Donald Trump and Joe Biden, the presumed presidential nominees, have remarkably different stances toward energy production and consumption, and the role of government in those trends. We identify issues that are risks to prices and the industry.

What Does a Biden Presidency Mean for the Future of Oil & Gas?

AEGIS does not imply support for either candidate. We seek to inform readers of the implications of a Biden presidency on oil and gas prices and regulatory risk.

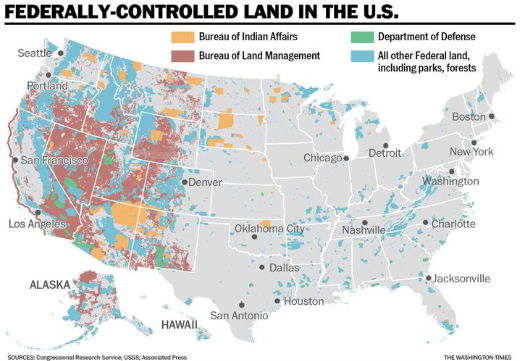

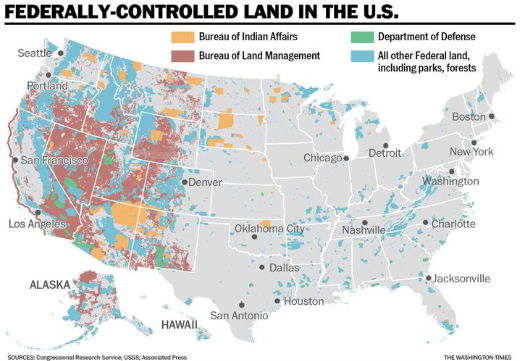

Joe Biden: Eliminate new permits for oil and gas drilling on federal lands and waters. (https://joebiden.com/climate/, July 7, 2020)

- The U.S. produces 23.7% and 13.0% of the country's oil and gas, respectively, on federal lands.

- During the Trump administration drilling permits granted skyrocketed.

- AEGIS View:

- Less activity on federal lands would reduce total reserves and potential supply. The effect is eventually bullish for prices.

- However, E&Ps with affected leases could see write-downs on reserve values

- Affected E&Ps would become more susceptible to regulatory risk, while those with no exposure to federal lands would benefit from less competition

|

|

3rd Party Take: "If the ban is on just new drilling leases, leaving existing leases in place, it would reduce revenues by $6 billion nationally over the next 15 years and eliminate 270,000 U.S. jobs.", Institute for Energy Research (Impact of Biden's Bans on Fracking and Oil Production on Federal Lands and Offshore, IER, May 7, 2020

