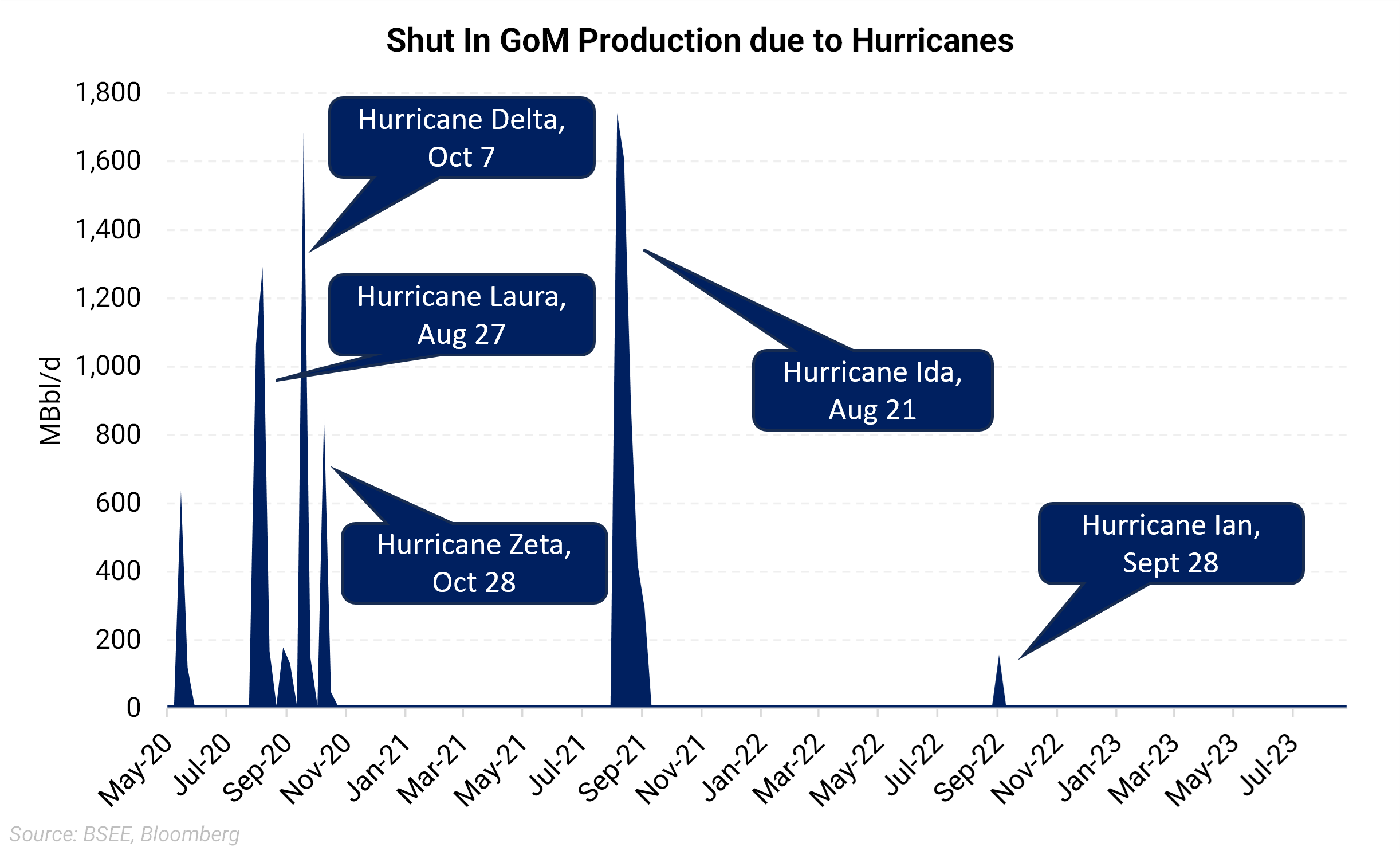

Should a hurricane disrupt oil and gas production in the GOM, it could cause up to 40% of total GOM production to halt for a week in a mid-impact scenario. In a high-impact scenario, 90% of production might be shut down for 16 days, said Enverus in a late August study.

Historically, hurricanes haven't significantly altered oil prices unless there's a direct hit on energy infrastructure. While the U.S. Strategic Petroleum Reserve has previously countered production halts by releasing oil, dwindling SPR stocks could impede a similar response this year.

Hedging

Hedging is just as important for offshore oil and gas producers as it is for onshore producers. Maybe even more so due to the higher exploration and production costs associated with offshore drilling. Hedging strategies are largely the same, except for one major consideration: hurricanes. Offshore producers in the Gulf of Mexico (GOM) must account for production shut-ins associated with hurricanes.

Common practice is to reduce or shut in production as a hurricane approaches platforms, and non-essential employees are transported back to the mainland for safety. Sometimes, all personnel are evacuated if the storm is big enough. The result is usually 3-5 days of lower or no production as the wells are throttled down as the storm approaches, temporarily shut in while the storm passes, and are slowly brought back online afterward.

Hurricanes are most common in August and September, but several storms have made landfall in October in the last few years. Due to this risk of lower production during hurricane season, offshore oil producers need to change how they hedge their production during hurricane season.

