|

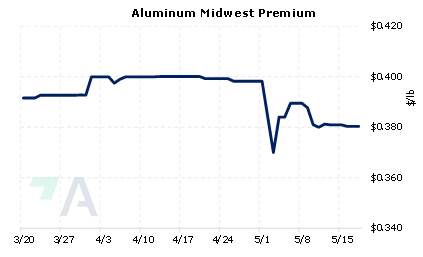

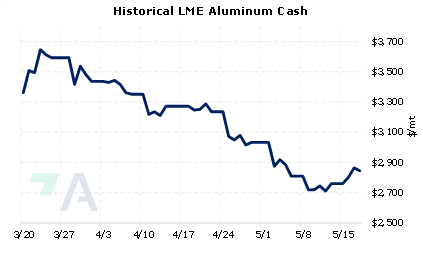

High energy costs have forced several European aluminum smelters to shut down, leading to supply shortages across the region. Global LME aluminum stocks were 518,900 mt on Wednesday, the lowest level since November 2005. Europe’s production shortfall has driven end-users to pull inventories from Asian LME warehouses (specifically Malaysia), according to Reuters and LME data. As of May 16, canceled warrants, which is metal that is scheduled to leave the warehouse, in Malaysia totaled 234,500 mt, representing nearly 79% of the LME’s canceled warrants. LME warehouse levels are considered a measure of the balance of supply and demand. Aluminum prices might rebound if production does not recover, and end-users continue to draw on warehouse stocks. |

|

|

|

LME Aluminum prices are down nearly 30% from the March highs, and end users might take advantage of the recent drop in prices by using simple hedges involving swaps and call options. These could cap your aluminum costs, guarding against a price recovery. Such positions are standard for consumer hedging, but they can result in opportunity costs or cash costs if metal prices decline. Please contact AEGIS for specific strategies that fit your operations. (5/18/2022)

|

||

|

|

||

Note: Clients with AEGIS Platform access can see this and other research, plus hedge portfolio reporting and tools here. |

||

|

|

||

Price Indications |

||

|

|

||

|

|

||

Today's Charts |

||

|

|

|

|

|

|

AEGIS Insights |

||

|

05/11/2022: AEGIS Factor Matrices: Most important variables affecting metals prices 05/11/2022: China's Metals Exports are on the Rise |

||

|

|

||

| Important Headlines | ||

|

5/16/2022: Shanghai targets June COVID lockdown exit as China economy slumps 5/16/2022: Column: European smelter hits mean another year of zinc shortfall 5/16/2022: Europe's aluminium deficit triggers further large LME stock draw

|

||

|

|

||

|

|

||

|

Important Disclosure: Indicative prices are provided for information purposes only, and do not represent a commitment from AEGIS Hedging Solutions LLC ("Aegis") to assist any client to transact at those prices, or at any price, in the future. Aegis makes no guarantee to the accuracy or completeness of such information. Aegis and/or its trading principals do not offer a trading program to clients, nor do they propose guiding or directing a commodity interest account for any client based on any such trading program. Certain information in this presentation may constitute forward-looking statements, which can be identified by the use of forward-looking terminology such as “edge,” “advantage,” “opportunity,” “believe” or other variations thereon or comparable terminology. Such statements are not guarantees of future performance or activities.

|

||