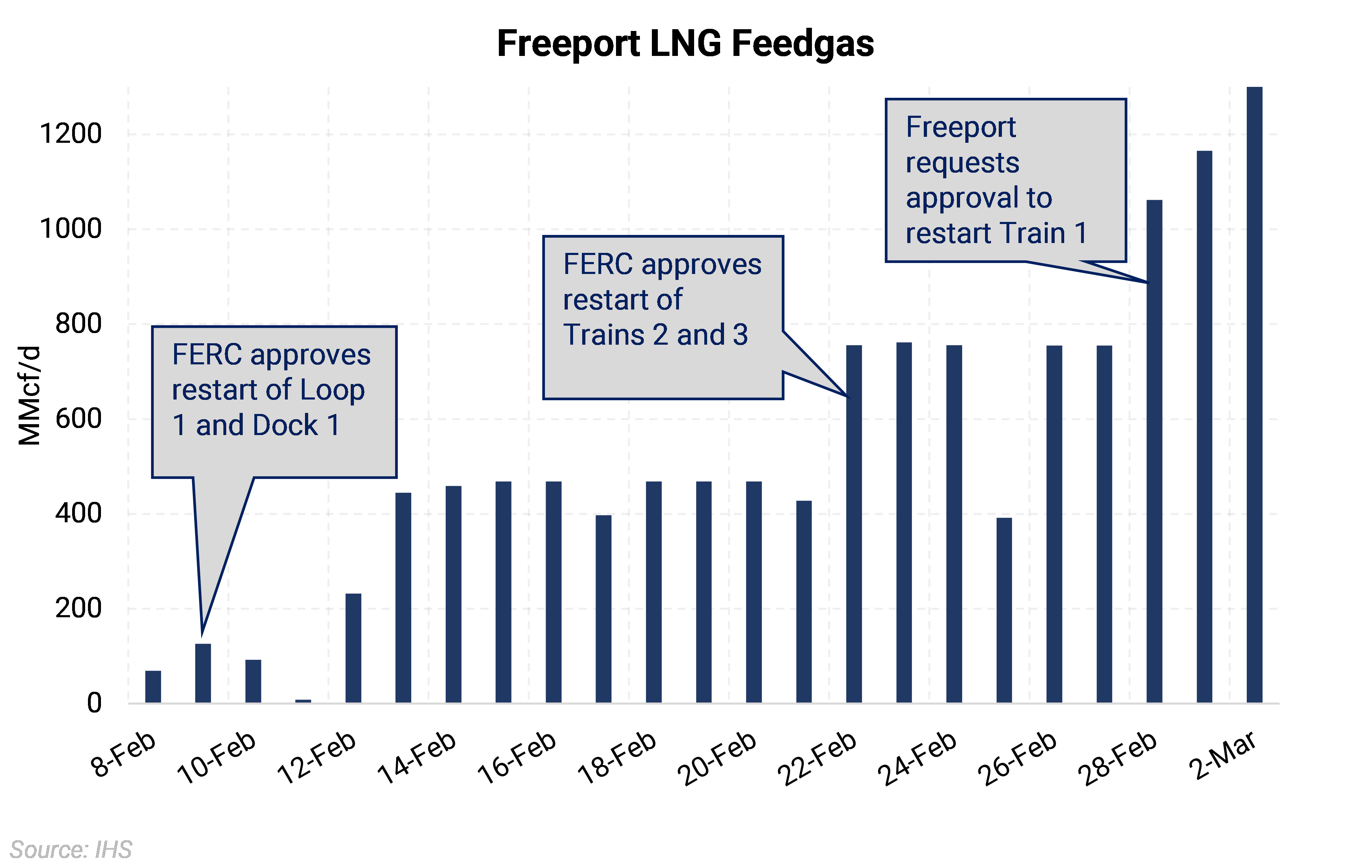

Gas flows into the facility began to increase in early February, as Freeport started to request approval to restart their three liquefaction trains. Feedgas flows are now at their highest level since June 2022, at 1.3 Bcf/d. Freeport is expecting to increase flows to 2.0 Bcf/d in the next few weeks following the approval of Train 1’s restart.

