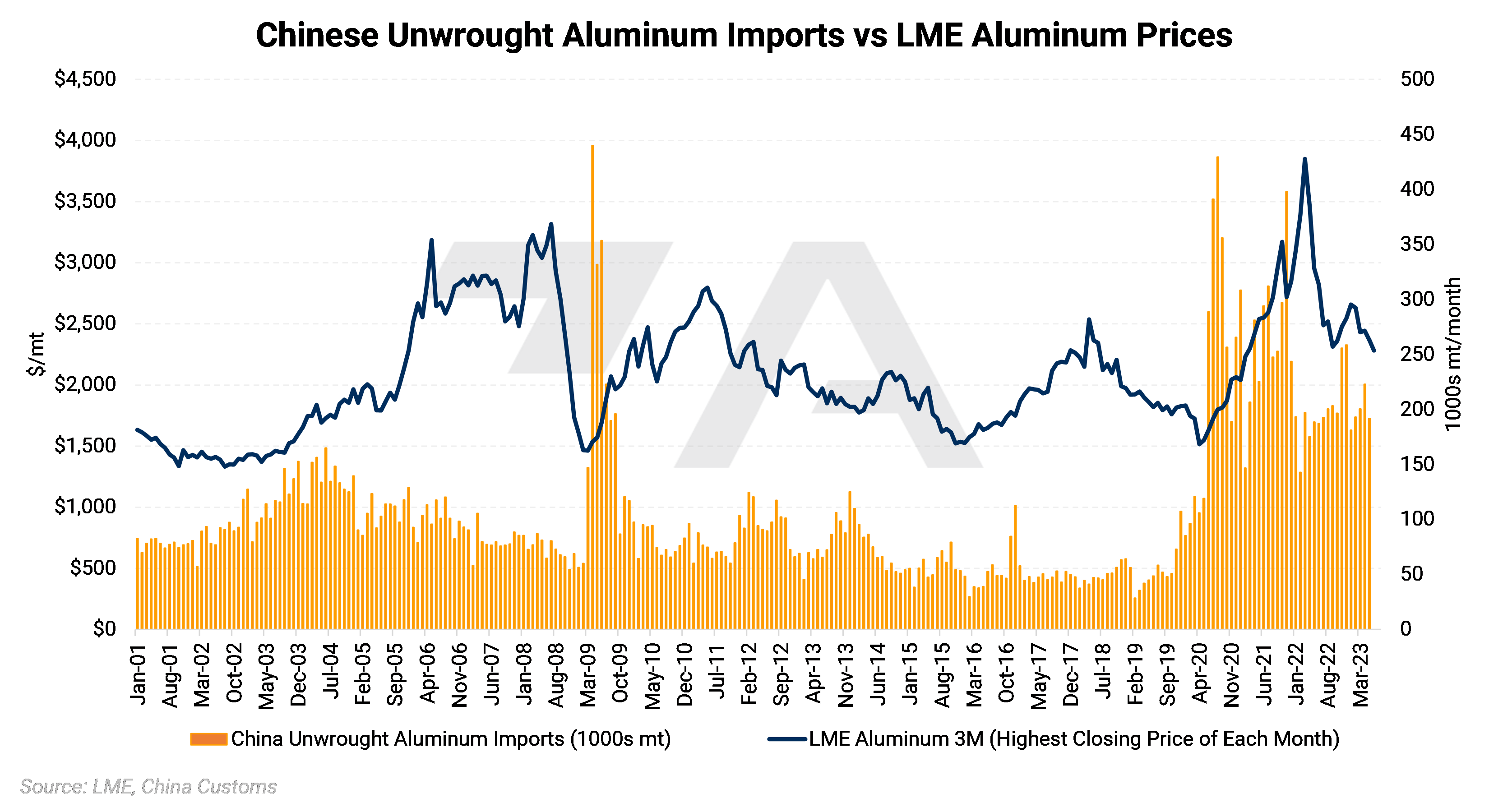

China’s aluminum imports are quite price sensitive. Prior to the pandemic, China’s aluminum imports increased dramatically when LME prices were below $2,000/mt, and dropped significantly whenever prices exceeded $3,000/mt. Since the pandemic, China has used imports to help fill in any production gaps, as well as to add to stockpiles, irrespective of global prices. |

