|

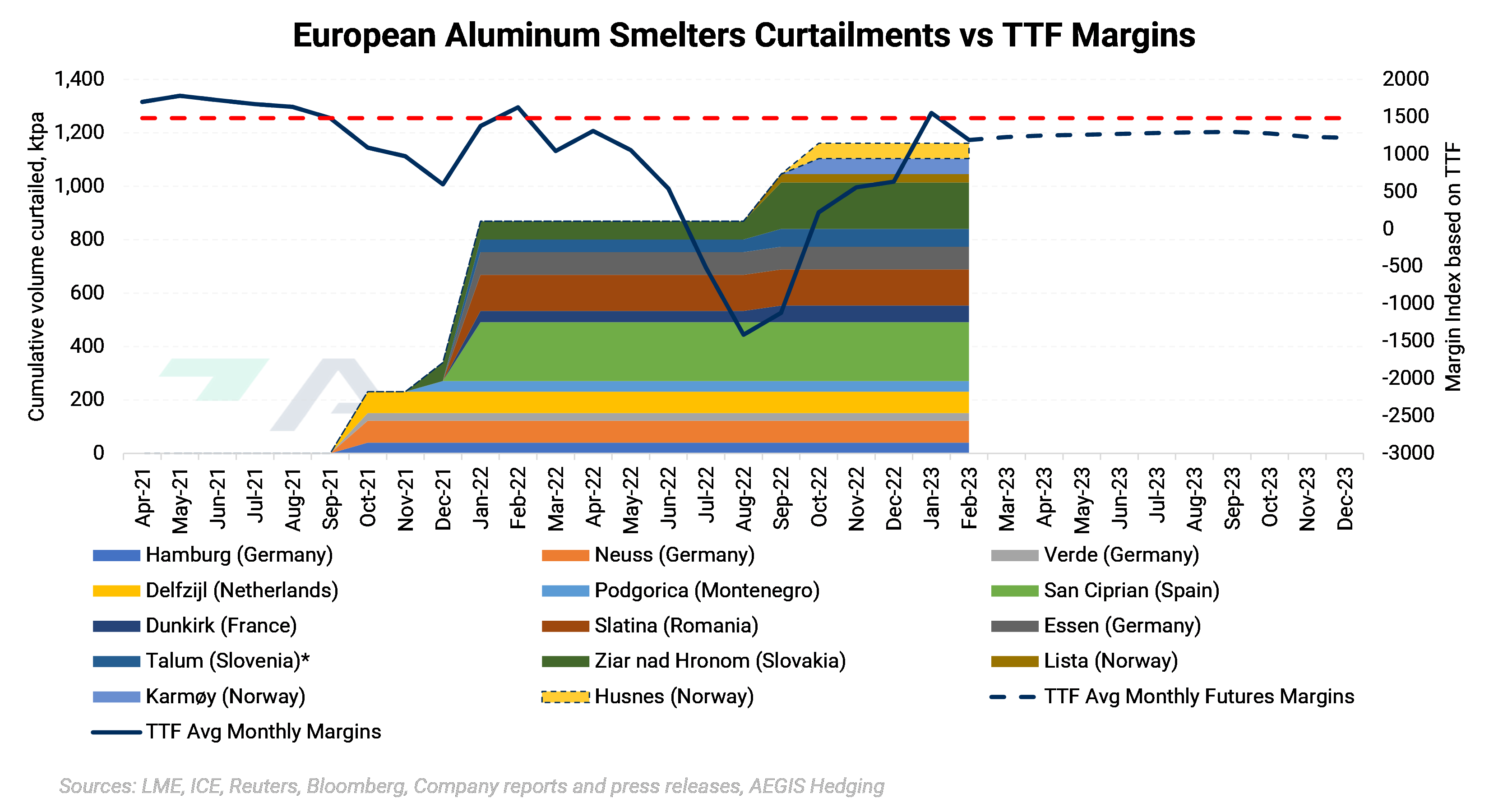

In the simplest of terms, aluminum smelting involves two major inputs and one major output: energy, alumina, and aluminum. Other costs matter, but with these three we can create a framework for understanding how the prices of each affect the profitability of aluminum smelting. Below our model of European smelter margins (solid blue line is historical; forwards in dashed blue) is shown against recently announced smelter curtailments. It shows that certain combinations of aluminum, alumina, and energy prices have led to new smelter shutdown announcements. |

|

|

The Margin Index in the chart above is not meant to be precise; rather, it is an economic indicator that shows when and why smelters have closed. By using past smelter behavior as a guide, our indicator also shows whether future smelting margins might be high enough to encourage production to return. Could these smelters restart operations if margins improved? Margins have improved tremendously since last August; however, the volume of curtailments remains stubbornly high. Moreover, AEGIS has only heard of one smelter (Aluminum Dunkerque) slowly being brought back online due to improved profitability. However, AEGIS notes that Aluminum Dunkerque receives most of its power from a state-sponsored nuclear energy program. According to company statements, Aluminum Dunkerque plans to slowly ramp up production and achieve full production by May 2023. Given that this announcement was only made about a month ago, and Aluminum Dunkerque did not elaborate on how much production will be brought online per month, we left the Aluminum Dunkerque portion of our above chart at the current curtailment level. So, what LME aluminum price would entice smelters to restart previously curtailed production? Based on our European aluminum smelter margin calculator from above, smelters started shutting off or making curtailments announcements when our model showed profit margins at approximately $1,485/mt (noted by the red dashed line). Based on the TTF futures curve, the profit margins are about $1,300/mt from March 2023 through the remainder of the year. Therefore, aluminum prices need to rise at least $185/mt before we could (or will likely see) smelters come back online. (Please note that our margin calculator is for demonstration purposes only and does not factor in every cost that an aluminum smelter might incur). |

