|

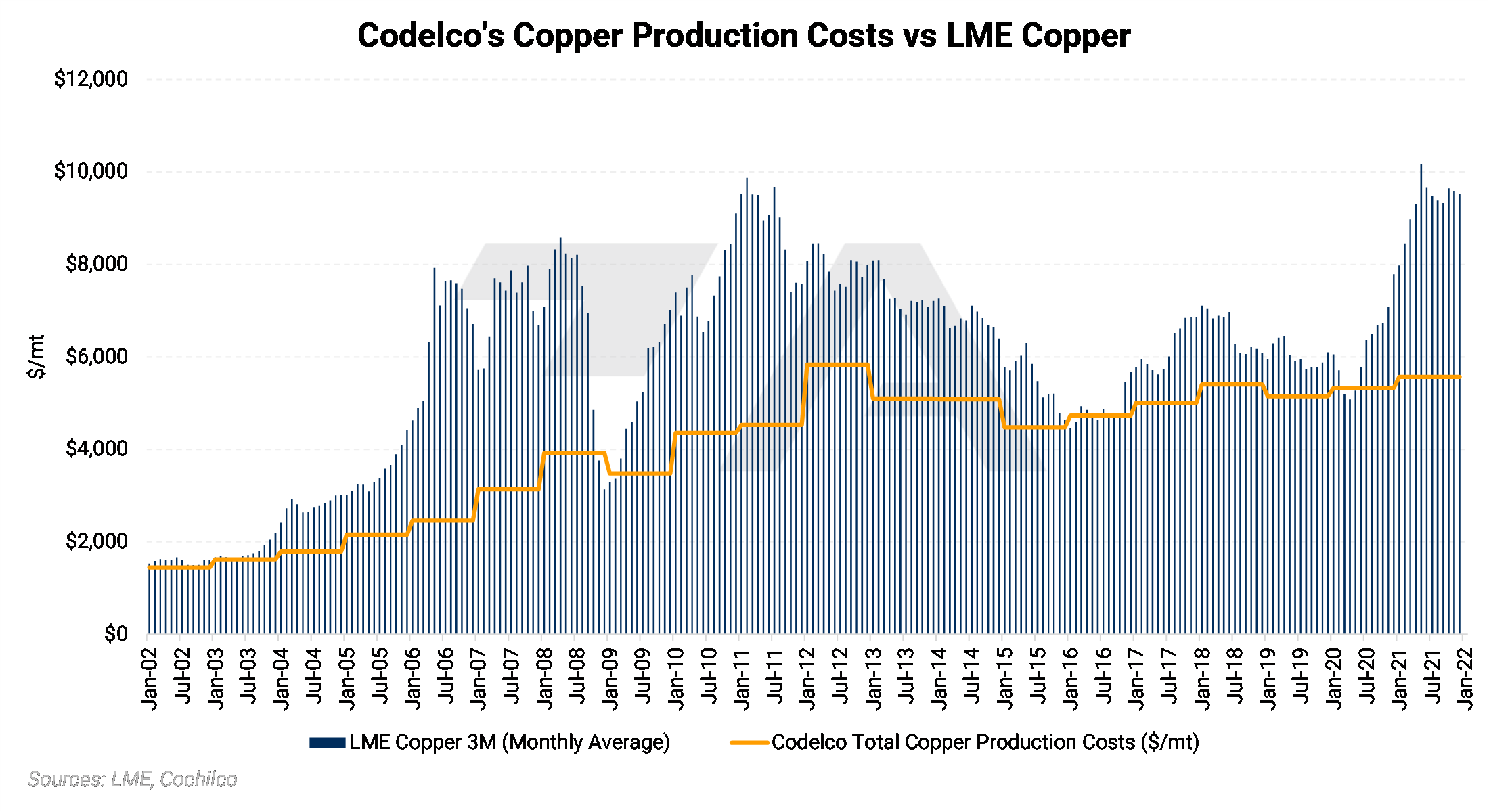

Codelco, the Chilean state-owned miner that is the world’s largest copper supplier, provides excellent historical data on its production costs. As we can see, Codelco’s production costs have generally risen over the past 20 years. In a recent semi-annual report, Codelco specifically stated that production costs rose in early 2022 due to higher energy costs. It is also interesting to note that since at least 2002, Codelco’s production cost levels seem to put a floor underneath the copper market. |

