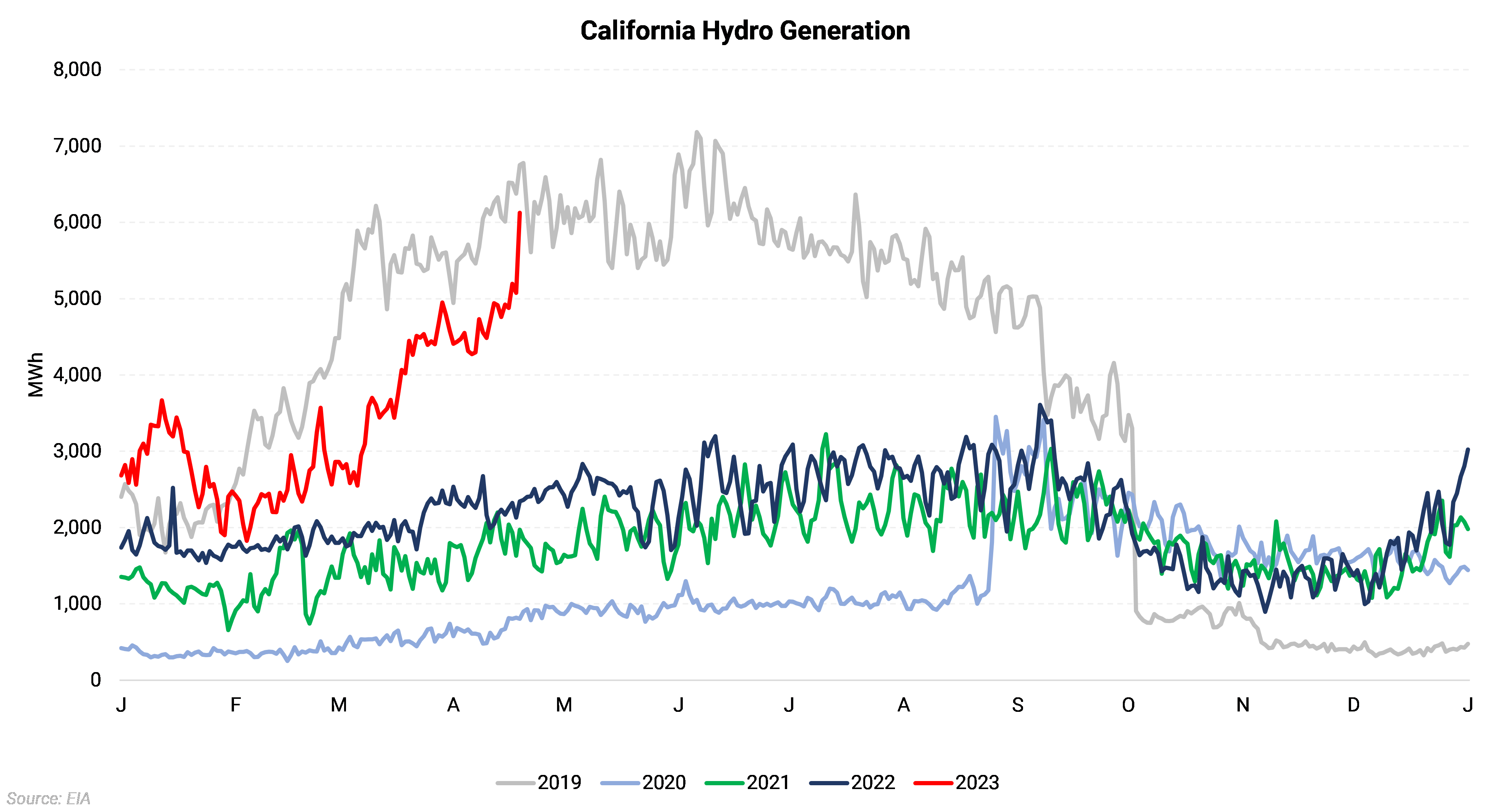

Record levels of rain and snow have reversed two years of significantly dryer-than-average conditions in California. This is setting up a major comeback in the state’s hydroelectric generation, which has already surged to multi-year highs. An increase in available electricity supply from the hydroelectric sector should reduce the call on natural gas for power generation, as seen in prior years such as 2019. This could directly impact natural gas prices in California and the western US.

