Source: S&P Global [OPEC+ mulls 2024 output policy amid geopolitical tensions]

Source: S&P Global [OPEC+ mulls 2024 output policy amid geopolitical tensions]

As Saudi Arabia, Russia, and other OPEC+ members gear up for an important meeting this Thursday, the global oil market is on the cusp of potentially significant changes. This meeting, originally scheduled for November 26 but delayed due to disagreements over African production quotas, is expected to address adjustments to the quota agreement that limits supply into 2024.

Current State of OPEC's Production Cuts

Currently, OPEC+ is maintaining a significant production cut, reducing oil output by 3.66 MMBbl/d. This cut, primarily led by Saudi Arabia and Russia, is set to continue until the end of 2024.

This figure includes a reduction of 2 MMBbl/d decided in November 2022, and an additional voluntary decrease of 1.66 MMBbl/d from nine OPEC+ nations agreed upon in April 2023.

In addition to these group-wide cuts, Saudi Arabia and Russia are making voluntary output cuts, with Saudi Arabia cutting 1 MMBbl/d and Russia 0.3 MMBbl/d, both until the end of 2023.

Key Issues and Disagreements

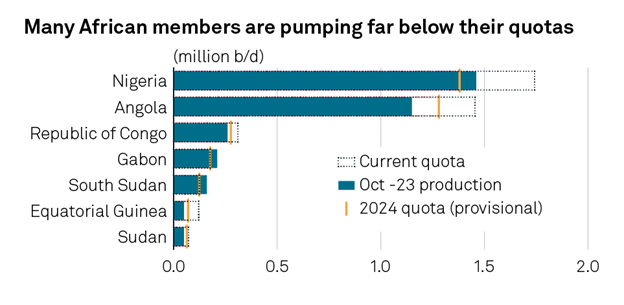

The central issue facing OPEC+ is the disagreement over output levels for African members, particularly Angola and Nigeria. This dispute led to the postponement of the group's meeting, as these countries were reluctant to accept lower output quotas.

This dispute traces back to OPEC’s meeting in June, where Angola, Congo, and Nigeria were urged by Saudi Energy Minister Prince Abdulaziz bin Salman to accept lower output targets for 2024. These targets were set in response to their reduced production capacities, a result of challenges like under-investment, operational disruptions, and aging oil fields.

Expected Developments in the Upcoming Meeting

As OPEC+ approaches its rescheduled meeting, there is increasing speculation about potential changes in their production strategy. Analysts now see a higher likelihood of OPEC+ announcing measures to further tighten oil markets. This shift in expectations comes amid a backdrop of falling crude prices and a potential oversupply in early 2024. OPEC+ is now considering an additional 1 MMBbl/d production cut as reported by Wall Street Journal on November 29.

While an extension of the current cuts is widely expected, there is also chatter of deeper cuts across the OPEC+ nations. The upcoming meeting is expected to focus not just on resolving the internal quota dispute but also on broader measures to stabilize the market, possibly including further reductions in output to deter bearish speculators and to counteract the recent weakness in oil prices.