|

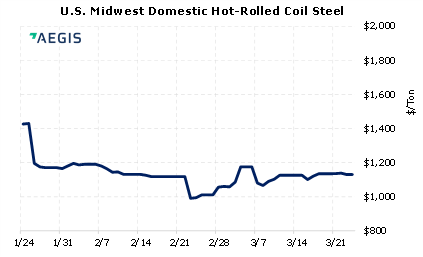

CME HRC prices could stay strong, as the US continue to cap steel imports. Despite South Korean efforts to negotiate, the US will not end the quota on South Korean steel imports, according to US Commerce. Currently South Korean steel is subject to a Section 232 Absolute Quota. Under the Section 232 Absolute Quota, the annual duty-free import volume of South Korean steel is strictly limited to 2.68 million mt per year. Absolute quota merchandise may not be imported into the U.S for consumption after the quota limit is reached, according to the US Customs and Border Patrol. With approximately 2.53 million mt in 2021, South Korea was the fourth-largest source of steel imports into the US, according to the US Census Bureau. The comments on limiting South Korean steel imports were from US Commerce Secretary Gina Raimondo in a Reuters interview late yesterday. The US has recently eased tariffs on steel imports from the UK, EU, and Japan. |

|

|

|

The forward curve for CME HRC steel futures has risen in recent weeks. However, it is still backwardated, meaning that future prices are lower than spot prices. Consumers can take advantage of this backwardation by purchasing swaps or call options. Please note that doing so might incur losses if prices slide further. The CME HRC steel market is thinly traded, so please contact AEGIS for strategies. (3/24/2022) |

||

|

|

||

Note: Clients with AEGIS Platform access can see this and other research, plus hedge portfolio reporting and tools here. |

||

|

|

||

Price Indications |

||

|

|

||

|

|

||

Today's Charts |

||

|

|

|

|

|

|

AEGIS Insights |

||

|

03/23/2022: AEGIS Factor Matrices: Most important variables affecting metals prices 03/23/2022: Russian Metals Production and Related News: Most Recent Developments (AEGIS Reference) |

||

|

|

||

| Important Headlines | ||

|

3/23/2022: U.S. not looking to renegotiate Trump-era steel quotas with South Korea, says Raimondo 3/23/2022: LME benchmark nickel spikes 15% to hit limit up 3/22/2022: METALS-Supply fears lift aluminium, nickel shows signs of normalising 3/22/2022: LME says it has no current plans to ban Russian metal from its system 3/20/2022: Australia bans alumina exports to Russia, sources coal for Ukraine 3/18/2022: LME’s copper industry group recommends banning Russian metal |

||

|

|

||

|

|

||

| Important Disclosure: Indicative prices are provided for information purposes only, and do not represent a commitment from AEGIS Hedging Solutions LLC ("Aegis") to assist any client to transact at those prices, or at any price, in the future. Aegis makes no guarantee to the accuracy or completeness of such information. Aegis and/or its trading principals do not offer a trading program to clients, nor do they propose guiding or directing a commodity interest account for any client based on any such trading program.

|

||