During one of the most weather-volatile growing seasons in recent memory, the USDA released its Planted Acreage estimates for corn and soybeans. Planted acres increased for both corn and soybeans, ordinarily a bearish type of revision for prices; but, traders expected even higher. Planted acres for corn came in at 92.692M acres, up 1.548M acres from March 31 Prospective Plantings report, but towards the bottom end of trade estimates from 92.0M to 95.84M. Likewise for soybeans, the USDA is penciling in 87.555M acres, only down 0.045M acres from the March 31 report, but well below trade estimates of 87.9M to 90.4M.

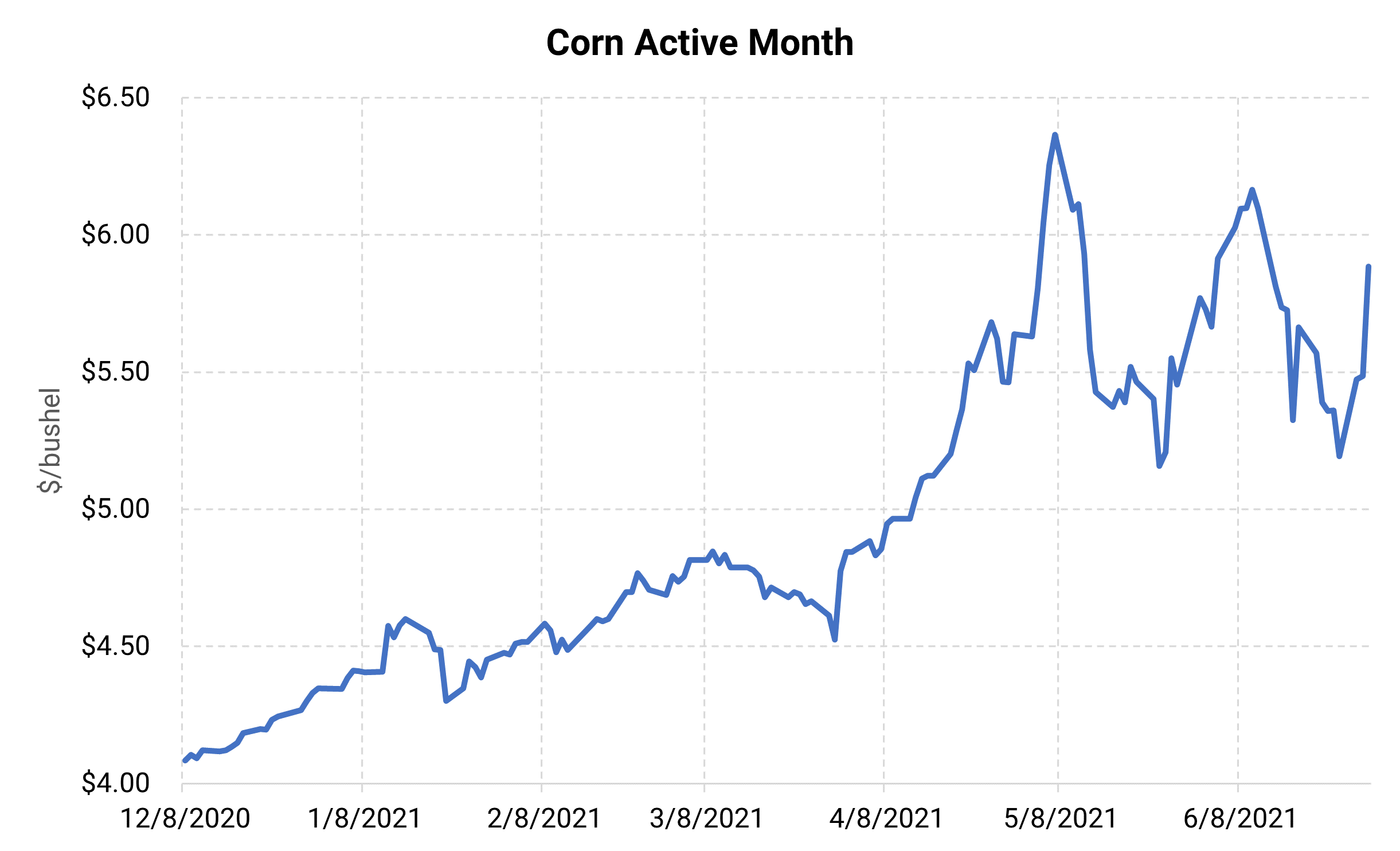

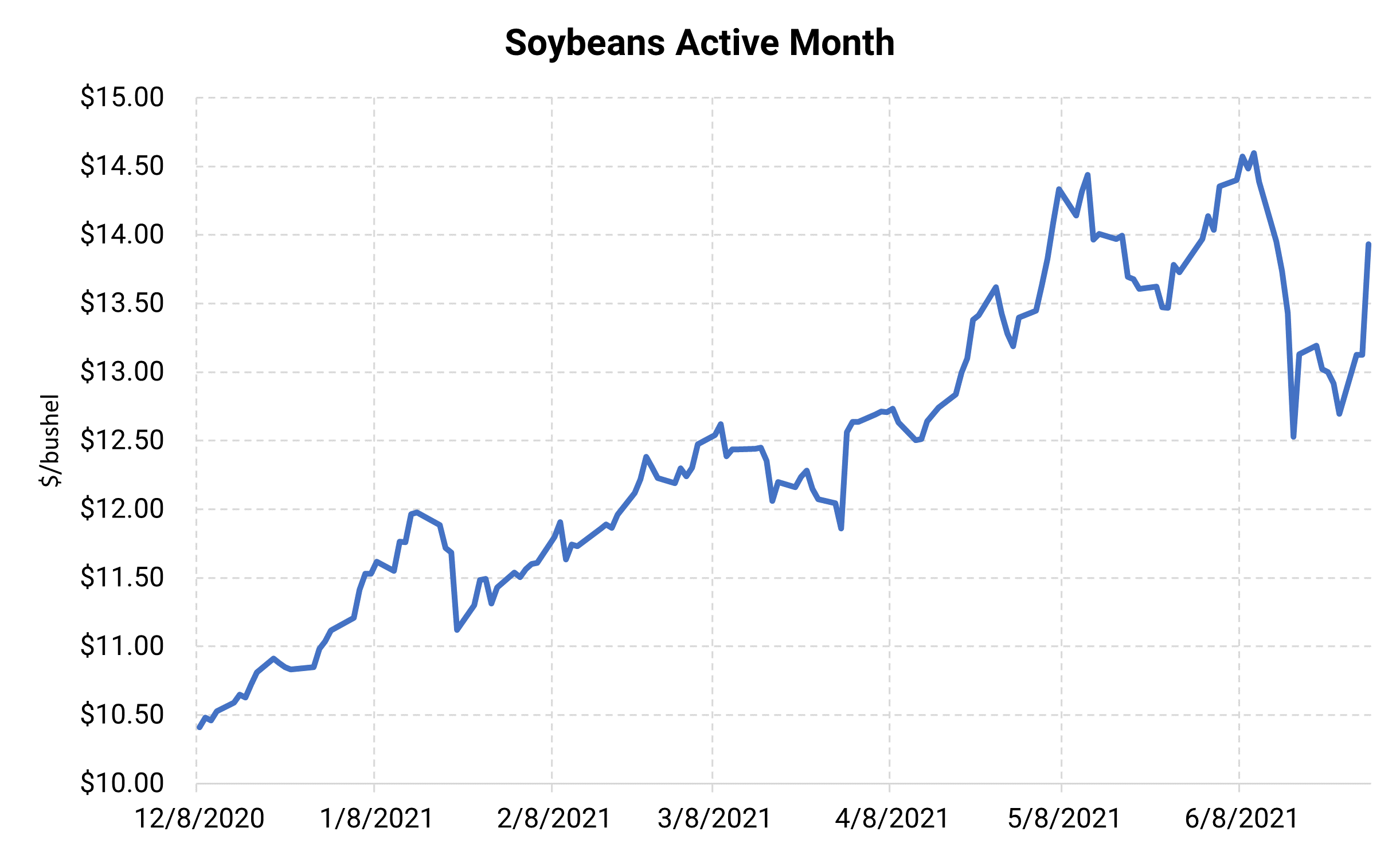

Trade’s response to the release was extremely bullish, with Dec '21 (new-crop) finishing limit up 40¢/bu to $5.88-½. Nov '21 (new-crop) soybeans settled up 86-½¢/bu to $13.99.

All eyes will now turn back to weather, as the summer outlook continues to look hotter than normal. With 64% of this year’s corn crop rated good-to-excellent, we have likely hit the highwater mark for crop conditions before pollination. A 64% good-to-excellent rating is below average for this time of year; however, there is still a lot of growing season ahead of us, and any major changes in weather (whether bullish or bearish) could have ramifications on ending stocks and therefore prices. If crop conditions stay below average, it could keep a floor under prices. Conversely, stable or improving conditions could keep prices capped.

|

|

AEGIS Thoughts & Strategies: Similar to weather, price volatility has been high during this growing season, and we look for that to continue through the remainder of the summer and into harvest season. That being said, new crop futures could remain range-bound if we have priced in worse-case scenarios for both weather and production. Likewise, the USDA can easily change the demand picture on subsequent reports. After huge selloff this month, producers are getting a second bite at the apple to get some moderate hedging done. Hedging for both producers and end-users should be done prudently, likely with option strategies. Being a swashbuckler in these markets could prove hazardous to your bottom line.

Commodity Interest Trading involves risk and, therefore, is not appropriate for all persons; failure to manage commercial risk by engaging in some form of hedging also involves risk. Past performance is not necessarily indicative of future results. There is no guarantee that hedge program objectives will be achieved. Certain information contained in this research may constitute forward-looking terminology, such as "edge," "advantage," 'opportunity," "believe," or other variations thereon or comparable terminology. Such statements and opinions are not guarantees of future performance or activities. Neither this trading advisor nor any of its trading principals offer a trading program to clients, nor do they propose guiding or directing a commodity interest account for any client based on any such trading program.