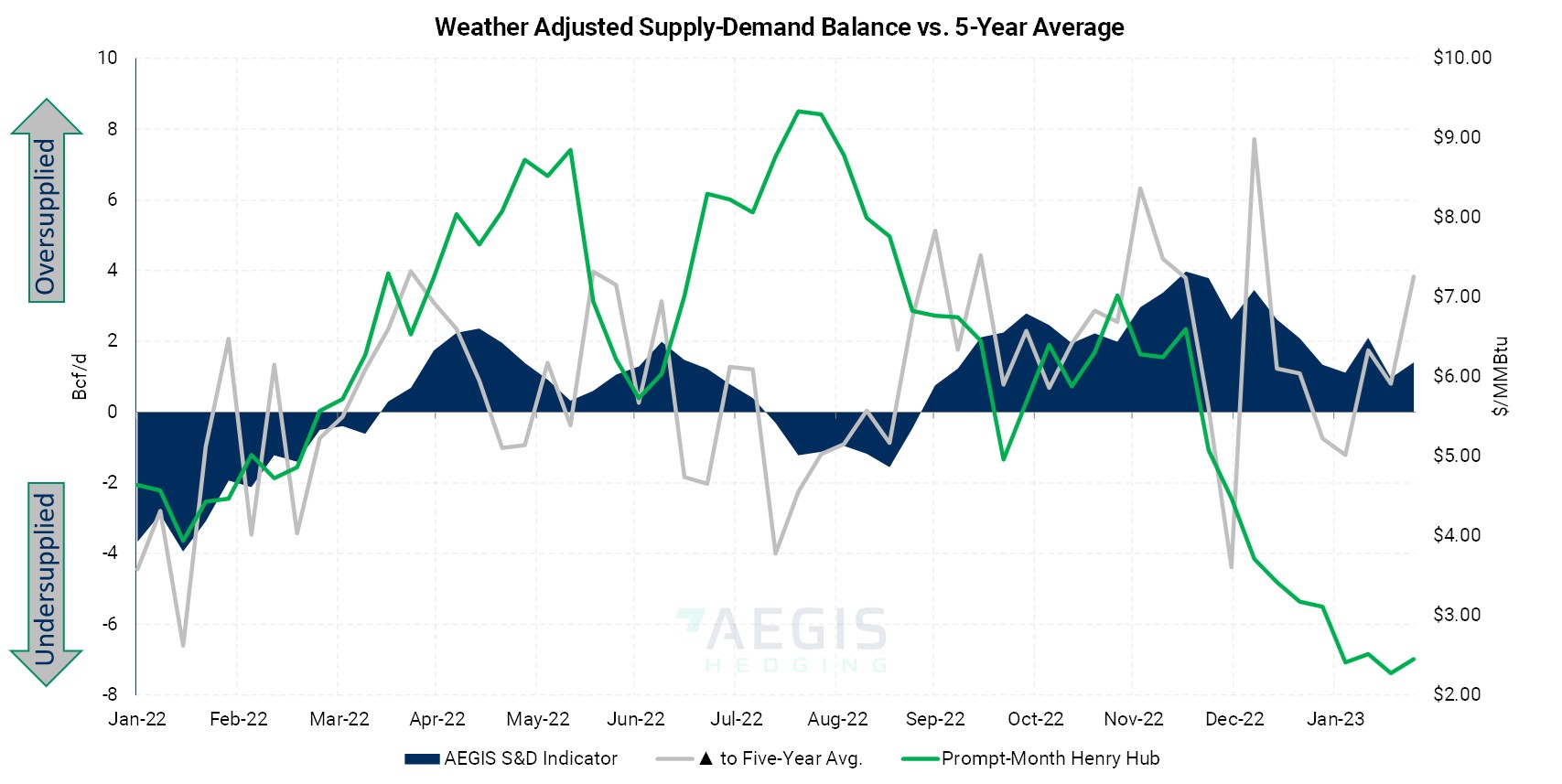

A 2.0 Bcf/d increase in gas demand from Freeport’s restart should bring the market closer to balance. After adjusting for weather, our calculations show that the natural gas market has been consistently oversupplied by an average of 2-4 Bcf/d since September 2022, as shown in the chart above. This oversupply has likely contributed to the precipitous drop in gas prices this year. While our expectation of 2023-2024 is for a structurally oversupplied gas market, Freeport’s resumption of operations lessons the glut.

As Freeport ramps up its flows, market balances should tighten somewhat. However, with gas production still expected to grow in 2023 it may only be a temporary supply-demand tightening. Gas prices have rallied on the backs of a returning Freeport and more bullish weather. Over the past seven trading days, prompt-month NYMEX futures have rallied 71c from a $2.07/MMBtu low on February 21. The roughly 12% rally in short order has presented hedging opportunities amid an overall bearish fundamental backdrop.