|

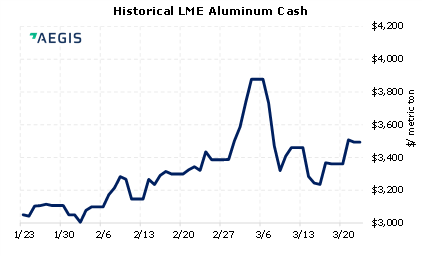

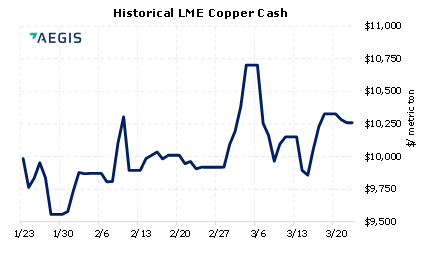

The LME will not abide by its own committee recommendation to ban Russian copper from LME warehouses. However, the exchange is in talks with several unnamed governments about whether it should continue to accept Russian deliveries into their warehouses, according to Bloomberg. Anonymous sources cited by Reuters claim that banning Russian metal “would exacerbate already tight supplies” and “a ban may also prove unlawful if no sanctions against producers are in place.” Based on recent LME data, nearly 12% of the LME’s aluminum in LME warehouses is Russian. Likewise, approximately 16% of nickel and 3% of copper in LME warehouses is of Russian branding. |

|

|

|

Consumers who are concerned about their copper or other LME metal input costs might consider purchasing swaps or call options. Please note that doing so might incur losses if prices decrease. Please contact AEGIS for specific strategies that fit your operations. (3/23/22) |

||

|

|

||

Note: Clients with AEGIS Platform access can see this and other research, plus hedge portfolio reporting and tools here. |

||

|

|

||

Price Indications |

||

|

|

||

|

|

||

Today's Charts |

||

|

|

|

|

|

|

AEGIS Insights |

||

|

03/16/2022: AEGIS Factor Matrices: Most important variables affecting metals prices 03/16/2022: Russian Metals Production and Related News: Most Recent Developments (AEGIS Reference) |

||

|

|

||

| Important Headlines | ||

|

3/22/2022: METALS-Supply fears lift aluminium, nickel shows signs of normalising 3/22/2022: LME says it has no current plans to ban Russian metal from its system 3/20/2022: Australia bans alumina exports to Russia, sources coal for Ukraine 3/18/2022: LME’s copper industry group recommends banning Russian metal |

||

|

|

||

|

|

||

| Important Disclosure: Indicative prices are provided for information purposes only, and do not represent a commitment from AEGIS Hedging Solutions LLC ("Aegis") to assist any client to transact at those prices, or at any price, in the future. Aegis makes no guarantee to the accuracy or completeness of such information. Aegis and/or its trading principals do not offer a trading program to clients, nor do they propose guiding or directing a commodity interest account for any client based on any such trading program.

|

||