Oil inventories are a good measure of the scarcity of oil. Prices have followed those inventory levels.

Some analysts with bearish price outlooks are forecasting oversupply in 2022. The EIA and Citibank both expect oversupply in 2022. Some analysts are more bullish on demand and less bullish on supply, forecasting tighter balances.

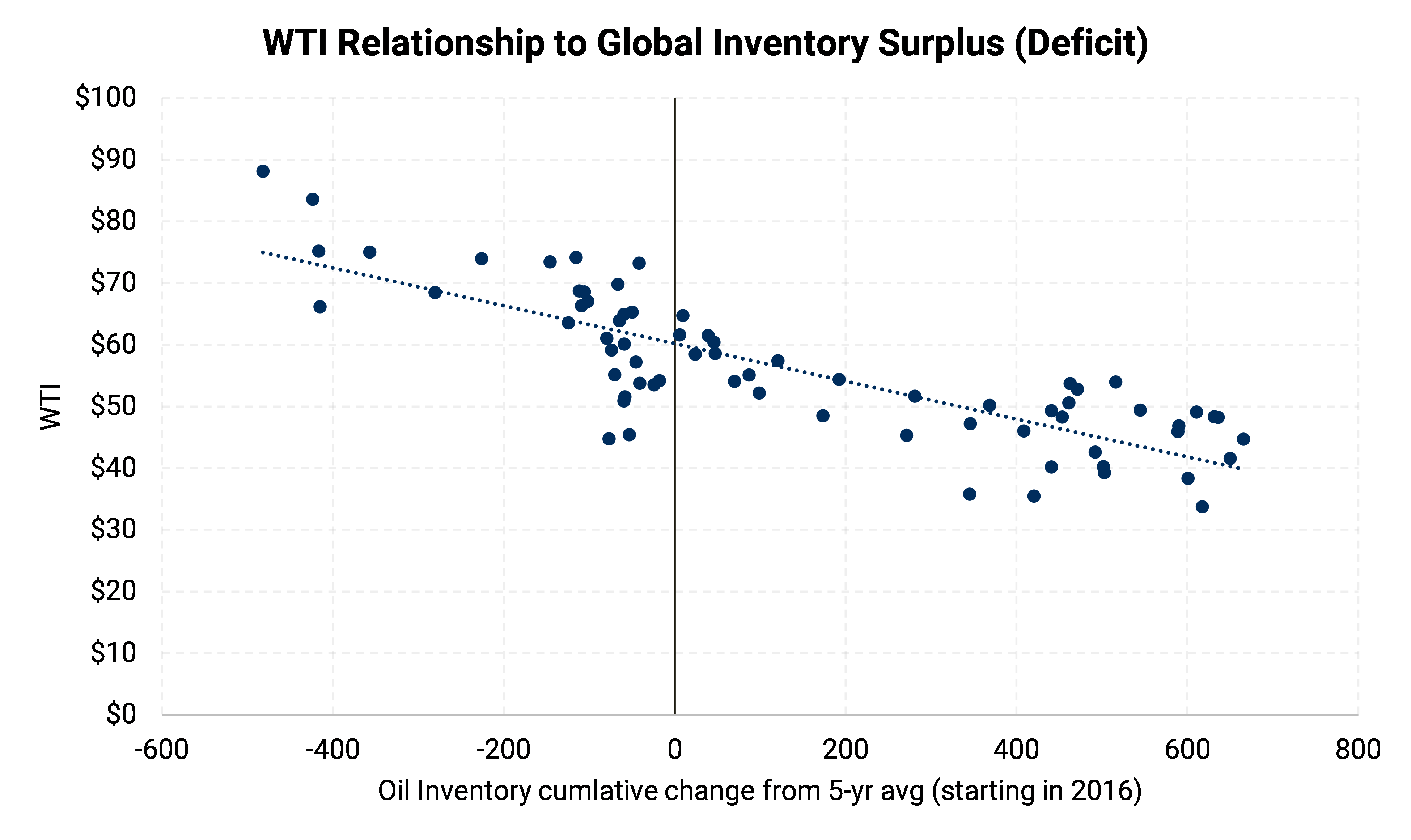

The chart below shows the relationship between WTI and the surplus or deficit for OECD inventories compared to the rolling five-year average. In recent years, prices have relaxed when inventories have grown, and rallied as inventories were depleted. Oil inventories have been declining compared to the five-year since early 2021. Over the same period, WTI has rallied $30, or 50%, to around $90/Bbl.

