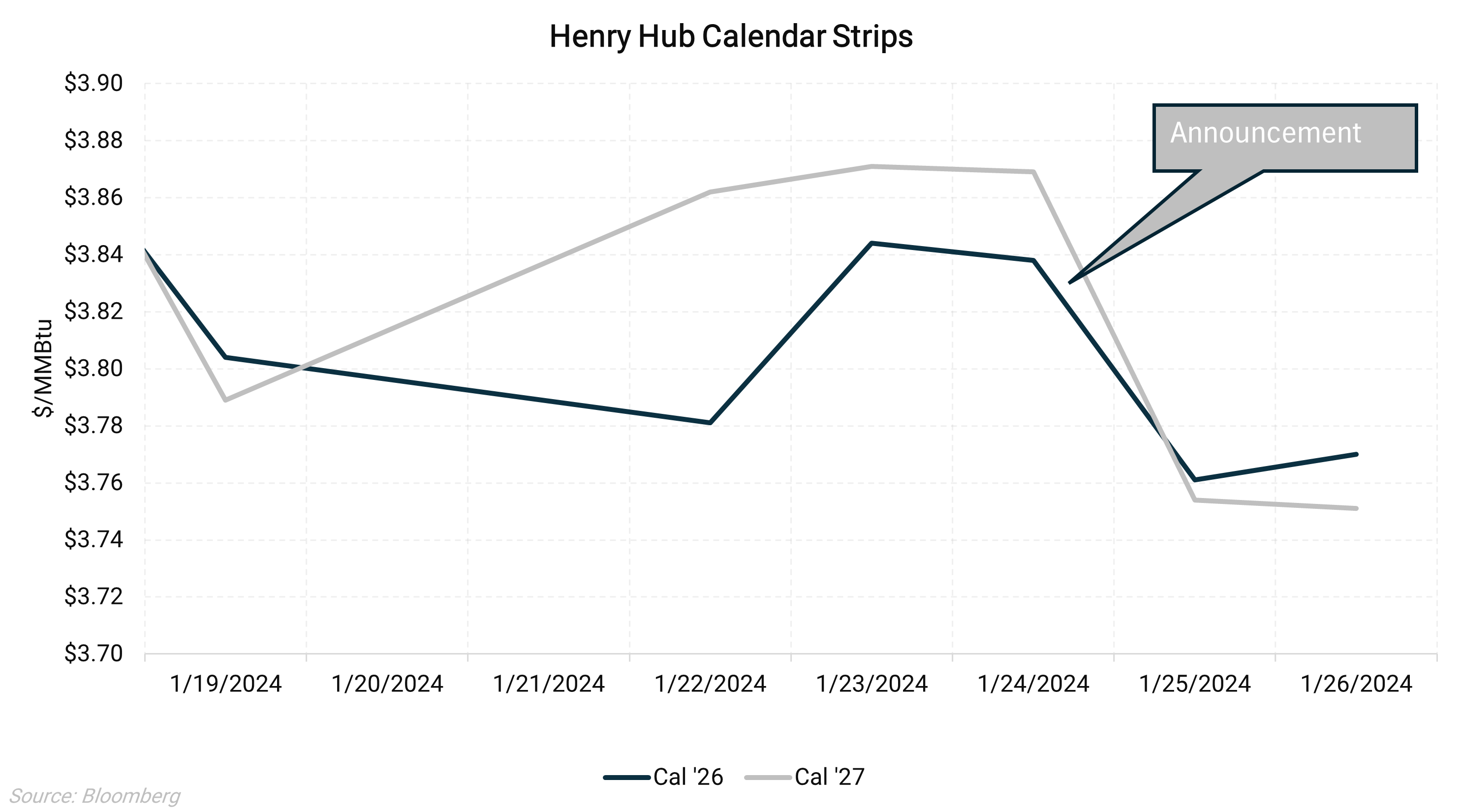

U.S. natural gas exports have been the largest driver of gas demand growth and are expected to remain the primary driver over the next few years. A pause in LNG export plant approvals, which the Biden Administration announced on January 25, could significantly reduce this and potentially weaken prices further out in the curve. The Henry Hub 2026 calendar strip is down 6.7c to $3.771/MMBtu since the announcement, and the Cal ’27 strip is off by 13.2c to $3.75/MMBtu, some of which was likely driven by the announcement. However, this will not impact near-term exports and may only have a limited effect on the status of future projects.

