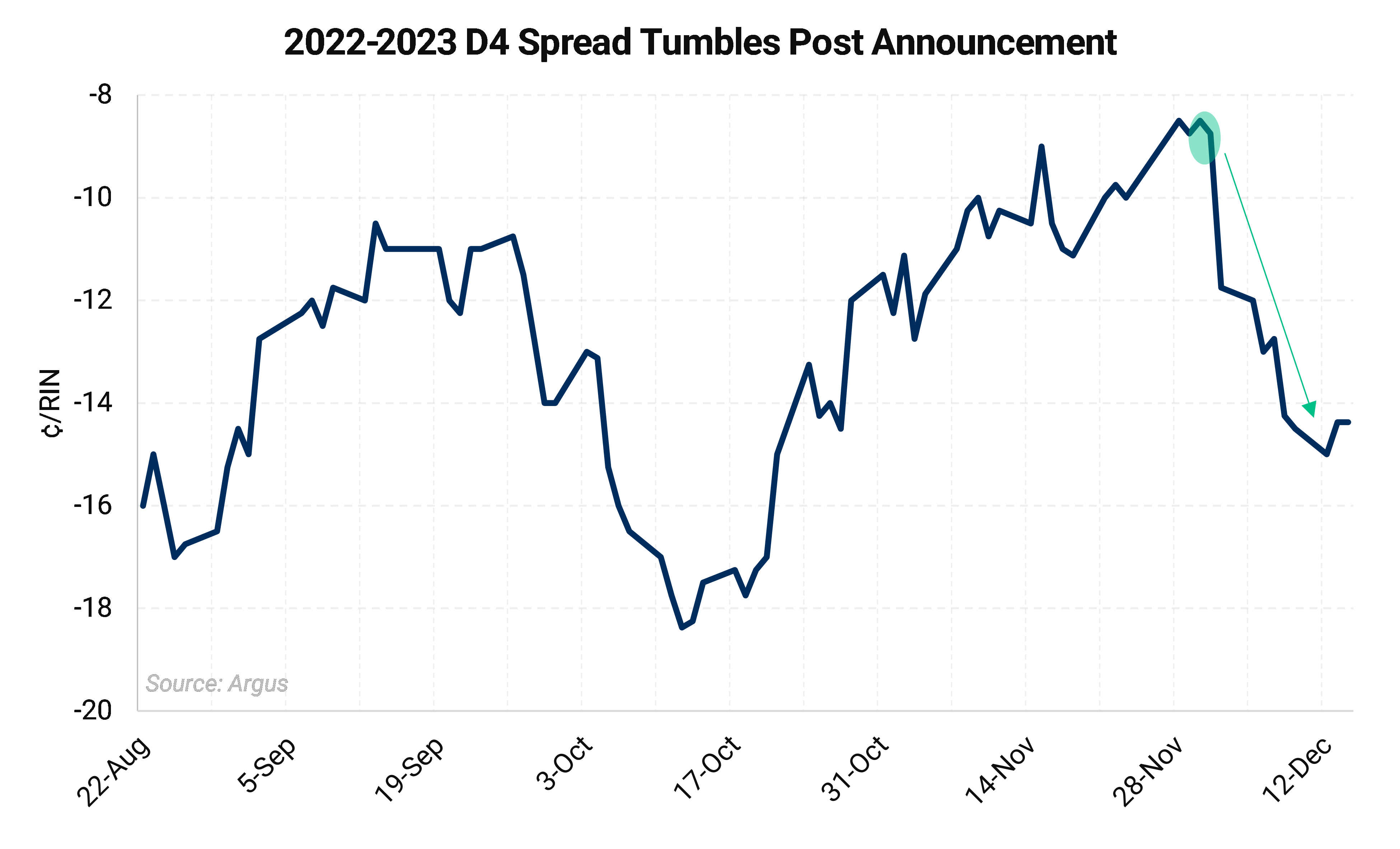

The EPA release of the Set Rule on December 1 led to heavy losses in D4 biomass-based diesel credits—the most common advanced RIN. D4 RIN prices were steadily creeping higher over the month prior amid market expectations of higher mandates for the advanced category given the lightning pace of renewable diesel facilities anticipated over the course of the next three years.

