|

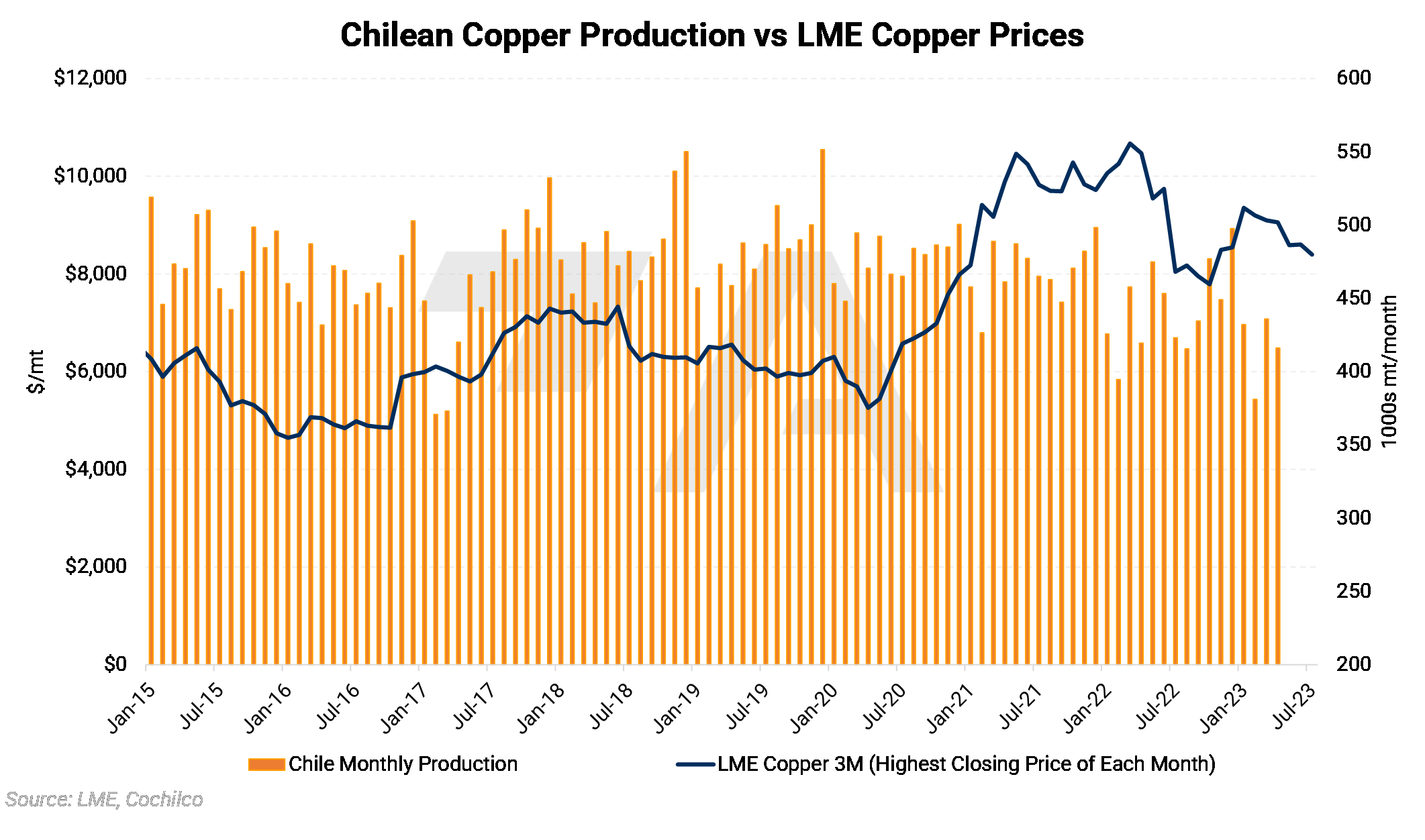

Chile is the world’s largest copper miner, responsible for 5.2 million mt, or about 24%, of global mine production in 2022. This dominance has waned slightly in recent years, mainly due to numerous production issues. Even without seasonal downturns to the December-January maintenance season, Chilean production has been hampered by weather, mudslides, political protests, and other issues. Even though production last year was down nearly 420,000 mt, or 7.1%, compared to 2021, the market has dropped as demand issues remain a top concern. |

