|

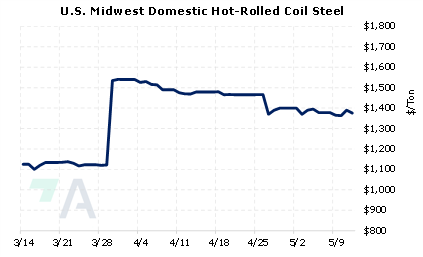

Supply shortages and China’s slowing economy could weigh on global steel demand, according to Nippon Steel Co. These fears come despite the company’s record $7.2 billion profit in the fiscal year ending March 31, 2022, according to their earnings summary released on Tuesday. Nippon’s president stated, “At this moment, we can’t find any positive factors…. [and] there are no signs of a reversal” in the global steel demand downtrend. As a net importer of steel, the US may find more cargoes -- even if bearing a tariff cost -- on its shores, depressing local steel index prices. |

|

|

|

U.S. steel prices escalated in 2021 and remain high in 2022. Re-routing of steel into the U.S. and away from China could suppress prices. If a potential drop in prices would be an opportunity for you to secure lower-cost steel, simple hedges involving swaps and call options are available. These could cap your steel costs, guarding against a price recovery. Such positions are standard for consumer hedging, but they can result in opportunity costs or cash costs if metal prices decline. Please contact AEGIS for specific strategies that fit your operations. (5/12/2022) |

||

|

|

||

Note: Clients with AEGIS Platform access can see this and other research, plus hedge portfolio reporting and tools here. |

||

|

|

||

Price Indications |

||

|

|

||

|

|

||

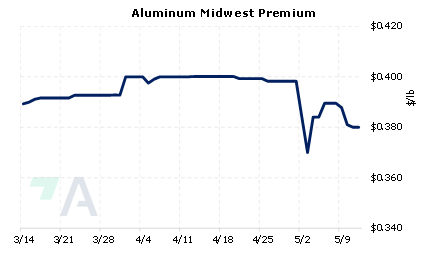

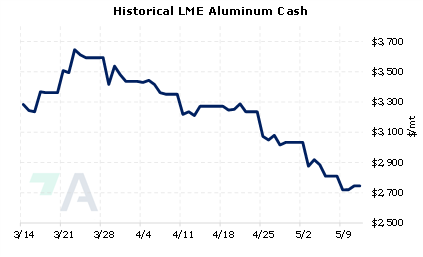

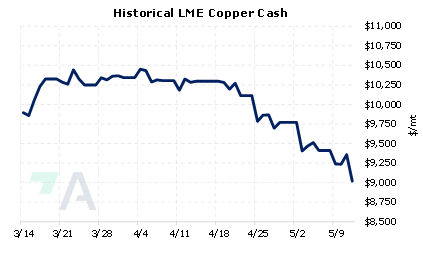

Today's Charts |

||

|

|

|

|

|

|

AEGIS Insights |

||

|

05/11/2022: AEGIS Factor Matrices: Most important variables affecting metals prices 05/11/2022: China's Metals Exports are on the Rise |

||

|

|

||

| Important Headlines | ||

|

5/11/2022: Shares of Spanish steelmaker Acerinox soar after record profit 5/10/2022: COVID-19 outbreak hobbles Chinese demand for cobalt, nickel, lithium 5/10/2022: Nippon Steel reveals plans to deliver 'carbon neutral' steel 5/6/2022: CME explores nickel contract after LME trade chaos |

||

|

|

||

|

|

||

| Important Disclosure: Indicative prices are provided for information purposes only, and do not represent a commitment from AEGIS Hedging Solutions LLC ("Aegis") to assist any client to transact at those prices, or at any price, in the future. Aegis makes no guarantee to the accuracy or completeness of such information. Aegis and/or its trading principals do not offer a trading program to clients, nor do they propose guiding or directing a commodity interest account for any client based on any such trading program.

|

||