|

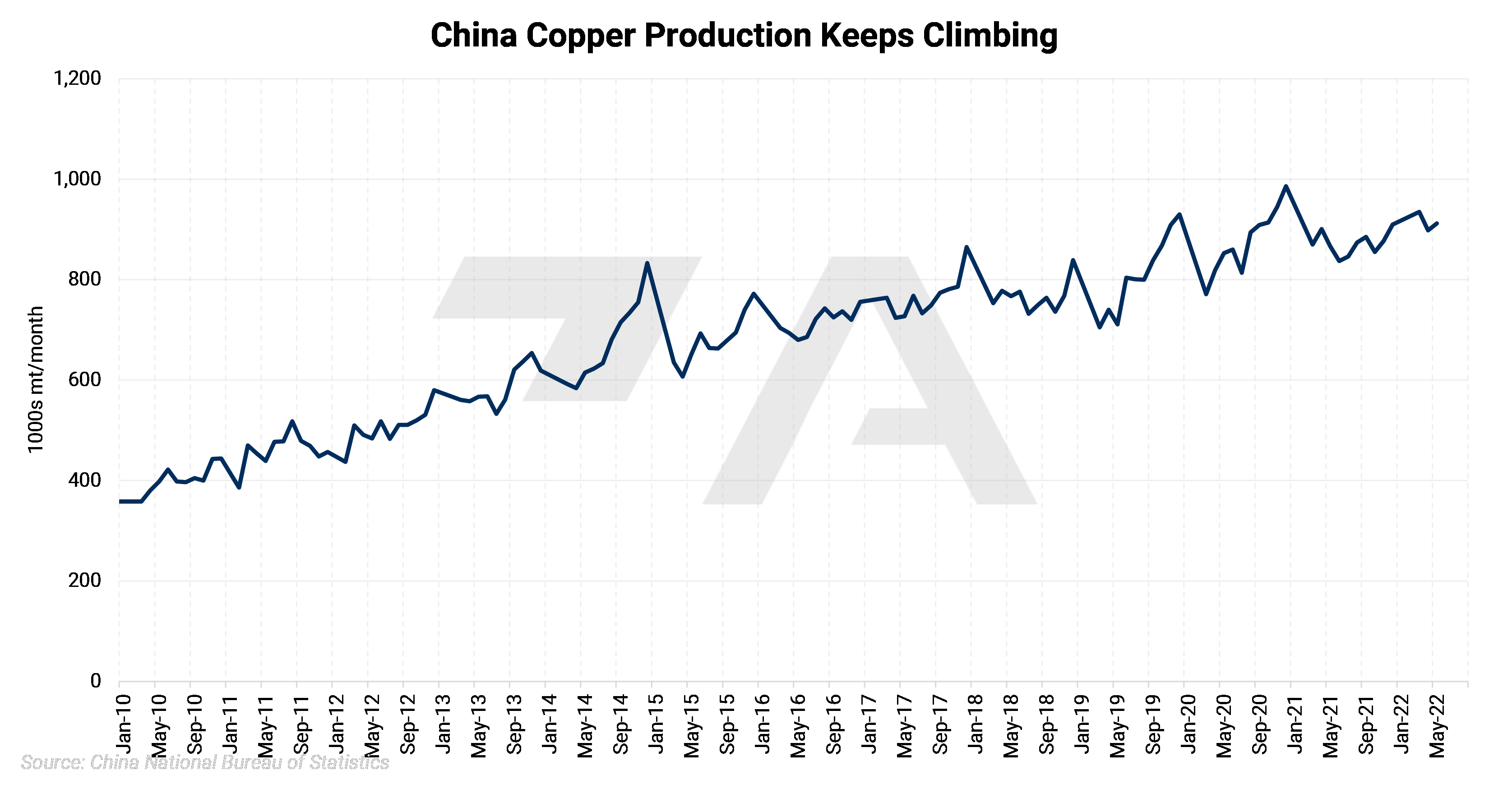

| Chinese production has increased in 2022, despite COVID lockdowns and lower demand. |

