|

In the simplest of terms, aluminum smelting involves two major inputs and one major output: energy, alumina, and aluminum. Other costs matter, but with these three we can create a framework for understanding how the prices of each affect the profitability of aluminum smelting.

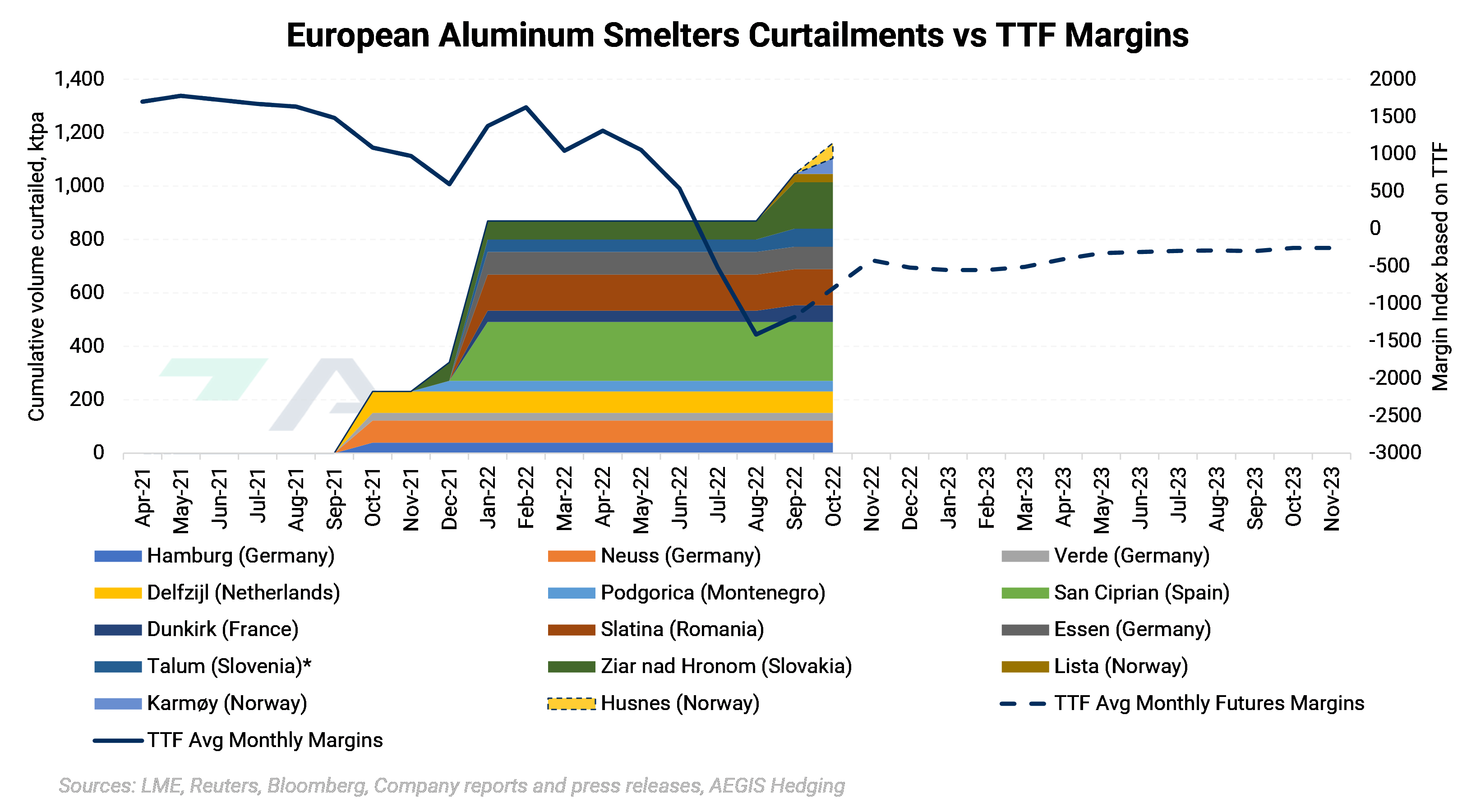

Below our model of European smelter margins (solid blue line in history; forwards in dashed blue) is shown against the announced smelter shutdowns. It shows that certain combinations of aluminum, alumina, and energy prices have led to new smelter shutdown announcements. |

