Financial hedges will sometimes not protect against weak cash prices. This happens when the hedging instrument does not exactly match the physical pricing formula. There are tools available to manage this risk. These include physically hedging your production with your marketer or using an index swap.

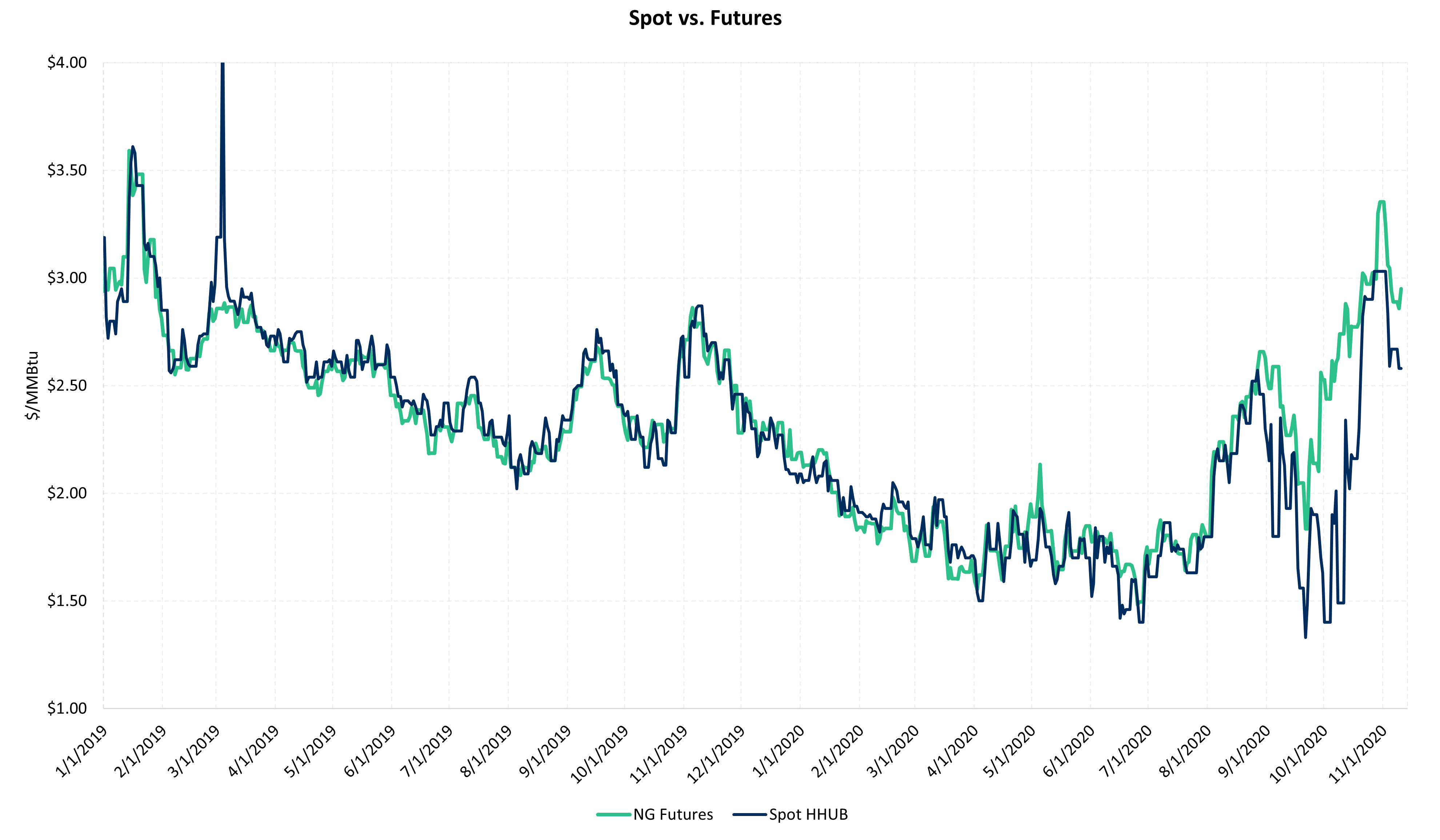

Most U.S. producers receive a price based on either a Platts "Gas Daily" basis location or Platts "Inside FERC" basis location for natural gas sold. Depending on which physical pricing formula you receive, you need to appropriately match your hedging (usually swaps) contracts to fully protect your revenue.The spot price, otherwise known as the cash price, is the price at which you would buy or sell a commodity for next-day delivery. The prompt-month futures contract is the price at which you would buy or sell a commodity for the month ahead. The chart above shows how cash prices and prompt-month prices can diverge. Futures experienced a sustained rally during October. This is around the same time weather became colder and storage oversupply became less of a concern. As a result, sentiment became very bullish going into the winter.

The chart above shows how cash prices and prompt-month prices can diverge. Futures experienced a sustained rally during October. This is around the same time weather became colder and storage oversupply became less of a concern. As a result, sentiment became very bullish going into the winter.

What caused cash to lag behind futures? One theory is that large macro hedge funds bought natural gas futures in large amounts, causing a disconnect between the futures and the spot price.

Another possible explanation for this divergence could be that while the rally in futures was occurring, multiple hurricanes were slamming the Louisiana coast. This caused power outages, delayed LNG cargo loadings, and dampened industrial demand in the local area, which may have added bearish price pressure to the spot market.

