July 7, 2023 - At the beginning of the year, two factors were on every crude analyst’s mind – the impending loss of Russian supply and China’s demand growth. Analyst assumptions crystalized on robust demand recovery in China after the nation abandoned its strict covid policy and a loss of Russian crude exports (nearly 8 MMBbl/d in January 2023) as the Western sanctions started kicking in.

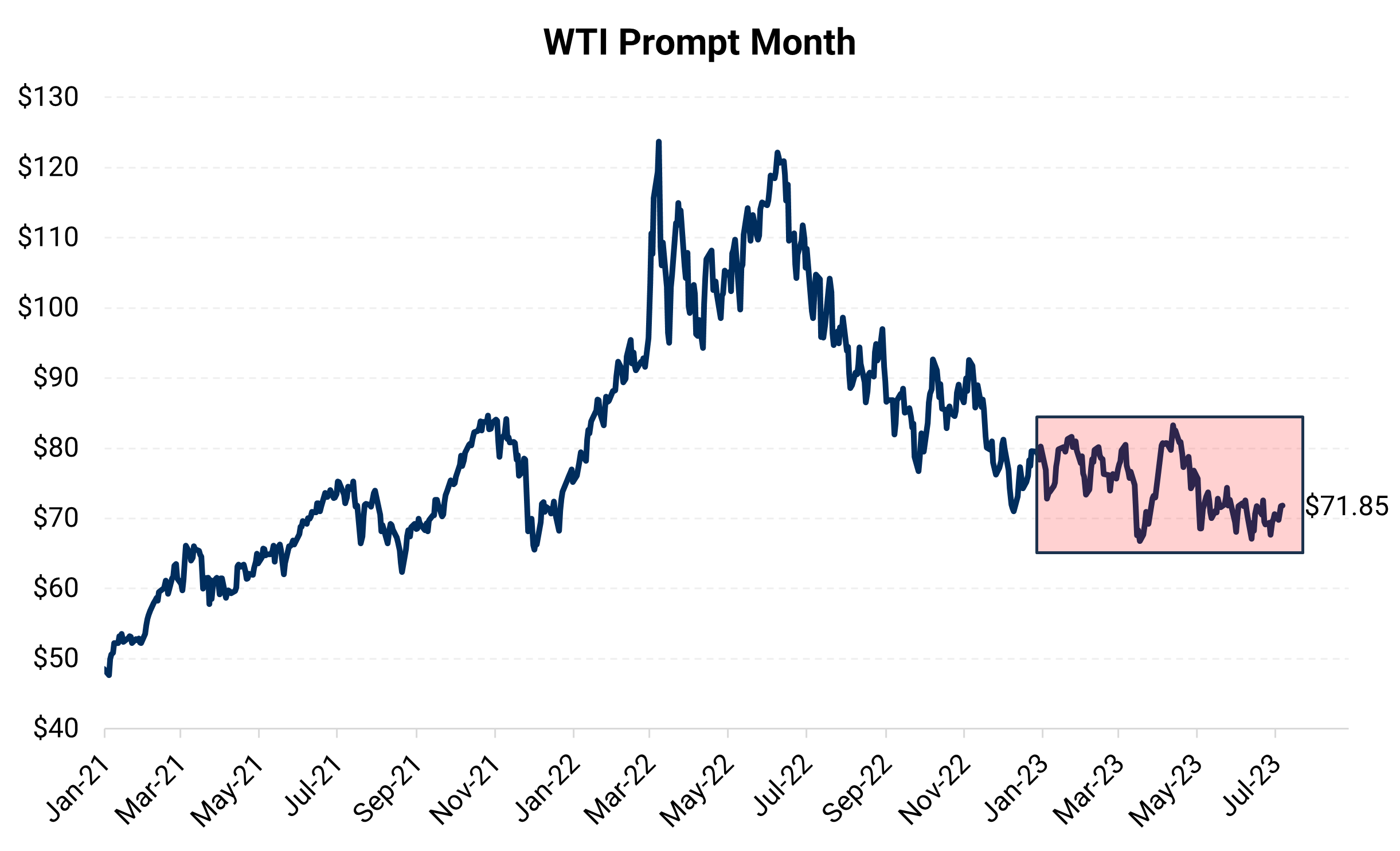

So, what has happened? Why have prices declined? Russian supply did not fall materially, and when it comes to China’s economic growth, the pace of growth fell short of bullish analyst expectations.

