|

Russia’s Nornickel, which is the world's largest refined nickel producer, made 52,000 mt of the metal in Q1 2022, up 10% year-over-year, according to a company press release dated yesterday. Regarding the Ukrainian conflict, the company stated, “In spite of certain challenges in logistics and deliveries of equipment, spares and consumables, due to geopolitical situation, our operations remain uninterrupted. Currently, we are using new logistical arrangements and exploring opportunities with alternative suppliers.” The ccompany says production increases at the Oktyabrsky and Taimyrsky mines, and ramp-up of the Norilsk Concentrator led to higher refined-nickel output. |

|

|

|

Consumers who are concerned about their nickel costs should consider financial swaps or purchasing call options. Such positions are standard for consumer hedging, but they can result in opportunity costs or cash costs if metal prices decline. Please contact AEGIS for specific strategies that fit your operations. (4/26/2022) |

||

|

|

||

Note: Clients with AEGIS Platform access can see this and other research, plus hedge portfolio reporting and tools here. |

||

|

|

||

Price Indications |

||

|

|

||

|

|

||

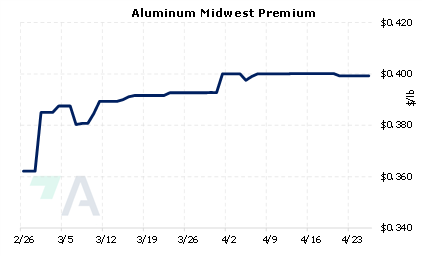

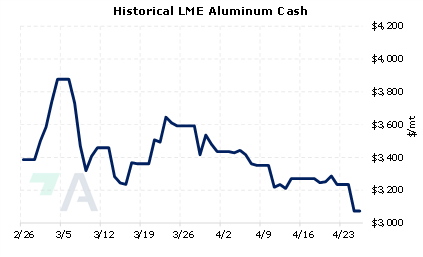

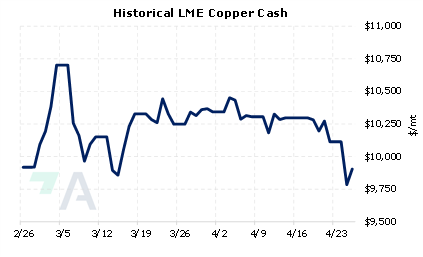

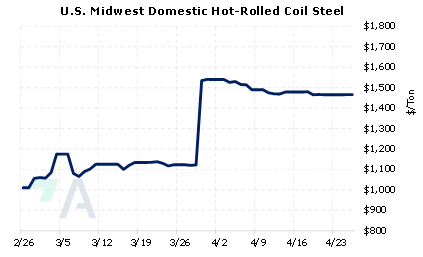

Today's Charts |

||

|

|

|

|

|

|

AEGIS Insights |

||

|

04/20/2022: AEGIS Factor Matrices: Most important variables affecting metals prices 04/21/2022: Russian Metals Production and Related News: Most Recent Developments (AEGIS Reference) |

||

|

|

||

| Important Headlines | ||

|

4/25/2022: Column: Bears tip-toe back into copper market as demand fears grow 4/24/2022: Indian aluminium producer NALCO faces coal scarcity due to train shortage 4/22/2022: March 2022 crude steel production |

||

|

|

||

|

|

||

| Important Disclosure: Indicative prices are provided for information purposes only, and do not represent a commitment from AEGIS Hedging Solutions LLC ("Aegis") to assist any client to transact at those prices, or at any price, in the future. Aegis makes no guarantee to the accuracy or completeness of such information. Aegis and/or its trading principals do not offer a trading program to clients, nor do they propose guiding or directing a commodity interest account for any client based on any such trading program.

|

||