|

Last Friday, the London Platinum and Palladium Market (LPPM) barred both Russian state-owned platinum and palladium producers, Krastsvetmet and Prioksky Plant of Non-Ferrous Metals from the exchange. This move blocks those producers from delivering to the world’s largest platinum and palladium market. Roughly 25% of the global palladium supply to the London market, or approximately 102 mt, will be affected by this decision, according to market participants cited by Reuters. London is the world’s largest platinum and palladium market. In 2020, Russia was the world’s largest palladium miner, and the second largest platinum producer. CME Palladium futures, the benchmark for US palladium prices, rallied to $2,423/troy oz or 9.0% on Friday, and up another 4% today (7:20AM CST). |

|

|

|

Consumers who are concerned about their palladium input costs should consider financial swaps or purchasing call options. Such positions are standard for consumer hedging, but they can result in opportunity costs or cash costs if metal prices decline. Please contact AEGIS for specific strategies that fit your operations. (4/11/22) |

||

|

|

||

Note: Clients with AEGIS Platform access can see this and other research, plus hedge portfolio reporting and tools here. |

||

|

|

||

Price Indications |

||

|

|

||

|

|

||

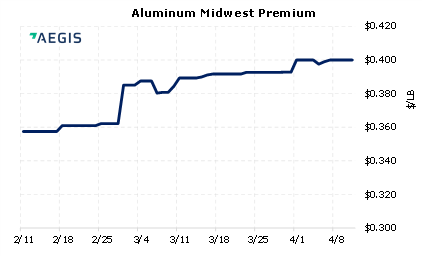

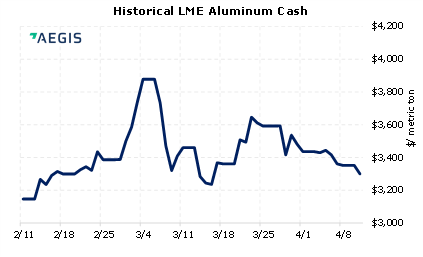

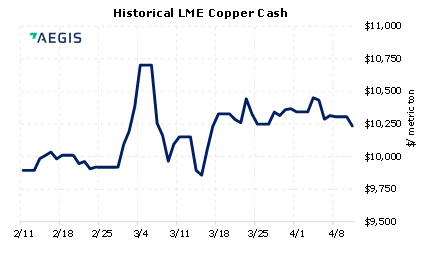

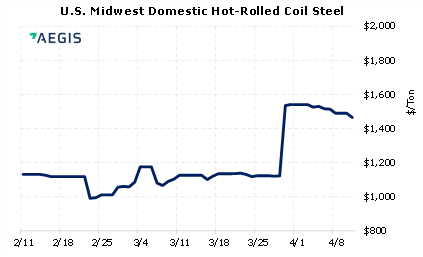

Today's Charts |

||

|

|

|

|

|

|

AEGIS Insights |

||

|

04/06/2022: AEGIS Factor Matrices: Most important variables affecting metals prices 04/05/2022: Russian Metals Production and Related News: Most Recent Developments (AEGIS Reference) |

||

|

|

||

| Important Headlines | ||

|

4/8/2022: London blocks sale of new platinum and palladium from Russian refineries 4/8/2022: LPPM GOOD DELIVERY PLATINUM AND PALLADIUM UPDATE 4/6/2022: Tesla, BMW, VW shutdowns in China drag on; microchips pile up as lockdowns continue 4/6/2022: Rusal exports first Guinea bauxite in nearly a month, data shows 4/5/2022: Global nickel smelting up in March despite Ukraine, satellite data shows 4/5/2022: Column-Mass exit from nickel market opens up a volatility trap: Andy Home |

||

|

|

||

|

|

||

| Important Disclosure: Indicative prices are provided for information purposes only, and do not represent a commitment from AEGIS Hedging Solutions LLC ("Aegis") to assist any client to transact at those prices, or at any price, in the future. Aegis makes no guarantee to the accuracy or completeness of such information. Aegis and/or its trading principals do not offer a trading program to clients, nor do they propose guiding or directing a commodity interest account for any client based on any such trading program.

|

||