Market: All

Hedge: Options and Fit to Curve Pricing

Navigating Options Payment in a Shifting Interest Rate Landscape

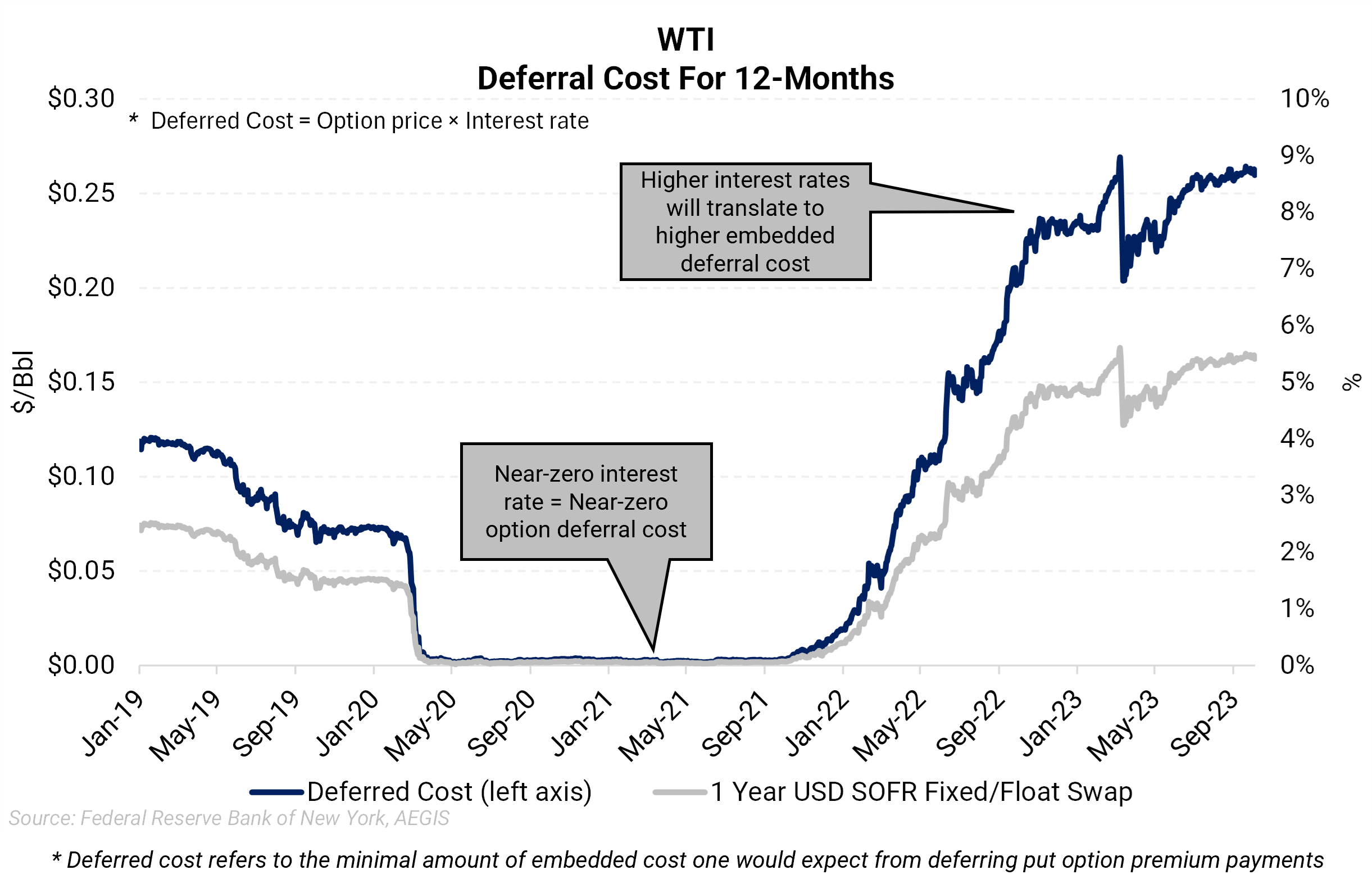

When you pay a premium for your hedges, you have options. You can pay that cost upfront or choose to pay the cost at the expiration of the contract, or defer the cost. Over the past 15 years, the answer was usually obvious, defer. Interest rates have been steadily rising since 2022, and AEGIS wants to explain how that may be changing the prices you have been receiving from your counterparties.

Impact of SOFR on Borrowing

A higher SOFR (Secured Overnight Financing Rate) means more expensive borrowing, especially as you go further down the curve. So, deferring the payment of an option premium will cost more in a higher interest rate environment. Rates have increased ~4% since 2019, and as a result, that 4% (at minimum) has been reflected in the prices your counterparties are able to provide.

Incorporation of SOFR and COF in Option Pricing

Typically, if you were going to place a hedge with a deferred put, a bank would include the average SOFR + COF (Cost of Funds) in the price of the option. Depending on the bank, this could mean you are seeing an option premium that is 7-8% higher than you would have seen in 2019 and years prior.

Comparative Advantages of Non-Bank Counterparties

Non-bank counterparties may have an advantage because they will not have some regulatory capital charges or need to account for risk-weighted assets. Unfortunately, some of those non-bank counterparties will run into other charges that they would pass along to the client, like higher cost of capital. AEGIS can help you find the counterparty that will be the most competitive.

The Ramifications on 'Fit to Curve' Swaps

Rising interest rates also affect swap prices. Fit-to-curve swaps are executed at one average price and distributed among each individual month to present value. Therefore, the way you distribute the price to each tenor depends on interest rates. However, it is usually small, somewhere around 3-4 cents per barrel.