|

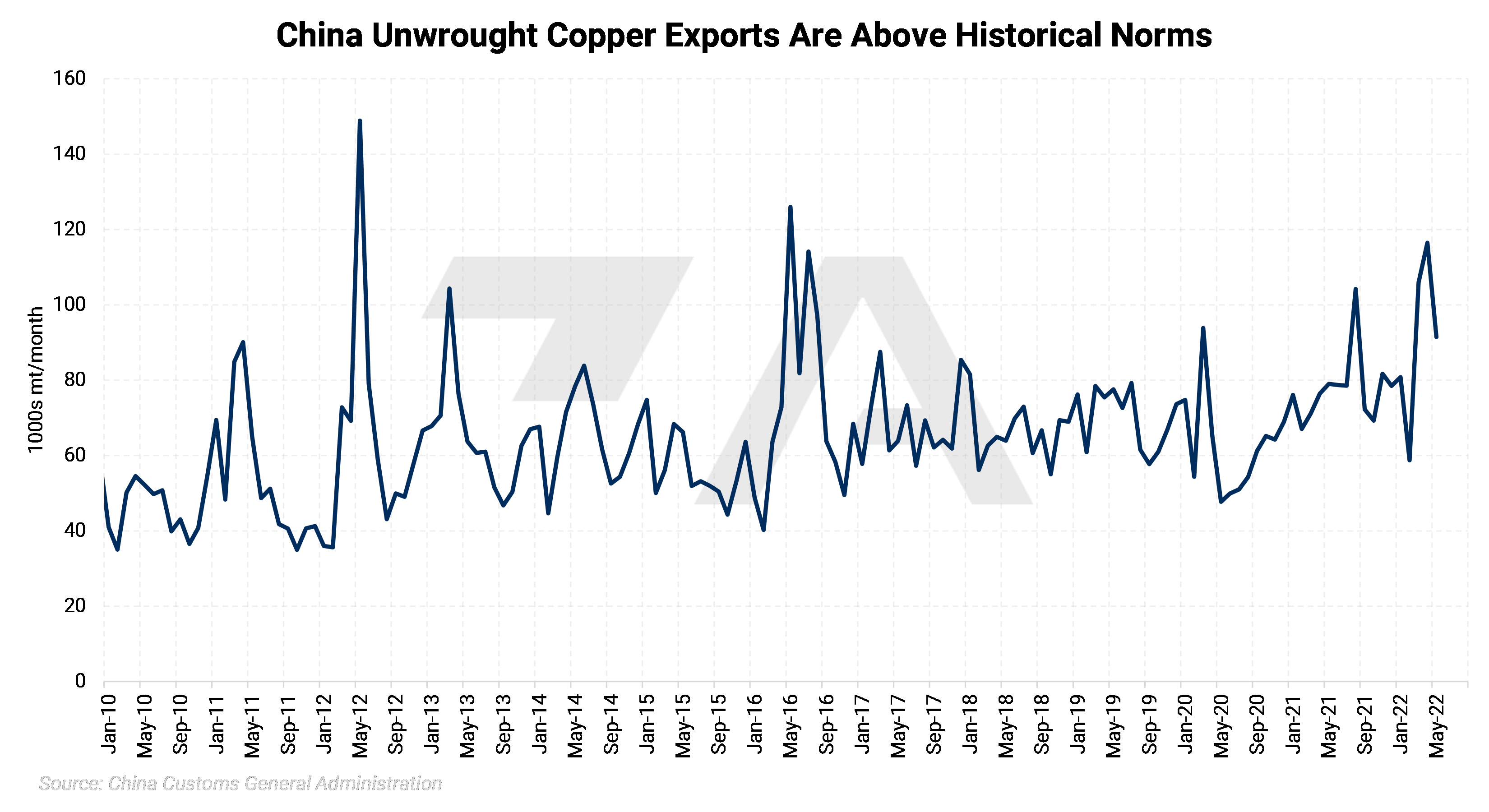

| As demand has waned, China's exports have increased. |

|

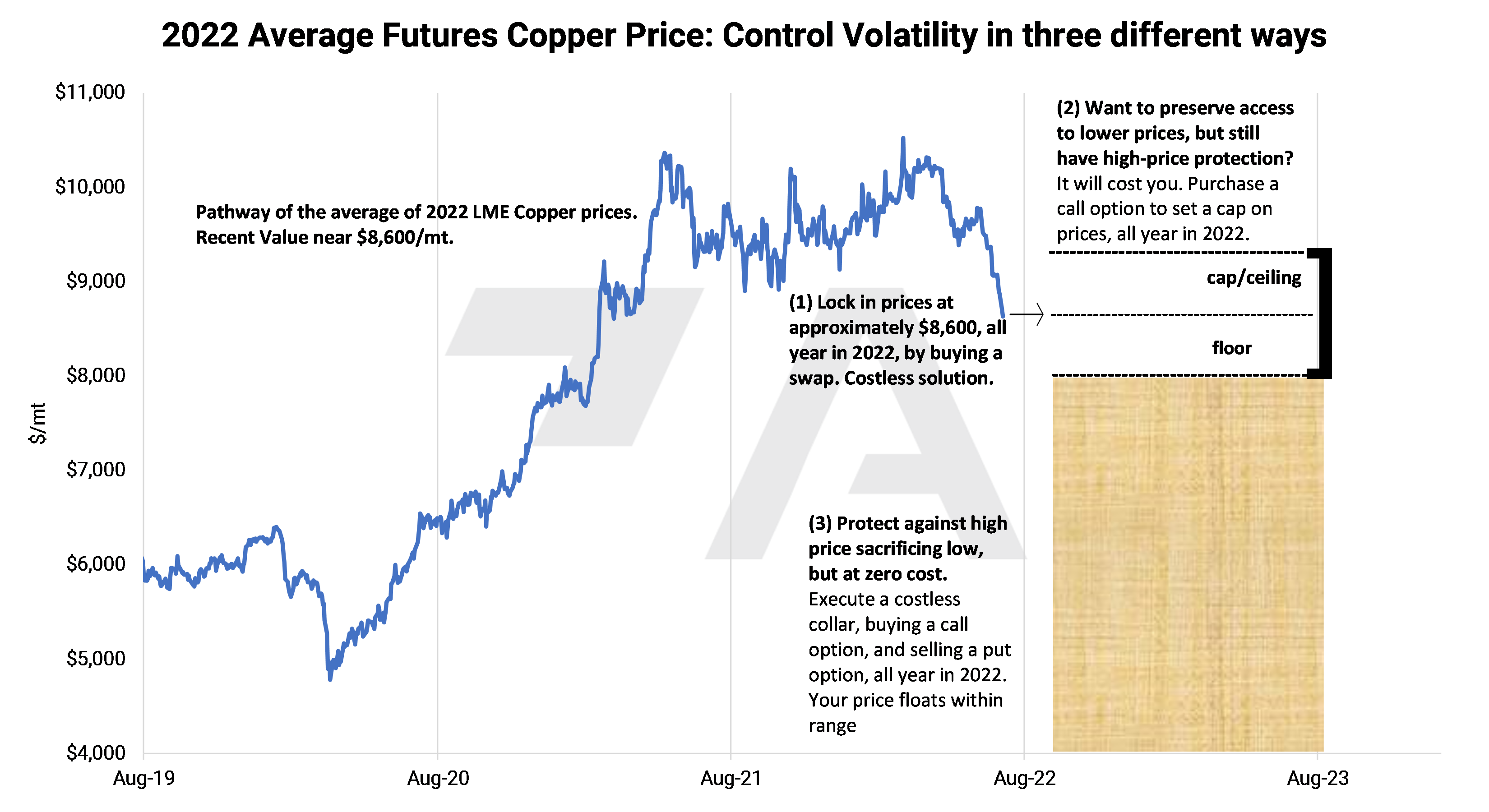

| As we explain below, hedging can be done in various ways. |

|

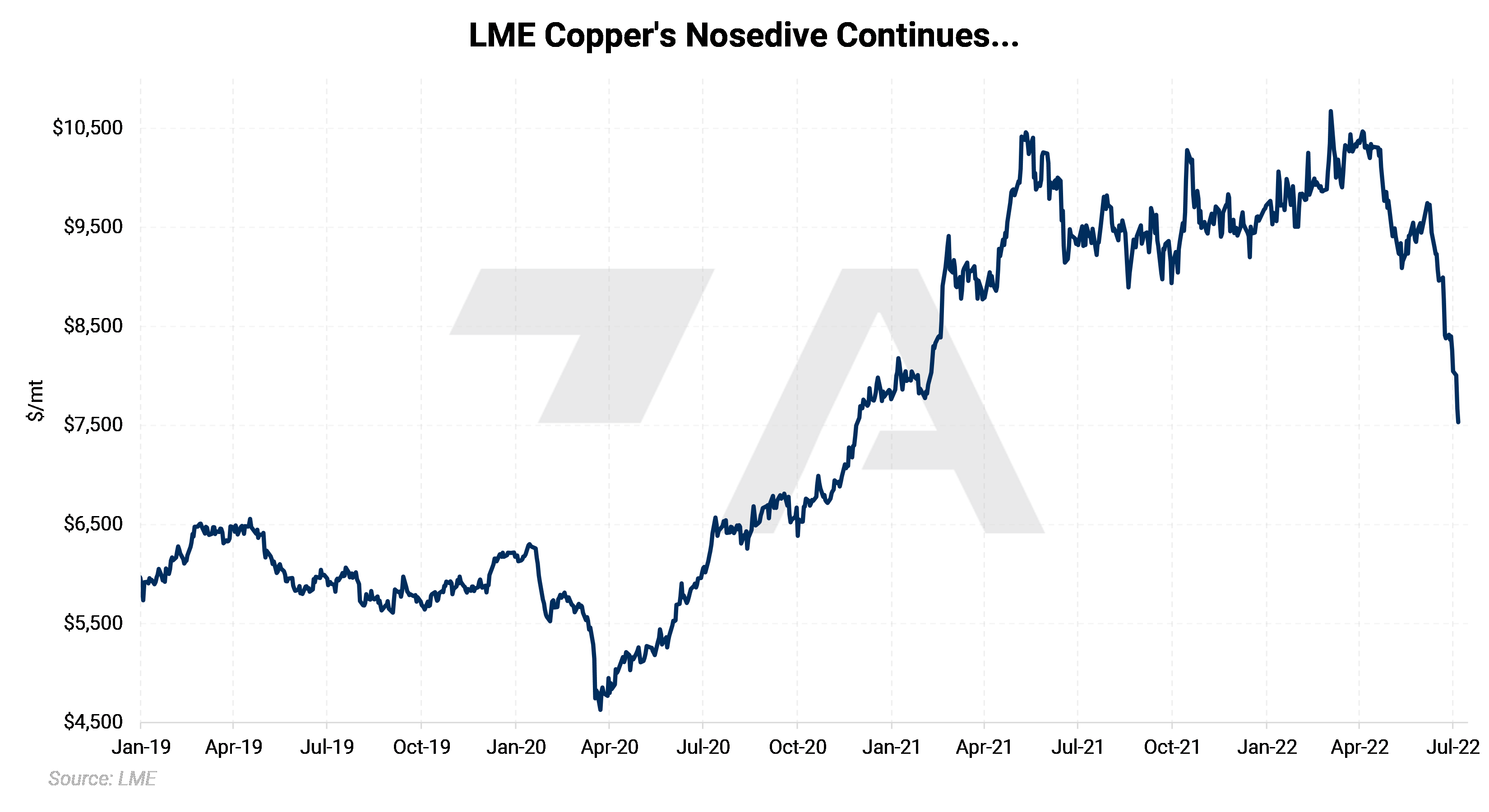

Cities throughout China have gone through a series of COVID tests and lockdowns in recent months. On Wednesday, July 6, Shanghai, a key industrial hub, announced they would conduct a new round of COVID tests this week, mere weeks after reopening from a two-month-long lockdown that shut down most economic activity. This flip-flopping COVID policy is weighing on copper prices and expectations of demand recovery for the red metal. Fan Rui, an analyst with Guoyuan Futures Co., recently told Bloomberg, "There is no bullish news at the moment, really… in China, the economy is facing a double blow from the flare-up of new cases and a weaker-than-expected demand recovery." Geordie Wilkes, head of research at Sucden Financial Ltd, echoed similar