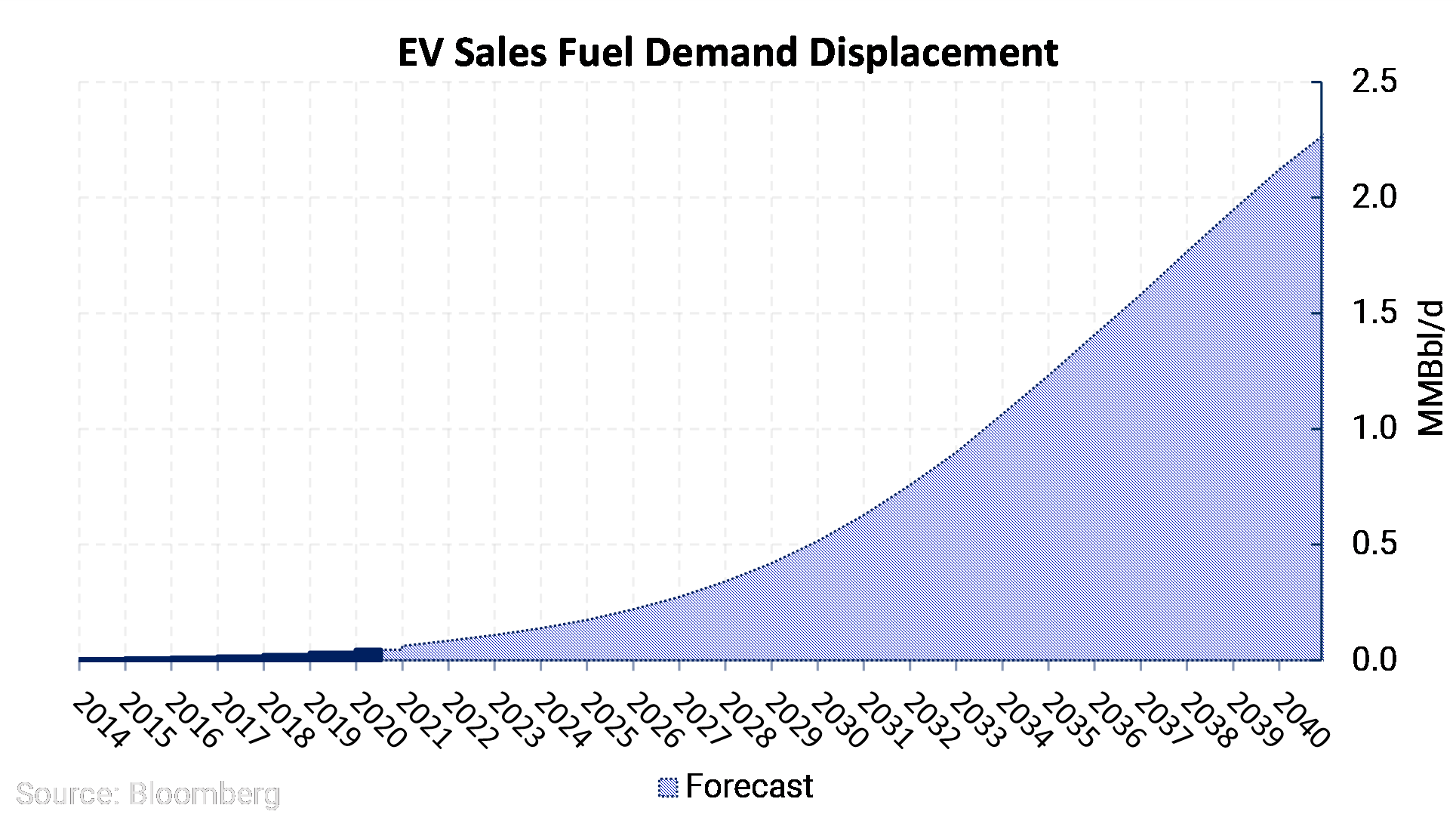

Joe Biden: Pass legislation aimed towards transitioning America to 100% electric vehicles (https://joebiden.com/climate/, July 7, 2020)

-

Biden's "Clean Energy Plan" states that 500,000 new public charging outlets will be deployed by 2030

-

Biden's "Clean Cars for America" proposal aims to subsidize U.S. consumers with rebates to car buyers who make the switch from internal combustion to electric vehicles

-

Biden has stated he would impose stricter regulations on car manufacturers and increase the fuel economy standards for new vehicles, mandating a fuel efficiency rating of 54.5 mi/per gallon for light-duty vehicles by the end of 2025

-

AEGIS View:

-

Gasoline demand would decrease under policies that favor both a significant increase in fuel efficiency and incentives to transition to electric vehicles

-

Refineries will have to align themselves with the long-term trend of the declining market for transportation fuels and find other ways to create value from refining crude

|

U.S. gasoline use will begin to decline more rapidly if policymakers strengthen support for EVs over gasoline-powered ones (ICEVs). Some Democratic presidential candidates proposed ending new sales of ICEVs by 2030 or 2035, sooner than some European countries. The pandemic will suppress demand in the short term. It could fall by about 4% by 2025 vs. 2019 levels if policymakers were to phase out new sales of ICEVs by 2040, we believe. Some of the declines would be due to ICEVs' continued efficiency increases.", (Biden Electric Vehicle Push Would Hasten Gasoline-Demand Decline, Bloomberg Intelligence, May 7, 2020)

