For hedgers, note that yesterday’s NYMEX Henry Hub Feb futures/swaps settled at $6.265.

The math would be a mark-to-market comparison of $6.265 versus the price at which the client executed the swap. For example, if the swap had been done when February gas was $5.00, the loss on the position would be $1.265 per mmbtu.

But there may be some better news for you if you hedged basis. Read on.

The default is a T+5 term that would require any gains or losses on the NYMEX Last Day hedges to be received or paid within five business days. This means that a hedge loss on February NYMEX Last Day positions would be due in a week, under these terms.

However, more liberal terms such as “Physical Day Following 25th” would mean that hedge gains/losses would be paid on the 25th day of the month after the month that was hedged. Specifically, this means that February hedges gains/losses would be paid around March 25. The clear benefit here is that cash payments are made closer to the date when the client receives cash for the physical sales of their gas during February.

There are two primary ways our clients price their physical gas. One is the daily average of Gas Daily at the local price point (e.g. Waha, Columbia Gulf Mainline). This is the average of the daily cash-price assessment at that location, published by Platts. We will not address this price scheme in detail at this time.

The second way is an Inside FERC price, also called “First of Month.” Most AEGIS clients who receive IFERC pricing receive it at a regional price, such as Waha in the Permian basin, or Columbia Gulf Mainline in Louisiana, or Colorado Interstate Gas in the Rockies.

This price is set just before the beginning of the month, through the negotiation of forward physical deals. During a three-day “bidweek,” forward physical sales prices are recorded, and a volume-weighted average price is published by Platts in their Inside FERC publication. The bidweek starts two days before the NYMEX Henry Hub contract settles, and ends on the NYMEX settlement day. This IFERC price is an average over three days of trading. The results of the February IFERC won’t be known until Tuesday, February 1.

The three-day bidweek may sound wrong to those of you with some years of experience. Bidweek used to end two days after NYMEX settlements (five days of trading). As of October 2021, the process ends on the same day as NYMEX (three days of trading). For February 2022, bidweek started on Tuesday and ran through Thursday (January 27).

For producers with a locational price – let’s use Waha in the Permian basin – your physical sales are often tied to the Inside FERC, described above.

And, if you hedged the basis using a “basis swap,” you have an implied hedge against the settlement-day trading shenaniga...we mean, rally.

The "basis swap" instrument is designed to be used for a producer who sells at a regional IFERC price. By taking a short position in the basis swap, you are protected against basis becoming weaker – that is, more negative, or less positive.

But we must be precise in defining basis, because this is where the benefit this week arises: The basis is the difference between the IFERC Waha fixed price and the NYMEX Last Day settlement (and the latter was $6.265).

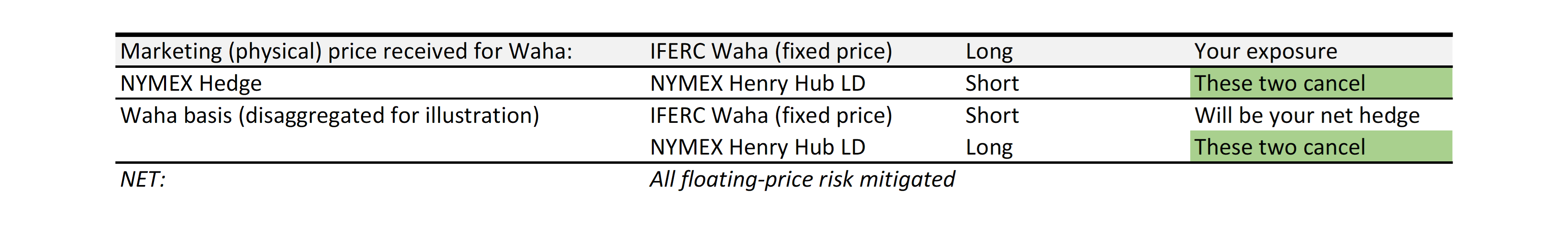

Therefore, you can rewrite the basis swap as two implied trades: a short position in the IFERC Waha Fixed Price and a long position in the NYMEX Last Day. Consult the table below to see how the hedge works for a Permian producer who sells gas on an IFERC Waha index.

The result is that if you hedge both the NYMEX Last Day and basis, then you have a net IFERC Waha (fixed price) hedge. In this example, no floating-price exposure remains if you matched volumes. The result is also that the NYMEX Henry Hub Last Day exposure was offset.

It only works for IFERC pricing, not Gas Daily pricing. That's for another article.

If you have a NYMEX Henry Hub Last Day hedge, there will be a separate settlement payment for that hedge, even if you had basis hedges that helped migitate that Last Day volatility.

After the IFERC prices are published on February 1, the basis hedges can then be settled. In many locations, those hedges may have done well (by themselves) because of what NYMEX did.

AEGIS already sent clients NYMEX gas settlements, and we will send IFERC settlement statements on Wednesday.