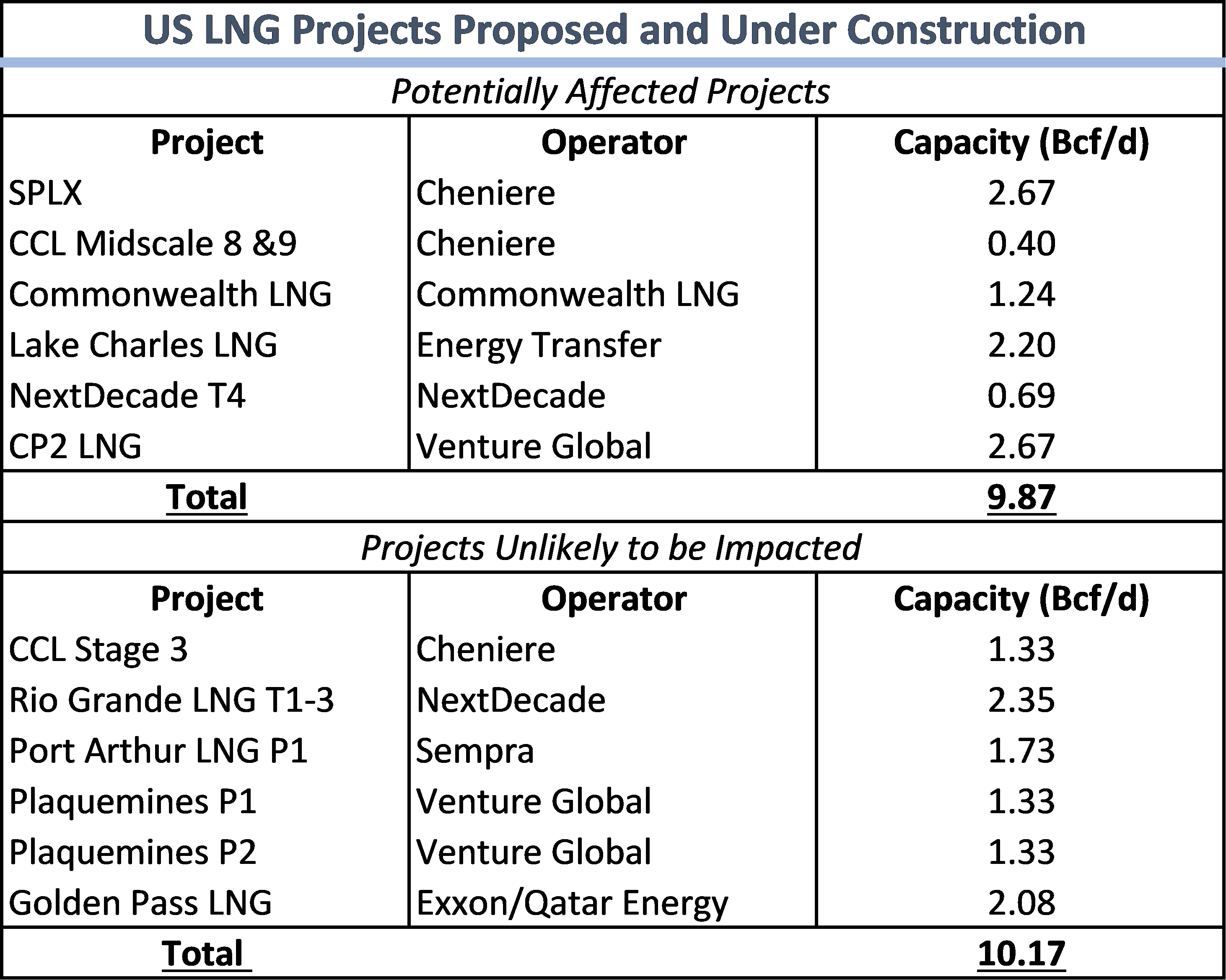

The White House statement says the pause will be temporary as the Department of Energy evaluates potential risks to the climate, economy, and energy security while creating an exception for “unanticipated and immediate national security emergencies.” The statement does not detail how long the pause will be in place or what facilities could be at risk, but the wording would seem to imply that only export plants currently without DOE approval would be affected. Most facilities planned for the next few years already have DOE approval, and many are already under construction. Facilities in the early planning stages, expected to enter service closer to 2030, could be impacted.

The table above shows projects that are potentially going to be impacted and projects that should be unaffected by the pause in export approvals. The at-risk facilities may still be completed; however, they may be delayed until the pause is lifted or the DOE finds the economic benefits outweigh the potential environmental harm.

A pause on LNG export approvals does not change our neutral 2025 Henry Hub outlook and bullish 2026 outlooks, given that facilities slated to enter service in the next two years should be unaffected. However, it may weaken the case for prices in years beyond 2027.