|

|

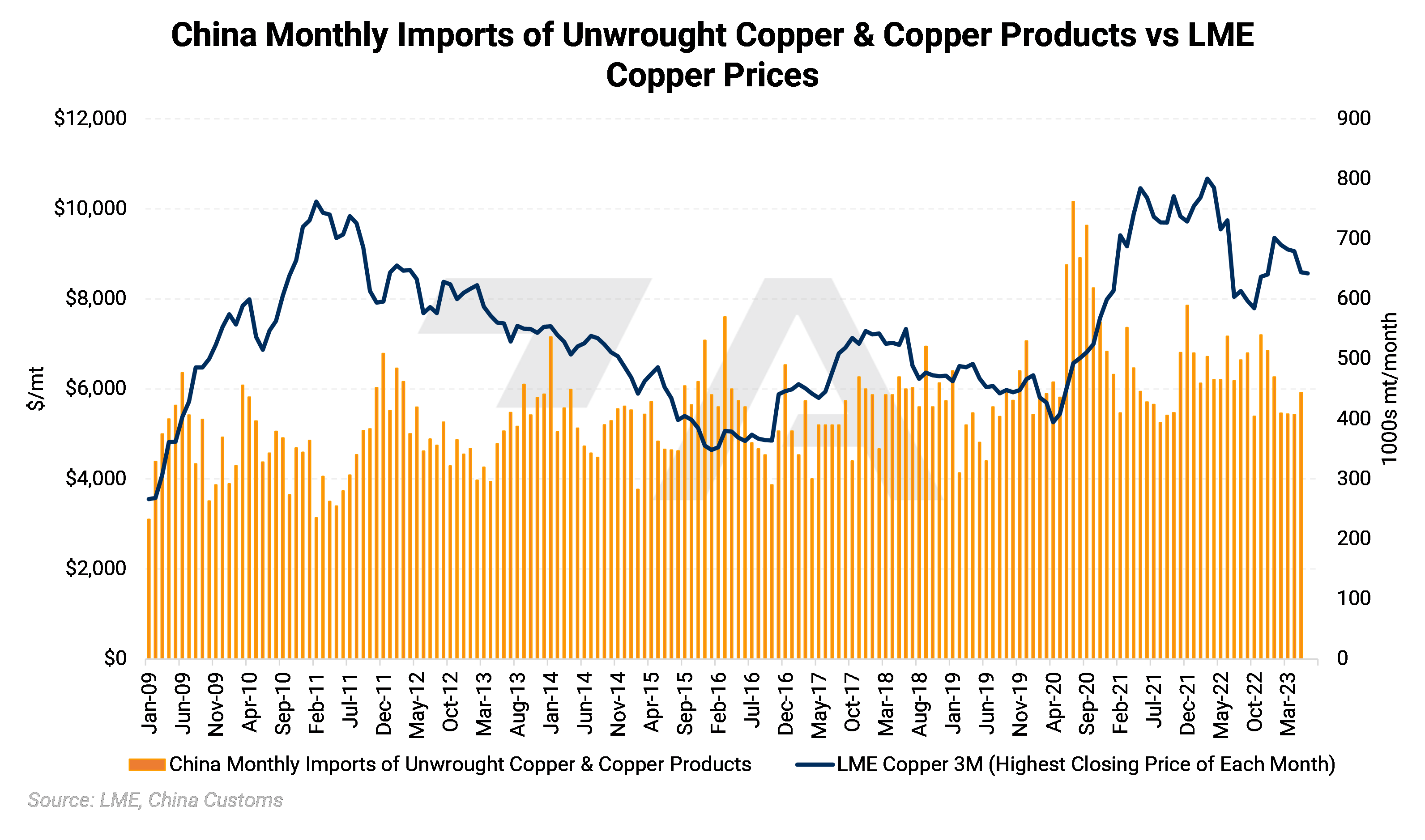

China’s imports of unwrought copper do not appear to be as price sensitive as that of aluminum. Since the pandemic, monthly imports have rarely dipped below 400,000 mt. That said, imports increased dramatically when LME prices dipped below $6,000/mt. |

|

|

Although it has yet to be reflected in import data, it does appear that China’s copper demand is improving. The Yangshan Copper Cathode Premium, which reflects import demand, has risen to $47.5/mt, up from $21.5/mt in mid-May. Ji Xianfei, an analyst with Guotai Junan Futures Co recently told Bloomberg, “Copper demand in China isn’t as bad as people imagined.” It is also interesting to note that the Yangshan Copper Cathode Premium and LME prices appear to be inversely correlated. |

|

|

|

China’s steel imports have fared far worse than that of aluminum or copper and are hovering near 30-year lows. This is largely due to poor demand from the manufacturing and real estate construction sectors. Both sectors will likely need to show signs of recovery before imports can rebound. (As a side note, iron ore imports have been relatively elevated and sideways since 2021. AEGIS, therefore, feels that steel imports are a better representation of demand.) |

|

|

|

One other bright spot is bauxite imports. Bauxite is the ore that is refined into alumina, and alumina is then converted into aluminum. Imports of this raw material are at an all-time high. Traditionally China relied upon Guinea, Australia, and Indonesia for bauxite. With Indonesia’s ban on bauxite exports starting this month, China could be stockpiling bauxite in case there are any production or export hiccups in Australia or Guinea. (We do note that alumina production has increased in 2023, but not enough to explain the uptick in bauxite imports.) |

|

|

|

Before we conclude, AEGIS would like to remind aluminum end-users that they can use swaps or options to mitigate their price exposure. Below is a chart that briefly details three different ways end-users of metals can hedge their input costs. Please contact us for further information. |

|

|

AEGIS Conclusion: |

|

As we stated at the outset, imports are likely the “canary in the coal mine” for Chinese metals demand. HRC steel is a regional market, however, a large consumer such as China can hold tremendous sway on foreign prices. Increasing Chinese steel demand could therefore put upward pressure on steel prices here in the US. Similarly, improving aluminum or copper demand, and a similar recovery in import volumes could also lead to higher global aluminum or copper prices. |

Important Disclosure: Indicative prices are provided for information purposes only and do not represent a commitment from AEGIS Hedging Solutions LLC ("Aegis") to assist any client to transact at those prices, or at any price, in the future. Aegis makes no guarantee of the accuracy or completeness of such information. Aegis and/or its trading principals do not offer a trading program to clients, nor do they propose guiding or directing a commodity interest account for any client based on any such trading program. Certain information in this presentation may constitute forward-looking statements, which can be identified by the use of forward-looking terminology such as "edge," "advantage," "opportunity," "believe," or other variations thereon or comparable terminology. Such statements are not guarantees of future performance or activities.