|

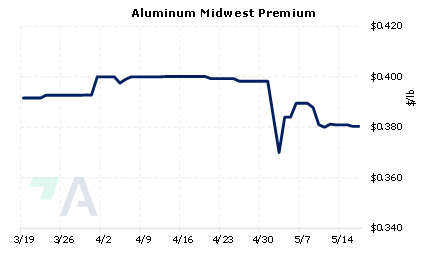

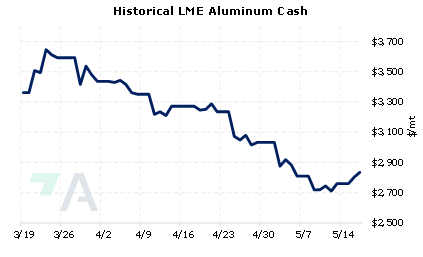

COVID lockdowns in China have not slowed the country’s primary aluminum production; China produced 3.36 million mt of primary aluminum in April, the highest monthly volume since 2002, according to data released earlier this week by the National Bureau of Statistics. Some producers have restarted smelters that were idled during last year’s government controls on emissions and power consumption, according to Bloomberg. Analysts cited by Bloomberg believe that production could continue to rise as margins remain high, leading to a further drop in prices. Based on customs data, China was a net exporter of aluminum in February. |

|

|

|

Aluminum end users might take advantage of the recent drop in prices by using simple hedges involving swaps and call options. These could cap your aluminum costs, guarding against a price recovery. Such positions are standard for consumer hedging, but they can result in opportunity costs or cash costs if metal prices decline. Please contact AEGIS for specific strategies that fit your operations. (5/17/2022) |

||

|

|

||

Note: Clients with AEGIS Platform access can see this and other research, plus hedge portfolio reporting and tools here. |

||

|

|

||

Price Indications |

||

|

|

||

|

|

||

Today's Charts |

||

|

|

|

|

|

|

AEGIS Insights |

||

|

05/11/2022: AEGIS Factor Matrices: Most important variables affecting metals prices 05/11/2022: China's Metals Exports are on the Rise |

||

|

|

||

| Important Headlines | ||

|

5/11/2022: EC to propose potential steel import safeguard changes late May, following review 5/11/2022: Shares of Spanish steelmaker Acerinox soar after record profit 5/10/2022: COVID-19 outbreak hobbles Chinese demand for cobalt, nickel, lithium 5/10/2022: Nippon Steel reveals plans to deliver 'carbon neutral' steel 5/6/2022: CME explores nickel contract after LME trade chaos 5/6/2022: China’s Covid lockdowns are hitting more than just Shanghai and Beijing |

||

|

|

||

|

|

||

|

Important Disclosure: Indicative prices are provided for information purposes only, and do not represent a commitment from AEGIS Hedging Solutions LLC ("Aegis") to assist any client to transact at those prices, or at any price, in the future. Aegis makes no guarantee to the accuracy or completeness of such information. Aegis and/or its trading principals do not offer a trading program to clients, nor do they propose guiding or directing a commodity interest account for any client based on any such trading program. Certain information in this presentation may constitute forward-looking statements, which can be identified by the use of forward-looking terminology such as “edge,” “advantage,” “opportunity,” “believe” or other variations thereon or comparable terminology. Such statements are not guarantees of future performance or activities.

|

||