|

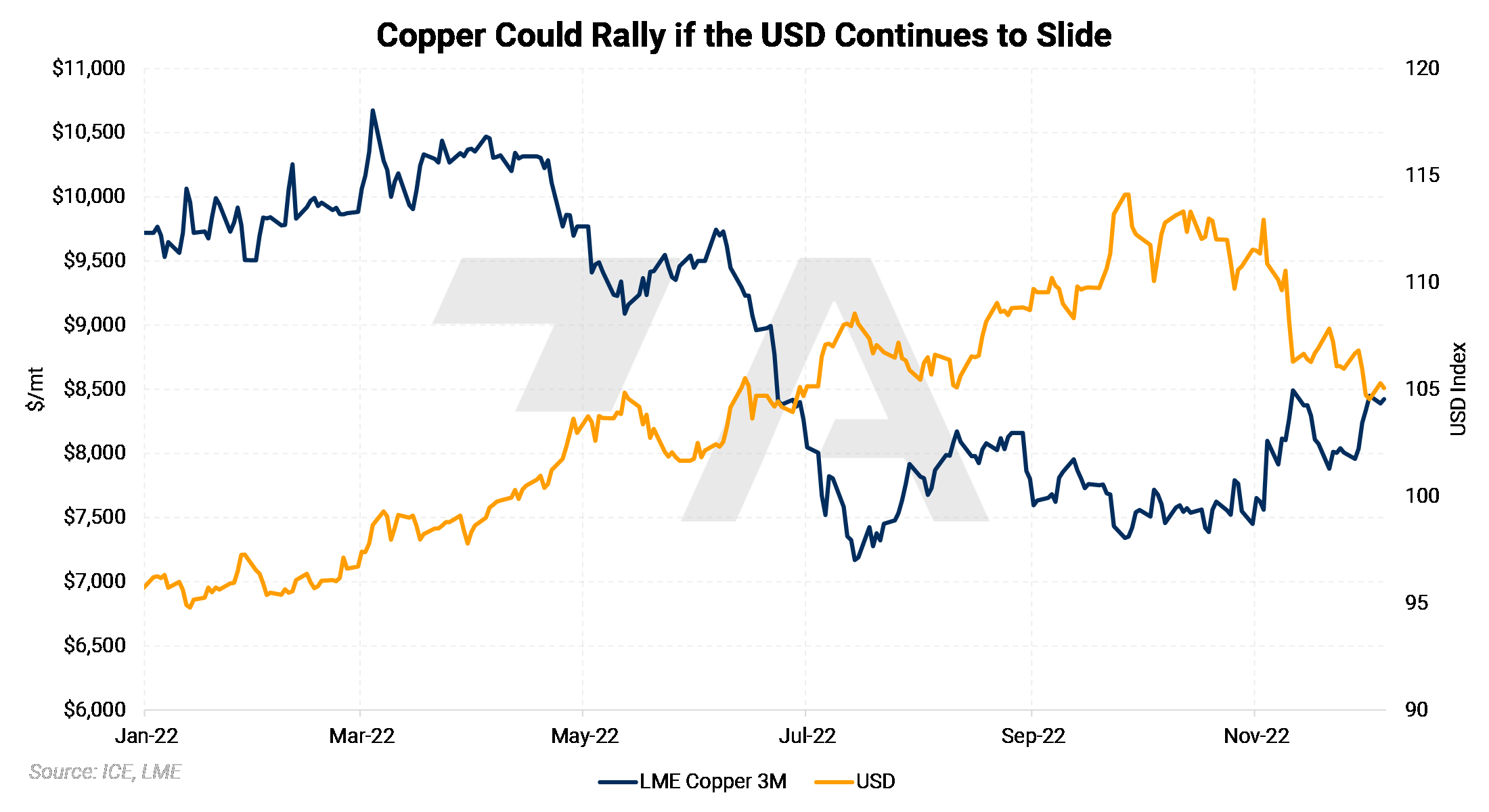

The USD and LME copper normally trade inversely to each other. True to form, the USD is down nearly 9% from the September highs, while copper prices have rallied nearly 16% (as of 12/7/2022 close). Regarding China, government officials stated they will allow home quarantine for “some” people” who have tested positive for COVID-19. Officials also stated they will “speed up” COVID vaccinations for the elderly. More actions will be announced “in coming days,” according to Reuters. In addition to the new COVID-19 policies, Chinese authorities have also relaxed financing restrictions on property developers, in an attempt to boost the faltering real-estate sector. Also, China’s central bank lowered the reserve requirement ratio (RRR) on domestic banks. The RRR is the percentage of funds that a bank must hold in reserve and not lend out. This move is meant to increase the country’s money supply. We also note that these measures could boost copper demand, and therefore could remain supportive of LME copper prices. (Source: Bloomberg) |

