|

The Congo-based Tenke Fungurume copper and cobalt mine, which is the world's second-largest cobalt mine, has suspended all cobalt exports, effective July 16, 2022, according to Reuters. A court-appointed administrator requested the stoppage, as the Tenke Fungurume mine is currently in the midst of a dispute between majority-owner CMOC, a Chinese mining concern, and minority-owner Gecamines, a state-owned Congolese miner, over how to market the mine's output. CMOC is denying the administrator access to the mine site. Gecamines has accused CMOC of understating the mine's reserves to reduce royalty payments CMOC pays to Gecamines. Logistics companies were made aware of the stoppage on July 16. |

|

|

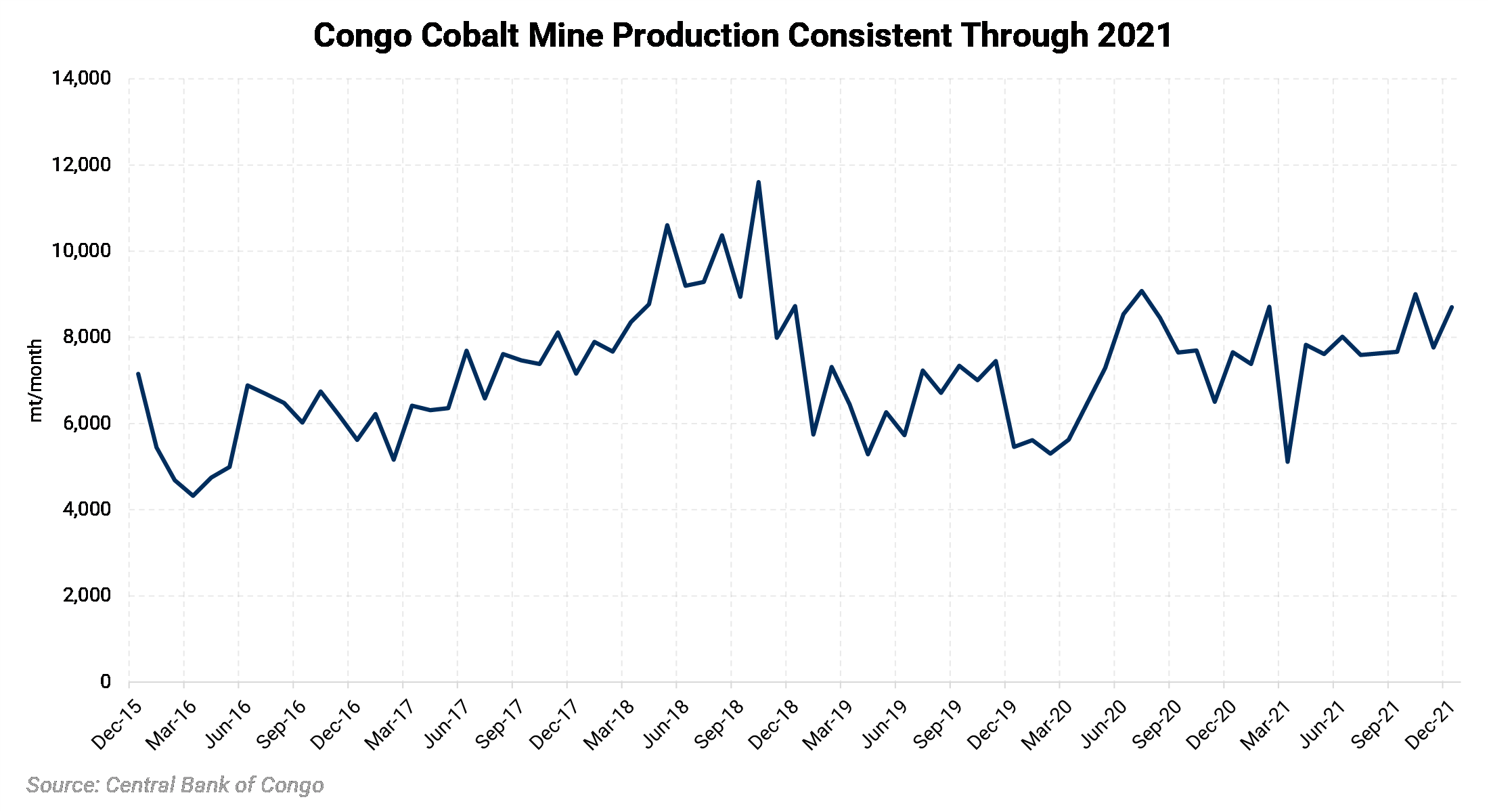

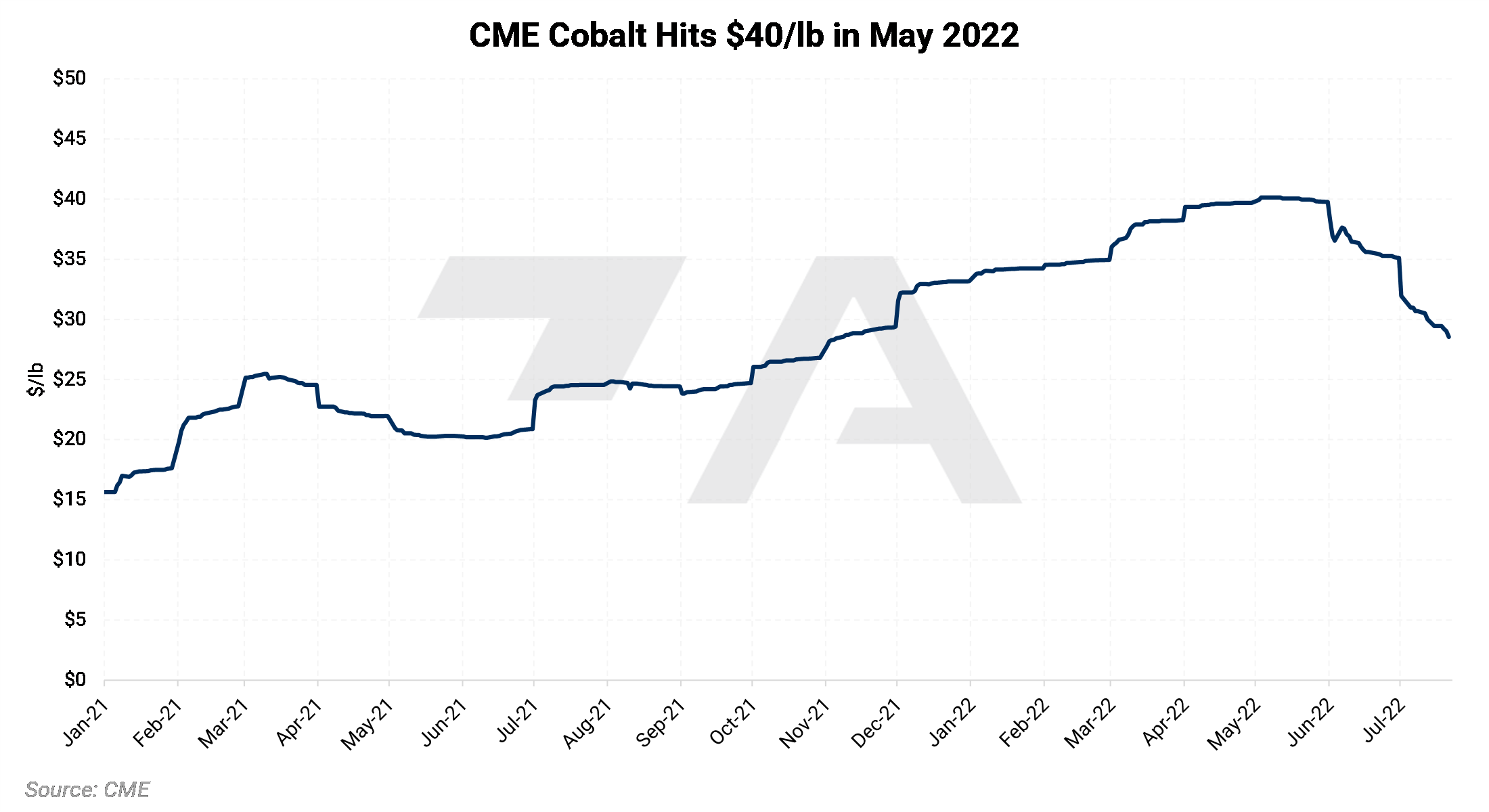

CME Cobalt marched higher throughout 2021 and continues to do so in 2022. The suspension of Congolese cobalt exports could continue this rally. |

