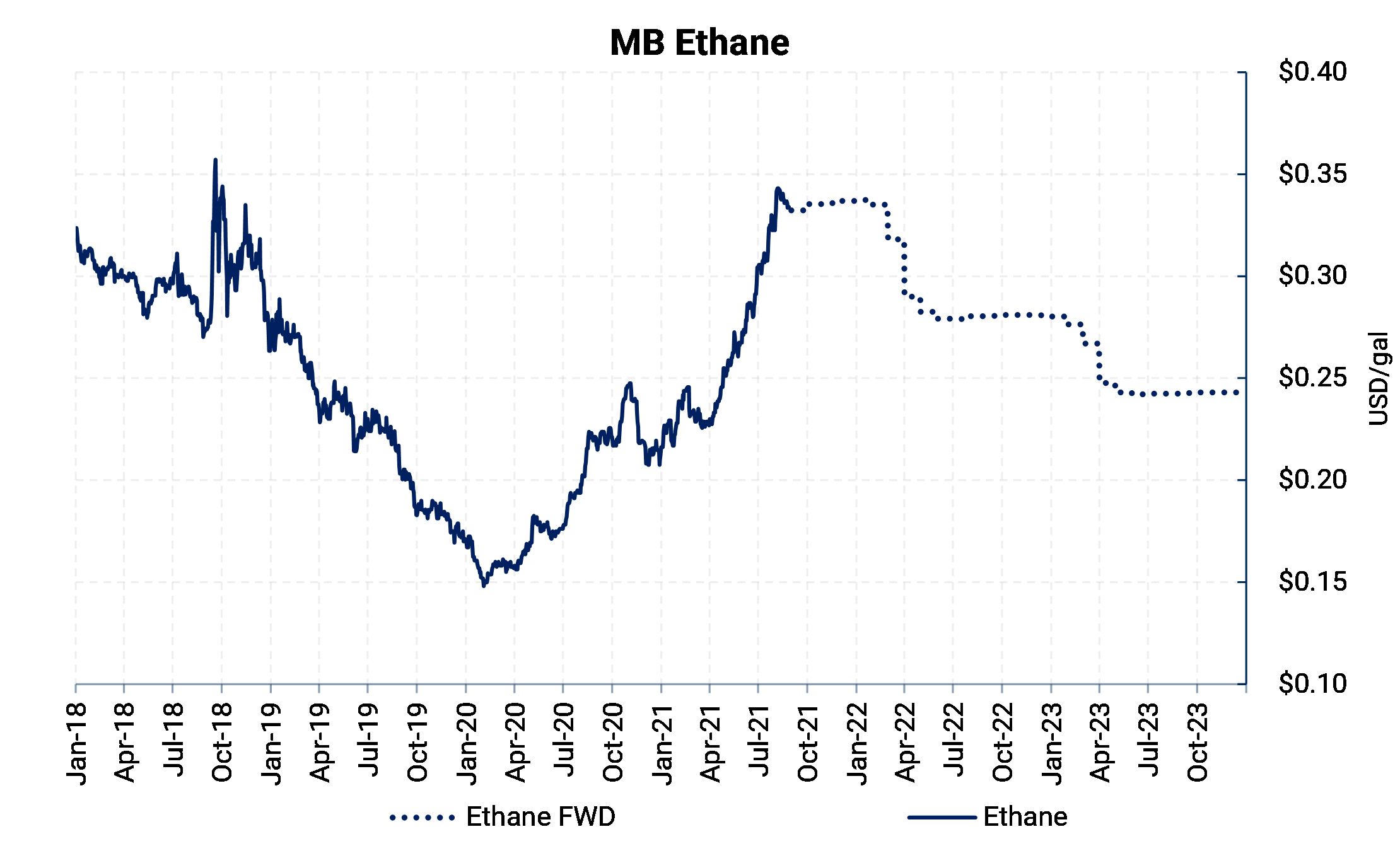

Ethane priced at Mont Belvieu has rallied over 60% to 34c/gal since the beginning of the year. It may need to move higher to create more supply from “rejected” ethane to offset growing demand.