|

|

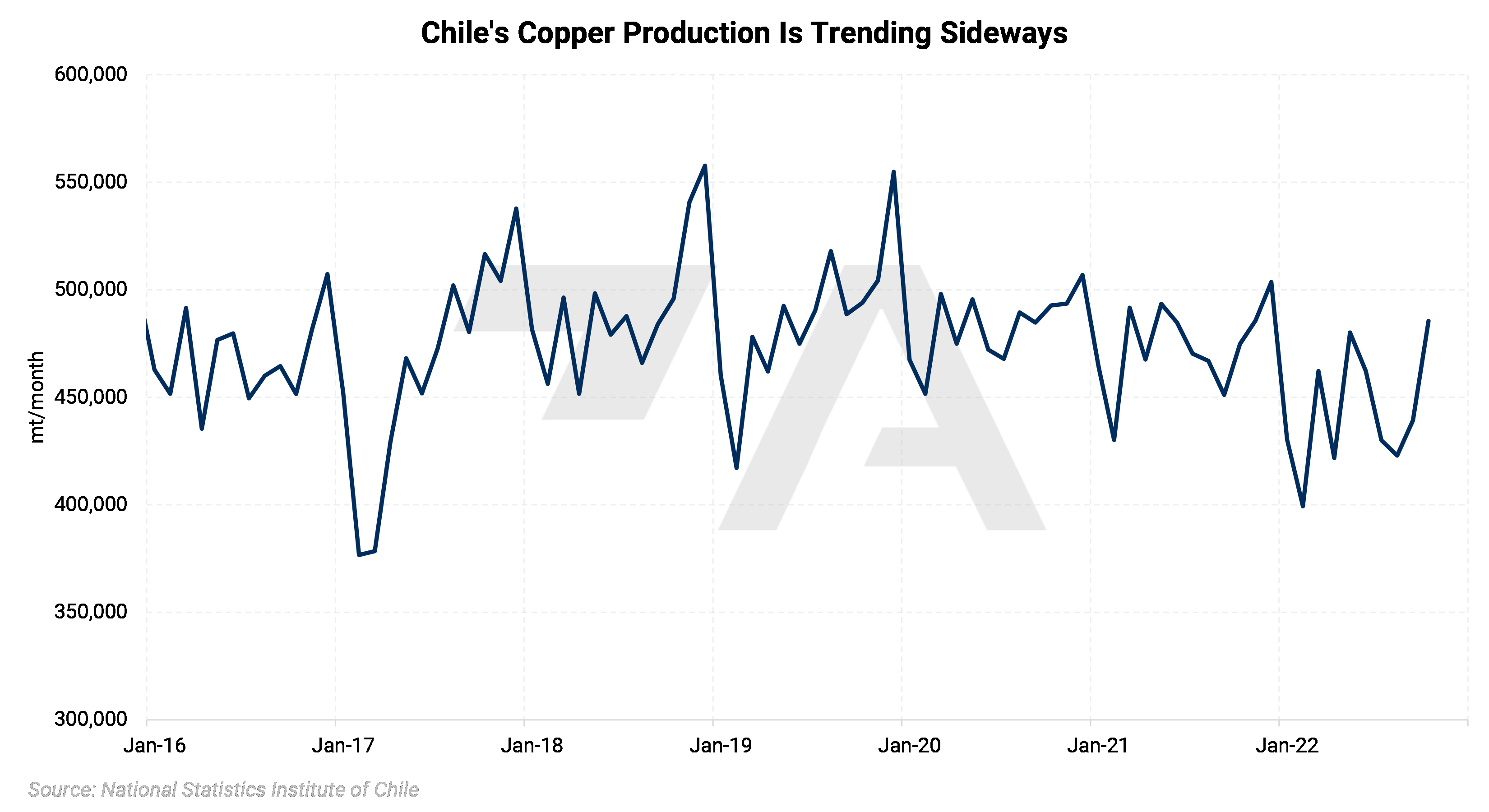

Largely due to China easing its COVID restrictions, Goldman Sachs has lifted its 2023 average price forecast to $9,750/mt, from $8,325/mt. They also upped their 3/6/12 months price targets to $9,500/$10,000/$11,000/mt, compared to $6,700/$7,600/$9,000/mt previously. According to their note, “China’s stockpiles of the metal almost entirely depleted” as we enter 2023, thus anticipating increased buyer demand as they build stockpiles. (Source: Bloomberg) The bullish views also go beyond 2023. Due to increasing demand from the energy transition, miner Glencore now predicts a cumulative copper shortfall of nearly 50 million mt by 2030. Despite the expected deficit, Glencore does currently plan to increase production. Earlier this week, Glencore stated “we want to see that deficit,” later declaring that they will only increase production when buyers are “screaming” for copper. According to the company, current production hovers near 1 million mt but could be increased by 60% even with the current assets. (Sources: Bloomberg, Glencore) However, not all the recent news was bullish for copper prices. Workers at BHP’s Escondida copper mine in Chile reached an agreement with the company last Monday morning (11/28/2022), thus avoiding a strike that was scheduled for that week. The workers were threatening to strike due to safety concerns, according to Reuters. The new agreement alleviates these concerns, as it contains” concrete and verifiable measures to improve the hygiene and safety of workers,” according to union statements. At 1.01 million mt, the Escondida copper mine produced nearly 5% of the world’s output last year, based on USGS and BHP data. AEGIS notes that the Chilean news is likely neutral to bearish for LME copper prices. (Source: Reuters, BHP, USGS) |

|

|

Despite China’s flip-flopping COVID policy and steady Chilean production, we note that copper prices are 16% off the mid-September lows (based on the 12/6/2022 close). That said, this could still be a good time for copper end-users to hedge future needs. Consumers can hedge copper in various ways, as we detail below. Buying swaps or call options are viable strategies, as either would establish a maximum copper price. Such positions are standard for consumer hedging; however, they can result in opportunity costs or cash costs if metal prices decrease. Please contact AEGIS for specific strategies that fit your operations. |

|

|

Important Disclosure: Indicative prices are provided for information purposes only and do not represent a commitment from AEGIS Hedging Solutions LLC ("Aegis") to assist any client to transact at those prices, or at any price, in the future. Aegis makes no guarantee of the accuracy or completeness of such information. Aegis and/or its trading principals do not offer a trading program to clients, nor do they propose guiding or directing a commodity interest account for any client based on any such trading program. Certain information in this presentation may constitute forward-looking statements, which can be identified by the use of forward-looking terminology such as "edge," "advantage," "opportunity," "believe," or other variations thereon or comparable terminology. Such statements are not guarantees of future performance or activities.