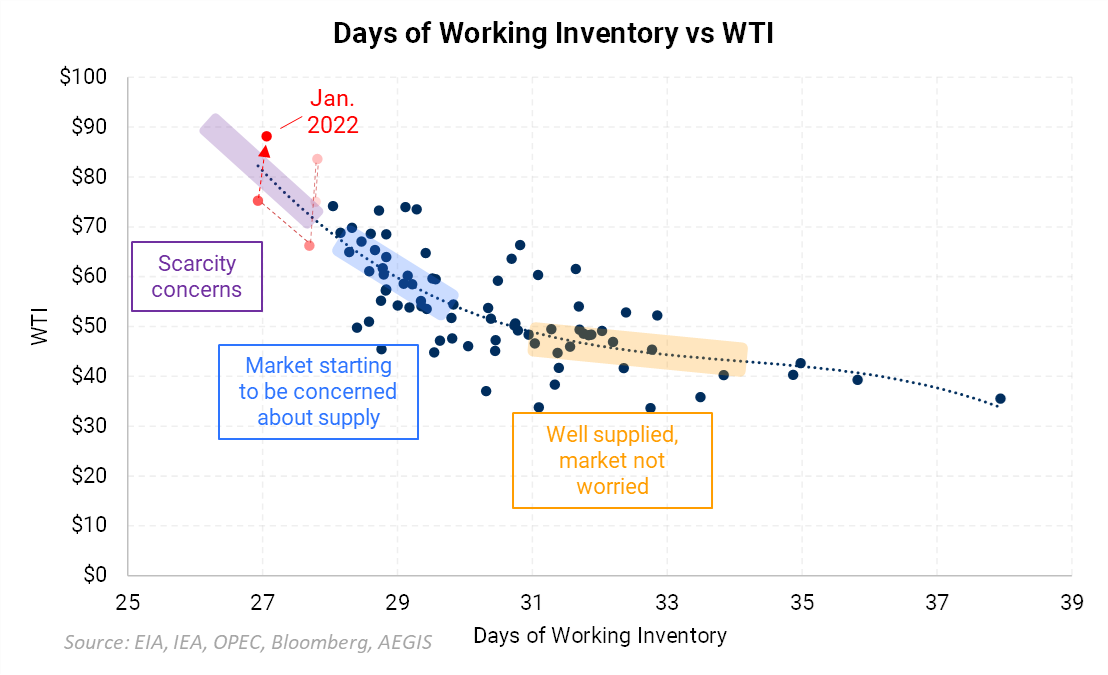

The chart above implies a linear relationship between inventories and price, but if we standardize those inventory levels for demand, another relationship emerges. Inventory deficits begin to matter more at the extremes. The chart below highlights how unusually low inventories can equate to rapid changes in price. Instead of the difference between inventories to the five-year average like the chart above, the second chart uses days of working inventory.

Days of working inventory (DOWI) is inventory divided by demand, standardizing inventories across time and representing the number of days the market has available. A smaller number means a smaller buffer. Similar metrics are published under the names “Days of Cover,” “Days of Demand,” or a variation of these.

In January, DOWI was the second smallest since 2016, and prices were the highest since 2016 (red dot). The other red dots show monthly measurements going back to September 2021. In history, prices generally rose as DOWI decreased. At a DOWI value near 29 days, there was a change: prices tended to escalate quickly.

Because we are at the extreme left of the chart, we don’t have recent data points to judge what might happen next if inventories are further depleted. However, this historical model does suggest that if inventories rise due to oversupply, you could see a rapid decrease in price.

Inventory levels are not the only factor to consider as multiple variables come into play to determine the price. But rising inventories are a cause of either relatively more supply or less demand, and price usually follows fundamentals. If you are in the oversupply camp for 2022, then price decay may be in the cards. However, if you believe demand will continue to keep supply additions in check, oil prices likely have more staying power.