Oil demand could move even higher if the lower retail gasoline prices encourage more transportation fuel demand. We are in the early innings of the 2022 summer driving season, and so far, refiners have had a difficult time meeting demand, which is still below pre-pandemic levels. The U.S. transportation fuels shortage has also been exacerbated by an increase in exports as countries try and phase out imports from Russia. |

|

|

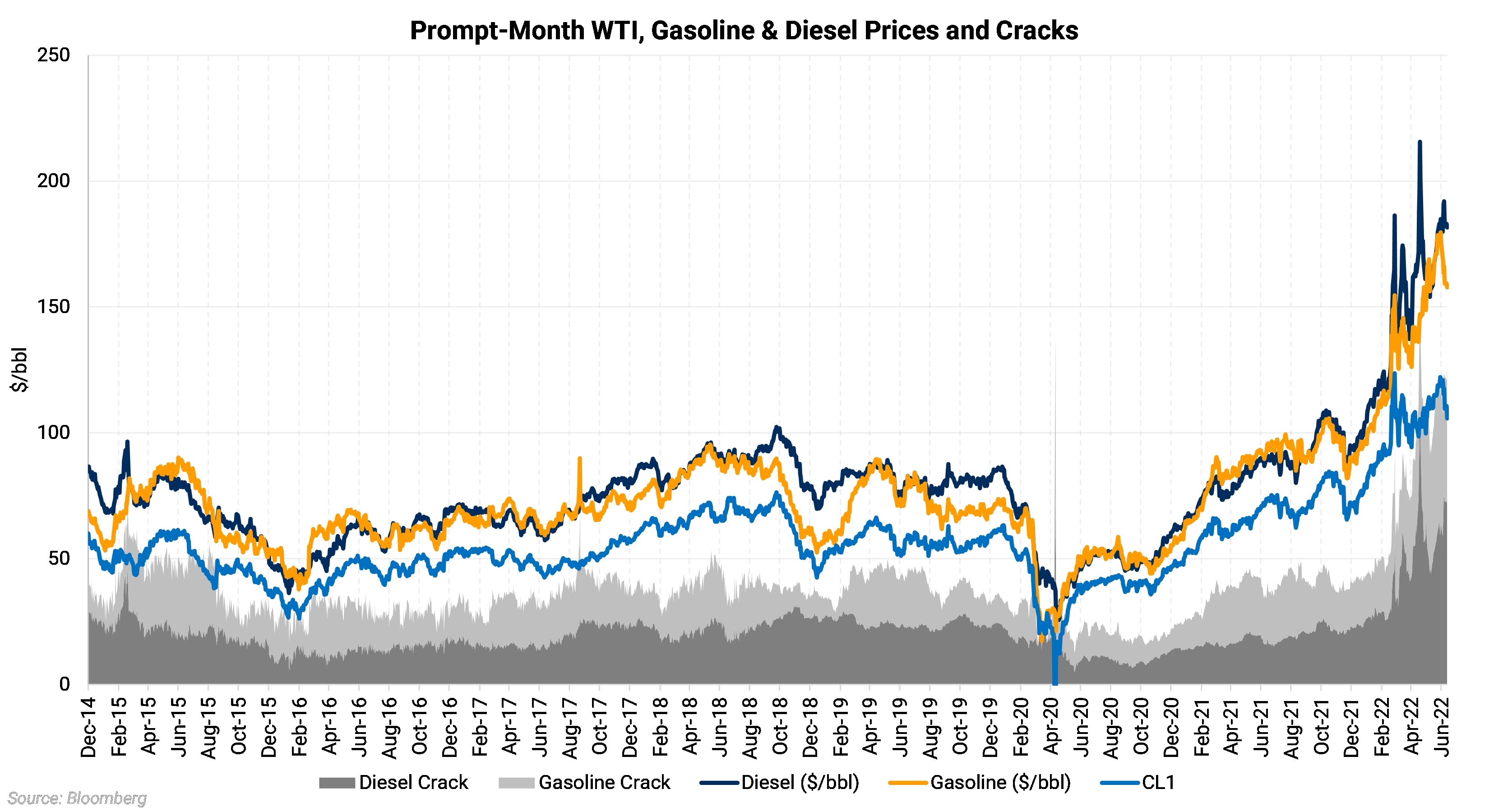

The chart above shows the product prices in $/bbl, and you can see the product cracks as well (product cracks represent the difference between the product price and crude price in $/bbl). Product prices have been rallying as it has become apparent that refiners are struggling to match demand. The product price and crude prices usually show a high level of correlation. Still, both product prices have become dislocated from the price of oil lately, implying a structural shortage in refining capacity. On Wednesday, June 22, U.S.-President Joe Biden asked congress to suspend the federal taxes on gasoline and diesel in an attempt to lower prices. The official said that the federal government currently charges 18 cents in taxes per gallon of gasoline and 24 cents per gallon of diesel, or approximately 3% of the total price. |

