Such a desire has led to a possible bifurcation of the aluminum market. An alternative market (and, along with it, an associated commodity price) is emerging: aluminum with traditional specs, but with a guarantee that it was made with "green" methods.

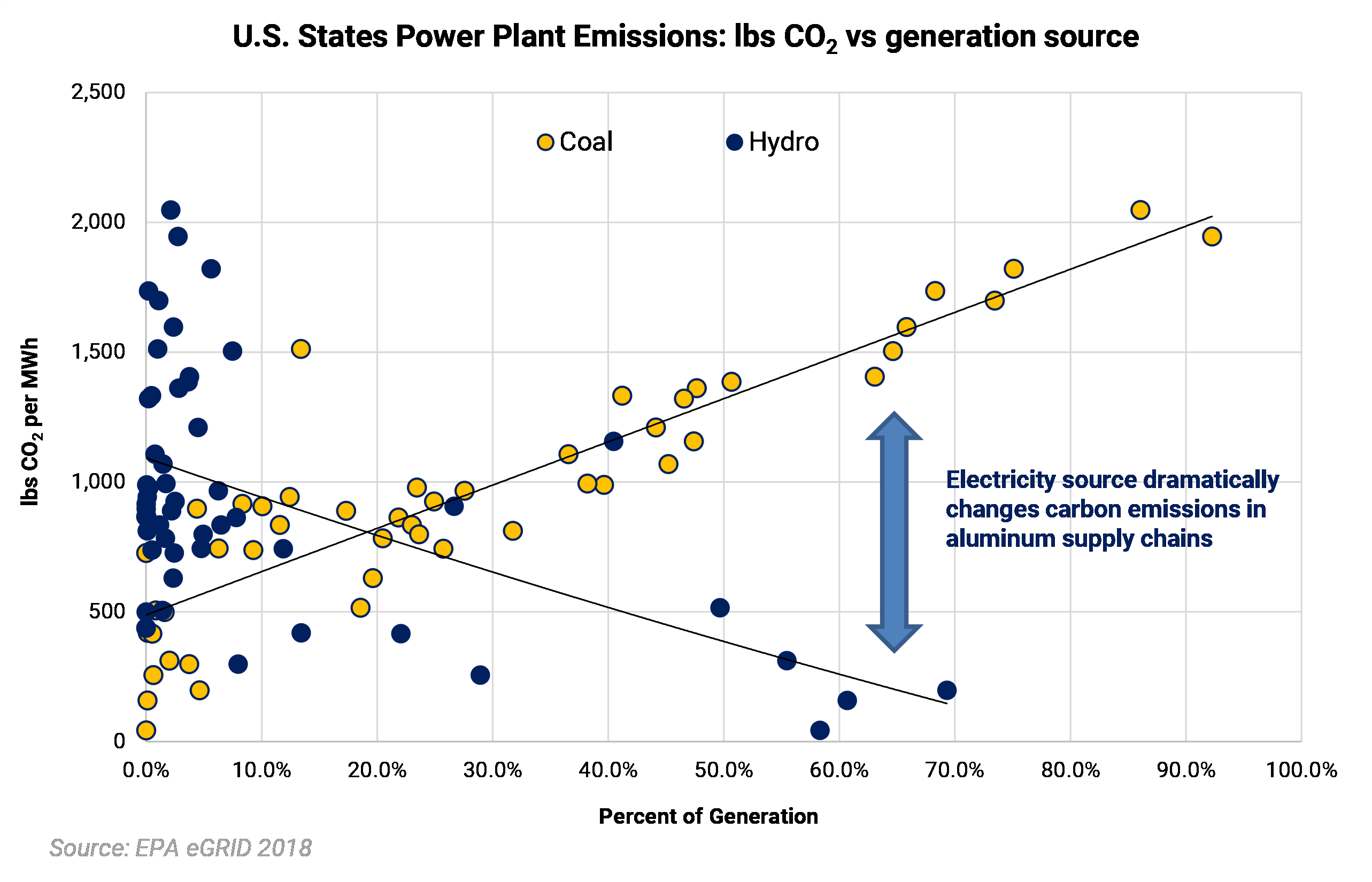

Aluminum production requires a lot of energy input, and the source of that energy determines the amount of emissions released in the process. At opposite ends of the spectrum are (1) electricity generated from burning coal, and (2) electricity generated from renewable sources, such as hydroelectric dams or wind turbines. Coal is among the least efficient sources for creating power, with respect to carbon emissions. Hydroelectric, wind, and solar generation produce near-zero marginal carbon emissions. Using coal as a fuel is a major contributor to carbon dioxide emissions. The chart above shows how many pounds of carbon dioxide were emitted in U.S. states where coal use is high, and where hydroelectric generation is high. For a power consumer in regions with high prevalence of coal generation, it is difficult to avoid high-carbon power sources. The principle holds wherever in the world you operate.

Using coal as a fuel is a major contributor to carbon dioxide emissions. The chart above shows how many pounds of carbon dioxide were emitted in U.S. states where coal use is high, and where hydroelectric generation is high. For a power consumer in regions with high prevalence of coal generation, it is difficult to avoid high-carbon power sources. The principle holds wherever in the world you operate.

Aluminum produced by using renewable generation (and avoiding coal generation) could command a premium price if carbon emissions are perceived as costly.

For example, Anheuser-Busch has reached 70% recycled aluminum in its cans in North America (Bloomberg Green), and it is working with giant aluminum producer Rio Tinto to secure more green aluminum supply. Rio Tinto uses hydroelectric power in Canada to run its smelters there. Anheuser-Busch, the largest beer brewer in the world, will be labeling its Michelob Ultra product with a low-carbon stamp. The new cans could reduce carbon emissions by 30% per can.

This deal is a typical supplier deal, as it is one-to-one between two companies. But commodities can be standardized, by definition.

Such a green aluminum contract would require producers to verify the emissions associated with the aluminum produced. But there are challenges, and such a contract has already seen some industry opposition.

As pointed out by MetalMiner, a "green aluminum" contract spec would face several problems.

First, having a standard calculation for what constitutes "green" or "low-carbon" could be problematic. There could easily be many ways to calculate the carbon impact, and an analysis of the entire supply chain — including bauxite mining and alumina production — would be the most complete, but complicated.

Second, producers with an advantage on low-carbon processes and with existing sales relationships may not want the price discovery and competition that would come with a standardized contract.

Third, a low-carbon contract could siphon liquidity away from the main LME aluminum contract. Also, a low-carbon contract might not find enough liquidity itself to be useful.

For those likely to be buying physical low-carbon aluminum for their own consumption, the emergence of low-carbon aluminum futures would likely influence the price you pay for the physical metal. The same applies for the standard, non-green aluminum cash and forward markets.

Second, the possibility of two grades for a metal with the same physical specifications adds complexity in how the price risk should be hedged. AEGIS can help in this if or when the new standards emerge.

Third, if a bifurcated aluminum market does emerge, liquidity of both markets could be affected. Trading forward contracts would require more care. Lower liquidity often means a greater chance for price discrepancies among different counterparties.