|

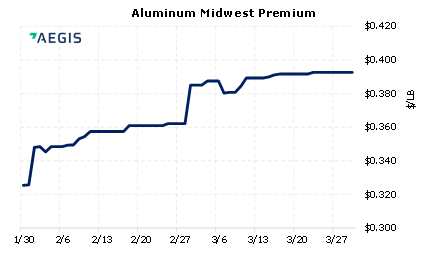

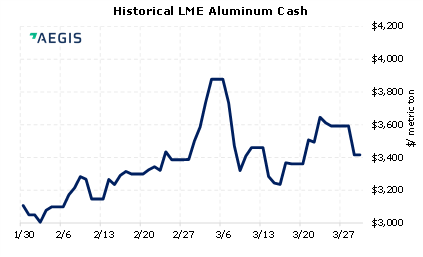

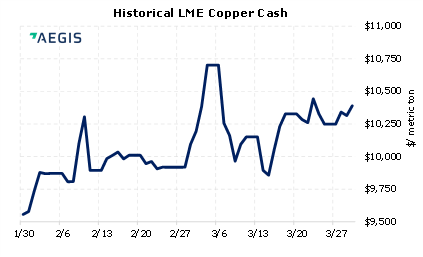

Most LME metals finished lower yesterday on news that talks between Russia and Ukraine offered a potential pathway to a meeting between Vladimir Putin and Volodymyr Zelenskiy to resolve the war; however, markets are up slightly this morning after no breakthroughs occurred during today’s talks, according to Bloomberg. Aluminum 3M contract was down nearly 5% yesterday, settling at $3,436/mt, but has recovered about 3% this morning. Russia’s aluminum producer, Rusal, has had problems with sourcing inputs due to logistical issues due to the conflict. The company has not been sanctioned by any Western governments; however, importers have distanced themselves from Rusal and are beginning to source aluminum from other suppliers, according to mining.com. |

|

|

|

Consumers who are concerned about their aluminum input costs might consider purchasing swaps or call options. Please note losses might occur if swap prices decline or if options premiums lose intrinsic or time value. Please contact AEGIS for specific strategies that fit your operations. (3/30/22) |

||

|

|

||

Note: Clients with AEGIS Platform access can see this and other research, plus hedge portfolio reporting and tools here. |

||

|

|

||

Price Indications |

||

|

|

||

|

|

||

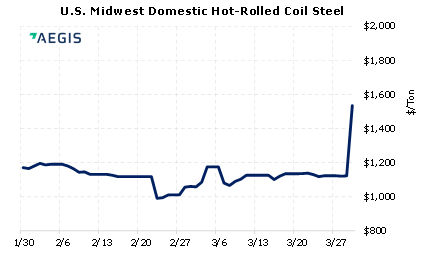

Today's Charts |

||

|

|

|

|

|

|

AEGIS Insights |

||

|

03/23/2022: AEGIS Factor Matrices: Most important variables affecting metals prices 03/23/2022: Russian Metals Production and Related News: Most Recent Developments (AEGIS Reference) |

||

|

|

||

| Important Headlines | ||

|

3/29/2022: CRU-CESCO-LME to hold independent review into nickel crisis 3/29/2022: PRECIOUS-Gold retreats, palladium slides 9% on progress in Ukraine talks 3/29/2022: LME board to evaluate lessons from nickel halt, parent company says 3/28/2022: METALS-Copper, nickel fall on China's COVID curbs, firm U.S. dollar 3/28/2022: Rusal can’t access alumina from Australia JV as pressure builds |

||

|

|

||

|

|

||

| Important Disclosure: Indicative prices are provided for information purposes only, and do not represent a commitment from AEGIS Hedging Solutions LLC ("Aegis") to assist any client to transact at those prices, or at any price, in the future. Aegis makes no guarantee to the accuracy or completeness of such information. Aegis and/or its trading principals do not offer a trading program to clients, nor do they propose guiding or directing a commodity interest account for any client based on any such trading program.

|

||