|

|

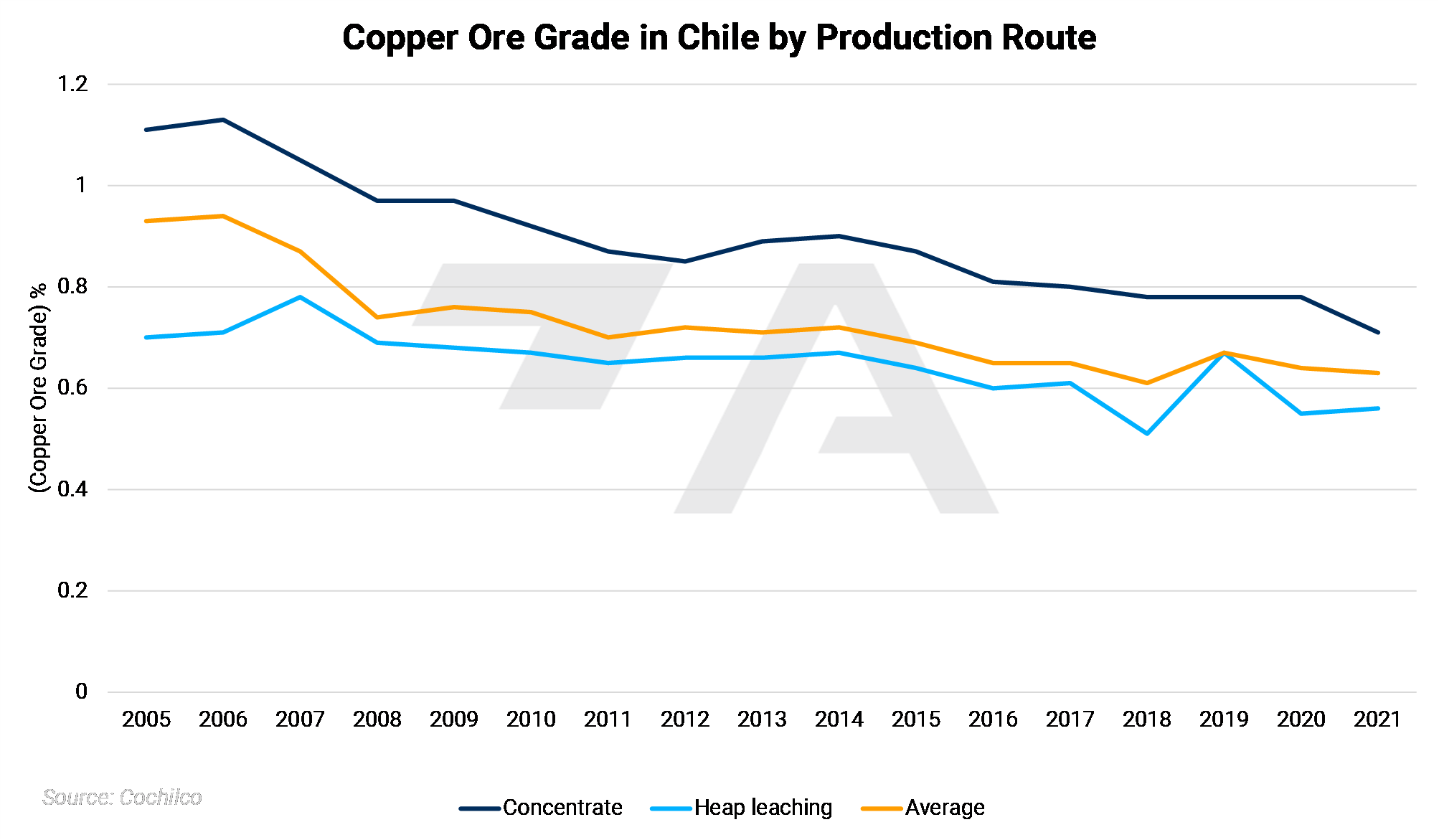

These rising production costs are directly tied to declining ore grades. As ore grades fall, production costs generally rise due to greater diesel and electricity usage. Chile has seen a rapid decline in ore grades over the past 20 years. According to Cochilco, Chile’s average ore grade currently is 0.63%, down from 0.93% in 2005. If these ore grades continue to fall, it is very likely that Chilean miners will deal with ever-increasing production costs. (In the chart below, heap leaching is defined as mining via strong acidic chemicals.) |

|

|

In neighboring Peru, which is the world’s second-largest copper producer, ore grades seem stable, but production costs are volatile. The Las Bambas mine, which is responsible for about 2% of global production and Peru’s largest, has seen ore grades drop from 0.72% in 2016 to 0.67% in 2022. Production costs at La Bambas were $2,248.71/mt in 2021, up slightly from $2,204.62/mt in 2020. Production costs have hovered near $2,204.62/mt since the Las Bambas mine started production in 2016. In their 2021 Annual Report, MMG stated that production costs will jump to between $2,866/mt to $3,086.47/mt, due in part to increasing energy prices and usage. This guidance proved to be conservative, as realized production costs were $3,373.06/mt last year. In the chart below, the Las Bambas mine played a huge role in the significant increase in Peruvian production since 2016.

|

|

|

|

So, what about these “up-and-coming” producers? One of the more interesting and promising projects to come online in recent years is the Ivanhoe Mines’ Kamoa-Kakula Mining Complex project in the Democratic Republic of the Congo (DRC). Last year, this project’s ore grade was 5.91%!! Total production was 333,497 mt, making this mine alone responsible for approximately 1.5% of global production in 2022. Output is expected to rise substantially by 2030. Production costs are currently approximately $3,065/mt, which is far more economically competitive than Codelco at $5,676/mt or MMG’s Las Bambas mine at $3,373.06/mt. This mine is responsible for a large portion of the growth in Congolese production since 2021. (Data according to USGS, and company reports) |

