|

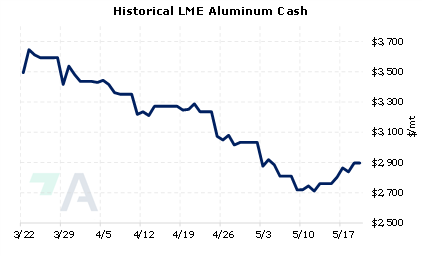

Aluminum prices are seeing a reprieve from the recent selloff. The 3M Aluminum Select contract last traded at $2,951/mt, up $123/mt on the week, or 4.3% (7:10 AM CST), and is on pace for the first weekly gains since March 21. The US Dollar has backed away from six-year highs this week and could be aiding aluminum’s price gains. Dollar-denominated metals such as aluminum are normally negatively correlated to the dollar. |

|

|

|

Production issues in Europe remain, forcing consumers to pull supplies from the LME warehouses. LME aluminum warehouse stocks, which are considered a measure of the balance of supply and demand, have dropped precipitously. As of this morning, “on-warrant” LME warehouse aluminum stocks, which are available to trade, totaled 194,175 mt, down 515,450 mt, or 72.6%, from 709,625 mt on January 1. Still, COVID lockdowns in China have tempered the country’s aluminum demand and could continue to do so. Based on data from S&P Global, business activity in China has dropped to the lowest level since February 2020. The lockdowns in Shanghai, a city with over 25 million residents, are beginning to ease; however, others, including Beijing, are increasing lockdowns, according to Reuters and Bloomberg. Aluminum consumers who are concerned that prices might increase further could consider utilizing simple hedges such as swaps and call options to protect margins. Swaps and call options are excellent tools to guard against a further increase in aluminum input costs. Such positions are standard for consumer hedging, but they can result in opportunity costs or cash costs if metal prices decline. Please contact AEGIS for specific strategies that fit your operations. (5/20/2022) |

||

|

|

||

Note: Clients with AEGIS Platform access can see this and other research, plus hedge portfolio reporting and tools here. |

||

|

|

||

Price Indications |

||

|

|

||

|

|

||

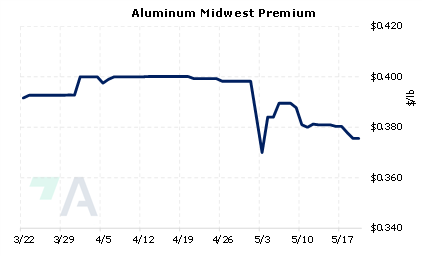

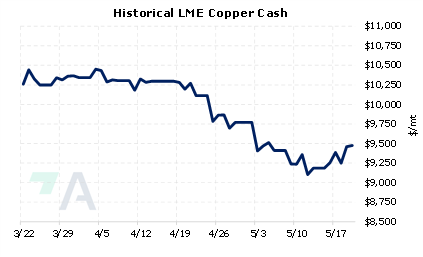

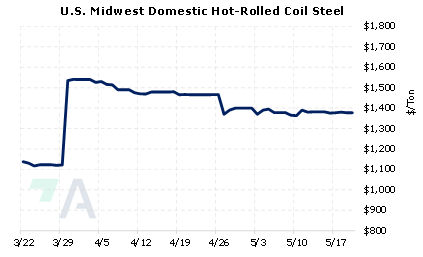

Today's Charts |

||

|

|

|

|

|

|

AEGIS Insights |

||

|

05/18/2022: AEGIS Factor Matrices: Most important variables affecting metals prices 05/11/2022: China's Metals Exports are on the Rise |

||

|

|

||

| Important Headlines | ||

|

5/19/2022: Some in Shanghai allowed out to shop; end of COVID lockdown in sight 5/18/2022: China's Xiaomi, Vivo and Oppo trim smartphone orders by 20% 5/16/2022: Shanghai targets June COVID lockdown exit as China economy slumps 5/16/2022: Column: European smelter hits mean another year of zinc shortfall 5/16/2022: Europe's aluminium deficit triggers further large LME stock draw |

||

|

|

||

|

|

||

|

Important Disclosure: Indicative prices are provided for information purposes only, and do not represent a commitment from AEGIS Hedging Solutions LLC ("Aegis") to assist any client to transact at those prices, or at any price, in the future. Aegis makes no guarantee to the accuracy or completeness of such information. Aegis and/or its trading principals do not offer a trading program to clients, nor do they propose guiding or directing a commodity interest account for any client based on any such trading program. Certain information in this presentation may constitute forward-looking statements, which can be identified by the use of forward-looking terminology such as “edge,” “advantage,” “opportunity,” “believe” or other variations thereon or comparable terminology. Such statements are not guarantees of future performance or activities.

|

||