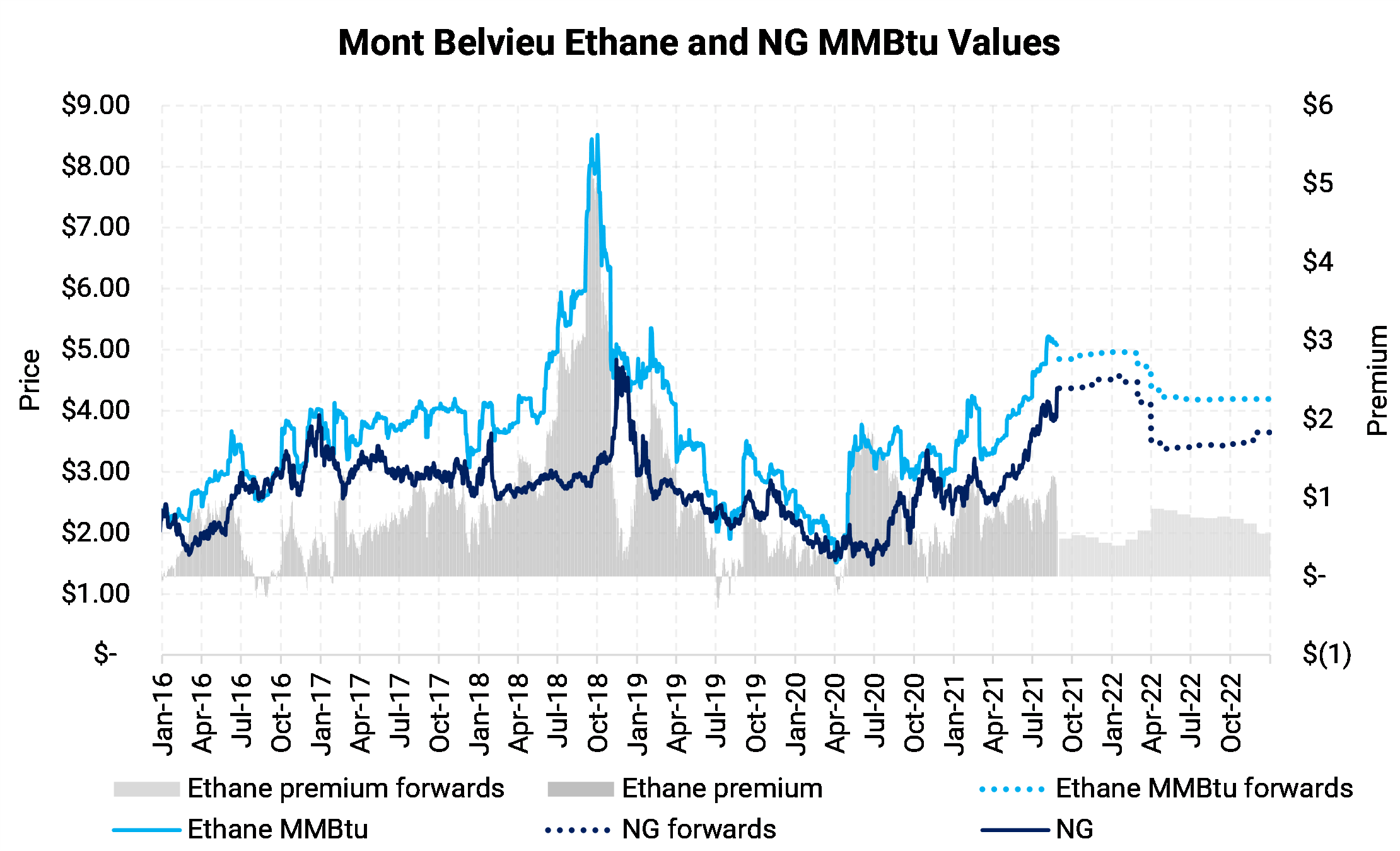

A combination of factors has led to the rise in ethane prices. Rising gas prices, both from NYMEX Henry Hub and improving basis in Texas and Oklahoma, have been the primary driver of higher ethane prices. Ethane trades at a spread to natural gas, with natural gas acting as the natural floor for ethane.

The chart below shows the relationship between gas and ethane on a Btu basis. There are multiple times in the past five years where natural gas has “supported” ethane prices where ethane (light blue line) stops or rebounds off natural gas prices (dark blue line).

But there are other reasons, besides natural gas prices, that ethane prices have risen. We need to focus on ethane-specific fundamentals to look into why ethane may be set up for a move higher. Ethane prices were hovering in the low 20c/gal range earlier this year as ethane inventories remained well above the five-year average. The glut of ethane started in late 2020 but was extended in early 2021 after winter storm Uri knocked out multiple Gulf Coast ethane crackers. The loss of cracking demand kept inventories elevated.

The ethane cracker fleet has returned from previous outages, plus a new cracking facility came online this summer to add to ethane demand. According to the EIA, ethane cracker demand was about 1.8 MMBbl/d as of May. Total ethane demand is near 2.1 MMBbl/d when adding in exports.