|

|

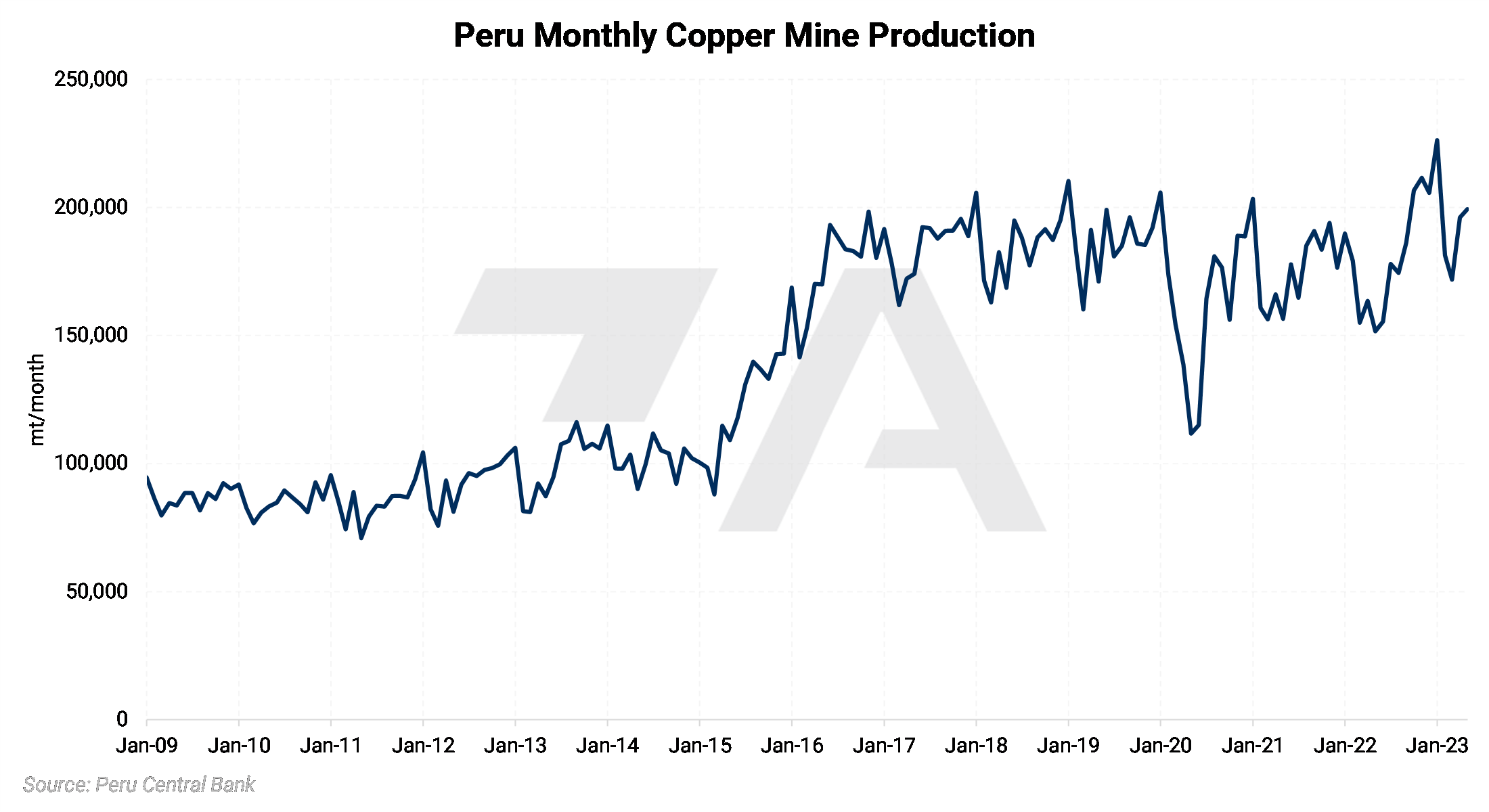

Peruvian producers have not been subjected to the output losses that neighboring Chile has had. At 2.2 million mt, production last year was down only 100,000 mt, or 4.3%, compared to 2021. Most of last year’s production losses occurred early in the year, as production climbed steadily in 2H2022, and reached an all-time high in December 2022. |

|

|

Moving onto “up-and-coming” producers in Africa, we can see that Zambian production has been volatile yet growing since 2010. The country was the world’s eighth-largest producer last year, with 770,000 mt, making it responsible for 3.5% of global output. Lack of investment and low/no profitability remain a hindrance for Zambian production, however. Earlier this month, Mopani Copper Mines stated that its production declined to 72,694 mt last year from 87,618 mt in 2021, largely due to a 45-day smelter maintenance shutdown. The mine also lost nearly $298 million last year, up from $74.2 million in 2021. These growing financial losses have forced the company to seek out new investors, the company stated. |

|

|

|

Meanwhile, Zambia’s northern neighbor, the Democratic Republic of the Congo, has seen production expand dramatically since 2010. One of the country’s largest projects, the Kamoa-Kakula Copper Complex, which was responsible for about 1.5% of the world’s copper mine output last year, is breaking its own production records. Last quarter, the mine produced 103,786 mt of copper concentrate, up 11% from 1Q2023. The average ore grade was 5.2%! This compares to Chile’s national average of 0.63%. The mine’s owner/operator, Ivanhoe Mines, believes the mine will produce 390,000 to 430,000 mt of copper concentrate, up from 333,497 mt last year. (Source: Ivanhoe Mines) |

|

|

|

As stated above, copper miners and other major sellers can mitigate downside copper price risk via LME swaps or options. Below we detail several strategies. Please contact us for further details. |

|

|

Important Disclosure: Indicative prices are provided for information purposes only and do not represent a commitment from AEGIS Hedging Solutions LLC ("Aegis") to assist any client to transact at those prices, or at any price, in the future. Aegis makes no guarantee of the accuracy or completeness of such information. Aegis and/or its trading principals do not offer a trading program to clients, nor do they propose guiding or directing a commodity interest account for any client based on any such trading program. Certain information in this presentation may constitute forward-looking statements, which can be identified by the use of forward-looking terminology such as "edge," "advantage," "opportunity," "believe," or other variations thereon or comparable terminology. Such statements are not guarantees of future performance or activities.