|

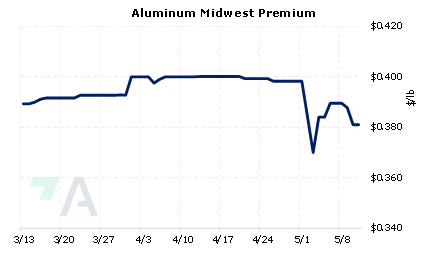

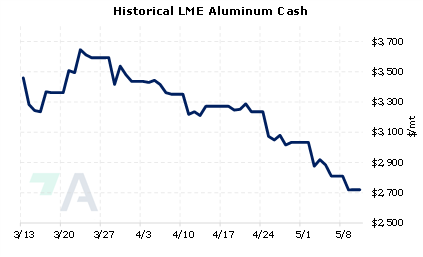

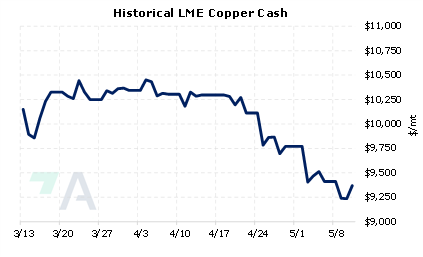

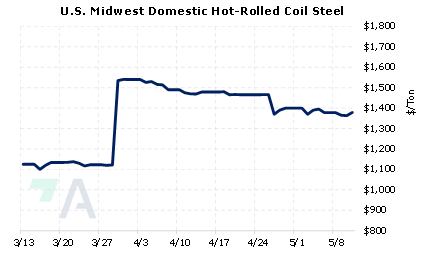

Public hearings on the economic impact of Section 232 import tariffs on steel and aluminum will begin in July 2022. The US International Trade Commission is seeking input from consumers and producers of those metals, which have been tariffed since 2018 by the Trump administration. Section 232 tariffs are at the discretion of the executive branch and are allowed for reasons of national security. Current tariffs are 25% on steel and 10% on aluminum. These tariffs were meant to reduce the flow of metals imports, thereby preventing foreign exporters from dumping cheap steel and aluminum onto the US market. AEGIS notes the cost of the tariffs has supported Midwest Transaction Price (Aluminum) and US-based steel tariffs (e.g. CRU Hot Rolled Coil). Reducing or eliminating those tariffs would likely reduce costs and perhaps prices in the U.S. The ITC will release findings in 2023. |

|

|

|

Consumers who are concerned about their metals input costs should consider financial swaps or purchasing call options. Such positions are standard for consumer hedging, but they can result in opportunity costs or cash costs if metal prices decline. Please contact AEGIS for specific strategies that fit your operations. (5/11/2022) |

||

|

|

||

Note: Clients with AEGIS Platform access can see this and other research, plus hedge portfolio reporting and tools here. |

||

|

|

||

Price Indications |

||

|

|

||

|

|

||

Today's Charts |

||

|

|

|

|

|

|

AEGIS Insights |

||

|

05/04/2022: AEGIS Factor Matrices: Most important variables affecting metals prices 04/21/2022: Russian Metals Production and Related News: Most Recent Developments (AEGIS Reference) |

||

|

|

||

| Important Headlines | ||

|

5/10/2022: Nippon Steel reveals plans to deliver 'carbon neutral' steel 5/6/2022: CME explores nickel contract after LME trade chaos |

||

|

|

||

|

|

||

| Important Disclosure: Indicative prices are provided for information purposes only, and do not represent a commitment from AEGIS Hedging Solutions LLC ("Aegis") to assist any client to transact at those prices, or at any price, in the future. Aegis makes no guarantee to the accuracy or completeness of such information. Aegis and/or its trading principals do not offer a trading program to clients, nor do they propose guiding or directing a commodity interest account for any client based on any such trading program.

|

||