|

The world’s largest tin exporter shipped 9,243 mt in April, up from 6,674 mt in March, according to the Ministry of Trade. April’s volume was the highest since September 2018. Total shipments in 2022 are 23,919.65 mt, which is up 11.2% compared to the same period in 2021. Nearly 71% of their March shipments went to China. Last November, Indonesian President Joko Widodo recently announced that the country might ban the export of tin starting in 2024. Indonesia is the world’s second-largest tin producer, bested only by China. |

|

|

|

Tin prices have dropped in May. The 3M last traded at $34,455/mt (7:00AM CST), down $6,145/mt, or 15% since May 1. This could be a good time for tin end-users to hedge future needs via swaps. LME Tin is extremely thinly traded, so we would suggest strategically placed limit orders. Using swaps can help guard against a potential increase in tin input costs. Such positions are standard for consumer hedging, but they can result in opportunity costs or cash costs if metal prices decline. Please contact AEGIS for specific strategies that fit your operations. (5/23/2022) |

||

|

|

||

Note: Clients with AEGIS Platform access can see this and other research, plus hedge portfolio reporting and tools here. |

||

|

|

||

Price Indications |

||

|

|

||

|

|

||

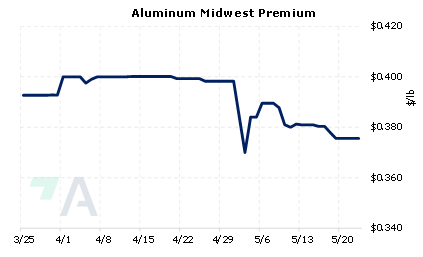

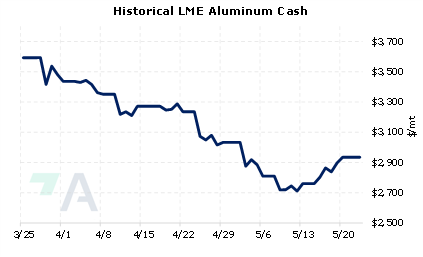

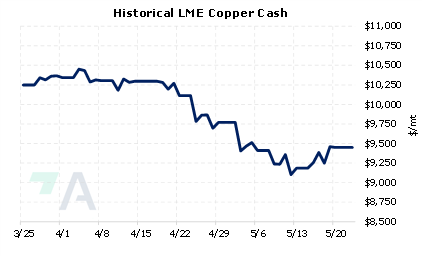

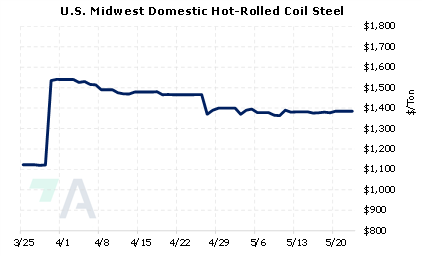

Today's Charts |

||

|

|

|

|

|

|

AEGIS Insights |

||

|

05/18/2022: AEGIS Factor Matrices: Most important variables affecting metals prices 05/11/2022: China's Metals Exports are on the Rise |

||

|

|

||

| Important Headlines | ||

|

5/23/2022: Moody's says increase in India's export duties on iron ore, pellets to raise costs for steel mills 5/22/2022: Indian steelmakers face hit on Europe deals over export tax, Jindal executive says 5/21/2022: Work suspended at Botswana's Khoemacau copper mine after accident kills two |

||

|

|

||

|

|

||

|

Important Disclosure: Indicative prices are provided for information purposes only, and do not represent a commitment from AEGIS Hedging Solutions LLC ("Aegis") to assist any client to transact at those prices, or at any price, in the future. Aegis makes no guarantee to the accuracy or completeness of such information. Aegis and/or its trading principals do not offer a trading program to clients, nor do they propose guiding or directing a commodity interest account for any client based on any such trading program. Certain information in this presentation may constitute forward-looking statements, which can be identified by the use of forward-looking terminology such as “edge,” “advantage,” “opportunity,” “believe” or other variations thereon or comparable terminology. Such statements are not guarantees of future performance or activities.

|

||