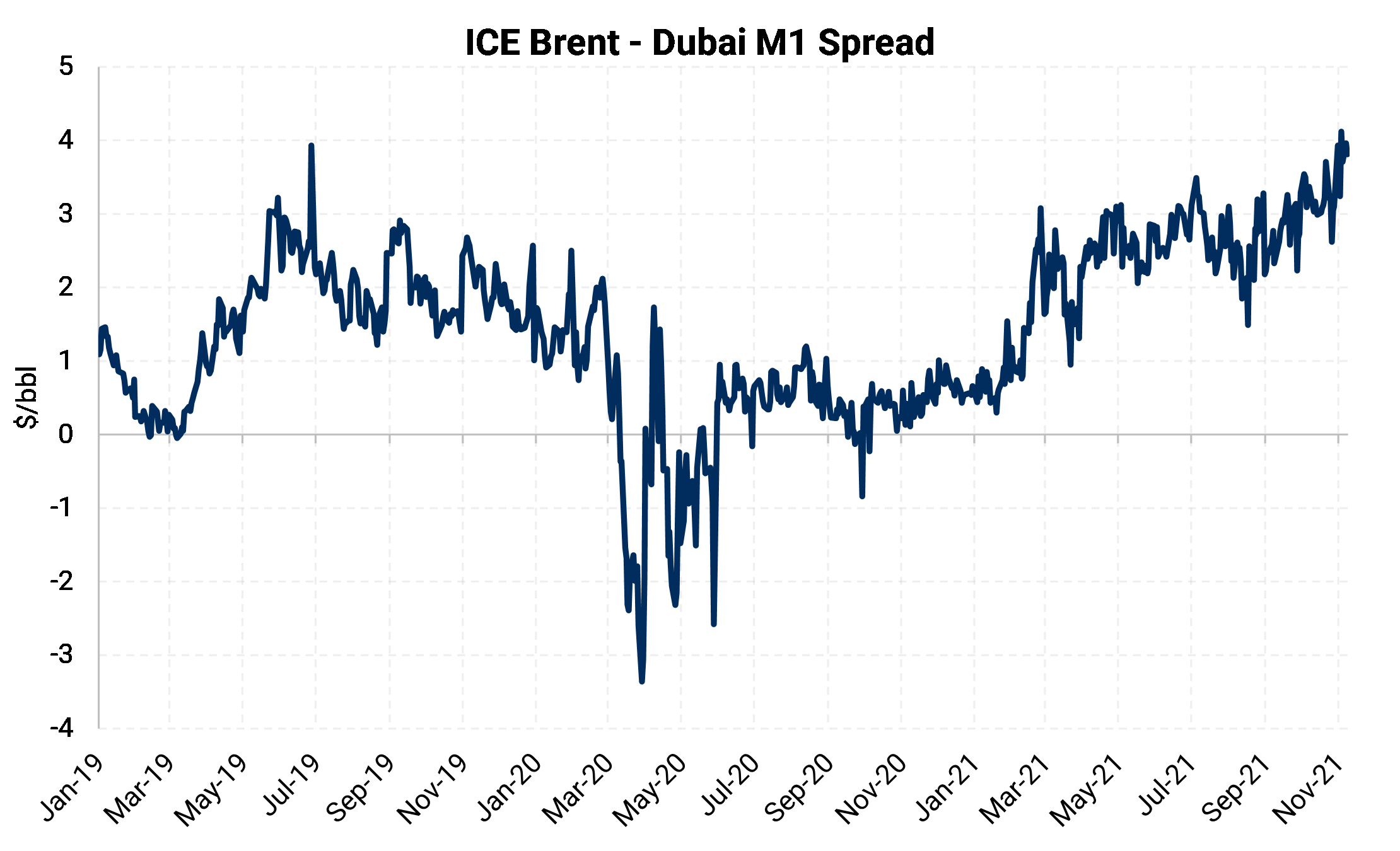

Heavy sour crude oil differentials to light sweet barrels have widened considerably over the last month as demand for sour barrels has felt the impact of rising natural gas prices as we head into winter. Brent/Dubai is the wideset it has been in several years.

|

| Source: Bloomberg, AEGIS Research |

Hydrocrackers and hydrotreaters rely on methane in making hydrogen to eliminate sulfur in refining. The sharp rise in global natural gas prices have materially added to the cost of refining sour crudes in European and Asian markets in particular, resulting in weaker margins on the end products. The same phenomenon does affect US refiners but has occurred to a much lesser extent given the extreme differences in gas prices between these three regions.