|

Joe Biden: Require public companies to disclose climate risk and greenhouse gas emissions in their operations and supply chains (https://joebiden.com/climate/, July 7, 2020)

|

|

3rd Party Take: "The single act of forcing greater climate risk disclosure could portend other financial regulations that would reduce investor interest in fossil fuels, all of which can be done by a Biden administration without Congress. The power of disclosure is underappreciated. Interrupting the flow of capital into resource production interrupts resource production. It takes money going into the ground to take oil, gas, and coal out." (Biden may use financial regulations to slow fossil fuel investments, Washington Examiner, June 18, 2020)

A Biden administration would be able to withdraw the overhaul on NEPA conducted by the Trump Administration that drew heavy criticism from Democrats

-

The National Environmental Policy Act (NEPA) is a United States environmental law that promotes the enhancement of the environment and established the President's Council on Environmental Quality (CEQ). NEPA mandates an environmental study if a major project involves federal funding or permitting

-

The Trump administration revisions aimed to decrease the number of infrastructure projects that would be subject to NEPA review, effectively shortening long permit processes that have historically delayed projects

-

The Trump administration has made it easier to acquire drilling permits on federal and Indian lands. The time needed to complete a permit now averages 108 days, down from 257 under the Obama administration, according to the Department of the Interior

-

NEPA played a direct role in the court-mandated shutdown of the DAPL Pipeline (read more here)

-

AEGIS View:

-

The NEPA reforms hinge on the outcome of the upcoming elections, Congress could reverse the NEPA reforms if democrats hold a majority in both the House and the Senate, or Joe Biden could withdraw the overhaul for rewrites if elected this November

-

If the NEPA revisions stand, this would be beneficial for the industry. Project timelines would be shorter, and the approval process for new projects would be quicker

3rd Party Take: Mike Sommers, president, and chief executive of the American Petroleum Institute, predicted that the changes would speed up the construction of "not only the modernized pipeline infrastructure we need to deliver cleaner fuels but highways, bridges and renewable energy. These reforms will help accelerate the nation's economic recovery and advance energy infrastructure while continuing necessary environmental reviews." (Bringing NEPA Into 21st Century Will Advance U.S. Infrastructure, API, July 16, 2020)

Joe Biden: Nominate a commissioner for the Federal Energy Regulatory Commission to gain a party majority (FERC), (https://joebiden.com/climate/, July 7, 2020)

-

The next Republican commissioner seat is open in July 2021. If the current administration fails to nominate a seat and confirm a replacement before the end of this year, that responsibility would fall upon the next administration

-

FERC has five commissioners who are nominated by the U.S. President and confirmed by the U.S. Senate. There may be no more than three commissioners of one political party serving on the commission at any given time. The commissioners of the organization are currently split evenly at two republicans and two democrats, with one seat remaining open

-

AEGIS View:

-

A Democrat majority at FERC could create additional hurdles for energy infrastructure projects, in the form of new and more stringent environmental reviews, or a slower review process overall

-

LNG Terminals and interstate natural gas pipelines could be most affected, with projects currently under construction facing uncertainty whether permits issued under the previous administration would stand in court

3rd Party Take: "Biden also notes that he would appoint FERC commissioners who "will drive market reforms, like expanding regional electric markets... [and] integrating renewables." While Biden would nominate new commissioners, Congress would also need to approve them — offering them an opportunity to stymie the process." (Biden-Sanders task force's climate plan excludes fracking ban, sees FERC role, S&P Global, July 16, 2020)

Joe Biden: Repeal fossil-fuel subsidies and redirect the funding toward facilitating America's transition to renewable energy (https://joebiden.com/climate/, July 7, 2020)

