|

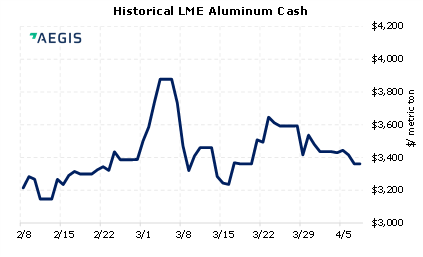

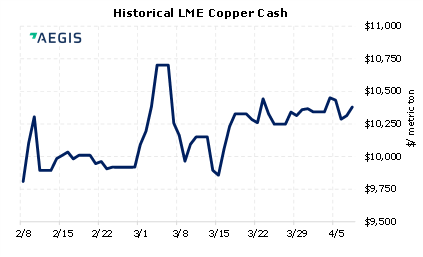

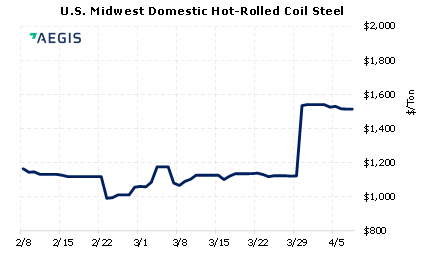

Metals prices are mostly down this week as an extensive COVID lockdown in China has tempered demand, especially for the automotive sector. Tesla’s factory in Shanghai has been closed since March 28, and Volkswagen’s Shanghai factory was shuttered on April 1, according to Automotive News Europe. VW’s and BMW’s factories elsewhere in China have also temporarily ceased production due to government pandemic controls. Shanghai, which at 25 million people is China’s largest city and an important industrial hub, entered a lockdown in March to repel a rapid rise in COVID cases. The lockdown was supposed to end this week Tuesday; however, on Monday authorities extended the lockdown “indefinitely,” according to Reuters. |

|

|

|

Consumers who are concerned about their metals input costs should consider financial swaps or purchasing call options. Such positions are standard for consumer hedging, but they can result in opportunity costs or cash costs if metal prices decline. Please contact AEGIS for specific strategies that fit your operations. (4/8/22) |

||

|

|

||

Note: Clients with AEGIS Platform access can see this and other research, plus hedge portfolio reporting and tools here. |

||

|

|

||

Price Indications |

||

|

|

||

|

|

||

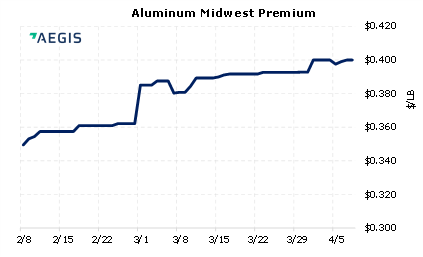

Today's Charts |

||

|

|

|

|

|

|

AEGIS Insights |

||

|

04/06/2022: AEGIS Factor Matrices: Most important variables affecting metals prices 04/05/2022: Russian Metals Production and Related News: Most Recent Developments (AEGIS Reference) |

||

|

|

||

| Important Headlines | ||

|

4/6/2022: Tesla, BMW, VW shutdowns in China drag on; microchips pile up as lockdowns continue 4/6/2022: Rusal exports first Guinea bauxite in nearly a month, data shows 4/5/2022: Global nickel smelting up in March despite Ukraine, satellite data shows 4/5/2022: Column-Mass exit from nickel market opens up a volatility trap: Andy Home |

||

|

|

||

|

|

||

| Important Disclosure: Indicative prices are provided for information purposes only, and do not represent a commitment from AEGIS Hedging Solutions LLC ("Aegis") to assist any client to transact at those prices, or at any price, in the future. Aegis makes no guarantee to the accuracy or completeness of such information. Aegis and/or its trading principals do not offer a trading program to clients, nor do they propose guiding or directing a commodity interest account for any client based on any such trading program.

|

||