|

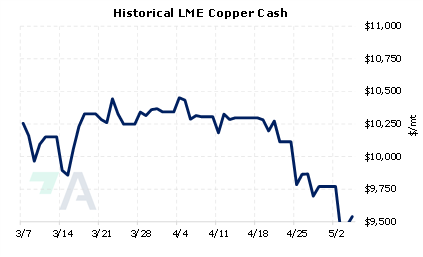

The COVID outbreak in China, which started in March and worsened in April, has softened the country’s demand for copper. LME Copper 3M Select is now down 2.2% for the year and 12.0% from the March highs (7:10AM CST), pushing into negative territory with this week’s trade. Approximately 180 million people in China remain on full or partial lockdown, according to recent statistics from CNN. These areas represent 40% of China's output and 80% of its exports, according to Capital Economics. Data released last week by China’s National Bureau of Statistics shows that manufacturing activity in April slowed due to lockdowns, weighing on copper demand and prices. Copper is currently the only LME metal with a negative annual return. Is this a hedging opportunity for copper consumers? |

|

|

|

Consumers who are concerned about their copper input costs should consider financial swaps or purchasing call options. Such positions are standard for consumer hedging, but they can result in opportunity costs or cash costs if metal prices decline. Please contact AEGIS for specific strategies that fit your operations. (5/5/2022) |

||

|

|

||

Note: Clients with AEGIS Platform access can see this and other research, plus hedge portfolio reporting and tools here. |

||

|

|

||

Price Indications |

||

|

|

||

|

|

||

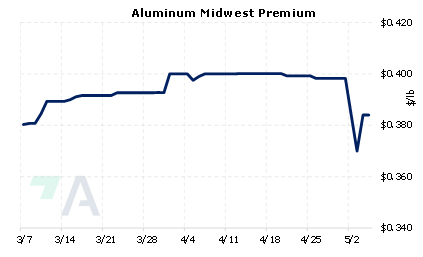

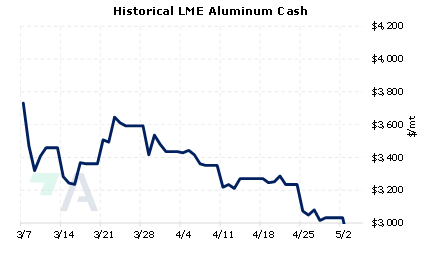

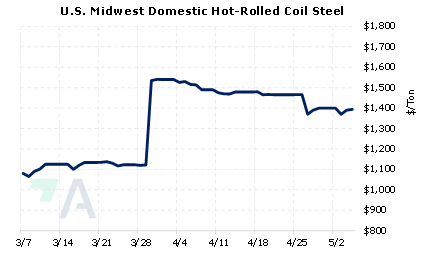

Today's Charts |

||

|

|

|

|

|

|

AEGIS Insights |

||

|

05/04/2022: AEGIS Factor Matrices: Most important variables affecting metals prices 04/21/2022: Russian Metals Production and Related News: Most Recent Developments (AEGIS Reference) |

||

|

|

||

| Important Headlines | ||

|

5/4/2022: Beijing steps up COVID curbs as virus spreads in China 5/3/2022: Stock futures fall after big market reversal to start May 5/3/2022: Aluminium maker Hydro warns of rising costs after record Q1 profit |

||

|

|

||

|

|

||

| Important Disclosure: Indicative prices are provided for information purposes only, and do not represent a commitment from AEGIS Hedging Solutions LLC ("Aegis") to assist any client to transact at those prices, or at any price, in the future. Aegis makes no guarantee to the accuracy or completeness of such information. Aegis and/or its trading principals do not offer a trading program to clients, nor do they propose guiding or directing a commodity interest account for any client based on any such trading program.

|

||