-

Conservative estimates by the Environmental and Energy Study Institute put U.S. direct subsidies to the fossil fuel industry at roughly $20 billion per year; with 20 percent currently allocated to coal and 80 percent to natural gas and crude oil. However, per EESI, these figures do not include indirect subsidies and negative externalities ultimately borne by society or the US government

-

AEGIS View:

-

If subsidies for fossil fuels end, the economics of drilling a well will drastically change. Intangible and tangible drilling cost would be eliminated, making it more capital intensive to drill a new well

-

E&Ps' supply and reserves would be directly affected as companies are forced to become more selective when drilling due to a higher hurdle (breakeven) rates

3rd Party Take: "A separate, peer-reviewed analysis by some of us in 2017 demonstrated that without a dozen key subsidies, nearly half of the U.S.'s future oil production could be unprofitable at $50-per-barrel oil prices—the level at which prices may hover in a low-carbon future." (Fossil Fuel Subsidies: A Closer Look at Tax Breaks and Societal Costs, EESI, July 29,2019)

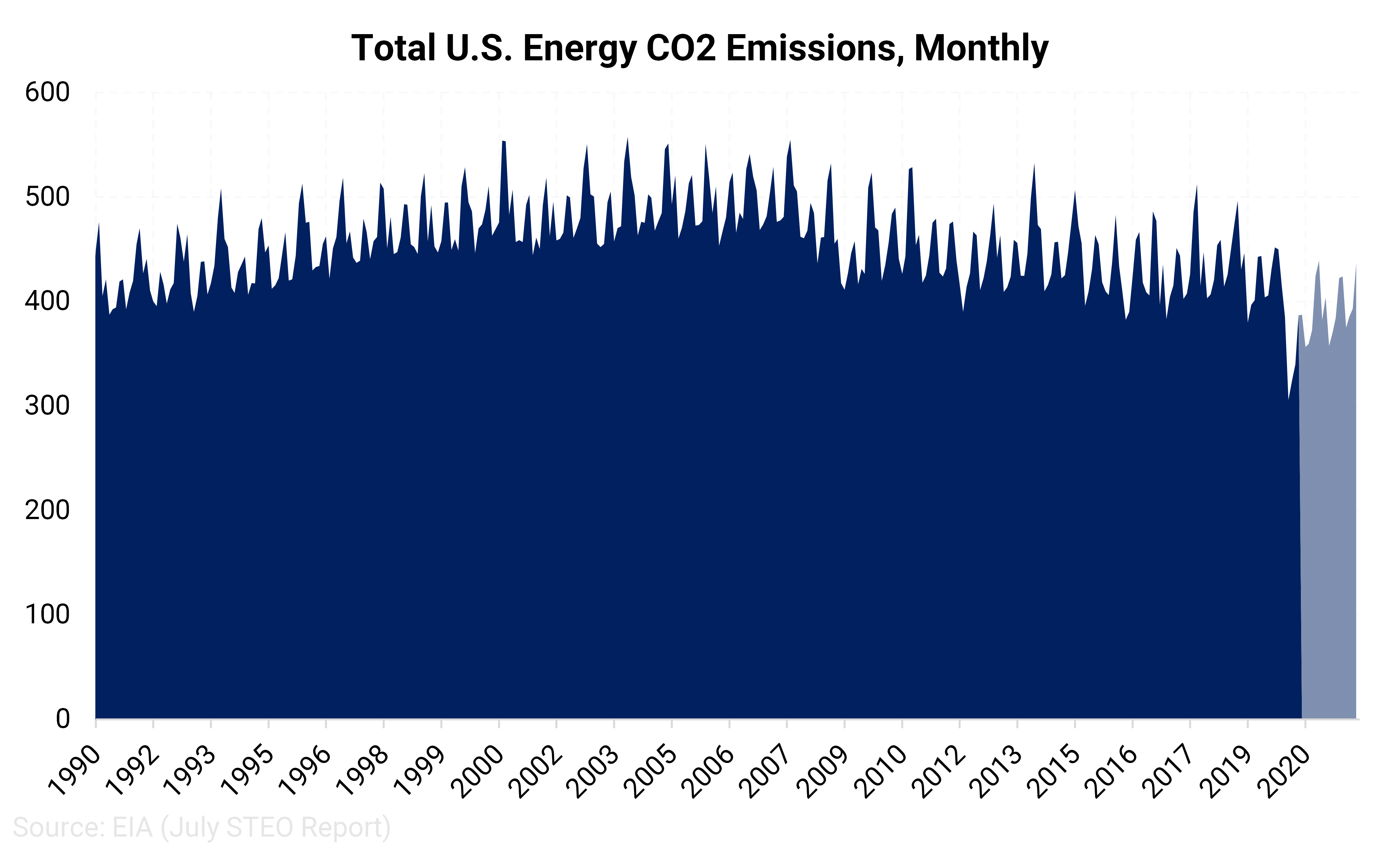

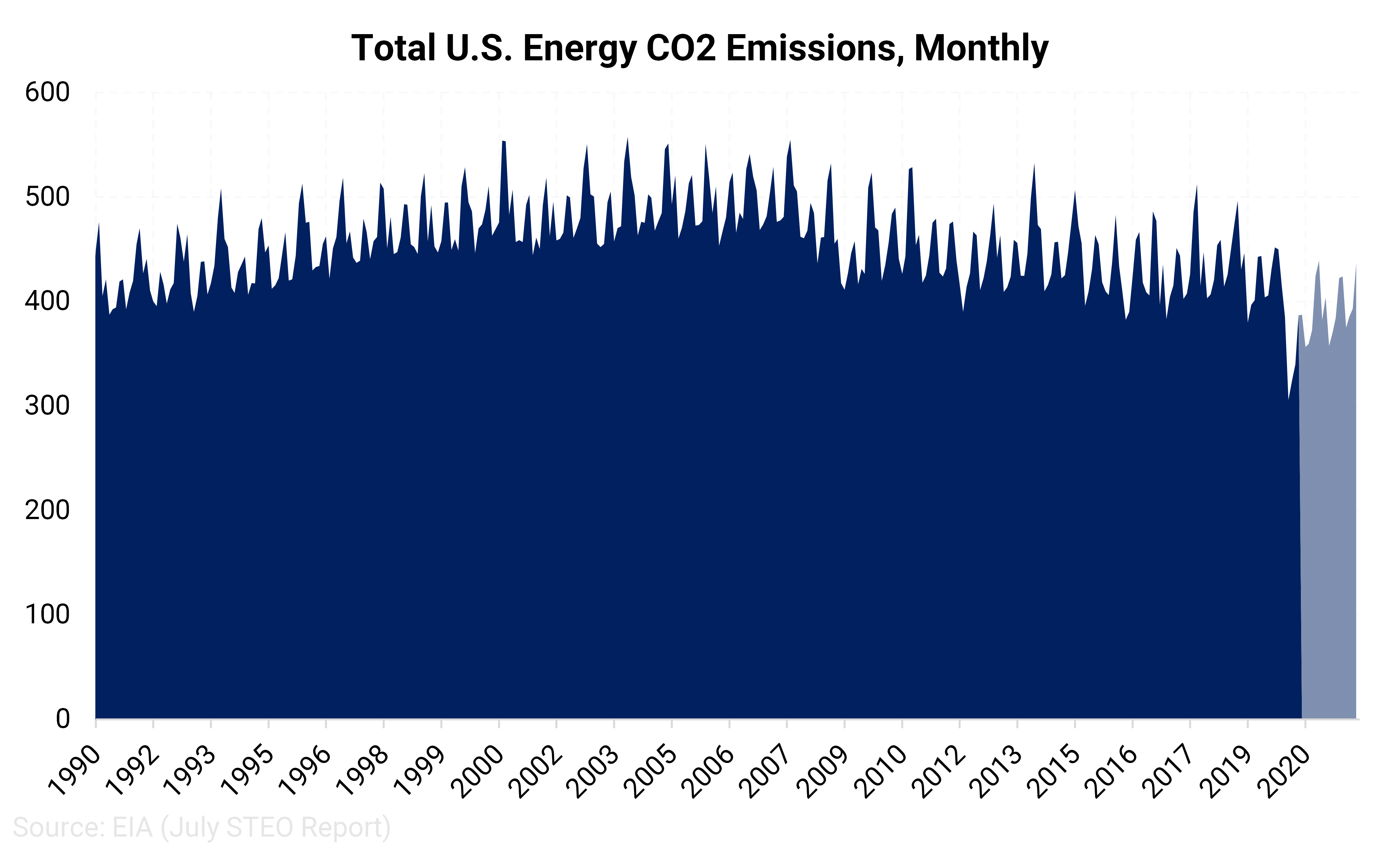

Joe Biden: Require utilities to get all their power from emissions-free sources within 15 years (https://joebiden.com/climate/)

-

In 2019, 38% of U.S. electricity was generated using clean sources, according to the EIA, showing the magnitude of the hurdle to achieve 100% clean energy sources

-

The Biden policy was inspired by California's (passed in 2018), requiring that the state would be 100% carbon-free by 2045

-

