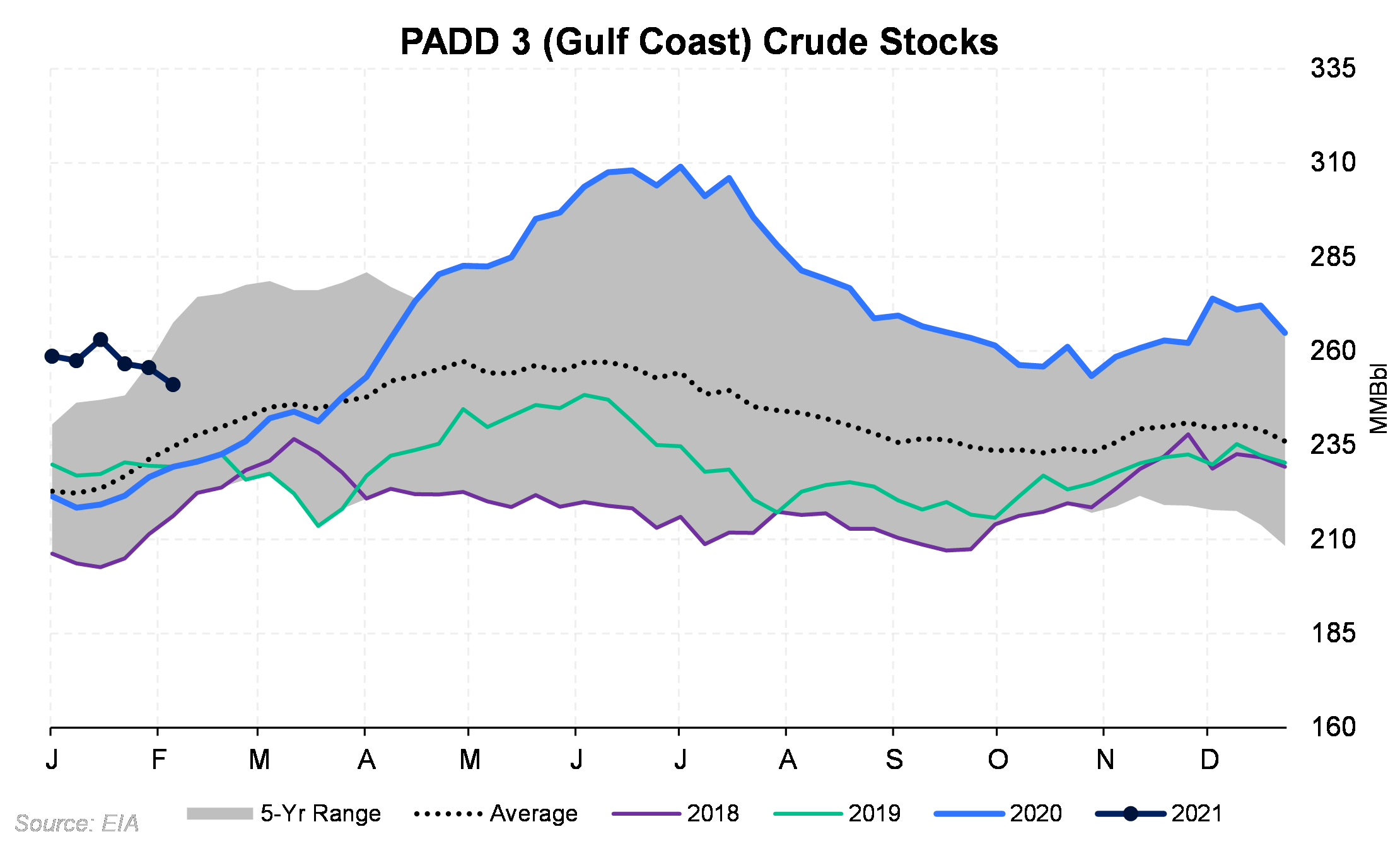

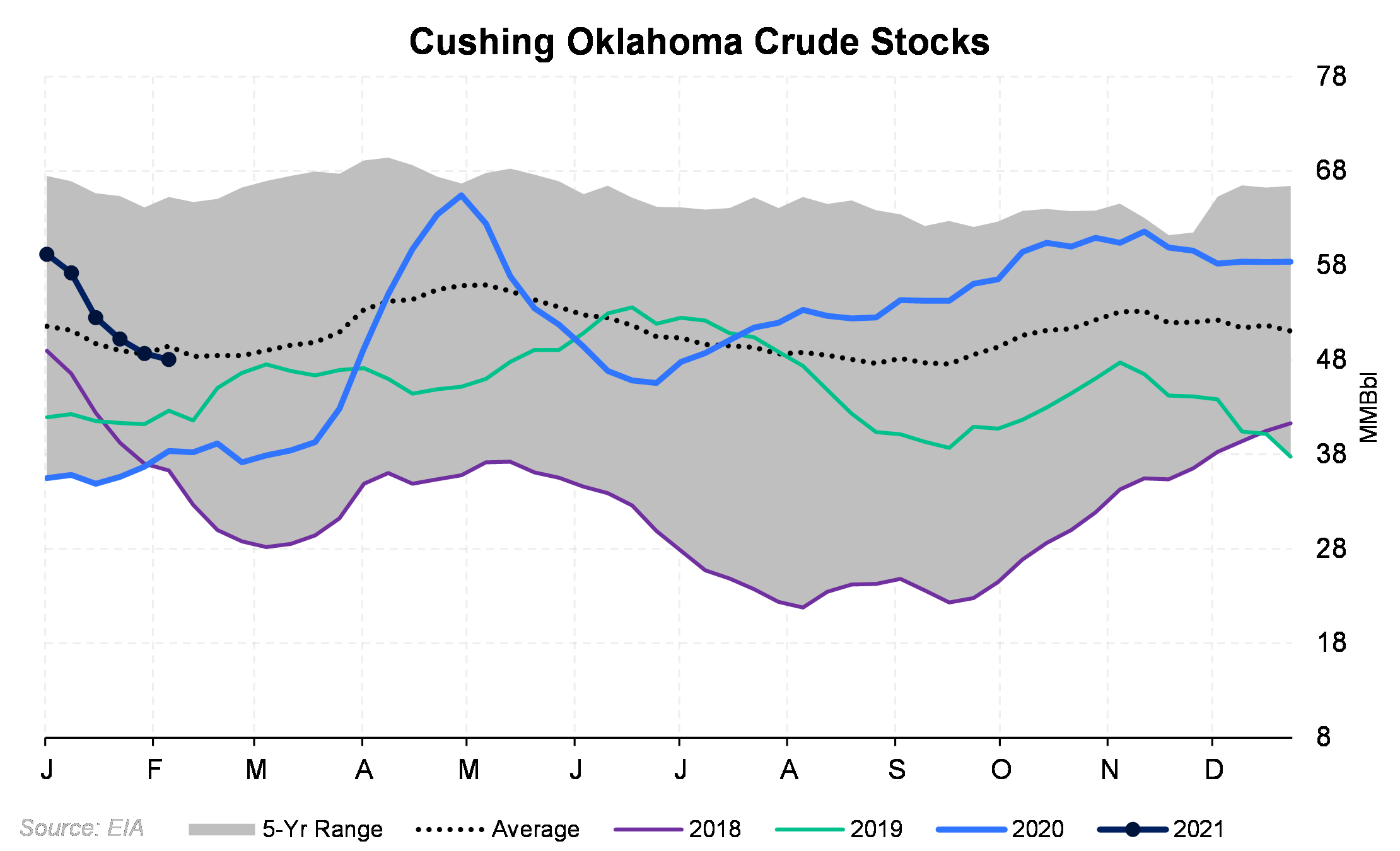

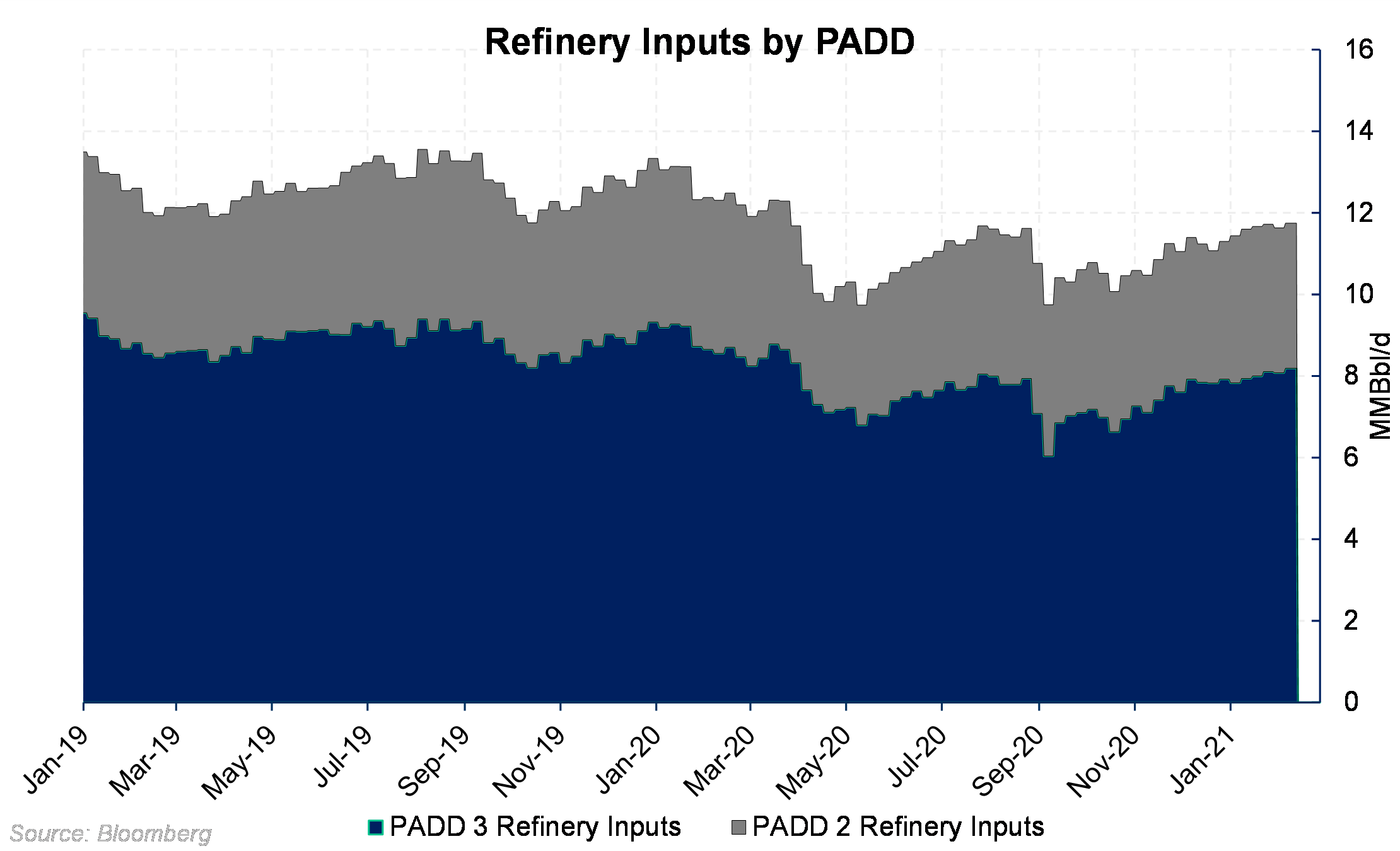

Crude inventories at Cushing have decreased by over 10 MMBbls or 300 MBbl/d during January, while PADD 3 (Gulf Coast) inventories also declined by 12 MMBbls. Collectively, Cushing and PADD 3 inventories are down by over 22 MMBbls thus far in 2021, or around 0.51 MMBbl/d, while refinery inputs are up nearly 0.65 MMBbl/d.

|

|

Last week, PADD 3 stocks returned to the trailing five-year range for the first time since April. If you look in the chart (top-left), during 2020, PADD 3 stocks were at or near historical highs for most of the year, making the return to the five-year range even more impressive. Cushing stocks are depleting quickly as well, now in their five-year average for the first time since July.