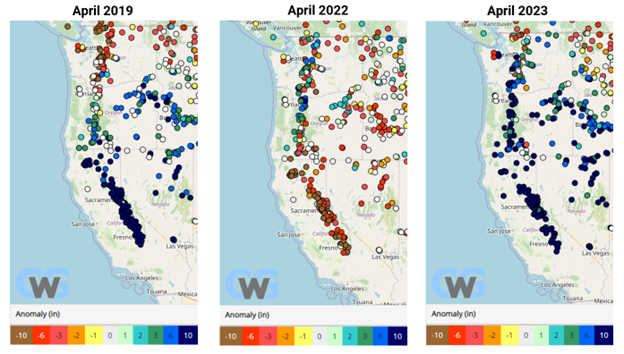

After multiple years of drought, the state of California finally found relief this year. A series of powerful storms referred to as “atmospheric rivers” have dumped record levels of rain and snow across the state. This precipitation has boosted available water resources in the state’s many reservoirs and brought snowpack levels significantly above average. The snowpack is vital to the state’s water levels as it functions as a form of natural storage and feeds into rivers and lakes as the snow melts in late spring and summer. This setup of well-supplied reservoirs in the spring is very similar to 2019 and a stark contrast to water levels this time last year. The three maps below from Commodity Weather Group display the water level anomaly in reservoirs across the western US in April 2019, 2022, and 2023.

