Oil futures gapped up on Sunday afternoon trading in response to the sudden, escalated conflict between Hamas and Israel over the weekend.

Traditionally, after geopolitical events that cause knee-jerk reactions to prices, markets relax back to the near level observed before the event. It takes actual disruptions to supply or demand to have a lasting effect on the market. While the turmoil is still fresh, in our view, prices are likely to relax from the initial pop unless there are continued events that could impact physical oil flows.

Monday’s geopolitical risk premium in the oil markets is most likely because of the potential supply risk from Iran. The knowledge that the Iranian government has backed Hamas and reports that Iran helped plan the weekend's attack leads many to believe there could be action taken against Iran. A harder line from Washington on Iran’s oil supply or retaliation from Israel directly on Iran are possibilities.

Regardless of the current events, AEGIS remains bullish on oil prices. Oil fundamentals remain bullish, and despite WTI’s drastic move below $90/Bbl last week, OPEC+’s supply reductions should keep this market tight and reduce inventories.

Historically, conflicts in the Middle East's oil-rich regions often prompted a sharp increase in oil futures, even with no immediate supply loss. However, depending on the potential for the situation to escalate or involve other major oil-producing countries, oil prices gradually stabilize if there is no material disruption.

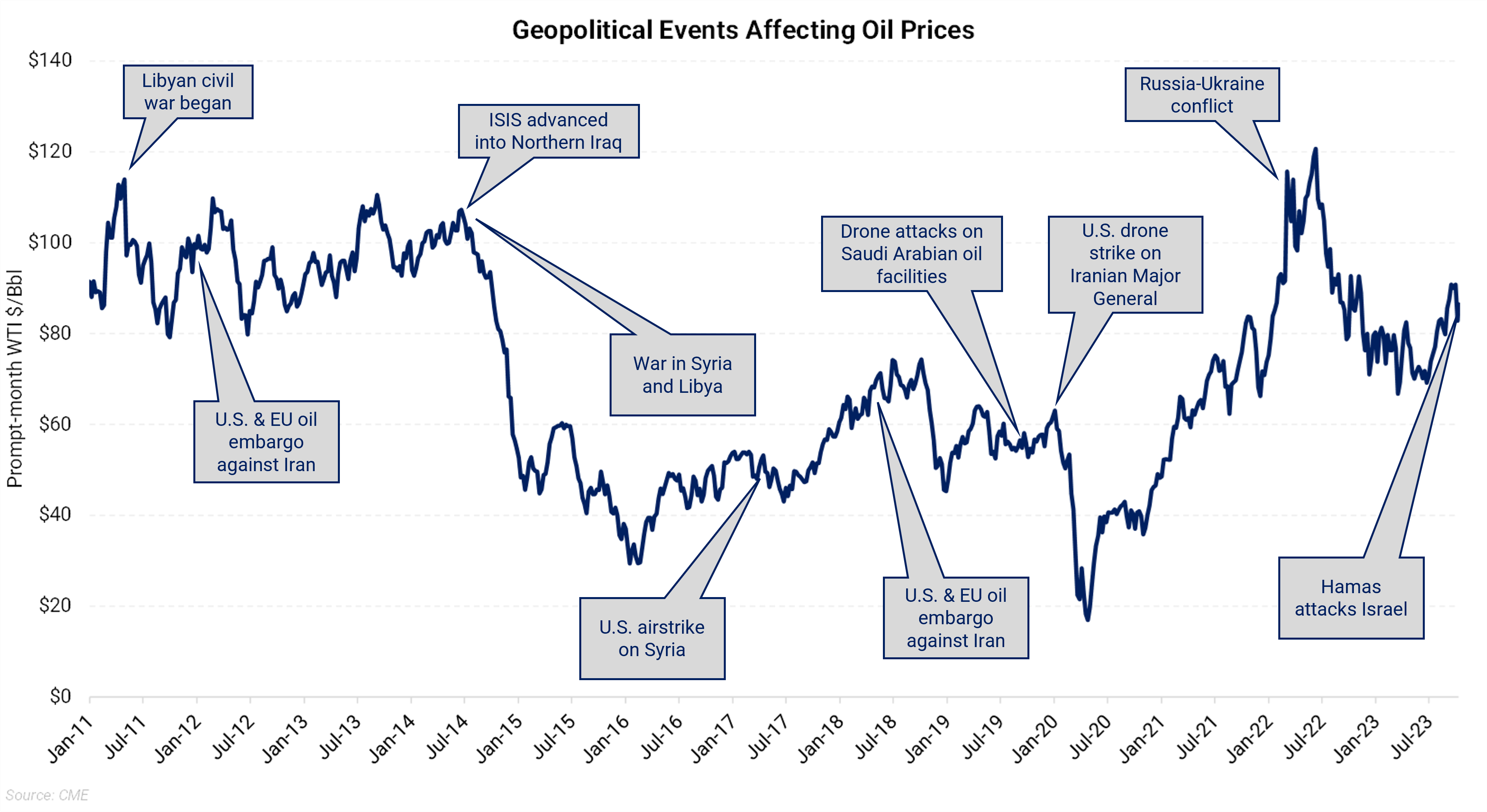

Most of the geopolitical events shown in the chart above, like ISIS's advancement into Northern Iraq in June 2014 (despite oversupply and slowing global demand), the U.S. drone strike on an Iranian Major General in Jan. 2020, an airstrike in Syria in April 2017, etc., did not have a considerable supply loss in the aftermath of a conflict, but oil prices surged due to apprehensions about potential disruptions.

In contrast, events like OPEC's production adjustments, the drone attack on Saudi Arabian refineries in 2019, the 2011 Libyan civil war, and sanctions on Iran directly impacted oil supply, justifying the subsequent price movements.

Palestinian group Hamas initiated the largest military assault on Israel since the Yom Kippur War in 1973, prompting Israel to respond with airstrikes on Gaza. Hamas, which is based in the Gaza Strip and backed by Iran, had previously been designated a terrorist organization by the US, EU, UK, and other countries. The conflict poses a risk to U.S. attempts to mediate a peace agreement between Saudi Arabia and Israel, potentially jeopardizing a deal involving US security guarantees and assistance to develop a civilian nuclear program. While currently, there are no immediate impacts on supply and demand, the situation could have broader geopolitical implications.

Last Friday, Saudi Arabia informed the White House of plans to increase oil production - currently at around 9 MMBbl/d due to a unilateral cut of 1 MMBbl/d - in early 2024 if crude prices stay high, aiming to strengthen the three-way agreement with the US and Israel. However, Saudi negotiators emphasized that market conditions will guide production decisions and that these talks do not constitute a long-term commitment to reducing oil prices. Nevertheless, the growing conflict in Gaza could decrease the probability of a near-term normalization in Saudi-Israeli relations.

Furthermore, based on the WSJ report that Iranian security officials helped plan the Hamas assault, there is a risk that the White House will take a tougher stance on sanctions enforcement, reversing its previously looser approach, which has enabled Iran to raise its oil production by more than 0.5 MMBbl/d this year to reach 3.2 MMBbl/d as of August '23.