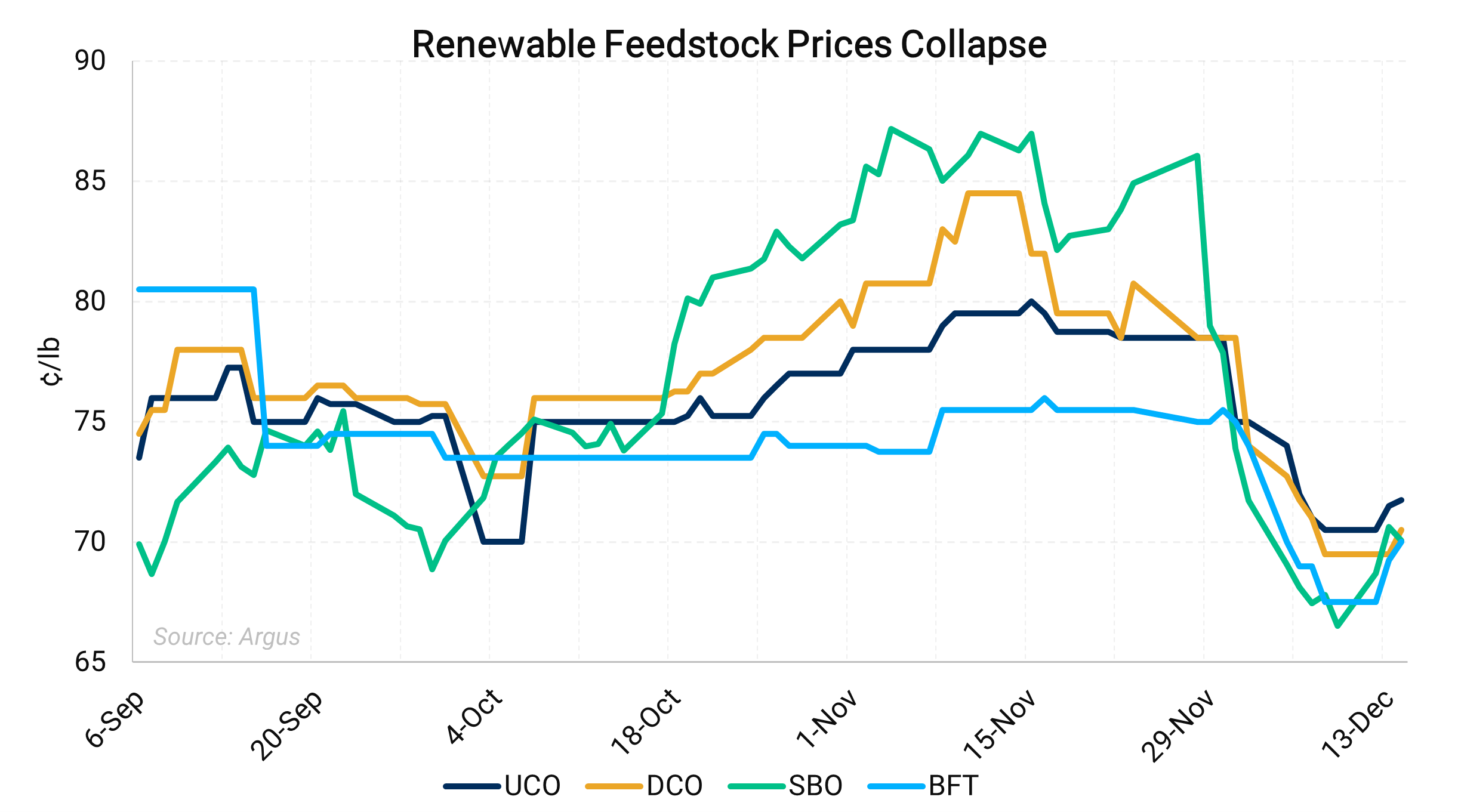

Current vintage D4 RINs shed 16.25¢/RIN, or 8.33%, in just one session following the announcement, while CBOT soybean oil shed 6.83¢/lb, or 9.08%. The chart above shows that losses in 2023 vintage D4 RINs outpaced losses in the 2022 vintage D4s. The spread had been narrowing in anticipation of more stringent 2023 targets for the advanced category, driving a heavier selloff as the new advanced targets would now be much more achievable.