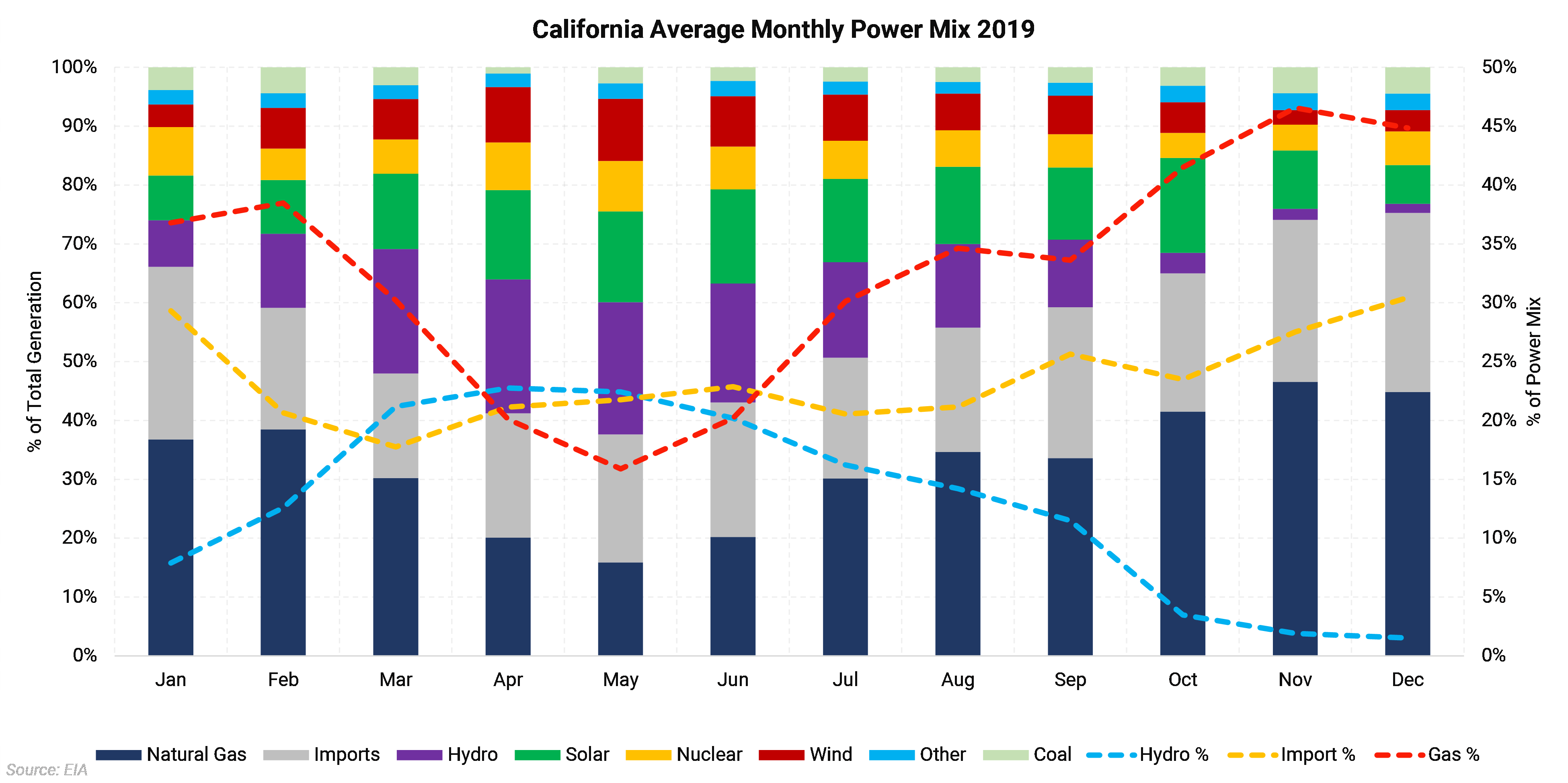

California generates electricity from various sources, but three stand out as the predominant power supply sources. Natural gas, hydro, and imported electricity together contribute more than half of all power supplied in the state. Depending on demand and availability, these three sources can occupy up to 70% of the power mix.

In 2019, the well-supplied reservoirs led to higher hydroelectric generation, at least from spring through summer, before declining to nearly nothing by the fall as drier conditions returned to the state. The autumn decline in hydro output led to the power sector increasing gas burns and imports, which was especially needed as solar output trends lower during this time of year, further reducing available supply.

