US Supply Remains RobustUntil the early 2000s, US secondary aluminum production had steadily grown for nearly 50 years. Although production has been volatile recently, it is still a key source of US supply. Production last year was 3.4 million mt, up 100,000 mt, or 3%, compared to 2021. |

|

|

Chinese Supply Expected To Grow DramaticallyAs the Wall Street Journal recently asserted, “Several decades of industrialization in China is expected to start throwing off more secondhand metal than ever before, which companies hope can be recycled and sold again.” With 14 million mt of secondary aluminum annual capacity, China is the world’s largest secondary aluminum producer. However, capacity utilization, which measures how much of their production capabilities they are using, has hovered between 40% and 60% in recent years. This means they only produce approximately 6 to 8 million mt of secondary aluminum annually. The Chinese Communist Party (CCP) expects secondary aluminum production to grow to 11.5 million mt/year by 2025 and 18 million mt/year by 2030, according to its most recent “Five Year Plan,” which outlines the CCP’s economic development goals. Given that the 2030 target is above the current annual production capacity, more scrap processing facilities will need to be built. Unless Chinese or global aluminum demand dramatically increases over the coming years, this newfound supply could weigh on LME prices for a considerable time. |

|

|

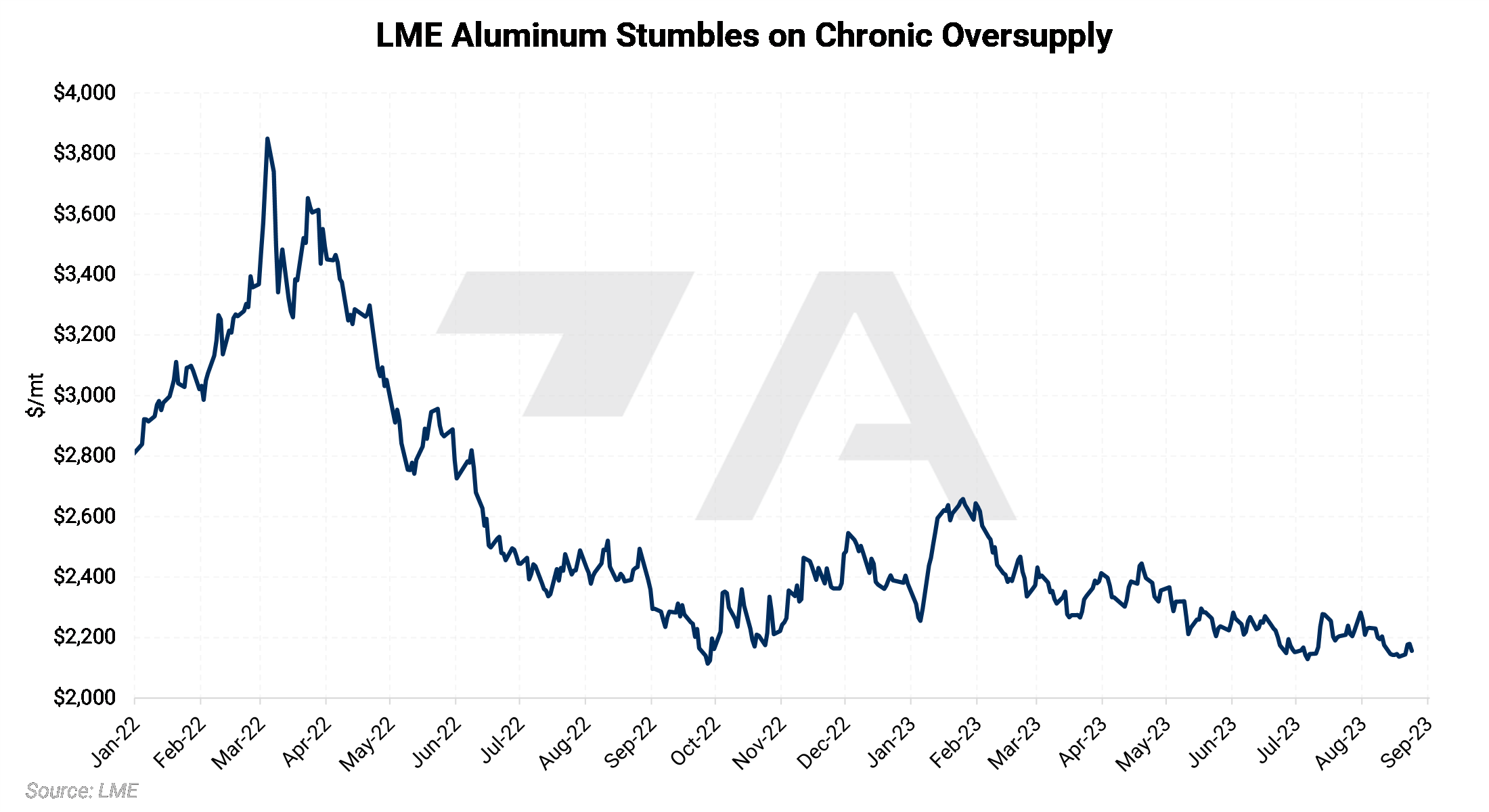

Oversupply Weighs on PricesAny impending aluminum shortage is definitely not being reflected in aluminum prices. Except for several minor rallies, LME aluminum prices have been under pressure since early 2022, having peaked near the start of the Russia-Ukraine conflict. Fears that Russian aluminum supplies would be cut off from the global market proved to be overhyped as the country’s aluminum production and exports continued. Despite self-sanctioning efforts by Western buyers, Russia's aluminum exports are going to new, willing buyers, namely China. Discounted Russian supplies continue to have an oversized impact on the global market, thereby pressuring prices. |

|

Aluminum Futures Forward Curve Remains In Steep ContangoDue in part to this chronic oversupply, LME Aluminum’s futures forward curve is now in a very steep contango. This means that aluminum producers can hedge forward in 2024 and beyond at prices that are much higher than spot or nearby. Please get in touch with AEGIS for strategies on how to hedge in a severe contango market. |

|

|

This price risk can be hedged!Aluminum producers can reduce or eliminate price risk by hedging at a predetermined price. In this case, they would sell LME Aluminum swaps to protect against future production. This could be used as an inventory hedge as well. Put options are also a viable strategy. The chart below demonstrates the current average price for 2024 LME Aluminum futures and several ways an aluminum producer can mitigate this price risk. AEGIS is also very adept at developing strategies for aluminum consumers. This might include simply buying call options. Again, please get in touch with us for further details. |

|

|

AEGIS can build your hedging program.These financial hedges are done through a counterparty (such as a bank or a broker) and are not meant to replace any sales or purchases in the physical market but are a supplement to them. These hedges will also make you less susceptible to the spot market. We are also happy to introduce new clients to more counterparties, helping you receive the best possible price. Please get in touch with us for details. |

Important Disclosure: Indicative prices are provided for information purposes only and do not represent a commitment from AEGIS Hedging Solutions LLC ("Aegis") to assist any client to transact at those prices, or at any price, in the future. Aegis makes no guarantee of the accuracy or completeness of such information. Aegis and/or its trading principals do not offer a trading program to clients, nor do they propose guiding or directing a commodity interest account for any client based on any such trading program. Certain information in this presentation may constitute forward-looking statements, which can be identified by the use of forward-looking terminology such as "edge," "advantage," "opportunity," "believe," or other variations thereon or comparable terminology. Such statements are not guarantees of future performance or activities.