Price strength has opened an opportunity to hedge ethane (July 2023). If you have exposure to ethane and gas, opt to hedge ethane.

Ethane is currently priced at a premium to natural gas. We remain neutral to bearish on natural gas through the Summer 2024 strip. Because natural gas is the fundamental price floor for ethane, ethane has more chance of falling than rising.

Our rationale is posited on a bearish gas outlook and a tighter frac spread (spread between ethane and natural gas in MMBtu). If you were bullish on ethane prices in 2024, you could make a case that ethane prices would stay at current levels even if natural gas fell. AEGIS does not have a bullish stance on ethane’s supply-demand balance for 2024. We look to our gas view as the driver of ethane prices in 2024.

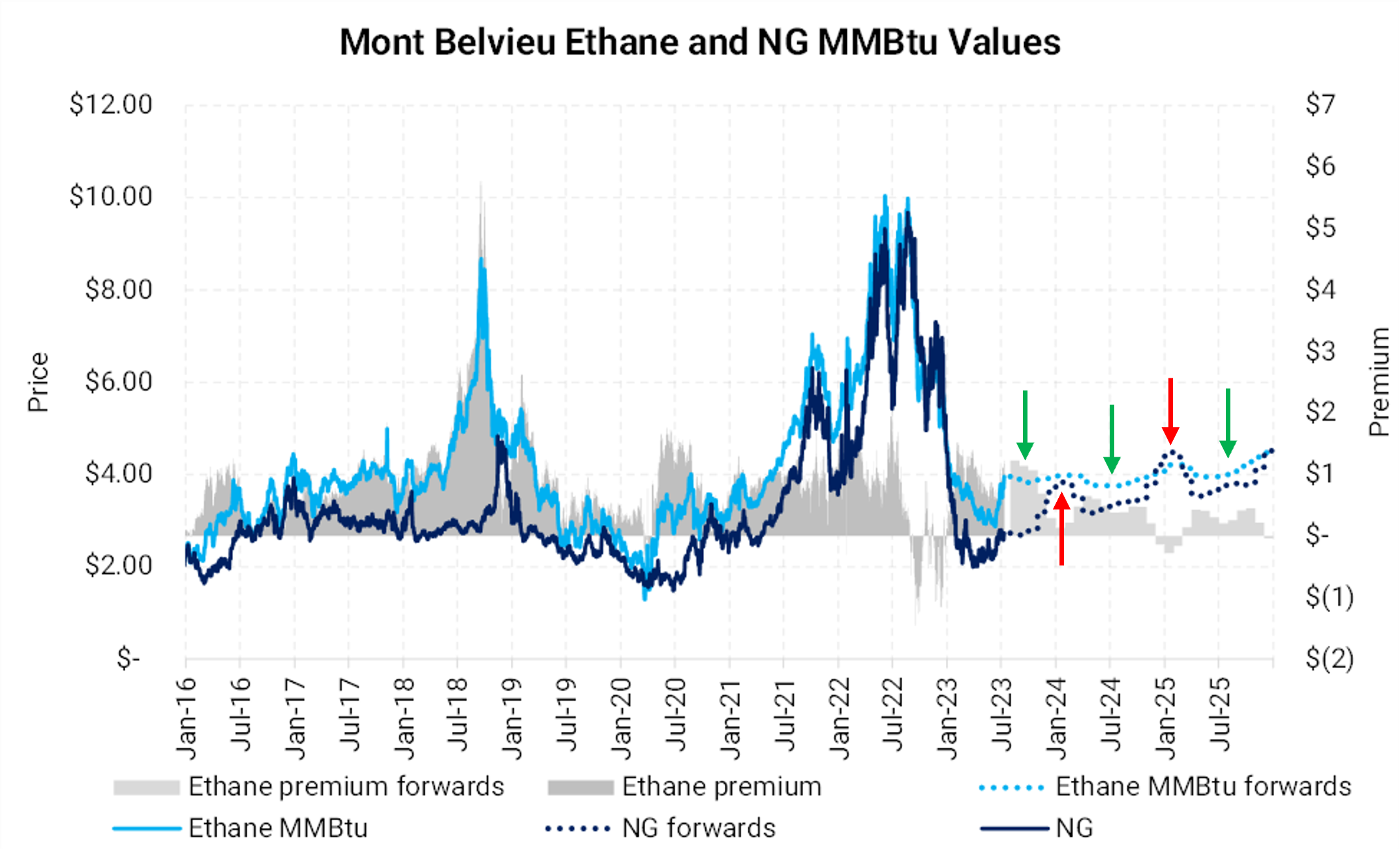

Natural gas acts as a floor for ethane on a MMBtu basis (see the chart below). The fundamental reason for this floor is that many processing plants choose to “reject” ethane and sell it as gas when ethane is cheap relative to gas. As a general rule, we suggest hedging ethane when the frac spread is wide.

The next few months show a frac spread of about $1.00/MMbtu, a difference that historically could be considered “wide.”

The green arrows above show a positive frac spread. Red arrows show months where ethane is on top of natural gas.

