With no warning, India stunned its steel industry last Saturday by enacting a 15% tariff on HRC and CRC steel exports, effective May 22. One major producer, alarmed by the government’s quickness and lack of transparency, told Reuters “They should have given us at least two-to-three months of time, we did not know about such a substantial policy.” |

|

|

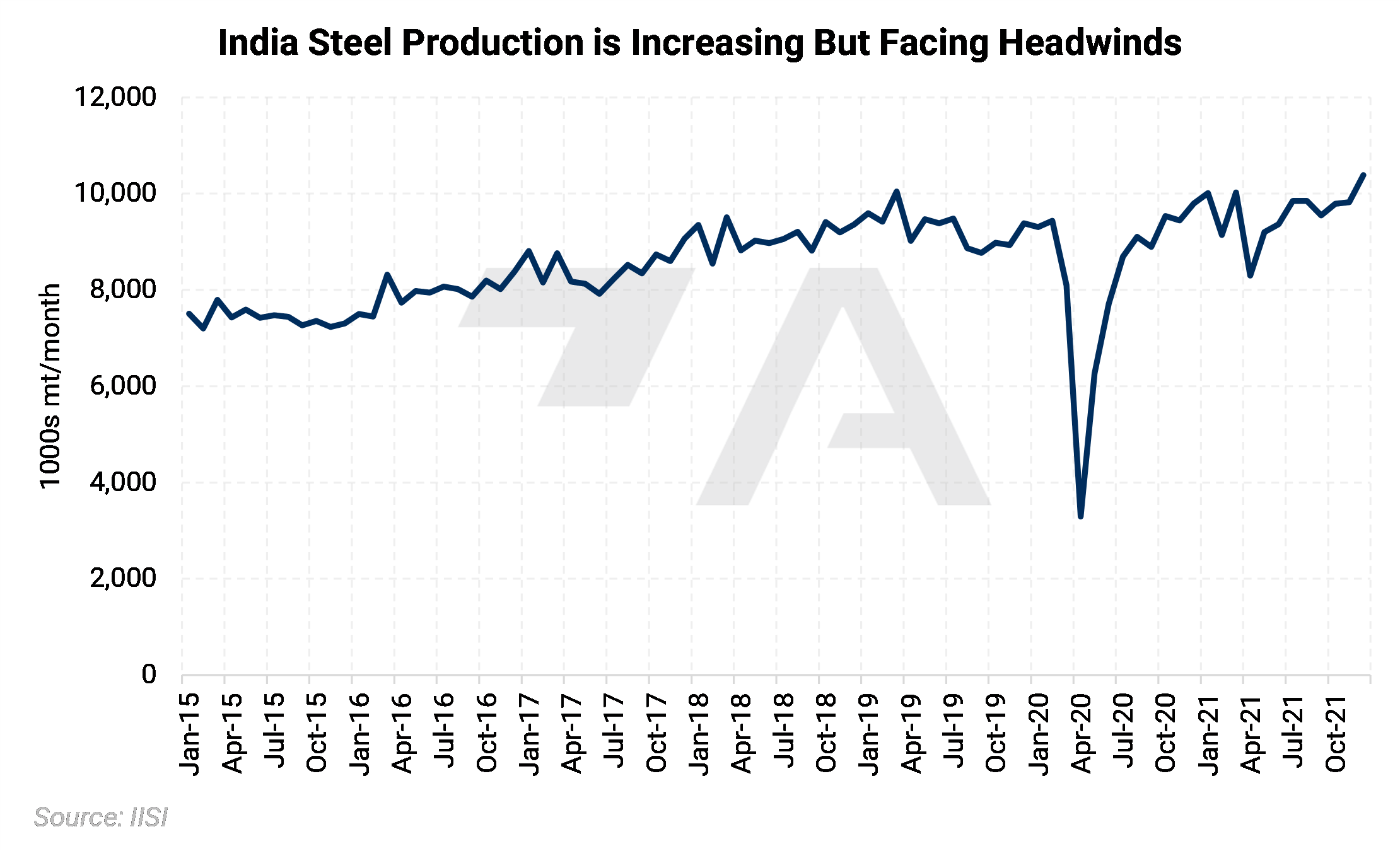

According to Reuters, Indian steelmakers are contending with lukewarm domestic demand and were aiming to increase exports, mainly to Europe. For example, JSPL plans to boost its exports to up to 40% of sales. Major Indian producers, including JSPL, JSW, Tata Steel, and ArcelorMittal Nippon Steel normally export approximately 20-25% of their production, according to Indian newspaper The Hindu Business Line. Prior to its invasion of Ukraine, Russia had been a major steel exporter to the European Union. European buyers have since shunned Russian steel, and Indian exporters were looking to fill the void, according to Reuters. One Mumbai-based distributor cited by S&P Global warned of production cuts, stating, "If domestic mills are not able to vent out their stocks via export and if they have to equate additional reduction in offer prices by 10%-15% in order to compete in international markets, they are left with two options…. either dump all inventory in government projects/consumers/trade market or cut down production." Indian steel producers are concerned about the longer-term implication of the tariffs. One anonymous producer cited by S&P Global stated "(The steel) Industry exported nearly 10% of production last year. Probably 10% of production will have to be cut in the short term…. Also, this policy severely hampers India's image as a stable policy country. Long-term international customers of India will have to go back to countries like China to de-risk." The country exported 13.5 million mt of finished steel in 2021, up from 10.8 million mt in 2021, according to the Ministry of Steel. Domestic steel production also increased year-over-year, as production in 2021 was 115.3 million mt, up from 99.6 million mt in 2020. AEGIS believes that this revelation could have implications on the American steel market. European importers that normally buy from India could increase shipments from the US. According to Argus, the EU relied on India for 15% of its HRC imports and 19% of its CRC imports in 2021. Due to the Section 232 tariffs, the US has not been a major importer or exporter of steel products to or from the EU since 2018. However, as of January 1, the US has dropped the tariffs, and the EU, aiming to normalize relations, is set to drop its own protectionist tariffs in July. With these impediments gone, American steel exporters could help fill a void if EU importers shun Indian steel. If this were to occur, it would likely be supportive to our domestic prices. |