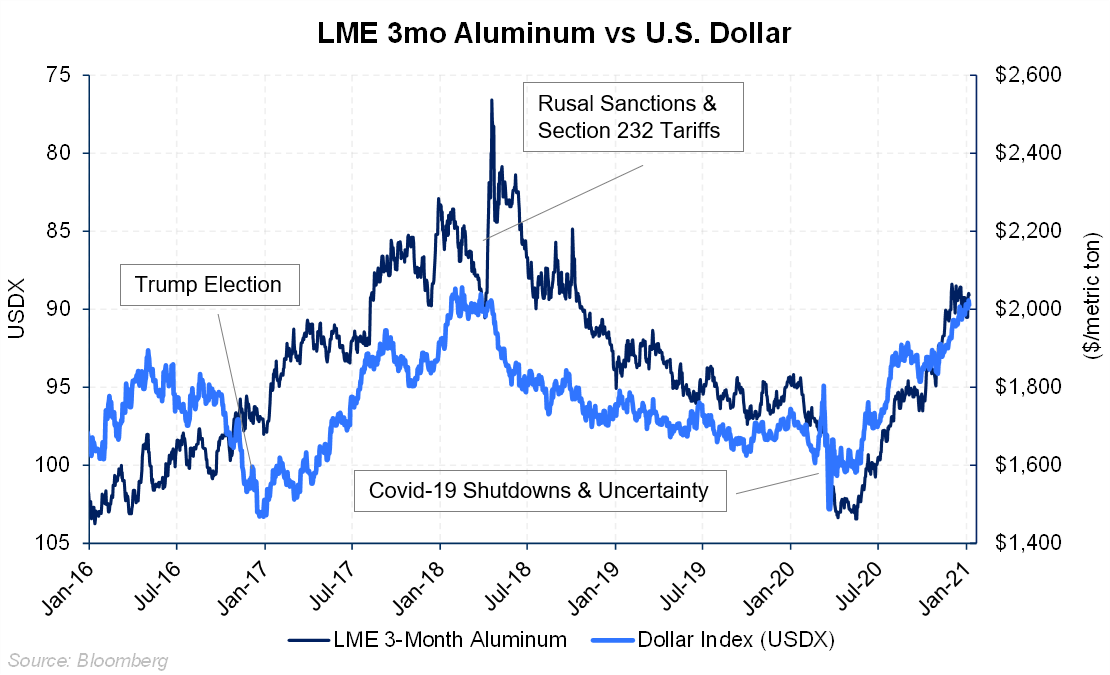

Corporate consumers often hesitate to hedge after extreme price increases. Recently we have seen the LME Index of base metals up by 55% since March of 2020, which has begun to put a strain on input costs. Keep in mind a bearish dollar view will likely continue to support base metals prices. Executive teams should be evaluating how further price increases could impact their bottom line and prepare accordingly for that possibility. Many traditional hedging strategies only include locking in fixed prices with suppliers or utilize swaps or futures contracts that provide price protection but do not allow participation if prices drop in the future. With economic uncertainty continuing into 2021, corporates should consider options strategies that provide protection against further price increases but would also take advantage of potential lower prices in the future. For commodities traded internationally, where USD is the primary currency, there has proven to be a well-established inverse correlation between the value of the USD and commodity prices. The relationship is particularly strong in LME base metals as shown in the five-year historical chart of US Dollar Index vs. LME 3-month aluminum price. In 2020, the dollar weakened by 9% versus the euro while LME aluminum, copper, zinc, and nickel prices rose by 10.8%, 26%, 19.7%, and 18.7% respectively. Supply, demand, and investor positioning are among a few of the other variables that also impact metals pricing. However, discounting for shocks to the system like the Rusal sanctions, Section 232 implementation in 2018, or the Covid-19 early shutdowns in 2020, the dollar vs. base metals inverse correlation holds strong.

In 2020, the dollar weakened by 9% versus the euro while LME aluminum, copper, zinc, and nickel prices rose by 10.8%, 26%, 19.7%, and 18.7% respectively. Supply, demand, and investor positioning are among a few of the other variables that also impact metals pricing. However, discounting for shocks to the system like the Rusal sanctions, Section 232 implementation in 2018, or the Covid-19 early shutdowns in 2020, the dollar vs. base metals inverse correlation holds strong.

Over the past several months as deficit-spending in the US revisits World War 2 levels. the dollar has been on a steady decline. With the election of Joe Biden to the Presidency, the bearish dollar outlook has continued. The Senate election in Georgia pointing to likely Democratic control of both Houses of Congress firms up the potential for further USD weakening (Currently $1.2315).

Recall that record pricing for many commodities was set during the 2000's commodities super cycle during which EURUSD peaked at near $1.60. Meanwhile, current nickel prices are only at 33% of 2008 levels with zinc, copper, and nickel at 62% to 80% of 2008 peak.

Despite the recent rally, more upside is being forecast by an increasing number of analysts.Questions or comments, please contact us at info@aegis-hedging.com.