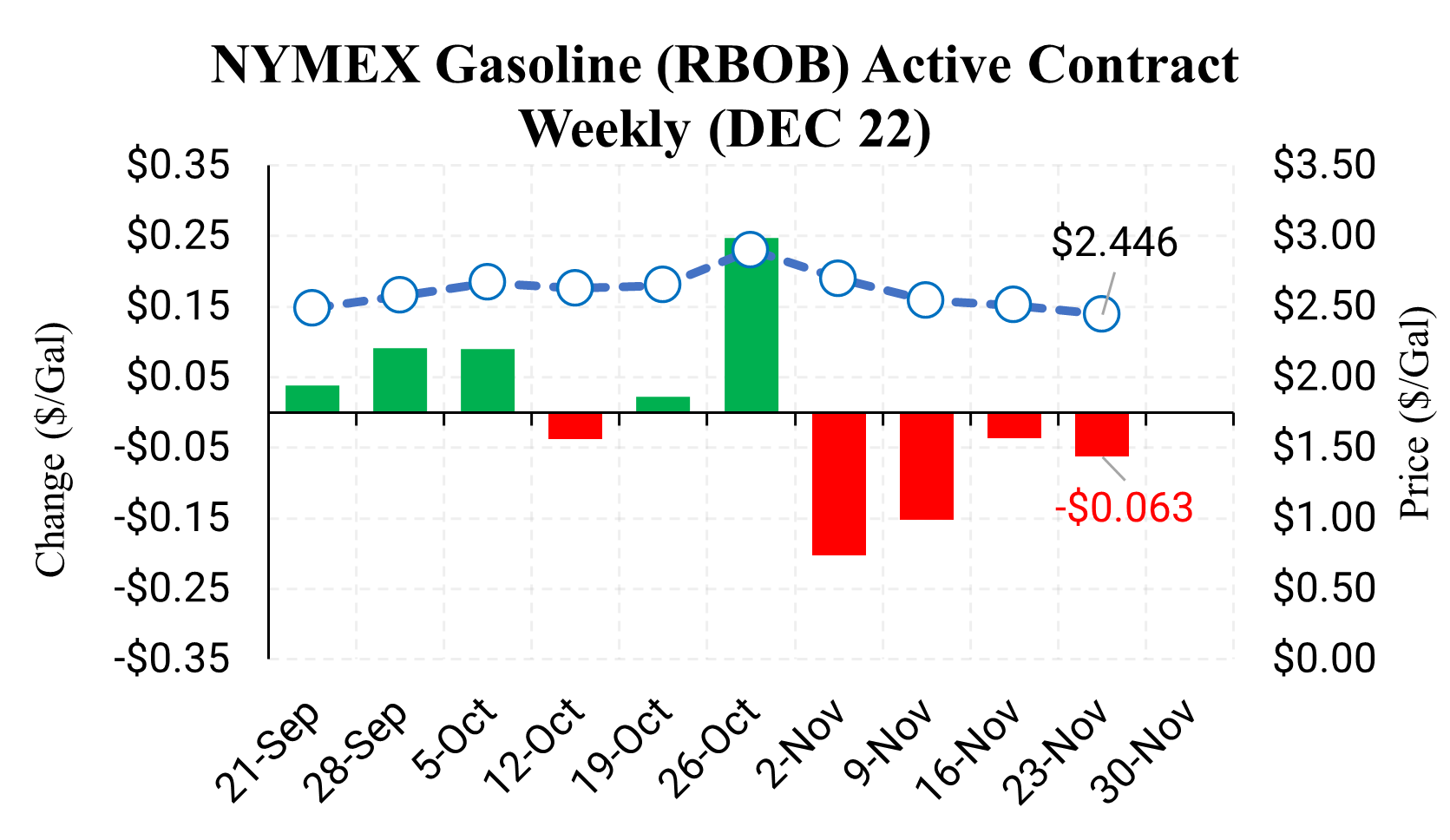

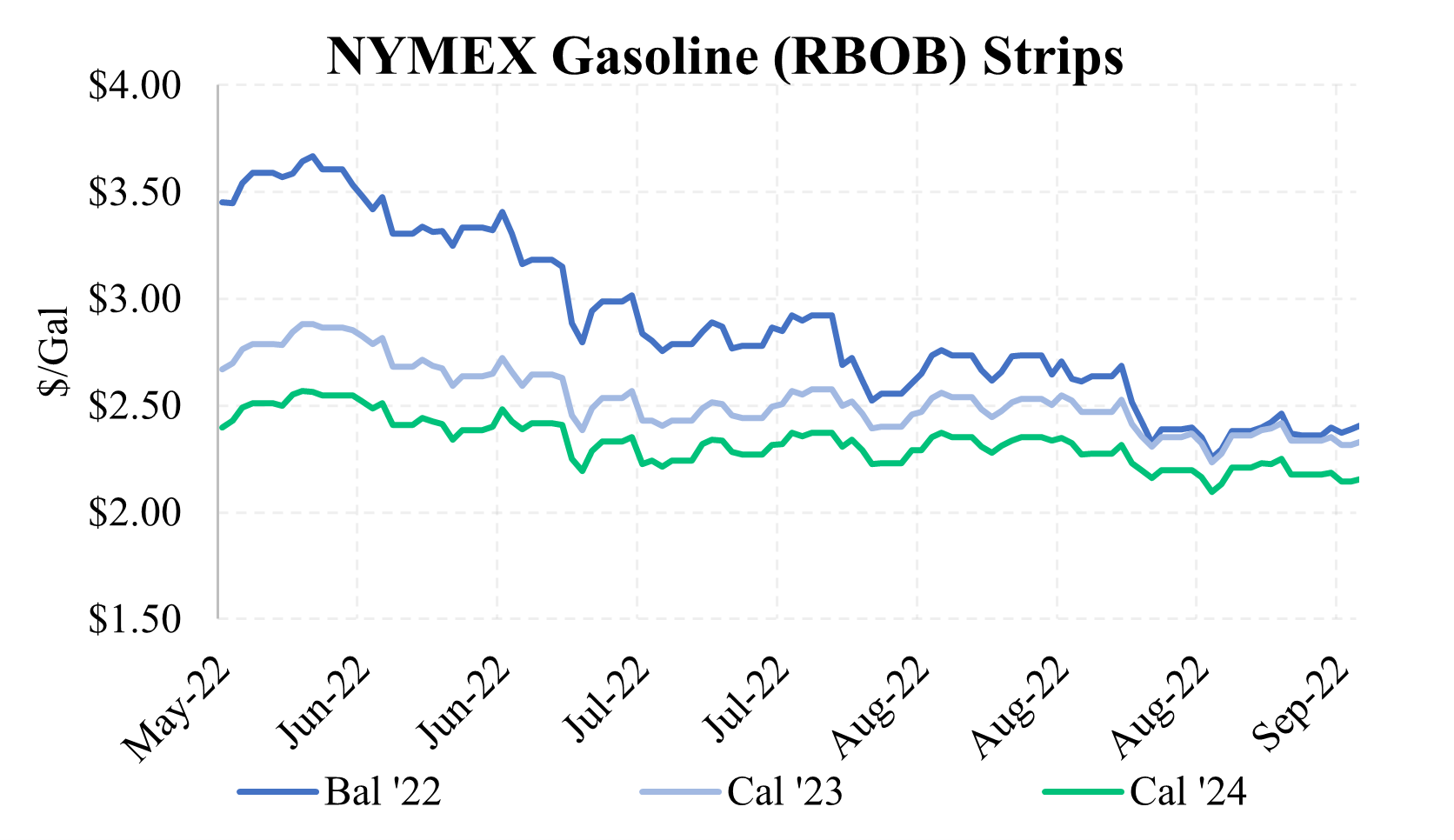

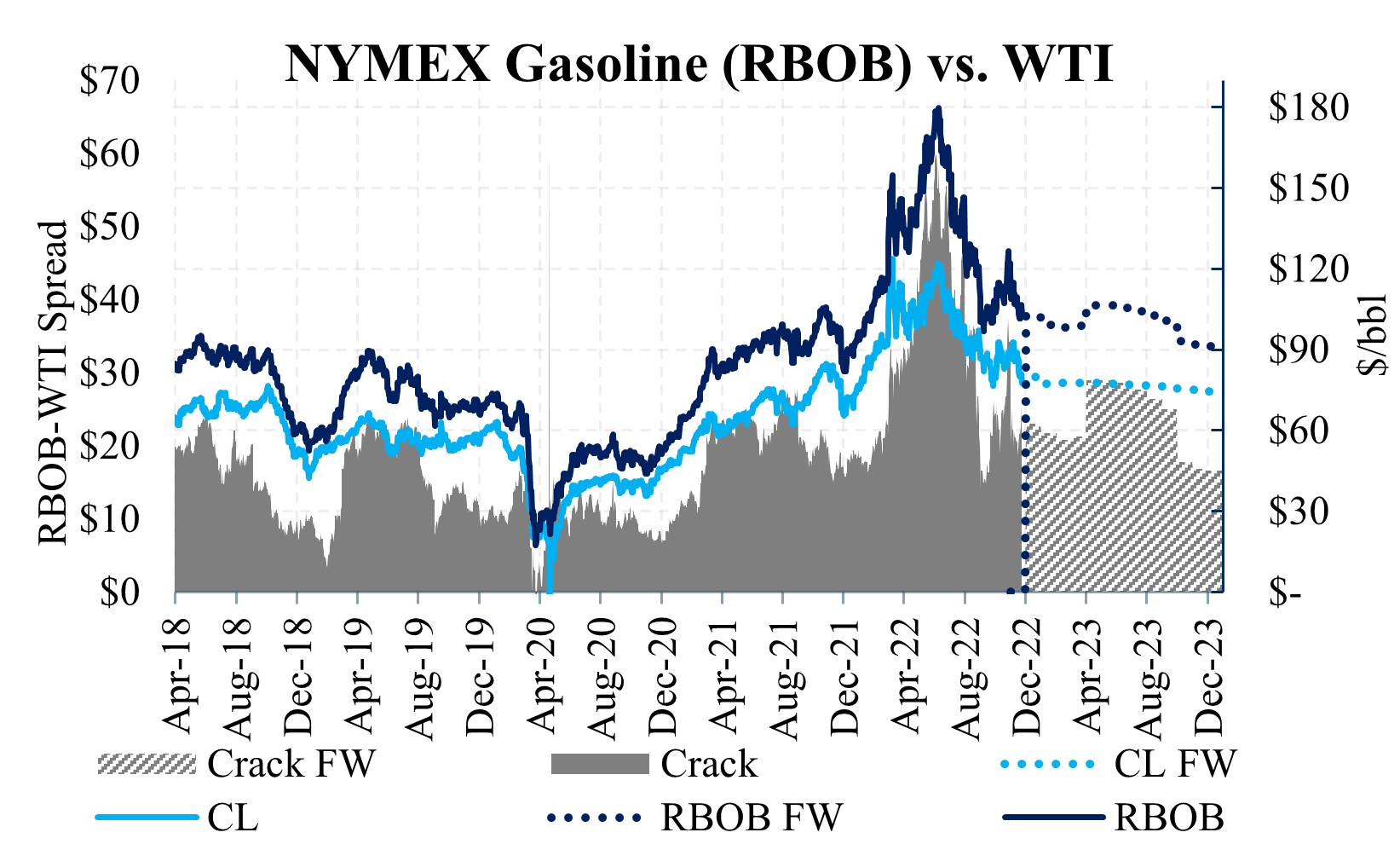

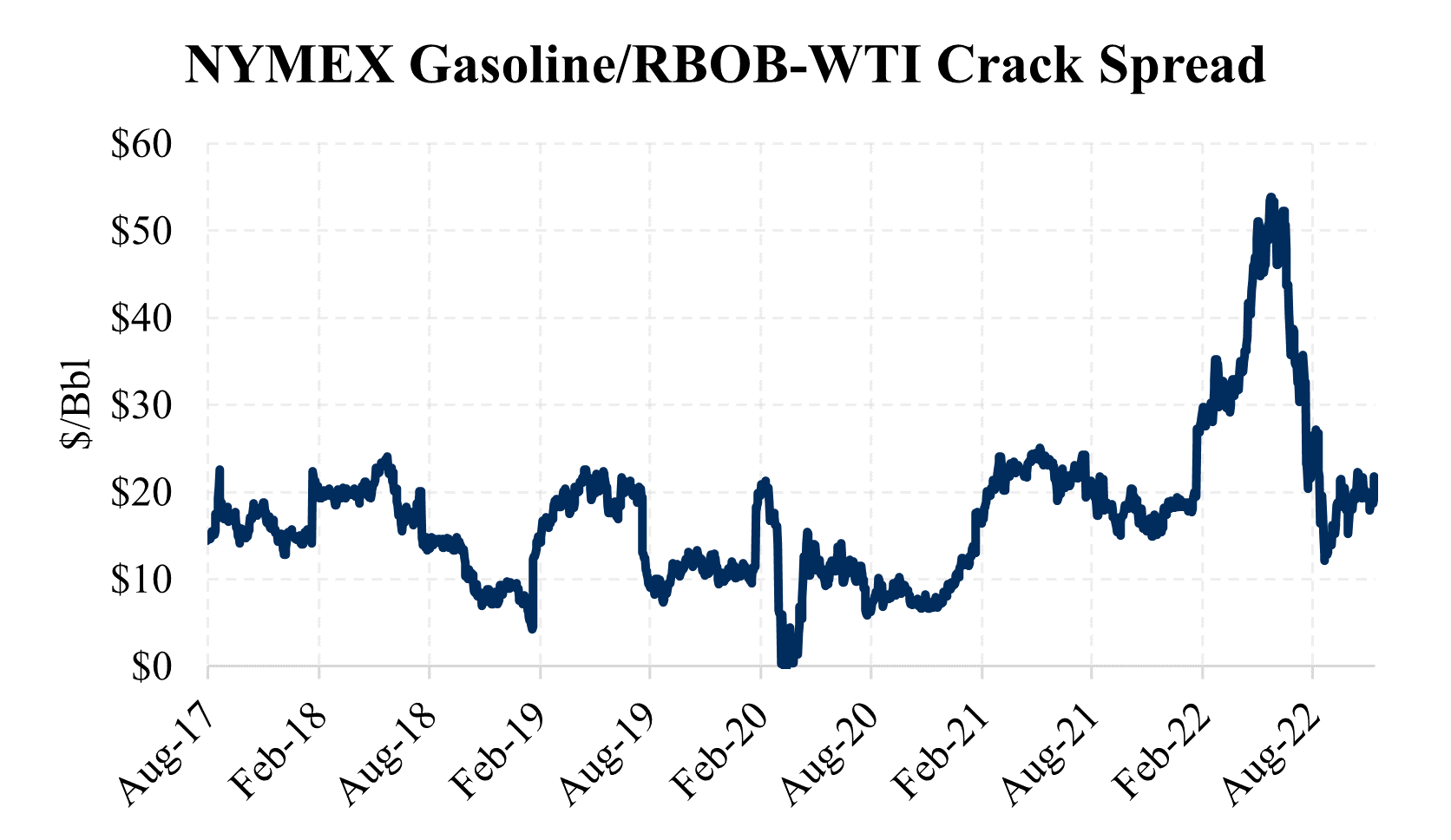

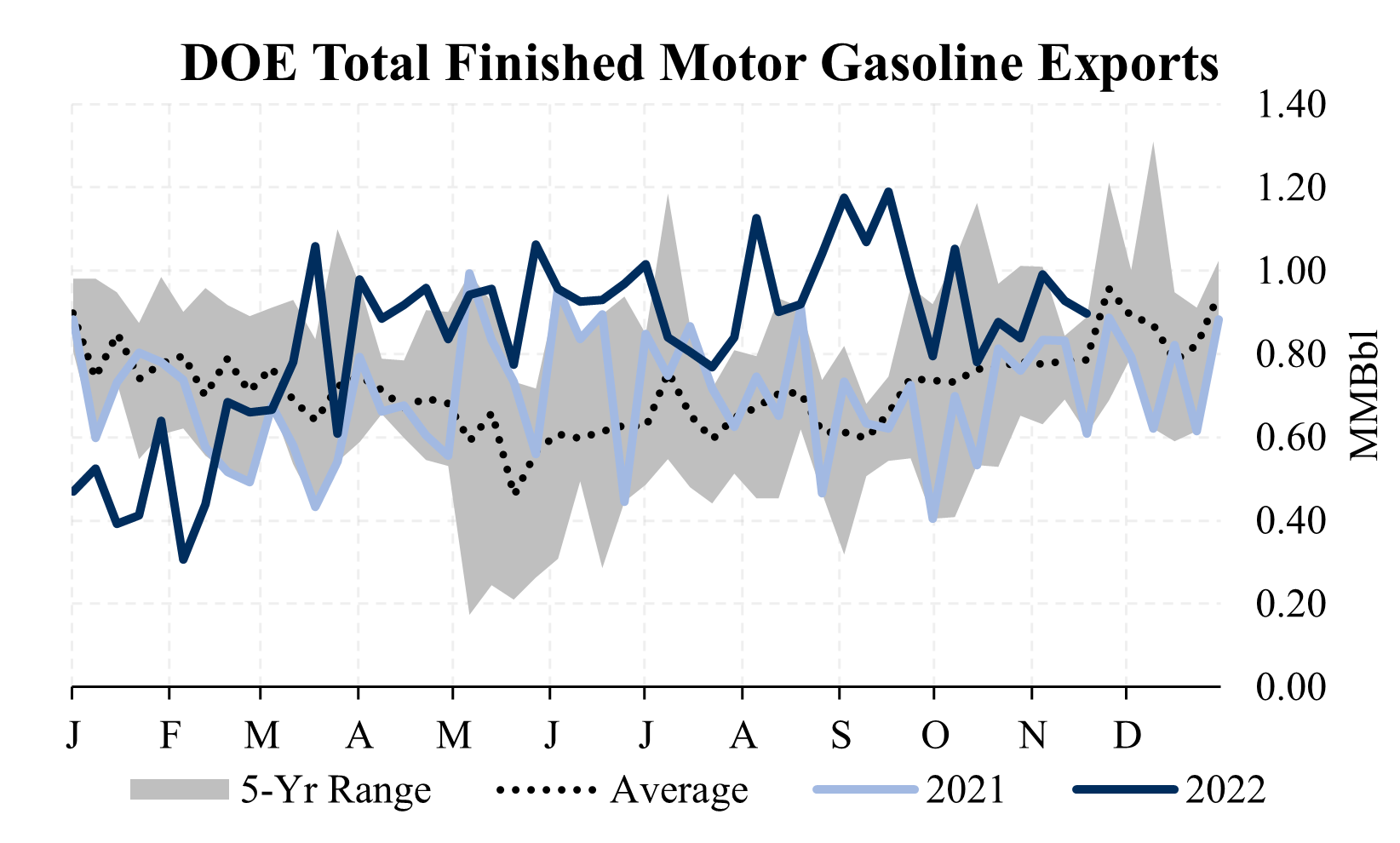