Additionally, the expectation of further interest rate hikes to curb high inflation in the Western economies and recessionary fears have been capping oil’s upside.

OPEC

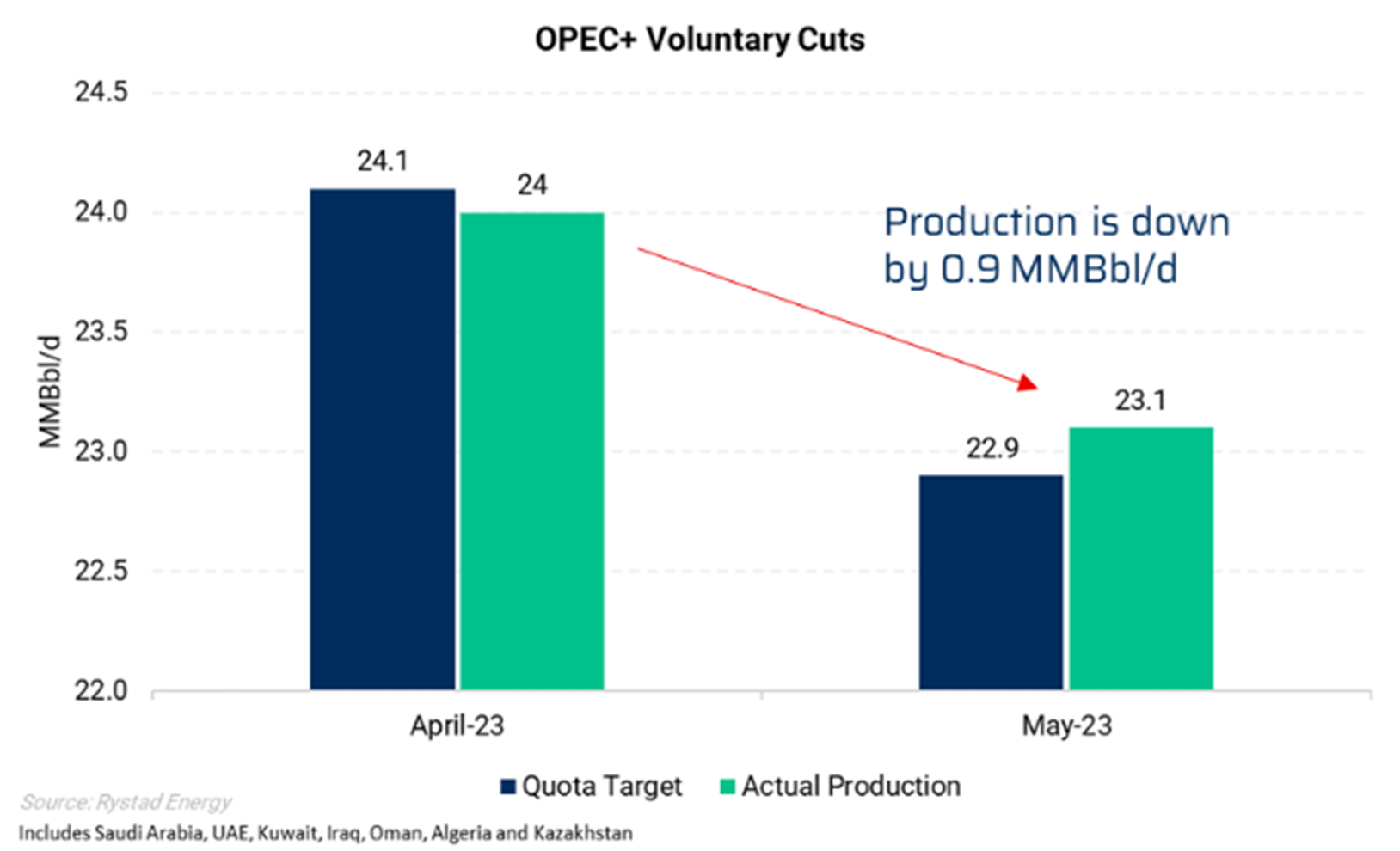

The cartel pledged to cut 2 MMBbl/d last October, 1.66 MMBbl/d in April 2023 and extended the cuts until the end of 2024. In addition, Saudi Arabia and Russia, key OPEC+ members, have announced plans to limit their oil production in August, extending July's cuts, to balance and stabilize global oil markets.