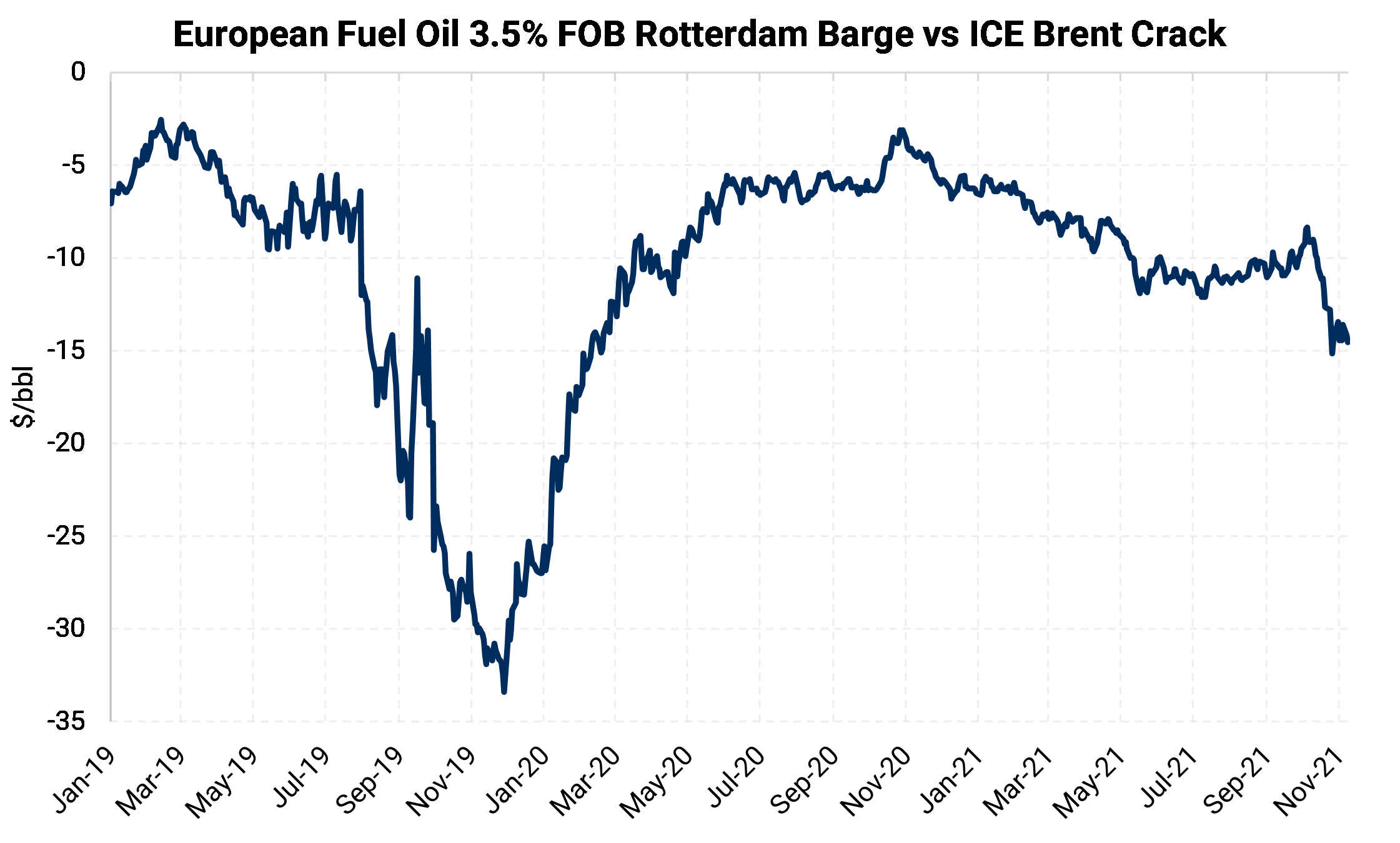

A second factor that has impacted sweet/sour spreads is fuel oil cracks. Global HSFO fuel oil cracks have been weakening since September as anticipated gas to oil switching for power generation has failed to materialize. Global heavy crude differentials have followed the fuel cracks wider.