According to Wood Mackenzie (June 27, 2019), the cost of full decarbonization of the U.S. power grid would be nearly $4.5 trillion, given the current state of technology. That is nearly as much as what the country has spent, since 2001, on the "war on terror," or over twice the cost of the proposed $2 trillion estimated by Biden

-

AEGIS View:

-

The proposal would harm demand of oil and gas, as the need for the fuels would diminish. Still, despite the strong rhetoric against fossil fuels, history suggests pragmatism will prevail and natural gas-fired power generation will continue to be a vital piece in the shift to renewables

-

The California energy landscape has been far from perfect. As record temperatures disrupted the state this summer, rolling blackouts were implemented for the first time in over 20 years. While there are several potential factors that may have contributed to the blackouts, many will point to the rapid decommissioning of gas-fired power generation plants and the reduced baseload capacity.

3rd Party Take: "Natural gas, wind, and solar are now the most common new generation fuels, but it took decades of renewable energy mandates and government spending on renewables research, tax breaks, and other subsidies to help make those resources plentiful and relatively inexpensive. Even so, capacity factors for wind and solar power are half or less than they are for coal, natural gas, or nuclear power, making the amount of generation from wind and solar capacity less than 10 percent of our generation today. For Biden to change the 62 percent of the generation currently from fossil fuels into renewable energy sources will cost far more than he states he will spend on his 'clean energy' standard and other goals in the building and transportation sectors and cost American families thousands of dollars needlessly, if it even can be accomplished." (American Energy Alliance, August 10, 2020)

Joe Biden: Existing wells on federal lands will be subject to more stringent regulation, aimed at reducing carbon emissions (https://joebiden.com/climate)

-

Biden has a strong record of voting for protection of federal lands dating back to the 1970s during his time as a U.S. senator, established protections for more than 550 million acres of federal lands and waters, and banned drilling in large parts of the Atlantic and Arctic Oceans

-

The Trump administration ended a five-year moratorium in late 2019 in California, opening 720,000 acres for development on federal land

-

The regulations would extend to offshore drilling in federal waters, which had seen record production before the pandemic, according to EIA

-

AEGIS View:

-

While uncertainty remains as to which regulations would be imposed under a Biden administration, it is likely oil and gas production on federal land would decline from its recent highs, reached under the Trump administration

3rd Party Take: "Targeting fossil fuel production on public land would not significantly decrease emissions over time because if demand for oil and gas rebounds after the coronavirus pandemic, production could move to other areas of the United States or to countries with less cumbersome regulations. In addition, supply-side restrictions are less predictable than those targeting reductions in fossil fuel demand, such as a carbon tax or a zero-carbon electricity mandate." (Washington Examiner, April 23, 2020)