|

|

|

As to be expected, miners process the highest-yielding ore first. This is certainly true with the Kamoa-Kakula project, as ore grades are projected to decrease from 5.91% currently to approximately 4.5% by 2030. It is worth noting that relative to the 2020 decade, the rate of ore grade decline is expected to slow dramatically in the 2030 decade and beyond. As we saw above in other major producers, production costs will likely rise as output increases and ore grades decline. |

|

|

|

Even if improving mining technology leads to greater production over the coming years, copper miners will always be subject to volatile variable production costs. These variable production costs such as diesel prices are hard to predict, however, this price risk exposure can be mitigated. Below is a chart that briefly details three different ways miners or other major copper suppliers can hedge their diesel input costs. Please contact us for further information. |

|

|

|

Of course, copper miners and other major sellers can mitigate downside copper price risk via LME swaps or options. Below we detail several strategies. Again, please contact us for further information. |

|

|

Important Disclosure: Indicative prices are provided for information purposes only and do not represent a commitment from AEGIS Hedging Solutions LLC ("Aegis") to assist any client to transact at those prices, or at any price, in the future. Aegis makes no guarantee of the accuracy or completeness of such information. Aegis and/or its trading principals do not offer a trading program to clients, nor do they propose guiding or directing a commodity interest account for any client based on any such trading program. Certain information in this presentation may constitute forward-looking statements, which can be identified by the use of forward-looking terminology such as "edge," "advantage," "opportunity," "believe," or other variations thereon or comparable terminology. Such statements are not guarantees of future performance or activities.