|

A recent COVID outbreak led to a drop in China’s refined zinc volumes in March, both month-over-month and year-over-year. LME Zinc 3M rallied nearly 14% in March while China was experiencing this production issues. Antaike, the Chinese state-backed research company, says refined zinc output in March was 423,000 tonnes, down 0.7% year on year; month-over-month production was off 3%. Transportation issues due to COVID in three important zinc-producing provinces (Yunnan, Shaanxi and Gansu) caused most of the setback in production. China is the world's largest zinc smelter. |

|

|

|

Consumers who are concerned about their zinc input costs should consider financial swaps or purchasing call options. Such positions are standard for consumer hedging, but they can result in opportunity costs or cash costs if metal prices decline. Please contact AEGIS for specific strategies that fit your operations. (4/13/22) |

||

|

|

||

Note: Clients with AEGIS Platform access can see this and other research, plus hedge portfolio reporting and tools here. |

||

|

|

||

Price Indications |

||

|

|

||

|

|

||

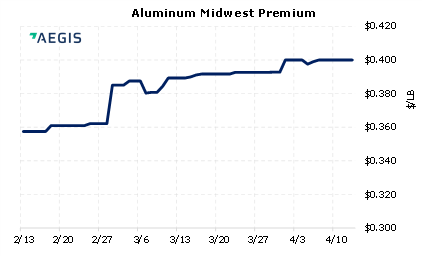

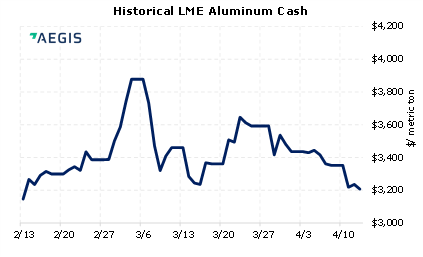

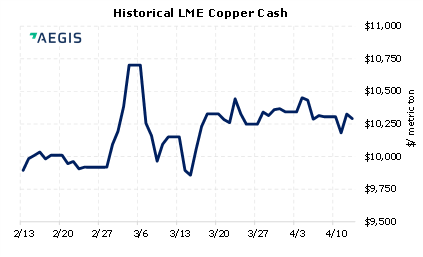

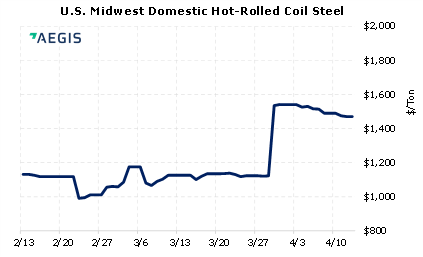

Today's Charts |

||

|

|

|

|

|

|

AEGIS Insights |

||

|

04/06/2022: AEGIS Factor Matrices: Most important variables affecting metals prices 04/05/2022: Russian Metals Production and Related News: Most Recent Developments (AEGIS Reference) |

||

|

|

||

| Important Headlines | ||

|

4/12/2022: China's March zinc output falls in face of COVID disruption, says Antaike 4/11/2022: METALS-Industrial metals fall as firmer dollar, China's COVID woes weigh 4/11/2022: China’s Nio halts EV production as COVID lockdowns disrupt its supply chain |

||

|

|

||

|

|

||

| Important Disclosure: Indicative prices are provided for information purposes only, and do not represent a commitment from AEGIS Hedging Solutions LLC ("Aegis") to assist any client to transact at those prices, or at any price, in the future. Aegis makes no guarantee to the accuracy or completeness of such information. Aegis and/or its trading principals do not offer a trading program to clients, nor do they propose guiding or directing a commodity interest account for any client based on any such trading program.

|

||