The return of cracker facilities and lower NGL production in the U.S. should work down the above-average level of ethane in storage. At some point, we believe it to be sooner rather than later, ethane prices could rise to force ethane to be recovered at the processing plant, rather than rejected into the gas stream for a higher netback.

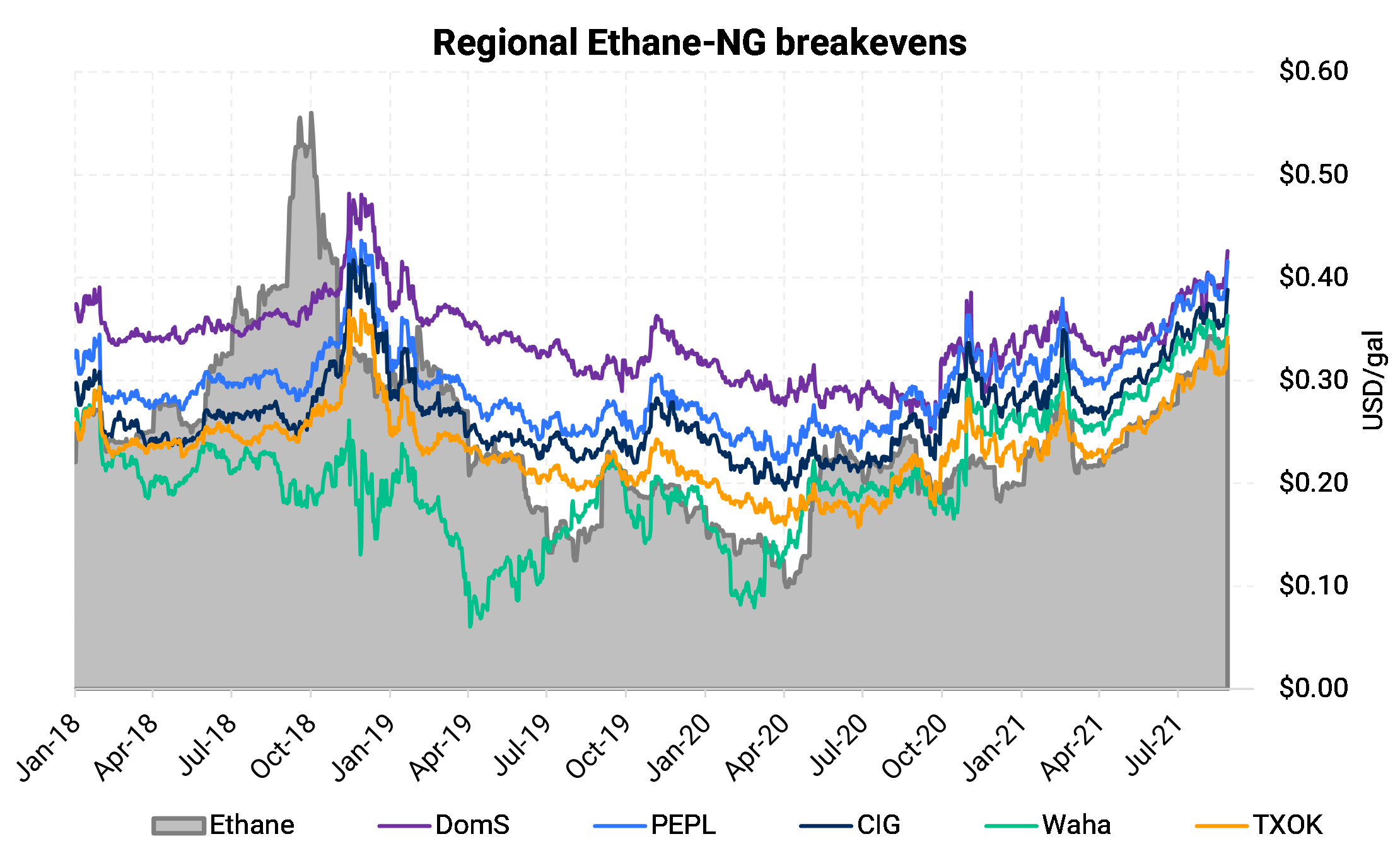

The chart below shows an AEGIS model of how high ethane prices would need to go, so that specific supply regions begin to recover the ethane instead of dumping it into the natural gas stream. According to our estimates, ethane has risen recently enough to tell Permian (green line) facilities to start capturing ethane.

For the ethane market to encourage more supply, barring a fall in gas basis, ethane prices will possibly need to rise toward 40c/gal for the Rockies to start dispatching rejected ethane.