As a producer, hedges are short positions, which appreciate if prices fall. When you have a choice between two products to hedge, like ethane and natural gas, you want to hedge the weaker of the two. When the frac spread is near zero or negative, you would want to hedge natural gas rather than ethane. A tight frac spread is when the light blue line nears parity with the dark blue line on the chart above.

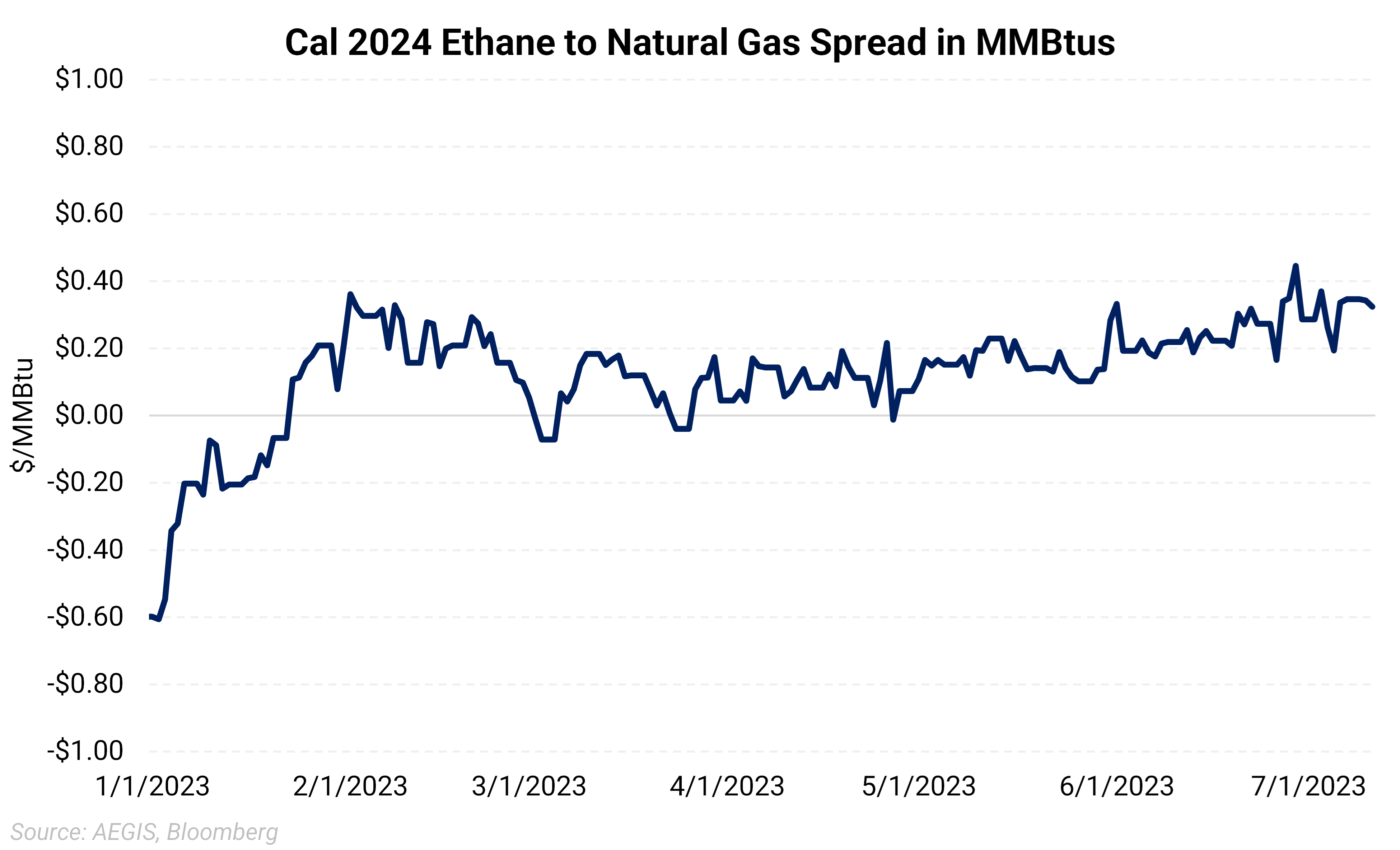

The chart below isolates the Cal 2024 strip for the frac spread. It shows that ethane has been trading near its highest relative value to natural gas since the beginning of the year. We see this as a good opportunity to hedge the ethane. We have a bearish outlook for natural gas in 2024. Ethane’s fundamental price floor, natural gas, is expected to realize lower. If ethane is priced at a premium to gas, then ethane is likely to be driven lower by weak gas prices and the frac spread potentially narrowing.

Our rationale rests on a bearish gas outlook and a narrowing the frac spread. If you were bullish on ethane’s S&D in 2024, you could make a case that ethane prices could stay near current levels even if natural gas fell.

AEGIS does not have a bullish stance on ethane’s supply-demand balance in 2024 and believes the U.S. ethane market will remain well supplied.

|

Source: Enterprise Product Partners May Investor Day |

Enterprise Products Partners touts the fact that ethane is likely to continue to be in a state of structural oversupply. The amount of ethane supply over domestic cracker demand end exports is rejected into the natural gas stream. |