With the recent rally in WTI, the shift toward a more backwardated curve is prompting draws from inventories. The current curve structure does not incentivize the common cash-and-carry arbitrage strategy. Simply put, it is not economical to hold crude in storage with future prices below spot prices.

Further, local PADD 2 production is falling.

PADD 2 (Midwest) refinery inputs have risen by around 0.3 MMBbl/d since the last week of December. Much of the increase in inputs happened during the first week of January. PADD 2 inputs have retreated since by around 0.1 MMBbl/d from their high of 3.66 MMBbl/d reached during the week ending January 15.

PADD 3 refinery inputs are also up, by around 0.35 MMBbl/d so far in 2021. Refinery inputs have increased from 7.83 MMBbl/d to 8.18 MMBbl/d.

If demand keeps rising faster than production, more oil would need to flow out of storage to satisfy refiners' needs. This would help keep the curve backwardated, or downward sloping, and would help hold prices higher. International supply-demand forces are still very important, but the U.S. market, especially in the interior, is short supply.

Commodity Interest Trading involves risk and, therefore, is not appropriate for all persons; failure to manage commercial risk by engaging in some form of hedging also involves risk. Past performance is not necessarily indicative of future results. There is no guarantee that hedge program objectives will be achieved. Certain information contained in this research may constitute forward-looking terminology, such as "edge," "advantage," 'opportunity," "believe," or other variations thereon or comparable terminology. Such statements and opinions are not guarantees of future performance or activities. Neither this trading advisor nor any of its trading principals offer a trading program to clients, nor do they propose guiding or directing a commodity interest account for any client based on any such trading program.