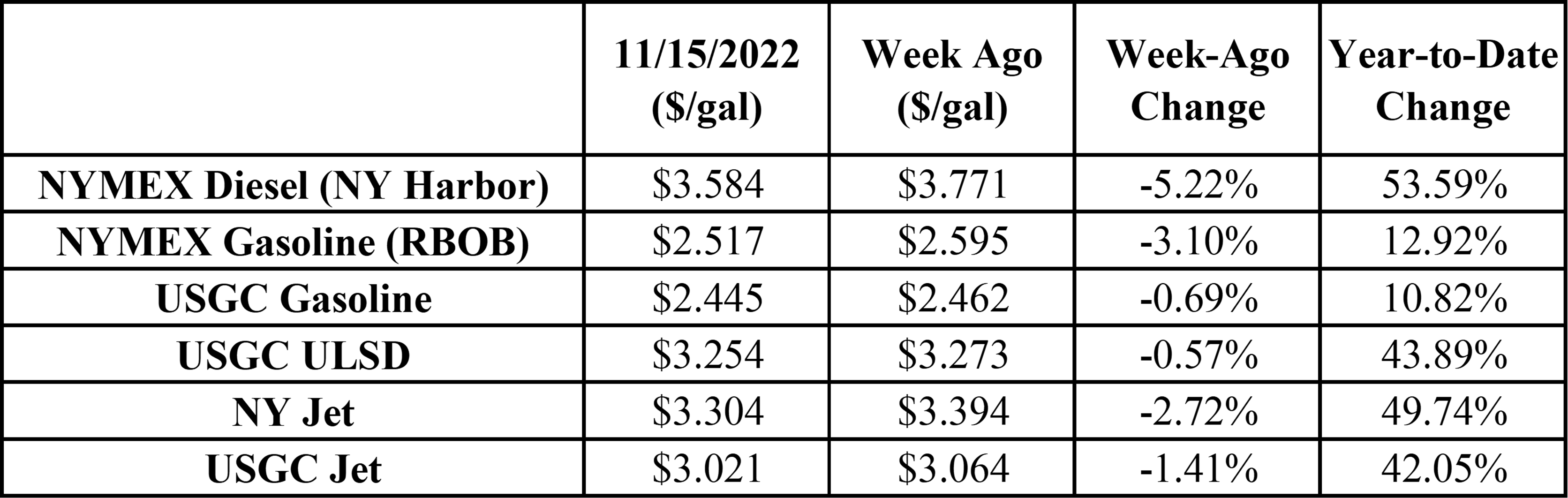

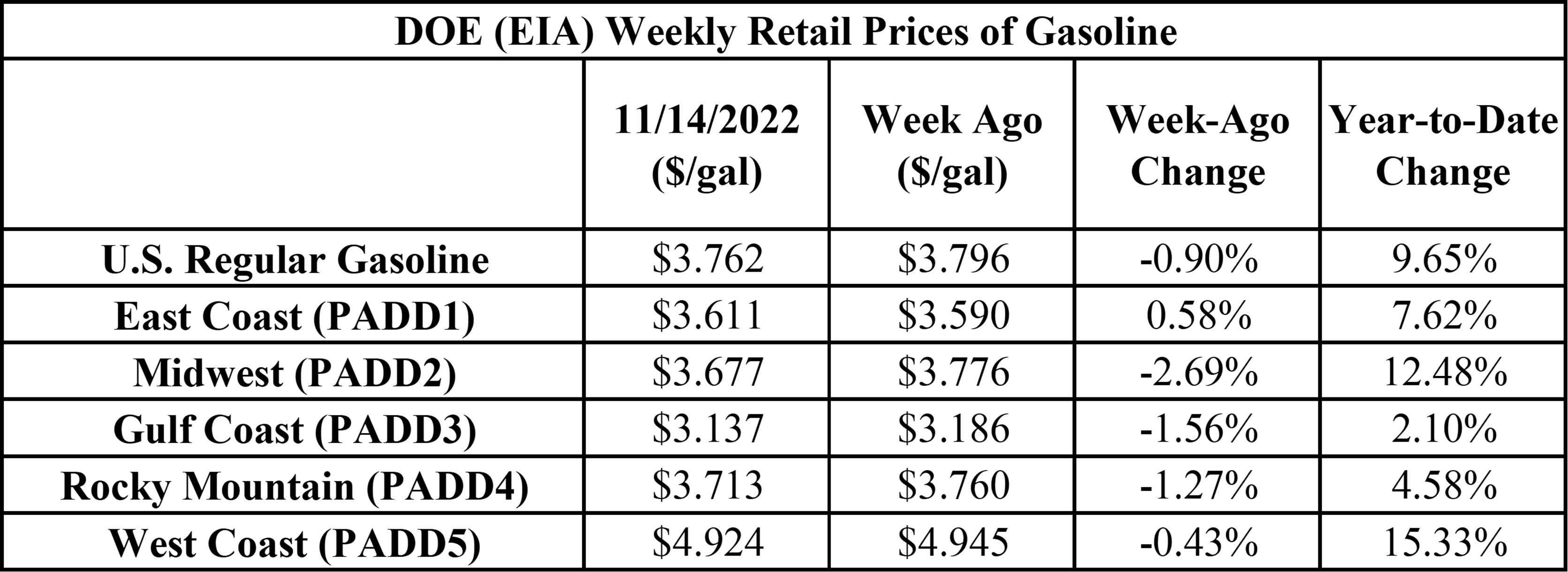

- Retail regular gasoline prices rose by 10c in the last four weeks to $3.827/Gal. About 48% of the change