AEGIS Thoughts:

Recent Price Action

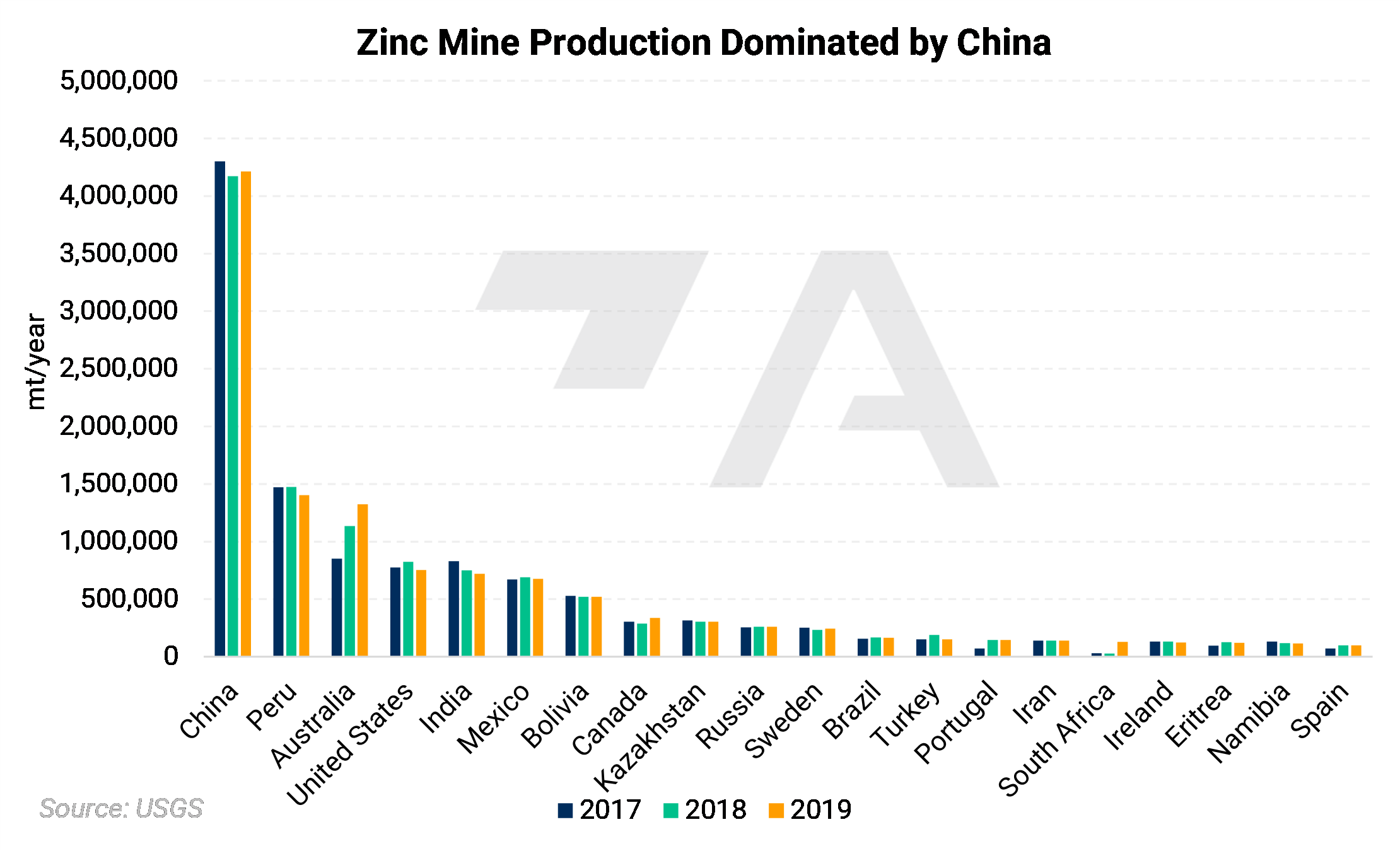

Zinc prices were in a downtrend from 2018 until early 2020 and bottomed at the start of the pandemic. The rally was likely because of supply constraints that persisted after demand recovered alongside a decreasing COVID threat. Global zinc mine production in 2020 was below 2018 and 2019 levels for most of the year. Production recovered in 2021; however, was at or below the five-year average for the latter half of the year. Cutbacks in Peruvian production were mainly why output slumped during this period. Similar production cuts and price action occurred in 2015 to 2016; however, Australia was the culprit during that period. Also, production began to dip to five-year lows as smelter production problems began in Europe.

China, the world’s largest zinc smelter, has seen a recent downturn in refined zinc production. A recent COVID outbreak led to a drop in China’s refined zinc volumes in March 2022, both month-over-month and year-over-year. LME Zinc 3M rallied nearly 14% in March while China was experiencing this production issues. Antaike, the Chinese state-backed research company, says refined zinc output in March was 423,000 tonnes, down 0.7% year on year; month-over-month production was off 3%. Transportation issues due to COVID in three important zinc-producing provinces (Yunnan, Shaanxi and Gansu) caused most of the setback in production.