Due to these events, you had bullish price effects occurring in the futures market, but bearish price effects occurring in the spot market.As previously mentioned, the two most common indexes U.S. producers receive for physical gas are Gas Daily price or an Inside FERC price, otherwise referred to as a first-of-the-month price (FOM). Gas Daily pricing is calculated as a weighted average of the daily cash prices for a month. Therefore, it is not known until the month ends. In contrast, Inside FERC is a flat price for the month, which is established before the beginning of a month (first of the month), during "bid week."

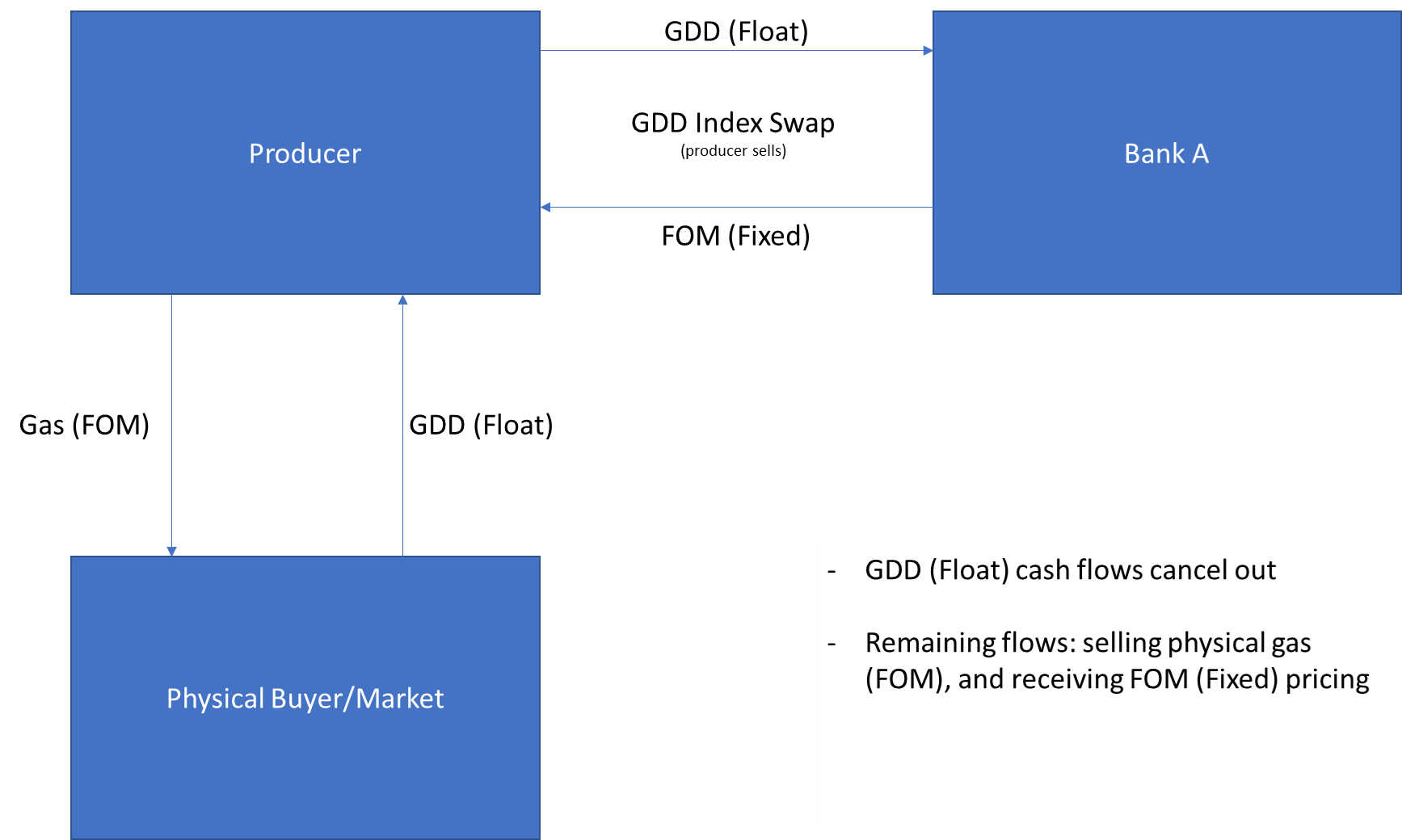

In the example below, we will show how an Index Swap can correct your hedges if your physical price does not match your financial hedges.

First, we will assume a producer is selling their physical gas at a Gas Daily price. Thus, they are exposed to swings in cash prices. Second, we also assume a producer has already hedged their NYMEX and gas basis with a counterparty. We make this assumption because, if a producer has not hedged their basis and adds a swing swap, that producer will be introducing basis risk into their book. Finally, for explanation purposes, we assume the basis location is Waha. In the above example, the producer is receiving a Gas Daily price from the physical purchaser of their natural gas. A producer can then go to a counterparty and sell a FOM (or IFERC) Waha Index Swap. By selling this type of Index swap, you are offsetting the Gas Daily price you receive from the sale of your natural gas and receiving a flat first-of-the-month price. You are now left receiving a FOM Waha price, which represents the "all in" price for your physical gas.

In the above example, the producer is receiving a Gas Daily price from the physical purchaser of their natural gas. A producer can then go to a counterparty and sell a FOM (or IFERC) Waha Index Swap. By selling this type of Index swap, you are offsetting the Gas Daily price you receive from the sale of your natural gas and receiving a flat first-of-the-month price. You are now left receiving a FOM Waha price, which represents the "all in" price for your physical gas.

It should be noted that not all counterparties make markets on index swaps. It may be easier to ask your marketer to change your physical pricing formula.

Please contact the AEGIS Trade team if you have questions regarding your physical contracts.