Saudi Arabia will continue its unilateral crude production cut of 1 MMBbl/d, reducing its projected output for both July and August to just under 9 MMBbl/d. This comes in addition to the previously pledged cut of 0.5 MMBbl/d from May, part of a larger 1.16 MMBbl/d reduction by eight OPEC+ members, extended until 2024.

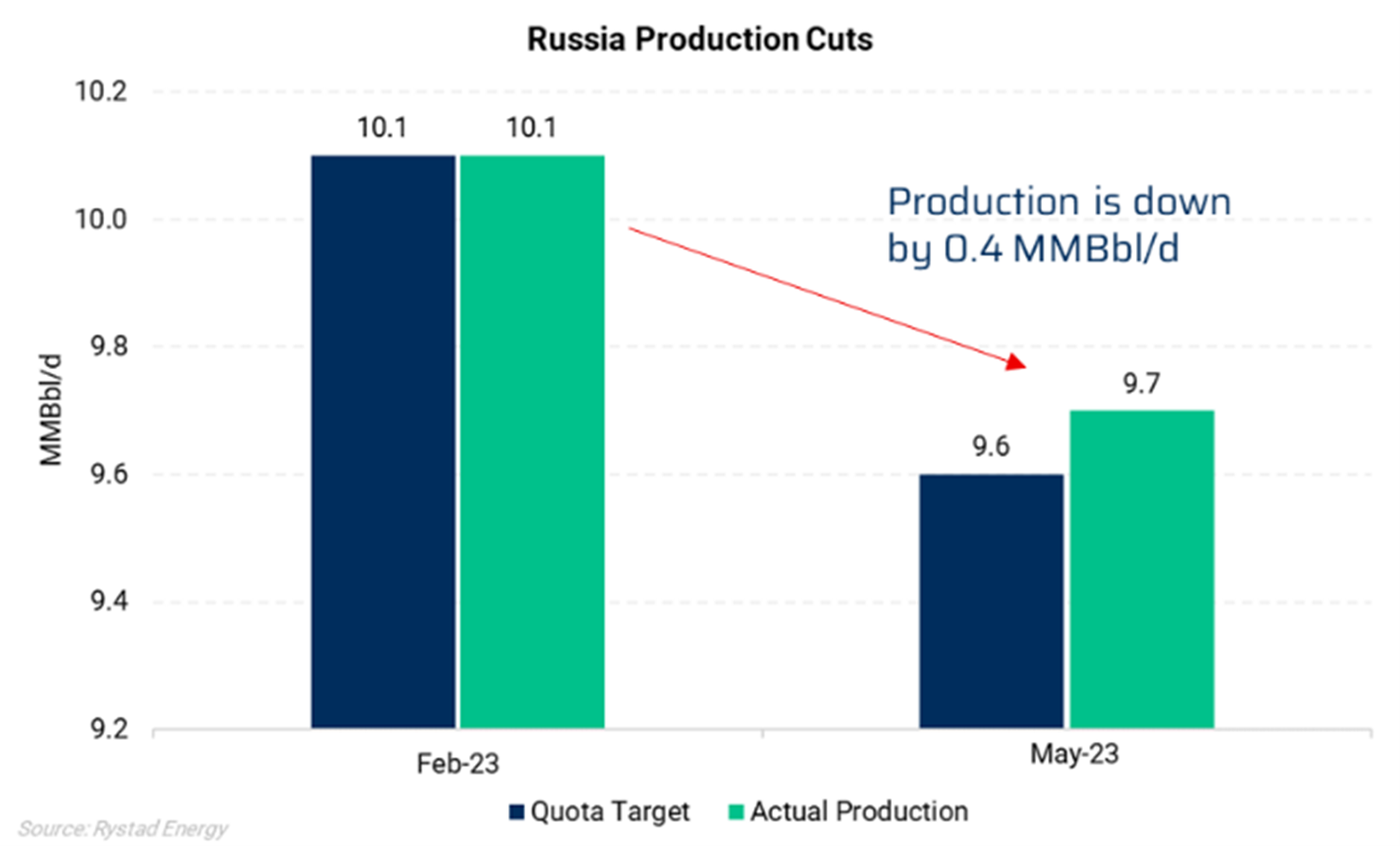

Russia has also pledged a voluntary reduction, curbing its oil exports by 0.5 MMBbl/d in August. Meanwhile, Algeria is set to decrease its output by an additional 0.02 MMBbl/d, resulting in a total output of 0.94 MMBbl/d in August, a further step following its April reduction of 0.048 MMBbl/d.

|

|

Signs of physical market tightening have started to surface. In May, eight of OPEC’s core 13 members made an output cut of about 0.9 MMBbl/d, according to Rystad Energy. Additionally, Russia curtailed its output by 0.4 MMBbl/d in May while maintaining resilient exports. AEGIS believes that these production cuts essentially set a floor to prices, and as Saudi Arabia's voluntary cut of 1 MMBbl/d, effective from July 1, starts to bite in, it could augment prevailing market tightness.