|

|

The Margin Index in the chart above is not meant to be precise; rather, it is an economic indicator that shows when and why smelters have closed. By using past smelter behavior as a guide, our indicator also shows whether future smelting margins might be high enough to encourage capacity to return. Note how three times our margin indicator dipped, in September of 2021, in December 2021, then in July-August of 2022. In or near each of these periods, a new round of smelter shutdowns were announced. ** Could these smelters restart operations if margins improved? It seems that a positive number in our margin index might encourage these companies to return. But there’s bad news: if we look at the forward price curves for aluminum, alumina, and energy, our index doesn’t cross zero through at least year-end 2023. Deriving a Smelting Margin Index Smelting’s energy source is usually electrical power. However, since there are not useful forward curves for country-specific or continental electricity prices, we will use ICE TTF natural gas futures as a proxy for European electricity prices in the AEGIS aluminum smelter margin estimate model you see below. This a very reasonable substitute, because European power prices have recently fluctuated with the price of the marginal fuel – natural gas. For our models, we use prompt-month ICE TTF futures, prompt month LME alumina futures, and the LME Aluminum Cash price to calculate historical margins. To calculate the electricity input cost, we use the International Aluminum Institute’s estimate that it takes approximately 15 MWh of electricity to produce one metric ton of aluminum in Europe, and then multiplied that figure by corresponding TTF futures prices. The future calculations are similar. We have used ICE TTF futures, LME alumina futures, and LME Aluminum futures through late 2023 to calculate a cost curve moving forward. For example, to calculate margins in March 2023, we used March 2023 futures for ICE TTF, LME alumina, and LME aluminum. Based on today’s (10/4/2022) prices, margins are negative through November 2023. (We stopped in November 2023 because the LME alumina futures forward curve ends that month. Also, please note that AEGIS’s basic aluminum smelting model does not include certain fixed costs such as employee salaries, insurance, etc.) As you see in our first chart above, as TTF (and therefore electricity) prices escalated, smelter margins worsened, leading to more and more curtailments. These curtailments came in two rounds, the first in October 2021 through January 2022, and the second one starting in late August 2022. Although margins did improve after the initial round of curtailments, it was not enough to entice production. Based on our estimated margin model, margins were still positive during the initial round of curtailments in late 2021 but were negative as the second round began in late summer 2022. When Will Smelters Return from Economic-Induced Shutdowns? Given that based on current prices margins are negative through November 2023, aluminum prices need to rise, or electricity prices need to fall, for margins to improve in 2023 (we will go through several possible scenarios in the Conclusion section). Otherwise, we could be grappling with curtailments for some time. |