was due to the price of crude oil, while the remainder was the refinery margin

- Scroll down for a chart of the RBOB-WTI crack spread, a measure of refinery margin. It shows elevated cracks this year

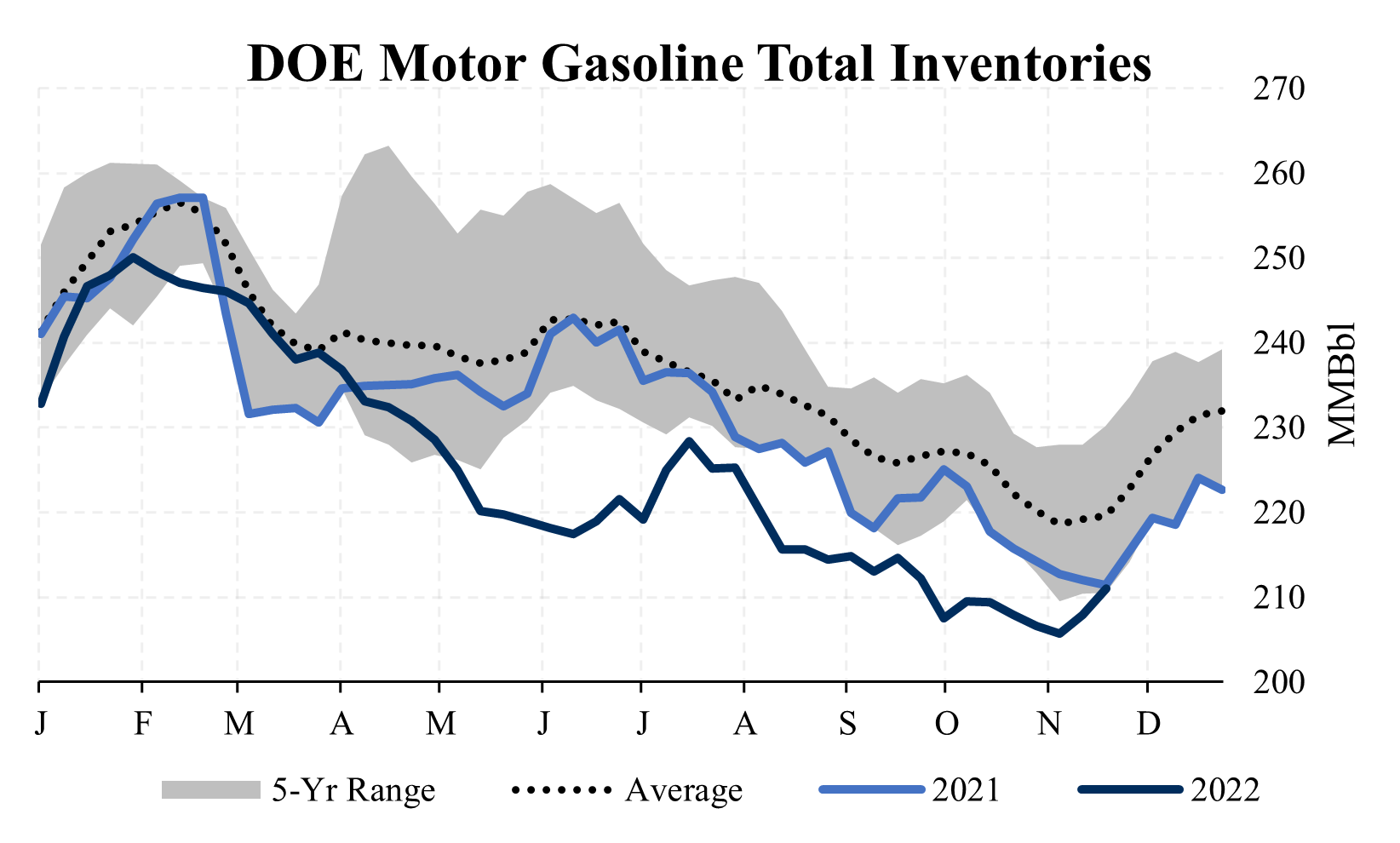

- Total motor gasoline inventories fell by 0.4 MMBbl/d for the week ending November 4 and are about 10% below the five-year average for this time of year