Crude Oil Supply & Demand

|

|

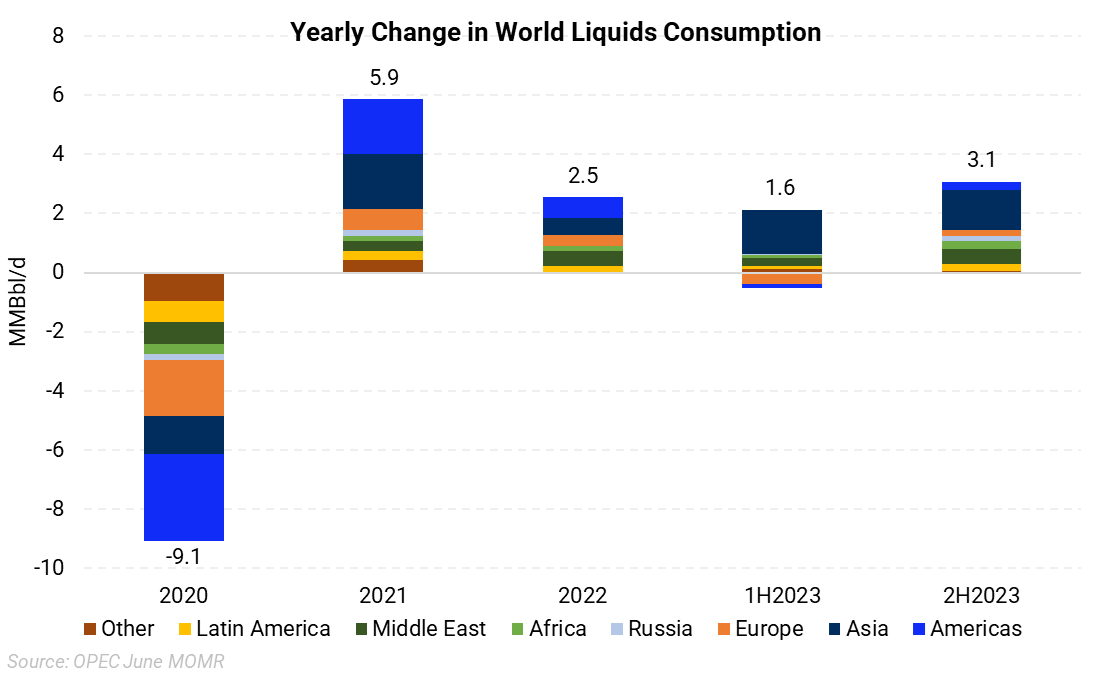

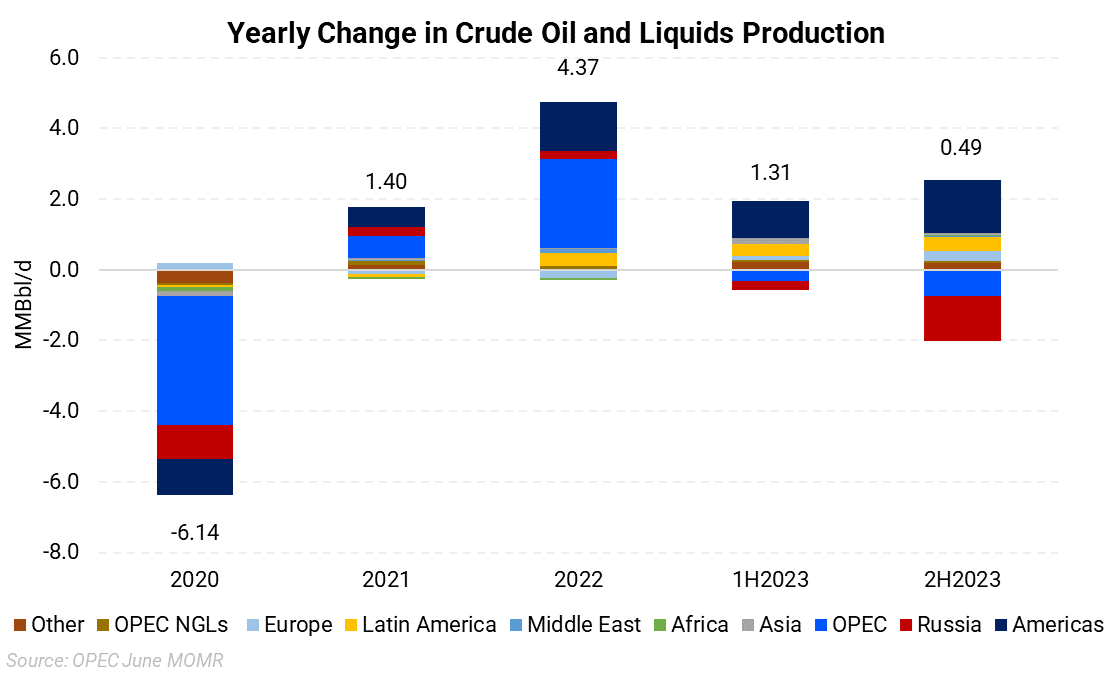

The charts above are from OPEC’s June monthly report, which does not include the latest August production cuts. The chart on the left shows global crude and liquids production, whereas the chart on the right shows global demand.

2023 is split into 1H2023 and 2H2023 to show how concentrated the demand growth is in the year’s second half. Our analysis of OPEC's monthly data indicates a projected supply/demand imbalance of about 2.6 MMBbl/d in the second half of 2023. Of this, Chinese demand recovery, as per the IEA, is expected to account for nearly 60%.

The point to note here is that regardless of the somewhat slow recovery of Chinese demand, it possesses enough momentum to tip the market into a deficit scenario, especially given the low production growth (0.49 MMBbl/d). Furthermore, even under a hypothetical scenario where Russian exports remain resilient and defy market expectations, the market would nonetheless remain in a deficit.

In conclusion, despite initial expectations of a loss in Russian supply and strong demand recovery in China, the crude oil market in 2023 has seen declining prices due to these factors not materializing as expected. However, production cuts by OPEC, Saudi Arabia, and Russia have essentially set a floor for prices. Even with slower Chinese demand recovery, the market is projected to face a supply/demand imbalance of 2.6 MMBbl/d in H2 2023. This holds true even if Russian exports remain resilient.

Our bullish outlook is based on the expectation of rising oil prices when supply-demand dynamics indicate a tight market from significant inventory drawdowns to balance the deficit. This is further corroborated by the WTI’s curve structure, which has moved into backwardation for the first time since May after being in contango for the majority of 2023, signaling a tighter oil market.