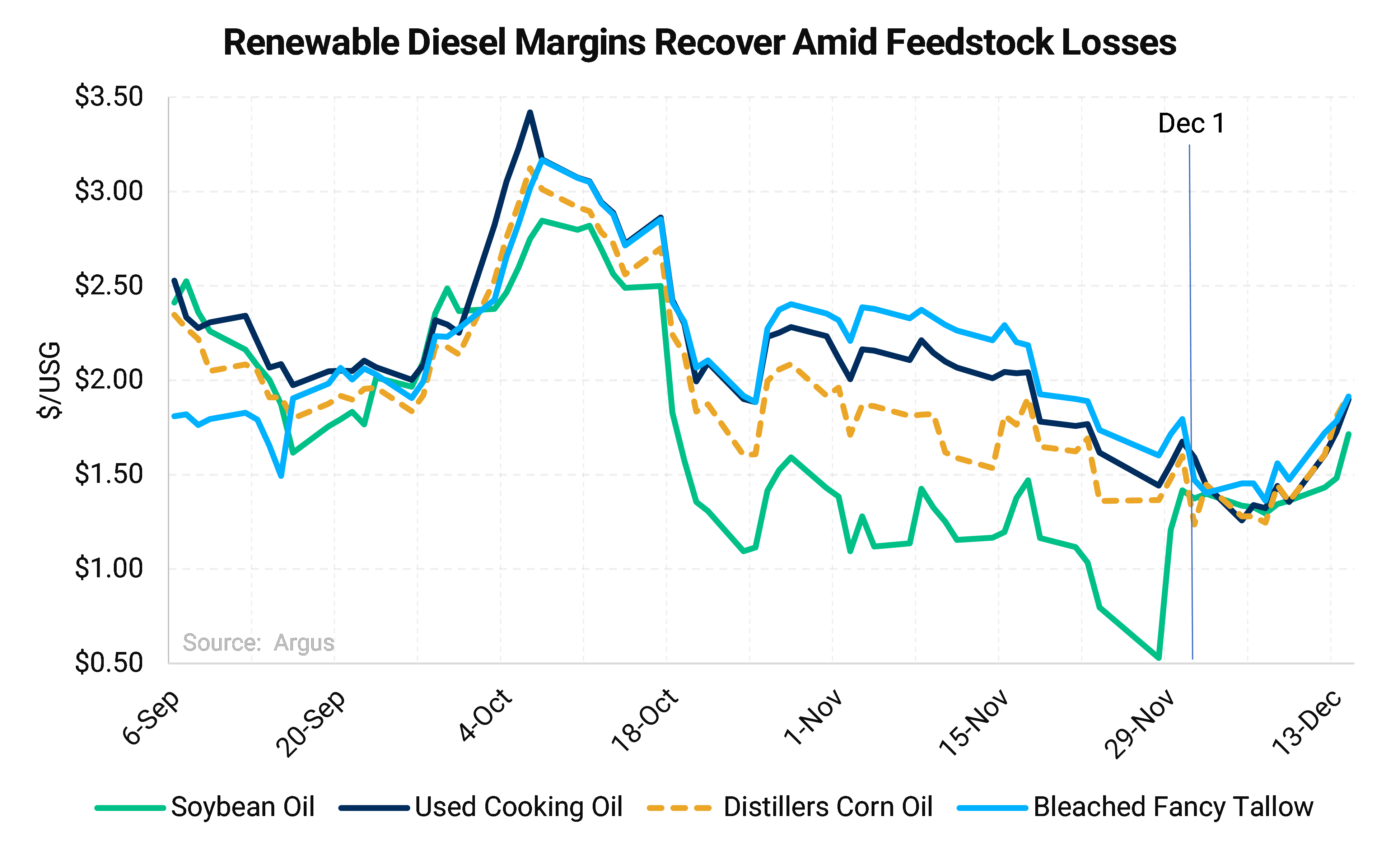

Nymex ULSD, the petroleum component of the margin equation, fell 10.05¢/gallon, or -2.99%, on December 1. As soybean oil losses outpaced ULSD weakness, this proved supportive of the wider margin environment.

D4 losses were marginally offset—though this was more muted or even delayed in spot feedstock markets—largely staving off a substantial decline in renewable diesel margins. Given spot feedstock moves on the day, margins for distillers’ corn oil (DCO) and bleached fancy tallow (BFT), were hit the hardest on December 1, while margins for other feedstocks were largely preserved.

Renewable diesel margins have recovered substantially since bottoming out on December 5 driven by a short-lived recovery in Nymex ULSD pricing alongside modest losses in spot feedstocks and tenuous D4 RIN strength. Gains ranged from 30¢ to nearly 68.5¢/gallon, or 19%-55%, over the course of just seven sessions.

Now that the dust has settled after the EPA announcement, one gets a sense for the underlying volatility spanning a myriad of interconnected variables. Yet margins and the associated markets have not settled into a trading band for now, the overall volatility in key variables such as Nymex ULSD and renewable feedstocks, the public comment period and headline risk ensure the renewable diesel margin environment remains turbulent well into 2023. The EPA public comment period kicks off virtually January 10, 2023, with the deadline for finalized targets still set for June 14, 2023.