|

|

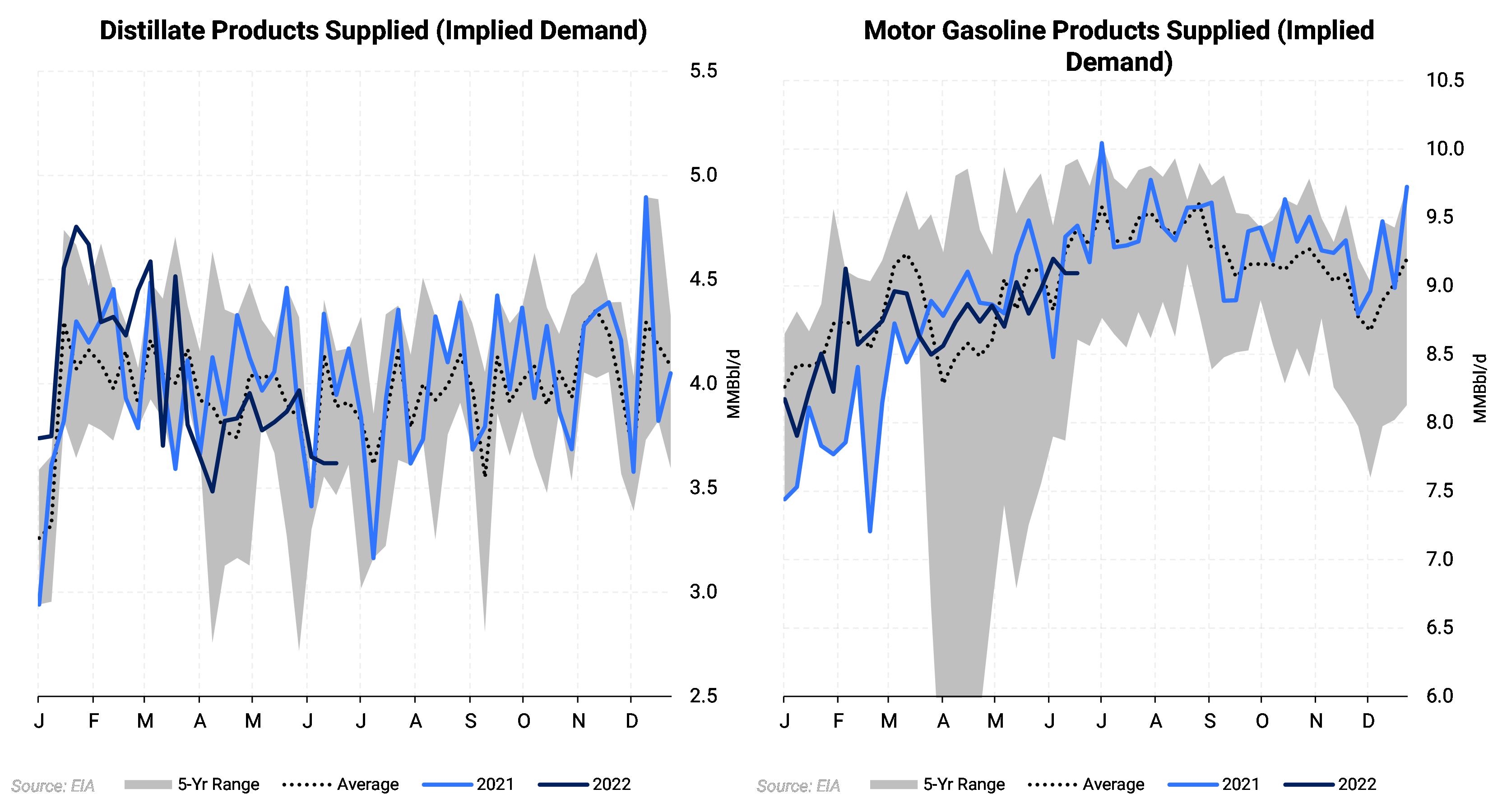

The chart above shows how demand for both products has fared so far. Fuels demand, and prices are intuitively inversely correlated, though the relationship can break down. So, in a perfect world, the price drop should encourage more driving and demand. However, this assumes that the refiners can increase production which is not necessarily true. Demand is still below 2019 levels, yet refiners have struggled to match domestic consumption and exports, which explains why so much product has come out of storage this year. The 3-2-1 crack spread, a commonly used proxy to gauge refiners' profits, is near all-time highs and could be used as a gauge for refineries' appetite for crude. Because of the record cracks, the U.S. is likely already running at nearly full tilt. U.S. refinery runs have averaged around 93-94% over the last couple of months, its highest seasonal level in four years, but the lost capacity shows when just looking at crude runs. The EIA released its refining capacity report on June 21, 2022, that shows the U.S. has lost close to 1.3 MMBbl/d of refining capacity over the last several years due to several refinery closures. The chart below shows that despite very high refinery utilization rates, total inputs are roughly in line with the five-year average. |

|

|

|

In conclusion, these tax cuts would be a bullish catalyst for crude because of the inverse relationship between retail fuel prices and demand. The resulting increase in fuel demand should result in refiners needing to burn more crude oil to meet said demand (assuming they can increase inputs otherwise it makes the refining capacity shortage more apparent and sends prices even higher). Further, the move is bullish over the long term as those taxes will eventually need to be reinstated, and demand will likely be higher. However, it will be very challenging politically to reinstate the tax anytime soon, and prices would likely have to be at much lower levels. |