Europe, although a smaller player than China, still represents approximately 15% of global refined-zinc production. Europe has had production problems in recent months due to sky-high electricity prices, according to Reuters. Late last year, Nyrstar, one the world’s largest zinc smelters, cut production by 50% at its Belgium and Netherlands operations. Its French operations also cut production in late 2021 and briefly ceased production in early 2022. However, in late March 2022 Nyrstar announced that is restarting its French operations on a limited scale. This could bring some relief to the market. However, electricity prices remain high and could undermine production.

Zinc inventories are quite small, compared to history. LME and SHFE zinc inventories are both at multi-year lows. Many market participants use exchange warehouse inventories as a gauge of the supply-demand balance. . Such small amounts in zinc stores shows that demand has been persistently higher than supply in the last two years. SHFE inventories have increased in recent months; however, this is likely a normal, seasonal increase.

Why the US is a net importer of refined zinc.

The US is the world’s fourth-largest zinc miner; however, most zinc ore is exported and later imported as refined zinc. In 2021, the US produced 705,000 mt of zinc ore and concentrate, of which 644,000 mt was exported. The US exported 261,000 mt of zinc ore and concentrate to Canada that year. However, we imported just over 700,000 mt of refined zinc, with Canada supplying 468,000 mt.

The U.S.’s Red Dog mine, which is owned and operated by Teck Resources, produced 503,000 mt of zinc ore and concentrate in 2021. This one mine accounted for approximately 71% of US production that year. The Red Dog mine supplies Teck’s zinc smelter (Trail) in southern British Columbia. According to Teck’s website, “Concentrates produced at Red Dog are shipped to our metallurgical facilities in Trail, British Columbia, and to customers in Asia and Europe.” It is likely that most (or all) of the zinc ore shipments from the US to Canada are from the Red Dog mine in Alaska to the Trail smelter in southern British Columbia.

Moreover, the U.S. only has one primary smelter, Nyrstar Clarksville, in Tennessee. Nyrstar also operates the largest zinc mine in the lower 48 states, based in Jefferson and Knox counties in Tennessee. In 2019, US primary smelter production was 99,900 mt. The US imported neither zinc ore nor concentrate that year. It is likely that only zinc ore mined in the lower 48 states is processed by this smelter.

As noted above, the U.S. is a net importer of refined zinc. Given that it only have one primary smelter, and prior to March 2020 only had one secondary smelter, the country’s demand far outweighs domestic supply. For example, in 2020, the U.S. produced 180,000 mt of refined zinc, imported 700,000 mt, and exported a mere 2 mt, thus making net apparent consumption (i.e., demand) 878,000 mt.

Zinc – Aluminum Substitution

Zinc and aluminum substitution mainly occurs in alloying while diecasting. Alloying is the combining of two metals: for instance, combining zinc and copper to make brass. Including brass and bronze production, alloying represents about 34% of zinc usage, according to the International Lead Zinc Study Group. Diecasting is injecting molten metal under high pressure into a die, or mold, of a desired shape. Many automotive components such as brake and powering steers parts are produced by diecasting various zinc alloys. The automotive industry is the most common application of zinc die casting, according to PHB Corp.

There are numerous reasons as why zinc might be substituted (or vice-versa) during diecasting or alloying processes. Many of the same products, such as automotive components, that are produced via zinc alloying diecasting can also be made from aluminum alloys. Gjuteriteknik, a Sweden-based die caster, sums up the differences between the two as follows:

“The main difference between the two are their weight and melting point. Aluminum is lighter than zinc, but zinc has a lower melting point. This means that manufacturing with zinc is quicker, more energy-efficient and has lower production costs. Zinc is therefore the best choice for slightly smaller products, where the weight is less important. Another important difference is that casting precision is significantly better and the strength of zinc is considerably higher, so wall thickness can be reduced. Wall thicknesses down to 0.4 mm are achievable.”

Demand changes from the automotive industry can also steer zinc vs aluminum preferences. For instance, Davis Index, a price benchmarking company with a large presence in India, recently stated in a 2020 blog post: “In India, die casting companies rued about low orders for zinc and relatively higher aluminum die cast orders post March. Change in demand pattern from auto sector is majorly impacting the consumption of zinc and aluminium alloys used for die casting.”

Expanding on the comments from Davis Index, die casters likely “rue” zinc to aluminum switching because dies that manufacture zinc alloy products tend to last longer due to zinc’s lower melting temperature.

Substitution between zinc- and aluminum alloys could be why zinc and aluminum prices tend to move together and could keep the zinc/aluminum zinc price ratio in check. The zinc/aluminum cash price ratio rarely eclipses 1.6. If the ratio hits that level, it usually and quickly retreats.

|