|

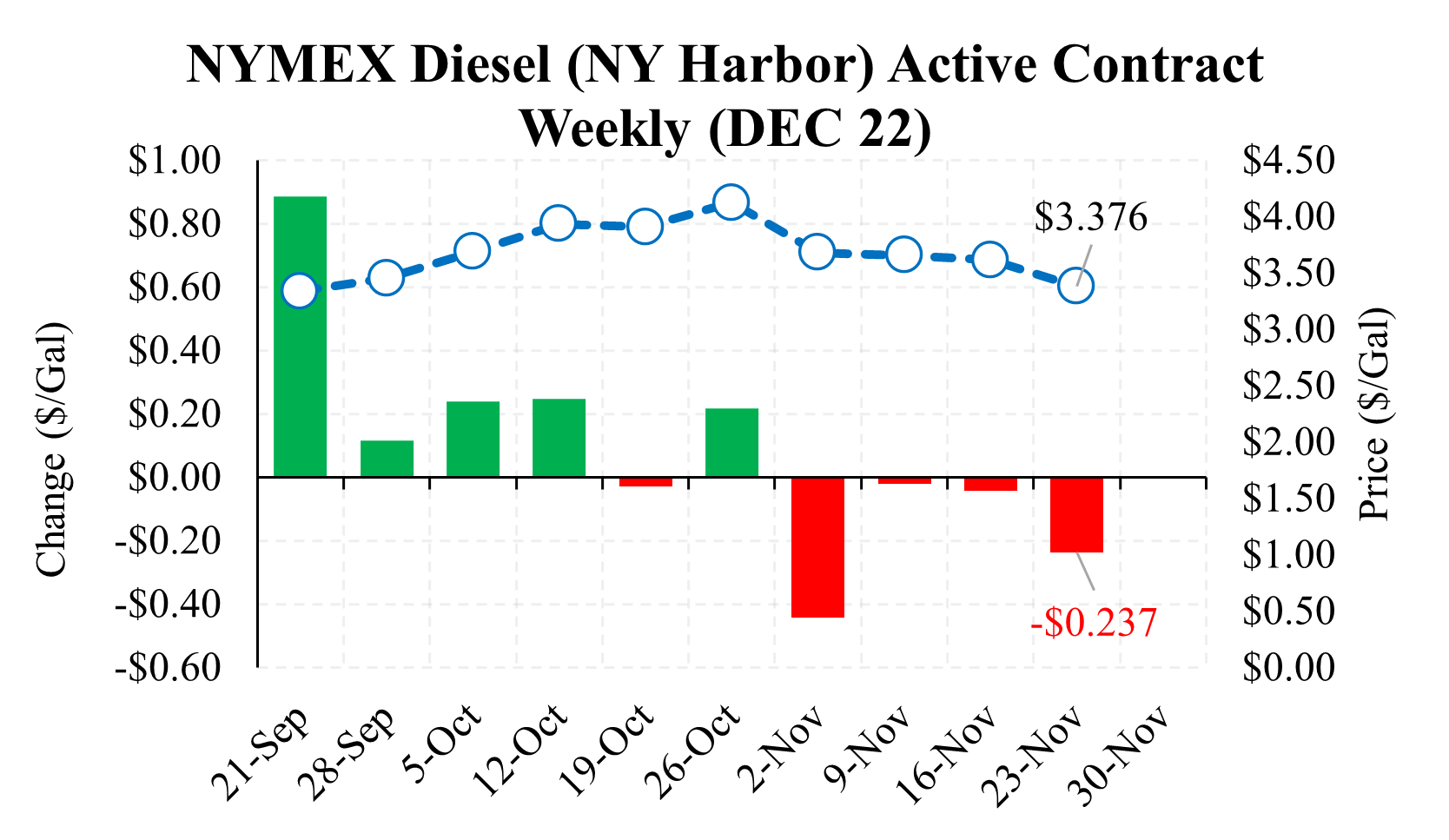

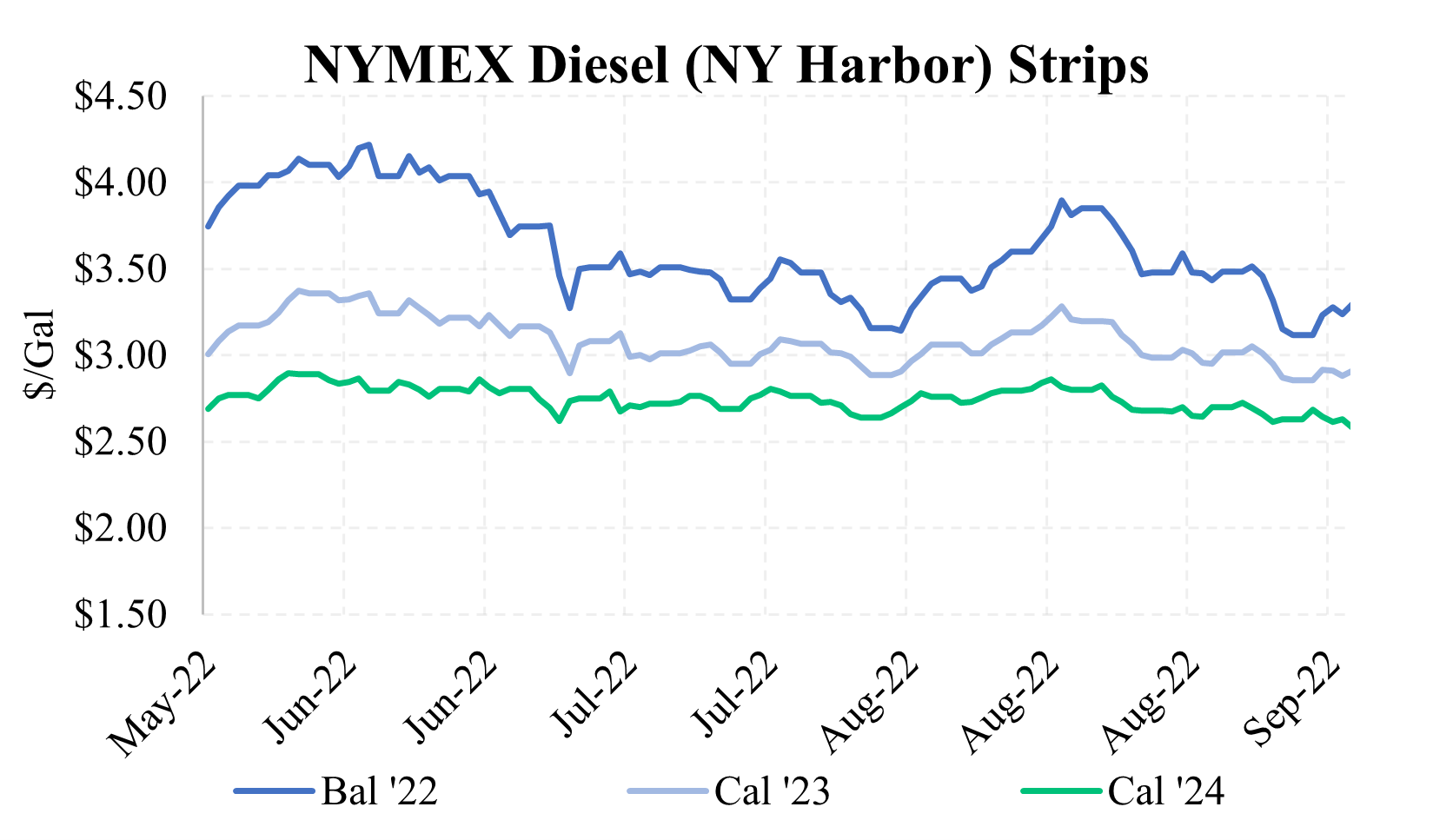

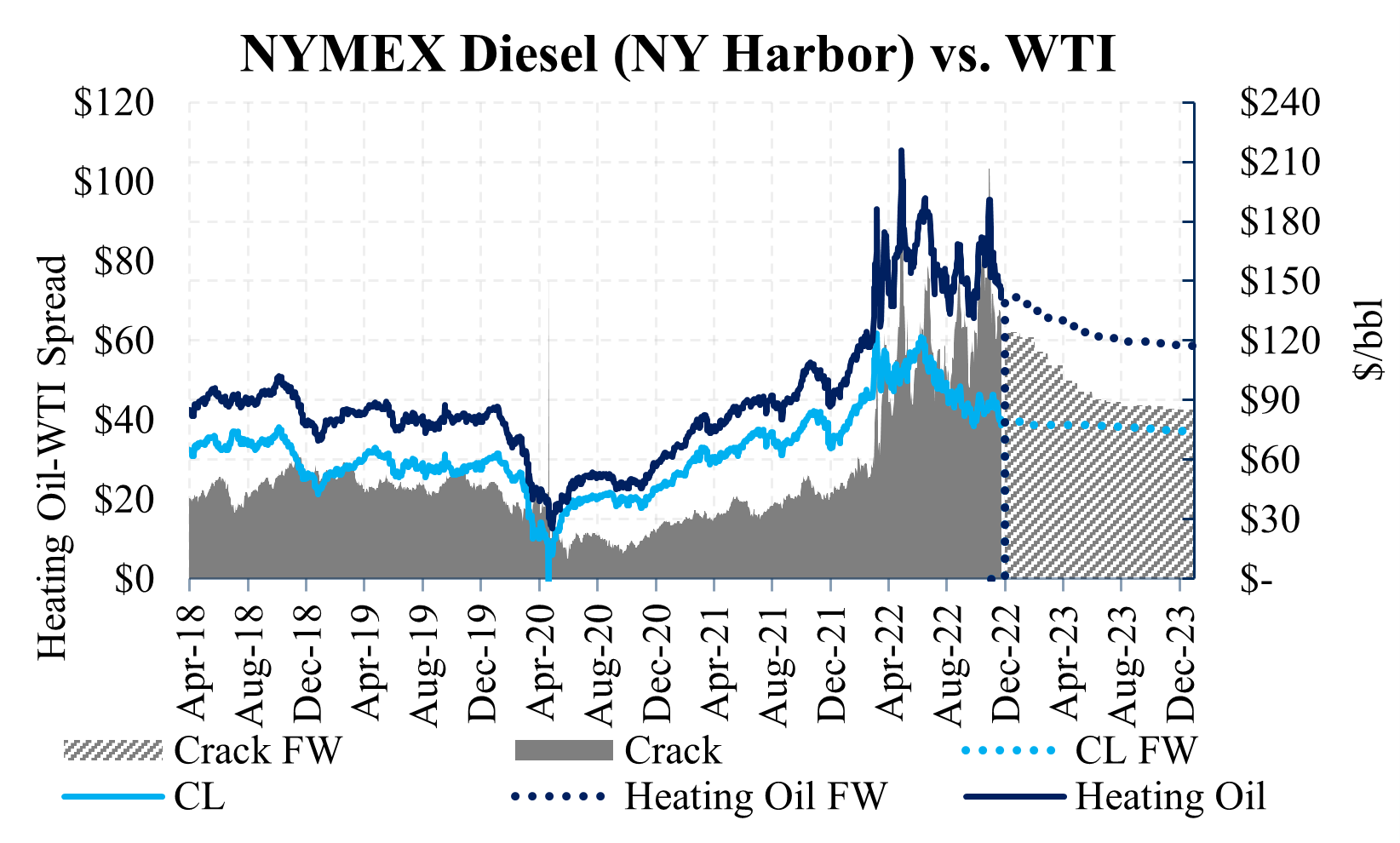

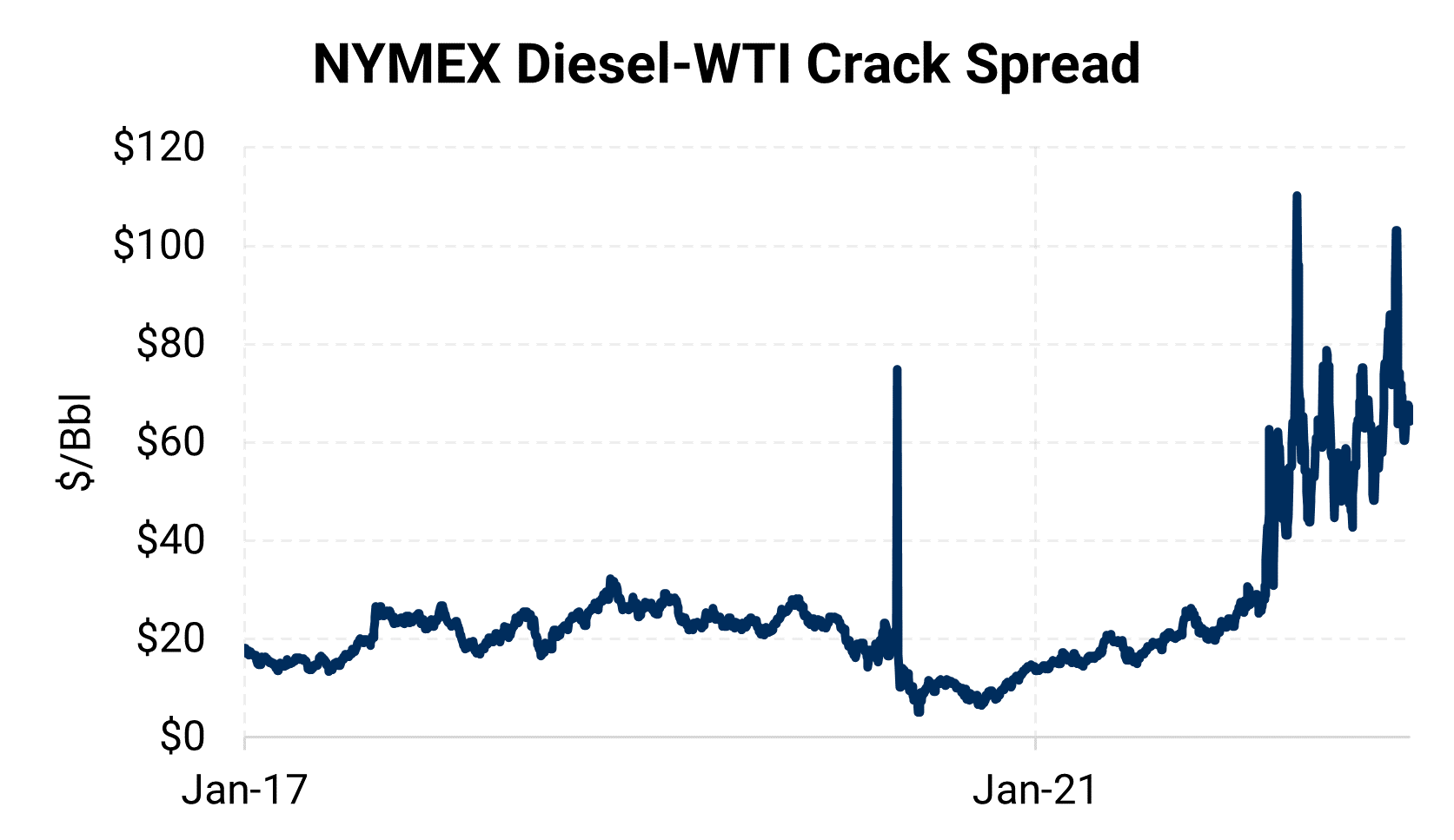

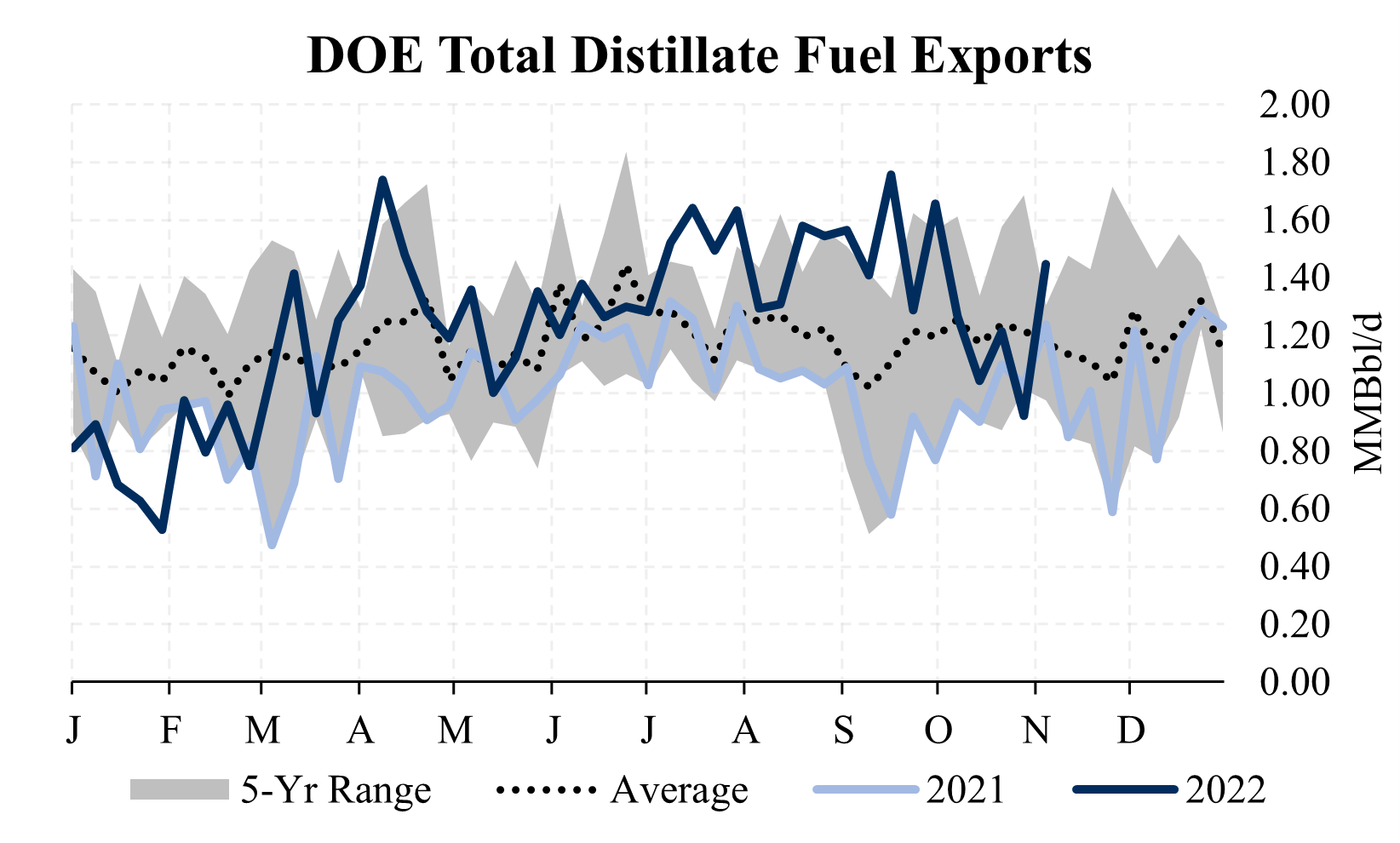

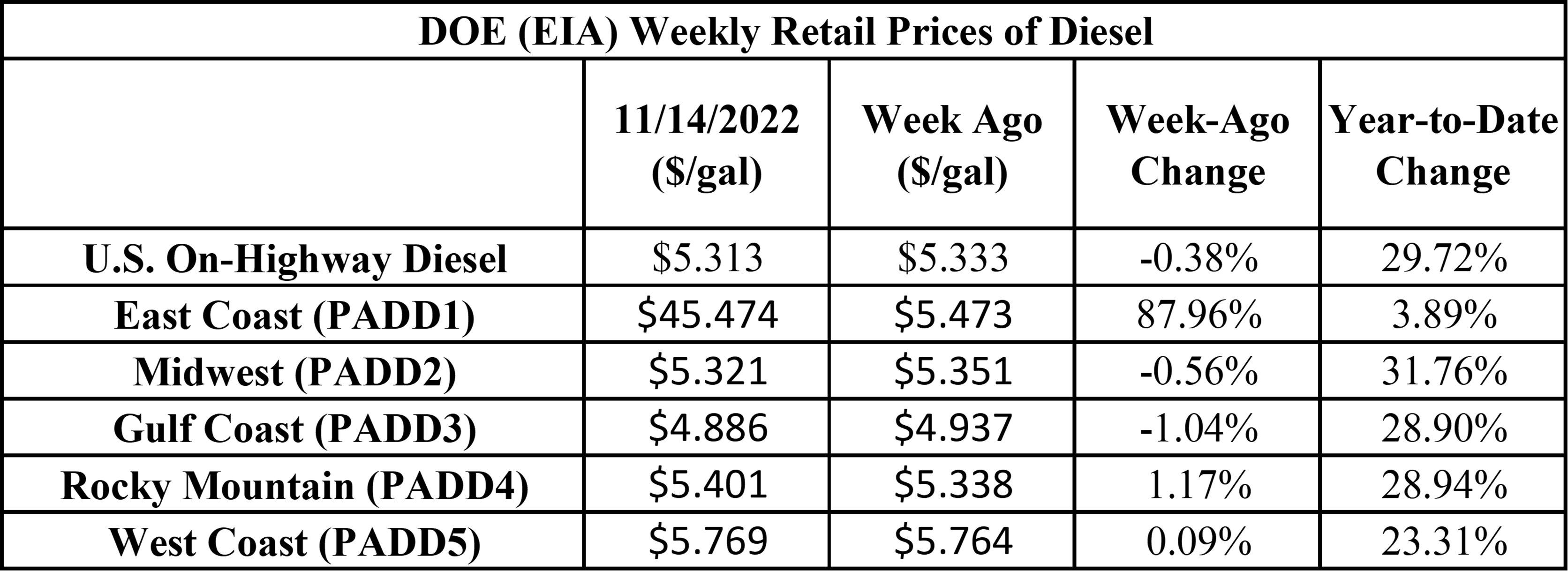

- Retail diesel prices rose by 8c in the last four weeks to $5.233/Gal. About 21% of the change was due to the price of crude oil, while the remainder was the refinery margin

- Scroll down for a chart of the NY Harbor ULSD-WTI crack spread, a measure of refinery margin. It shows elevated cracks this year

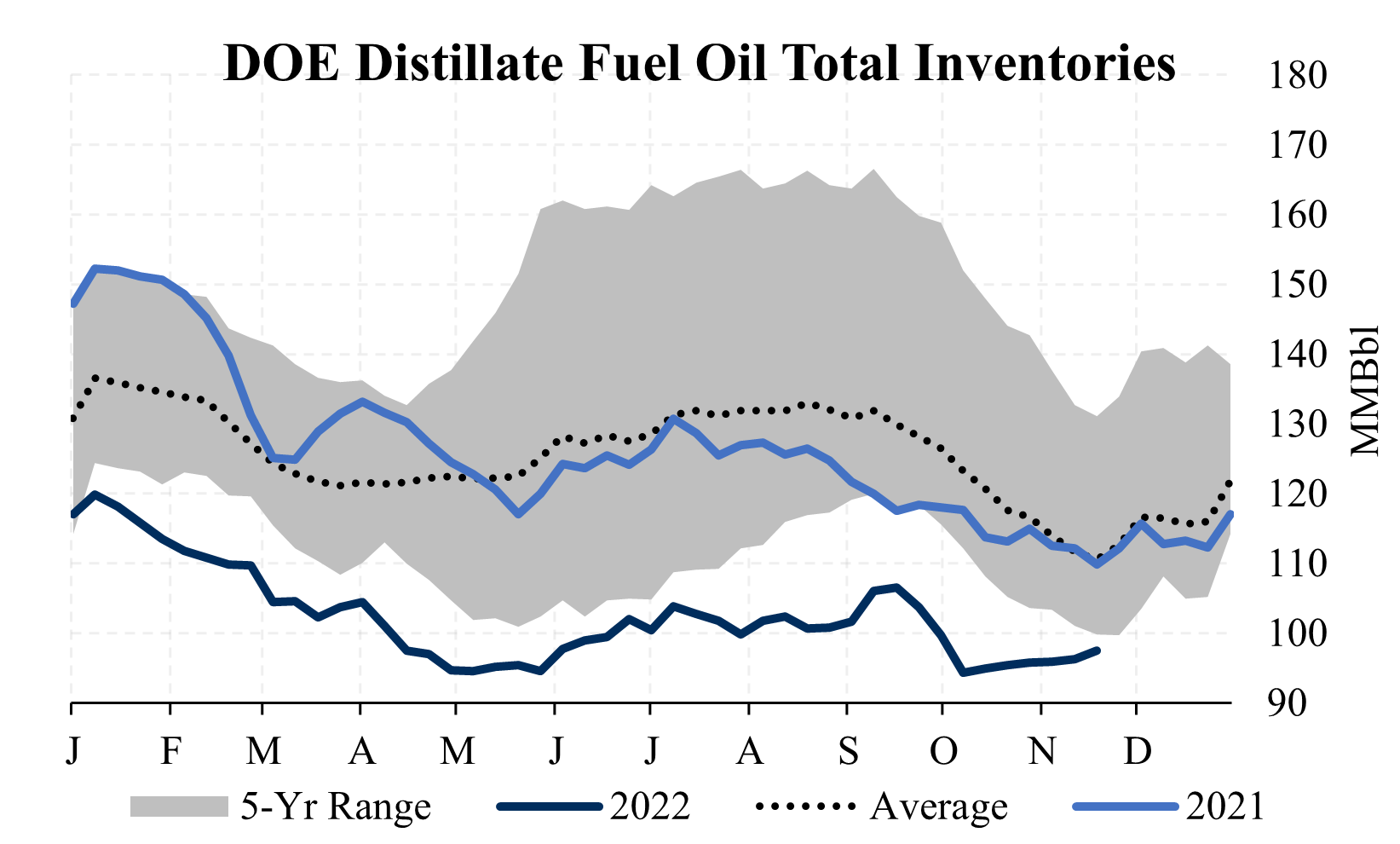

- Distillate fuel inventories fell by 0.5 MMBbl/d for the week ending November 4 and are about 17% below the five-year average for this time of year

- Europe buying Russian diesel in anticipation of import ban (Reuters)

- Russian diesel imports into Western Europe rose to 210,000 Bpd, up 126% from October levels

- Europe will be instituting a ban on Russian oil products by February 5, after a ban on Russian crude takes place in December

- Imports from Russia have accounted for 44% of Europe’s total diesel imports so far in November, and it is believed that diesel from the US, Middle East, and India will make up for the lack of Russian products following the ban

|