|

|

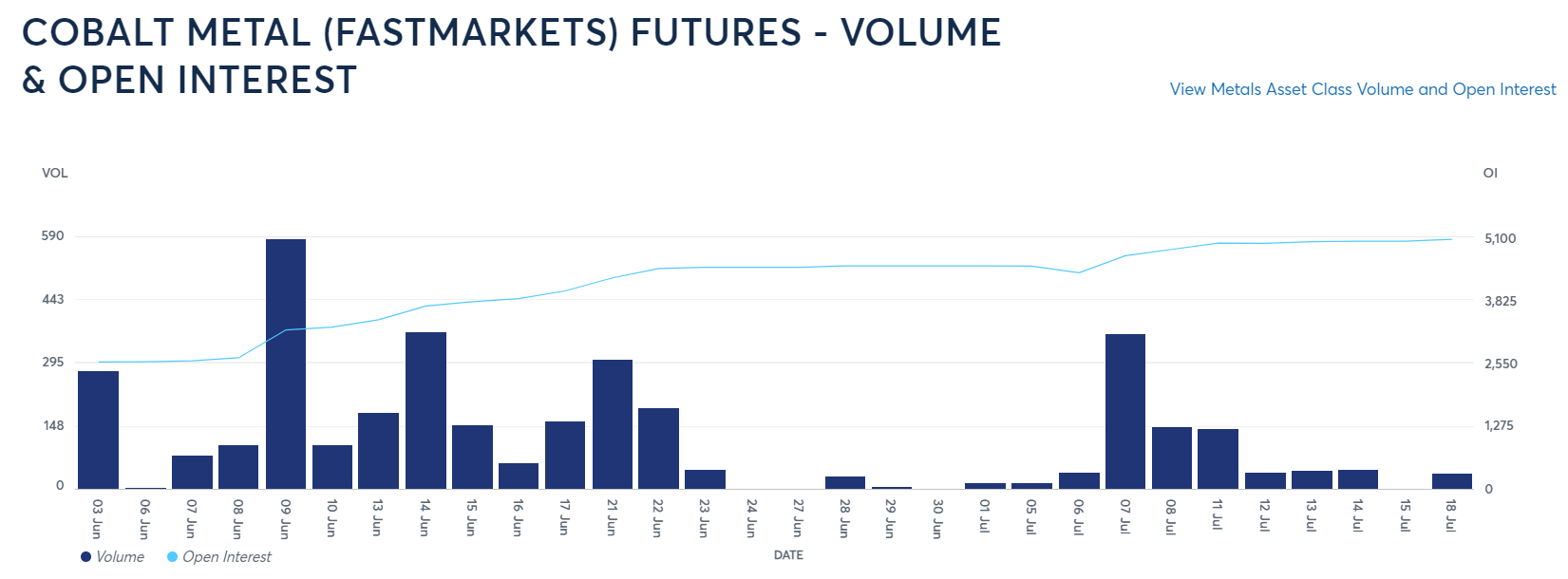

The CME started cobalt futures in late 2020, but volume and open interest has only picked up in recent months. In fact, open interest has nearly doubled from 2,480 contracts on June 2, 2022, to 5,091 contracts on July 18, 2022. There is currently no options market, but end-users such as electric vehicle producers can hedge future needs via swaps. Using swaps can help guard against a potential increase in cobalt input costs. Such positions are standard for consumer hedging but can result in opportunity costs or cash costs if metal prices decline. Please contact AEGIS for specific strategies that fit your operations. For information on Cobalt futures, please visit https://www.cmegroup.com/education/lessons/hedging-with-cobalt-metal-fastmarkets-futures.html. (Open interest data from CME, https://www.cmegroup.com/markets/metals/battery-metals/cobalt-metal-fastmarkets.volume.html) |

|

Important Disclosure: Indicative prices are provided for information purposes only and do not represent a commitment from AEGIS Hedging Solutions LLC ("Aegis") to assist any client to transact at those prices, or at any price, in the future. Aegis makes no guarantee to the accuracy or completeness of such information. Aegis and/or its trading principals do not offer a trading program to clients, nor do they propose guiding or directing a commodity interest account for any client based on any such trading program. Certain information in this presentation may constitute forward-looking statements, which can be identified by the use of forward-looking terminology such as "edge," "advantage," "opportunity," "believe," or other variations thereon or comparable terminology. Such statements are not guarantees of future performance or activities.