comments, stating, "We're certainly expecting more downside… We're not in a recession yet, but we're certainly seeing slower growth, so there aren't any real prospects for copper to rally meaningfully from here."

AEGIS believes demand must likely recover before the market can feel out a bottom. However, this could be a good time for copper consumers to begin hedging future needs. Such consumers might consider using the recent price dip by applying simple hedges involving swaps and call options. One other possible strategy is a costless collar. In this case, a "zero-cost collar" creates a maximum and minimum lead price for a copper consumer, as they would simultaneously buy a call option (creating a cap, or maximum) and sell a put option (creating a floor, or minimum). The call and put premiums offset, making the construction costless. It is popular because of the upside price protection, but you sacrifice access to much lower prices if prices should fall. Such positions are standard for consumer hedging but can result in opportunity or cash costs if metal prices decrease. Please contact AEGIS for specific strategies that fit your operations.

Important Disclosure: Indicative prices are provided for information purposes only and do not represent a commitment from AEGIS Hedging Solutions LLC ("Aegis") to assist any client to transact at those prices, or at any price, in the future. Aegis makes no guarantee to the accuracy or completeness of such information. Aegis and/or its trading principals do not offer a trading program to clients, nor do they propose guiding or directing a commodity interest account for any client based on any such trading program. Certain information in this presentation may constitute forward-looking statements, which can be identified by the use of forward-looking terminology such as "edge," "advantage," "opportunity," "believe," or other variations thereon or comparable terminology. Such statements are not guarantees of future performance or activities.