|

| Source: Bloomberg, AEGIS Research |

|

| Source: NE2, AEGIS Research |

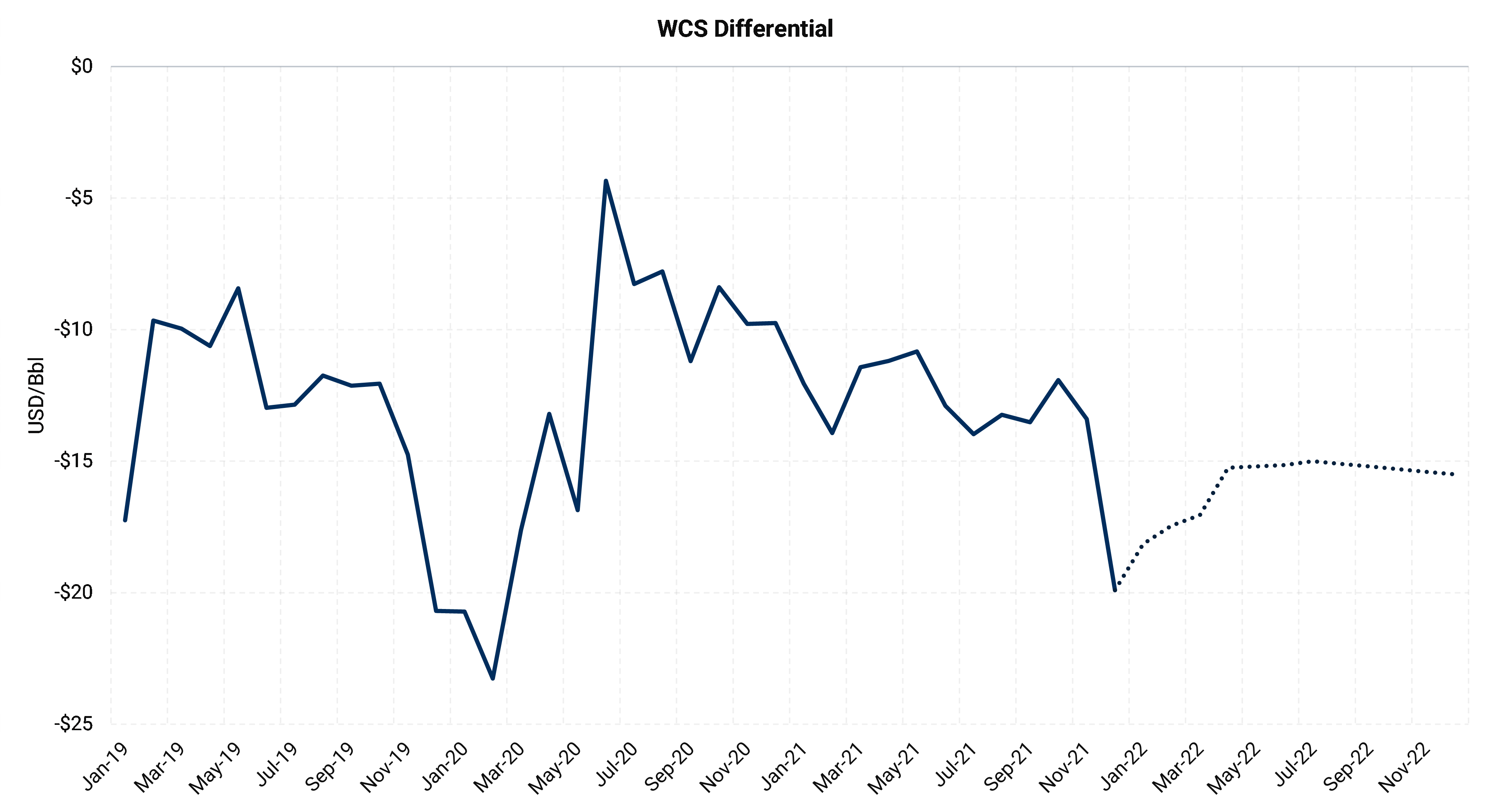

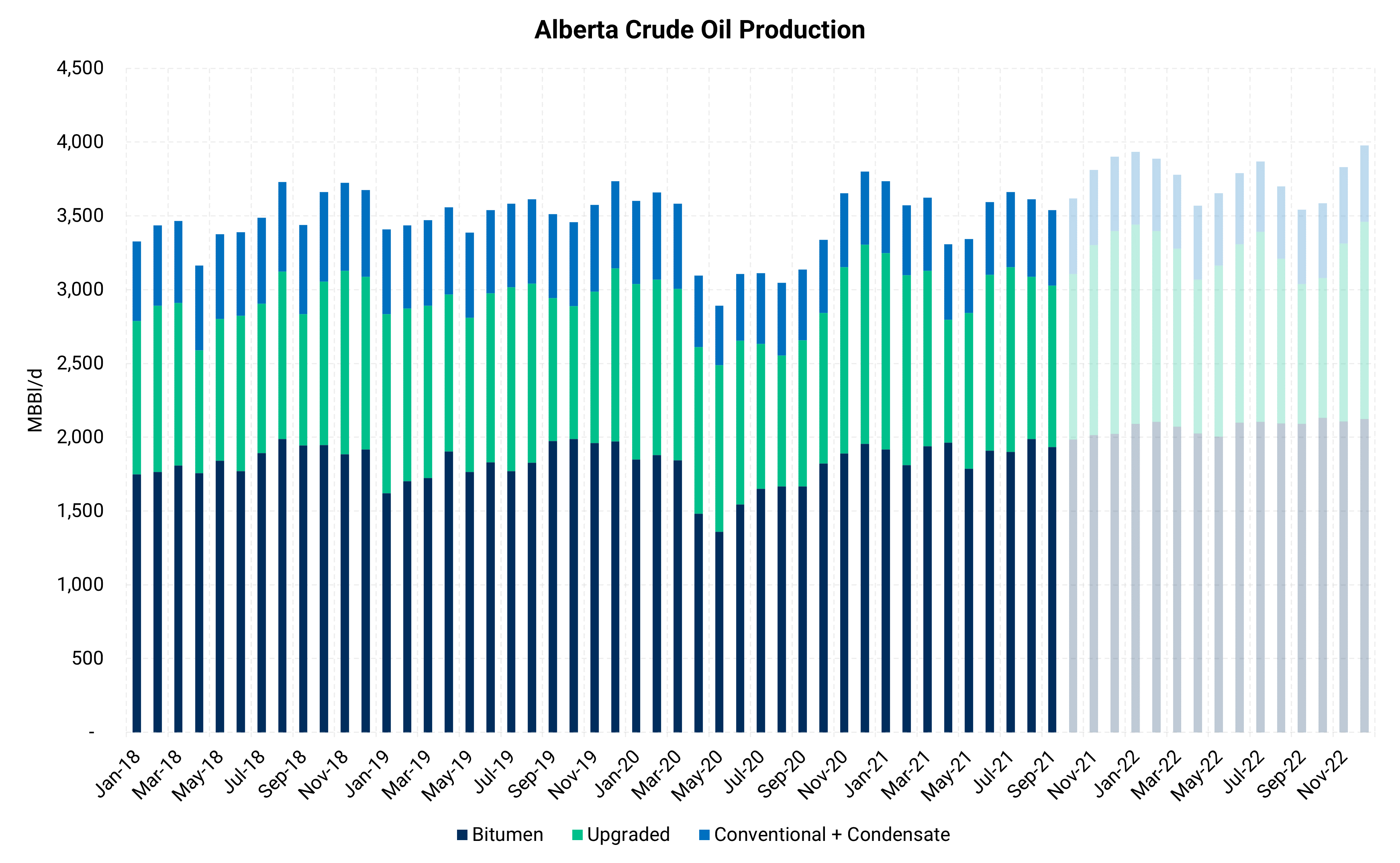

Canadian inventories have hit an all-time high according to AER data from the end of September. Additional October data from Genscape shows this trend continuing for October, but the pace of builds has been slowing. There are a few factors that could be contributing to the increase in storage even as pipeline capacity to move the barrels downstream has increased.

Heavy crude production is trending towards record highs as supply from additional oil sands projects come online. When coupled with the return of synthetic barrels following upgrader outages, the overall supply has likely ticked up quickly.

|

| Source: AER, Wood Mackenzie, AEGIS Research |

Enbridge Line 3 Replacement (L3R) began flowing barrels in early October with volumes materially higher by the end of the month. Mainline volumes are now flowing at record highs of ~3 MMBbl/d. The increase in storage is likely due to some amount of staging that took place as capacity on the mainline ramped up over October – one of the temporary logistical issues that we believe will sort itself out.

The timing mismatch of increased supply on the system vs the rebound of demand post refinery turnarounds and the effects on Canadian storage balances is certainly a factor in the widening of WCS. The ramp up of L3R is likely another, but the magnitude of the widening is puzzling. We believe the impact of weakening fuel cracks and high natural gas prices on global heavies should account for $2-$3 of the WCS widening. We attribute the balance of the $6-$8 weakening to temporary market dislocations that will ultimately be sorted as flows normalize.