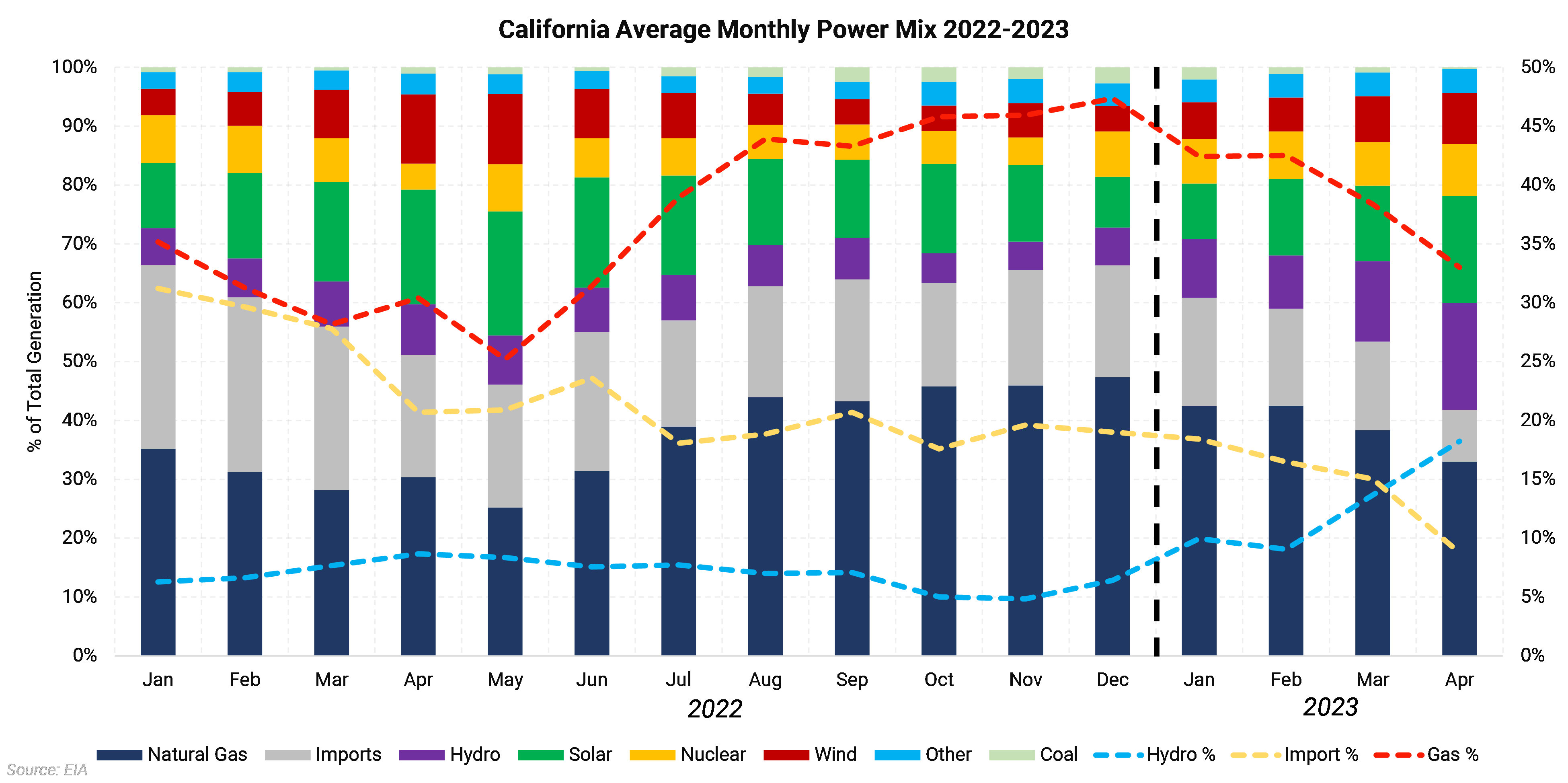

In 2022, water levels in lakes and reservoirs again fell to incredibly low levels, reducing hydro generation to less than 10% of the power mix. Natural gas and imports ramped up to occupy about 60% of the power mix throughout most of 2022. Even with limited snow melt so far, the impact of 2023’s record precipitation on hydro generation can already be seen. The share of the power mix occupied by natural gas has fallen about 10%, while hydro generation has increased at about the same rate. This is occurring while total electricity demand is well within historical norms for this time of year.

One notable observation is that power imports have reached multi-year lows, accounting for less than 10% of the power mix. Imports trended lower throughout 2022 as numerous solar, wind, and battery facilities came online. Much of California’s imported power originates in the Pacific Northwest, where surprisingly, the hydroelectric output is currently at a five-year low despite the wetness. The low generation has reduced the ability of the Pacific Northwest to export power, although as the snow melt ramps up, this will likely shift. Time of day is also an important variable when looking at imports. While California is, on average, a net importer of power, imports are used to shore up generation at night or during periods of high demand. In recent months California has often exported power during the day when solar generation peaks.

With gas burns already down more than 10% from the start of the year, the gas share of the power stack is expected to continue to fall, especially as the snowpack melts, further accelerating hydro output.

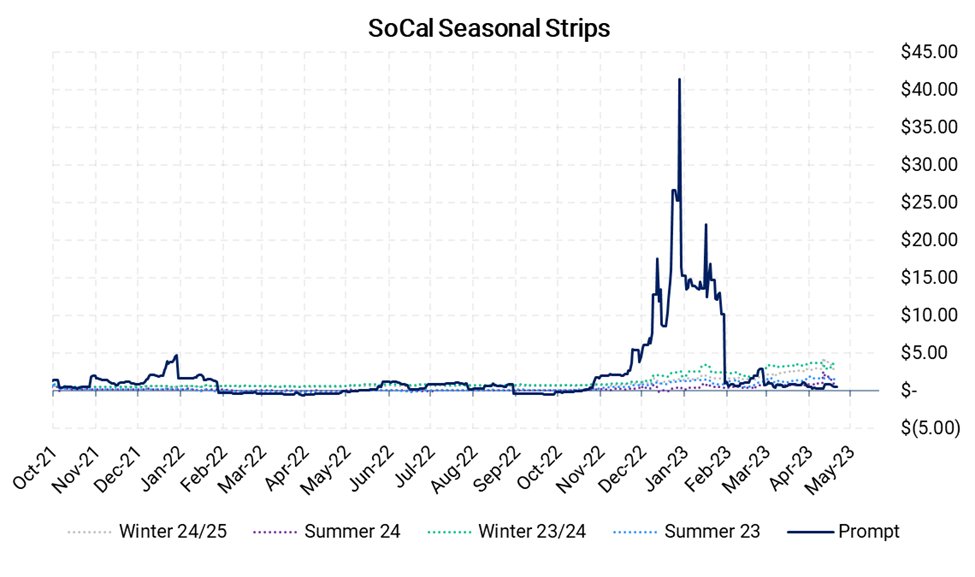

This drop in demand so far hasn’t been enough to keep forward prices for SoCal City Gate basis from staying elevated. The Summer ’23 Socal basis strip started in 2023 at $1.32/MMBtu and last settled at $1.56/MMBtu on April 19, which is higher than the basis spread has historically averaged. Winter prices remain elevated, with the Winter ‘23/’24 basis strip trading around $3.65/MMBtu. Assuming normal weather, it would be expected that these prices would fall. However, even if hydropower is as robust as expected this summer, 2019 shows that conditions can quickly change.

Contact us at info@aegis-hedging.com if you have questions.

Get market insights delivered to your inbox every day. Subscribe For Free.