|

Deriving a Smelting Margin Index Smelting’s energy source is usually electrical power. However, since there are no useful forward curves for country-specific or continental electricity prices, we will use ICE TTF natural gas futures as a proxy for European electricity prices in the AEGIS aluminum smelter margin estimate model you see below. This a very reasonable substitute, because European power prices have recently fluctuated with the price of the marginal fuel – natural gas. For our models, we use prompt-month ICE TTF futures, prompt-month LME alumina futures, and the LME Aluminum Cash price to calculate historical margins. To calculate the electricity input cost, we use the International Aluminum Institute’s estimate that it takes approximately 15 MWh of electricity to produce one metric ton of aluminum in Europe, and then multiplied that figure by corresponding TTF futures prices. The future calculations are similar. We have used ICE TTF futures, LME alumina futures, and LME Aluminum futures through late 2023 to calculate a cost curve moving forward. For example, to calculate margins in April 2023, we used April 2023 futures for ICE TTF, LME alumina, and LME aluminum. Based on today’s (2/23/2023) prices, margins are positive through December 2023 but need to improve further to entice production. (Please note that AEGIS’s basic aluminum smelting model does not include certain fixed costs such as employee salaries, insurance, etc.) As you see in our first chart above, as TTF (and therefore electricity) prices escalated, smelter margins worsened, leading to more and more curtailments. These curtailments came in two rounds, the first in October 2021 through January 2022, and the second one starting in late August 2022 through October 2022. Although margins did improve after the initial round of curtailments, it was not enough to entice production. Based on our estimated margin model, margins were still positive during the initial round of curtailments in late 2021 but were negative as the second round began in late summer 2022.

|

|

To compare our economic model to the reality that European smelters have experienced since late 2021, we will now calculate margins using actual “month ahead” electricity prices for various countries. To calculate “month ahead” margins, we used LME aluminum cash, prompt month LME alumina, and that specific country’s month ahead electricity prices. Thus, for example, on February 20, 2023, the one-month-ahead electricity price in France was $156.82/MWh, therefore the electricity cost to produce one ton of aluminum was $2,352.30. As our economic model above demonstrated, and the historical model below proved, curtailments occurred as margins worsened. Moreover, smelter margins based on month-ahead electricity prices are currently near or below zero. Thus, our analysis of “on-the-ground” aluminum production shows that European smelters are not incentivized to ramp up production. Like our analysis from above using TTF futures, it appears that margins need to be at $1,000/mt (noted by the red dashed line) or higher to entice production. If you're wondering how smelters could possibly make money with aluminum prices falling and energy prices rising, we wonder the same. What took them so long to shut down? One answer could be that fixed-price power agreements are in effect, so the true cost of energy is much lower than the spot rate in the market. |

|

|

|

In a final remark on historical curtailments, we wanted to show that the aluminum market has been unimpressed by the number of European smelters that have curtailed production. For example, LME aluminum prices dipped after the first round of announcements in October 2021. Aluminum prices jumped in early 2022 as more curtailments were announced; however, prices quickly dropped to pre-curtailment levels after the Russia-Ukraine conflict began. We also note that prices bottomed when curtailments were at their peak. Moreover, both spot and futures prices are still below “pre-curtailment” levels. As you can see, LME Aluminum cash prices were hovering at just over $2,800/mt when curtailments started in October 2021. Currently, cash prices linger near $2,370/mt. The futures forward curve for 2023, which is in contango, peaks at approximately $2,500/mt in December. Based on our margin calculations, LME prices do not necessarily need to rise to $2,800/mt (noted by the red dashed line) to entice production, but certainly need to rise from current levels. Are you an aluminum end-user looking to hedge your future needs? Consumers can hedge aluminum in various ways, as we detail below. Buying swaps or call options are viable strategies, as either would establish a maximum aluminum price. Such positions are standard for consumer hedging; however, they can result in opportunity costs or cash costs if metal prices decrease. Please contact AEGIS for specific strategies that fit your operations. |

|

Are you an aluminum end-user looking to hedge your future needs? Consumers can hedge aluminum in various ways, as we detail below. Buying swaps or call options are viable strategies, as either would establish a maximum aluminum price. Such positions are standard for consumer hedging; however, they can result in opportunity costs or cash costs if metal prices decrease. Please contact AEGIS for specific strategies that fit your operations. |

|

|

Important Disclosure: Indicative prices are provided for information purposes only and do not represent a commitment from AEGIS Hedging Solutions LLC ("Aegis") to assist any client to transact at those prices, or at any price, in the future. Aegis makes no guarantee of the accuracy or completeness of such information. Aegis and/or its trading principals do not offer a trading program to clients, nor do they propose guiding or directing a commodity interest account for any client based on any such trading program. Certain information in this presentation may constitute forward-looking statements, which can be identified by the use of forward-looking terminology such as "edge," "advantage," "opportunity," "believe," or other variations thereon or comparable terminology. Such statements are not guarantees of future performance or activities.