|

|

|

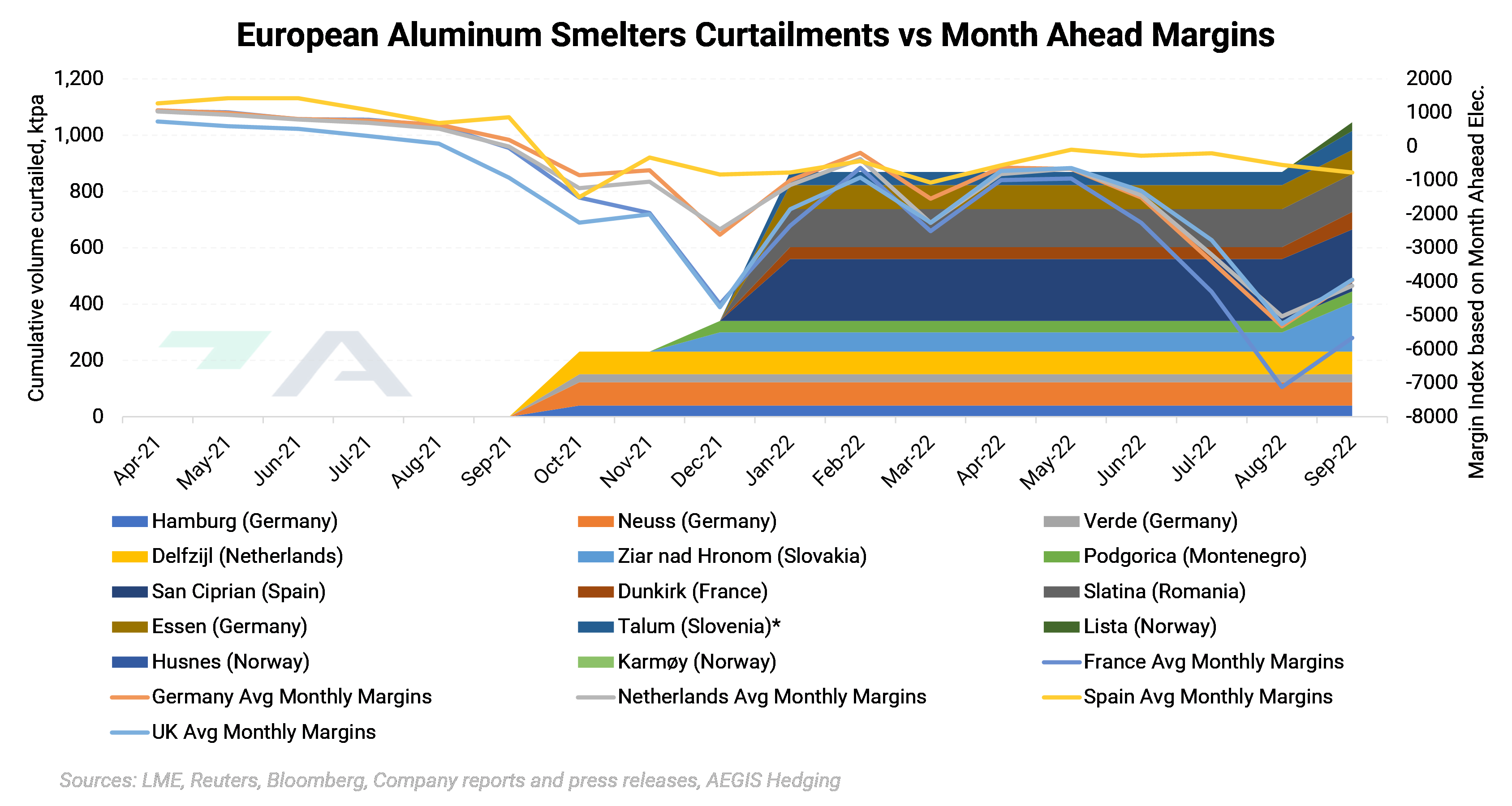

To compare our economic model to the reality that European smelters have experienced since late 2021, we will now calculate margins using actual “month ahead” electricity prices for various countries. To calculate “month ahead” margins, we used LME aluminum cash, prompt month LME alumina, and that specific country’s month ahead electricity prices. Thus, for example, on September 14, 2022, the one-month-ahead electricity price in France was $526.34/MWh, therefore the electricity cost to produce one ton of aluminum was $7,895.10. As our economic model above demonstrated, and the historical model below proved, curtailments occurred as margins worsened. If you're wondering how smelters could possibly make money with aluminum prices falling and energy prices rising, we wonder the same. What took them so long to shut down? One answer could be that fixed-price power agreements are in effect, so the true cost of energy is much lower than the spot rate in the market.

|

|

|

In a final remark on historical curtailments, we wanted to show that the aluminum market has been unimpressed by the number of European smelters that have curtailed production. For example, LME aluminum prices dipped after the first round of announcements in October 2021. Aluminum prices jumped in early 2022 as more curtailments were announced; however, prices quickly dropped to pre-curtailment levels after the Russia-Ukraine conflict began. By our calculations, as of 10/4/2022, approximately 1.16 million mtpa of European capacity has been taken offline. This represents approximately 25.9% of the continent’s total annual capacity. Will more production need to be taken offline before spot and futures prices respond? |

|

|

|

Even before the recent energy crisis, having a fixed electricity cost ensured profitability for aluminum smelting. During our research, we found several companies (namely Alcoa) that had long-term electricity purchase agreements with local power sources. In some cases, these agreements are dated through 2030 or longer. Similar to our calculations for month-ahead margins, in the chart below margins for a fixed cost producer using LME aluminum cash, prompt month LME Alumina, and a long-term, fixed electricity price of $50/MWh. As we can see, having a fixed electricity cost has let those producers stay profitable, despite deteriorating market conditions. Assuming an alumina price of $350/mt, the cash aluminum price would have to dip to $1100/mt before aluminum smelting became unprofitable. (AEGIS’s basic aluminum smelting model does not include certain fixed costs such as employee salaries, insurance, etc.) |

|

|

|

Are you an aluminum end-user looking to hedge your future needs? Consumers can hedge aluminum in various ways, as we detail below. Buying swaps or call options are viable strategies, as either would establish a maximum aluminum price. Such positions are standard for consumer hedging; however, they can result in opportunity costs or cash costs if metal prices decrease. Please contact AEGIS for specific strategies that fit your operations. |

|

|

AEGIS Thoughts:So, what energy price would make aluminum smelting feasible again? As of this writing (10/5/2022), LME cash aluminum is hovering near $2,290/mt. The LME aluminum futures forward curve through November 2023 is in a slight contango, meaning that futures prices are higher than spot. Thus, let's use an average 2023 price of $2,400/mt, similar to what we show in the hedging demo above. Prompt month LME alumina, as well as the futures curve through spring 2023, is approximately $350/mt. Assuming the forward curves for alumina and aluminum remain constant, the TTF price needs to be $136/MWh or lower to make aluminum smelting feasible. However, as the TTF futures forward curve through 2023 is hovering near $160/MWh, we would need a nearly $25/MWh price drop to entice aluminum smelters to restart production. We do note that compared to the prompt month and winter ’22/'23, TTF futures are lower in April ’23 and beyond, but not enough to entice aluminum production. Calculated a different way, what aluminum price makes production feasible with these astronomical electricity prices? Let’s assume that the TTF futures forward curve remains near $200/MWh for the foreseeable future. Likewise, let’s hold the LME alumina price at a constant $350/mt. Based on those figures, aluminum would have to be approximately $3,350/mt to make production feasible again. This is not unreasonable, as the LME 3M Select was trading at that level in early 2022. |

Important Disclosure: Indicative prices are provided for information purposes only and do not represent a commitment from AEGIS Hedging Solutions LLC ("Aegis") to assist any client to transact at those prices, or at any price, in the future. Aegis makes no guarantee of the accuracy or completeness of such information. Aegis and/or its trading principals do not offer a trading program to clients, nor do they propose guiding or directing a commodity interest account for any client based on any such trading program. Certain information in this presentation may constitute forward-looking statements, which can be identified by the use of forward-looking terminology such as "edge," "advantage," "opportunity," "believe," or other variations thereon or comparable terminology. Such statements are not guarantees of future performance or activities.