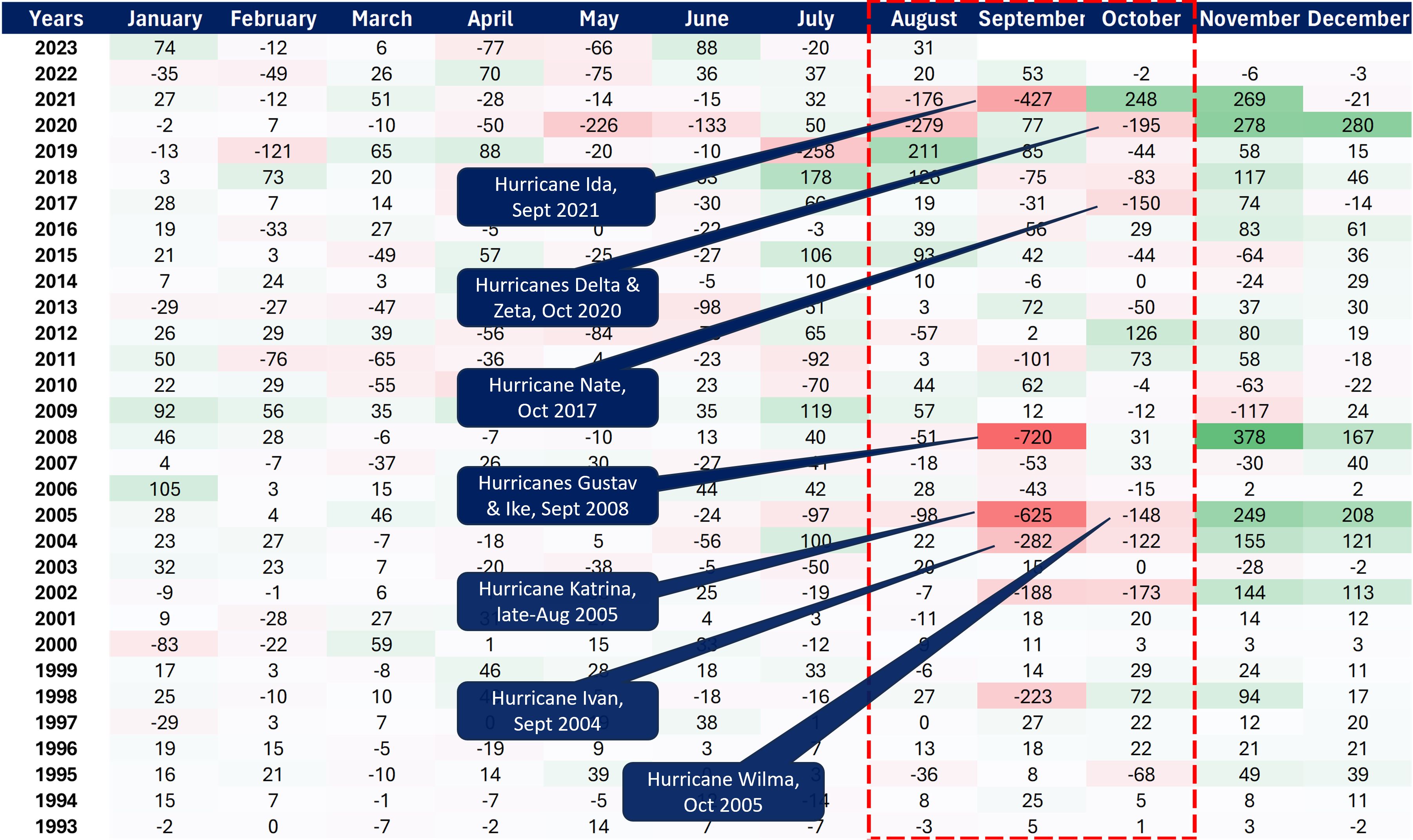

The heat map below depicts the deviation in the GOM’s oil production from its trailing three-month average over the past 30 years. The data indicates that August through October, the peak of the hurricane season, presents the highest risks to oil output.

Historically, the September-October period has seen relatively higher disruptions in output. For instance, Hurricanes Ike and Gustav in 2008 led to a sharp drop of -720 MBbl/d. Hurricane Katrina in 2005 resulted in a reduction of -625 MBbl/d. More recently, in 2017, Hurricane Nate, despite being less intense than other storms, caused significant outages, highlighting the period's vulnerability, especially when storms directly impact offshore platforms.

The most common strategy is to hedge less production during hurricane season, August-October. This reduces the risk of being over-hedged if hurricanes result in lower production and allows producers to use the same structures as they normally would (swaps, costless collars, costless 3-way collars, etc..…).

The less common strategy is to buy puts in August-October. Puts only provide downside protection but allow you to retain all your upside participation. The maximum downside exposure when buying puts is the premium spent to purchase the puts. Therefore, there is no risk of becoming over-hedged if your production drops due to hurricane-induced shut-ins.

A producer could choose to hedge 100% of normal hedge volume with puts or just the incremental amount above the 50% max recommended for swaps and collars. Using puts to hedge the incremental volume above 50% would allow you to use your normally desired structures for 50% of your production while hedging the smallest amount of volume with puts to keep your normal desired hedge percentage throughout the year so you remain fully hedged to the downside.

These are typical guiding principles when approaching heading in the GOM. AEGIS helps tailor these principles into custom strategies that are bespoke to each producer.