|

|

|

Many AEGIS clients in the upstream oil and gas industry have significant spend and revenue in steel. These upstream players include drillers and equipment producers. Consider the following facts and principles when thinking about steel exposure:

|

|

|

|

|

||

|

||

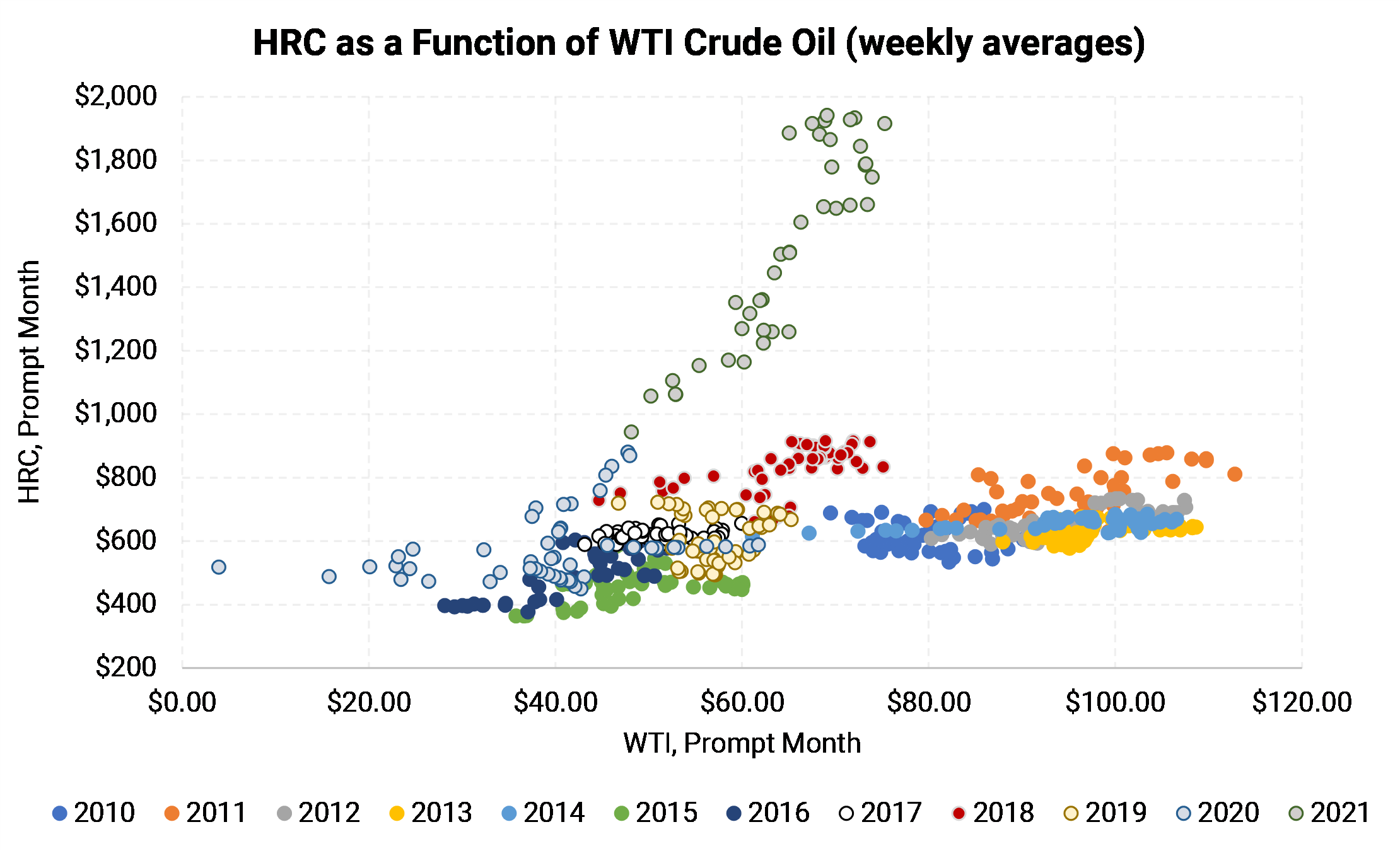

FindingsThe chart above shows that the price relationship between HRC steel and WTI crude oil has changed often in the past decade. In the years leading up to 2020, HRC would rise about $3.3/T for every $1/Bbl increase. Then, suddenly, in late 2020, that relationship changed to about $20/T for each $1/Bbl of oil price.And the correlation can change suddenly. The column chart above shows how the statistical relationship varies from year to year. The correlation wavered between .35 and .80 from 2012 to 2018. The 26-week rolling correlation chart also shows how quickly correlations can change. Even though the recent correlation between HRC and WTI has been high, it is much different than in past years. Will the coming months’ price relationship be more like 2020-21, or 2010-2019?AEGIS Conclusions:Given how volatile the correlation between HRC and WTI can be, we do not recommend that oil-and-gas equipment manufacturers use WTI as a proxy hedge for their steel input costs. However, prudent WTI swap or option strategies could be part of an overall enterprise hedge portfolio. Correlations can change for a variety of reasons. Supply or demand for one commodity may change more quickly or dramatically than for another. Likewise, a supply-demand shift for one commodity might not cause supply-demand to shift for another. Thus, yearly changes in correlation should be thought of as independent events, and the correlation of past or present year likely has no influence over the future. The 26-week rolling correlation chart above shows multiple instances of when correlation turned negative. A negative correlation implies HRC and WTI are moving opposite of one another. Since a cross-hedger wants prices to move in the same direction, a negative correlation suggests that your cross-hedge is moving against you. Thus, if not carefully constructed, hedging HRC with WTI futures can hurt the hedger. As we have shown, the relationship between WTI and HRC can quickly turn negative, which is bad for this type of hedge-by-proxy. Let’s suppose a tubulars manufacturer hedged steel input costs with WTI instead of HRC. The long position “hedge” in WTI would lose money if oil prices fell. It would be doubly worse if the HRC-WTI relationship reversed and HRC prices rose. All of this suggests that WTI swaps or futures should not be used as a proxy hedge for steel input costs. There are rare cases where oil options could control some steel-price risks, and AEGIS can help you diagnose if such a hedge would benefit you. For example, WTI options could be used to hedge an anticipated cyclical change in the oil and gas industry. If an equipment manufacturer is worried about a downturn in the oil and gas sector, they could buy WTI put options to offset a potential slump in equipment demand. For most clients, whether on the supply or demand side of steel equipment, we conclude that hedging of HRC should remain a separate issue and should be directly hedged with HRC swaps and/or options. Hedging HRC via WTI swaps and/or options is complex, and correlations can change over time. Please contact AEGIS to discuss the optimal strategies for you and your operation. |

||