|

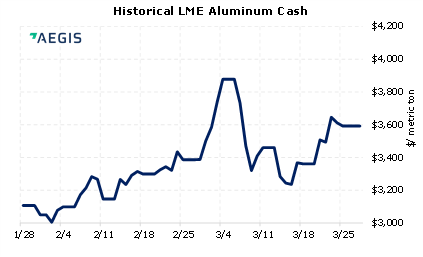

Chinese traders have sold 30,000 mt of alumina to Rusal in recent weeks, according to Bloomberg. Alumina, a key ingredient for aluminum production, is rarely exported from China as it is more profitable to use in domestic aluminum production. This modest tonnage was meant to “test whether the cargoes face any logistics issues or problems with sanctions, with more ready to ship if all goes well,” according to anonymous traders cited by Bloomberg. Rusal is currently having problems with sourcing alumina due to logistical issues from the Ukrainian conflict and Western sanctions. |

|

|

|

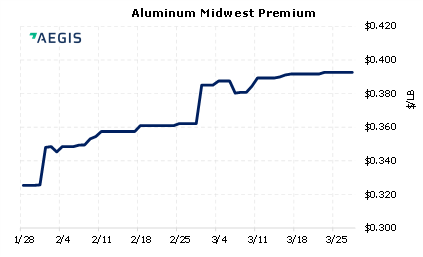

Consumers who are concerned about their aluminum input costs might consider purchasing swaps or call options. Please note losses might occur if swap prices decline or if options premiums lose intrinsic or time value. Please contact AEGIS for specific strategies that fit your operations. (3/28/22) |

||

|

|

||

Note: Clients with AEGIS Platform access can see this and other research, plus hedge portfolio reporting and tools here. |

||

|

|

||

Price Indications |

||

|

|

||

|

|

||

Today's Charts |

||

|

|

|

|

|

|

AEGIS Insights |

||

|

03/23/2022: AEGIS Factor Matrices: Most important variables affecting metals prices 03/23/2022: Russian Metals Production and Related News: Most Recent Developments (AEGIS Reference) |

||

|

|

||

| Important Headlines | ||

|

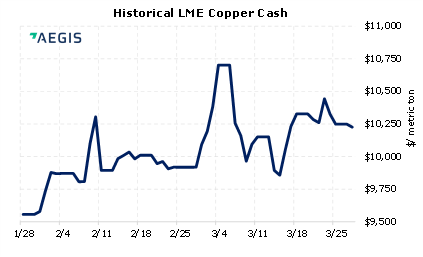

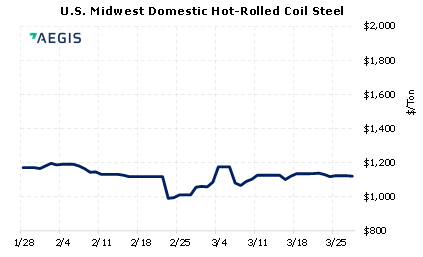

3/24/2022: LME benchmark nickel jumps 15%, hits price limit in thin market 3/23/2022: U.S. not looking to renegotiate Trump-era steel quotas with South Korea, says Raimondo 3/23/2022: LME benchmark nickel spikes 15% to hit limit up 3/22/2022: METALS-Supply fears lift aluminium, nickel shows signs of normalising 3/22/2022: LME says it has no current plans to ban Russian metal from its system 3/20/2022: Australia bans alumina exports to Russia, sources coal for Ukraine 3/18/2022: LME’s copper industry group recommends banning Russian metal |

||

|

|

||

|

|

||

| Important Disclosure: Indicative prices are provided for information purposes only, and do not represent a commitment from AEGIS Hedging Solutions LLC ("Aegis") to assist any client to transact at those prices, or at any price, in the future. Aegis makes no guarantee to the accuracy or completeness of such information. Aegis and/or its trading principals do not offer a trading program to clients, nor do they propose guiding or directing a commodity interest account for any client based on any such trading program.

|

||